I am reading a book on the history of the @Visa Payment network (formerly BankAmericard) and I can't stop seeing parallels with crypto

1) Memes

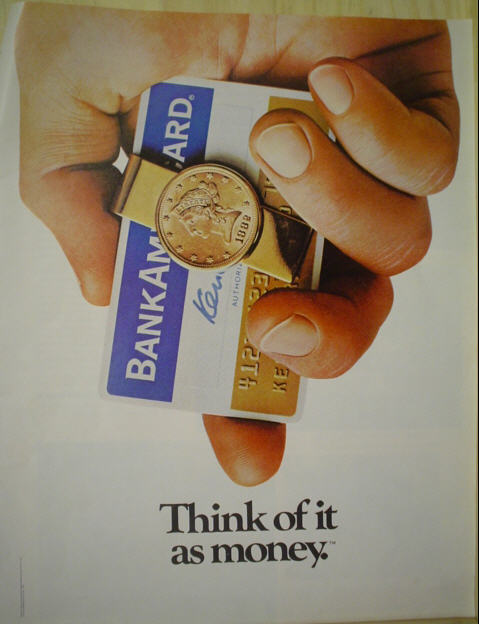

Dee Hock, the founding father of Visa knew he had to do first get people accustomed to electronic payments

"Think of it as money"

1) Memes

Dee Hock, the founding father of Visa knew he had to do first get people accustomed to electronic payments

"Think of it as money"

Was Visa's iconic tag line. The campaign ran in television print etc. and was not just paid for by Visa itself but by all member banks

Fun fact: They received some extra free advertising when Hank Aaron hit his 755th home run directly over the "Think of it as money" billboard

Fun fact: They received some extra free advertising when Hank Aaron hit his 755th home run directly over the "Think of it as money" billboard

2) Airdrops

Visa knew that they had to bootstrap a user base to make the system a success.

So Banks literally airdropped cards to people's homes and gave them a line of credit without asking any questions

The practice later became illegal

Visa knew that they had to bootstrap a user base to make the system a success.

So Banks literally airdropped cards to people's homes and gave them a line of credit without asking any questions

The practice later became illegal

Bad UX

We often talk about bad UX in crypto but it pales against the UX of card payments in 1970's

Merchants had to call their bank (acquirer) and verbally convey the transaction details to get a tx authorized

We often talk about bad UX in crypto but it pales against the UX of card payments in 1970's

Merchants had to call their bank (acquirer) and verbally convey the transaction details to get a tx authorized

Next the acquirer would call the issuing bank of the customer, which would manually check:

if the card was not on a 'black list'

the user's current balance, credit limit and purchase history

If all is in order the issuer would return an authorization code to the acquirer

if the card was not on a 'black list'

the user's current balance, credit limit and purchase history

If all is in order the issuer would return an authorization code to the acquirer

And the acquirer would give this authorization code to the merchant who was waiting on the line during this entire process

The merchant would then get the customers signature and write it on a 'sales draft' along with the auth code.

The merchant would then get the customers signature and write it on a 'sales draft' along with the auth code.

The entire process took 15 minutes on average. Don't ask me why anyone voluntarily chose this payment method.

For the customer the story ended here but for the banks it continued bc the payment was only cleared not settled.

For the customer the story ended here but for the banks it continued bc the payment was only cleared not settled.

Post-sale merchants had to send their sales draft to their bank by mail and acquirers had to then chase the payment up with the issuing bank

The process was incredibly error prone and unsurprisingly there were always disputes between the banks

The process was incredibly error prone and unsurprisingly there were always disputes between the banks

It took a lot of technological innovation and experimentation (there were competing payment networks') to get the payment experience right

4) Revolution

Dee Hock would certainly be a crypto fan today.

Dee:

"If electronic technology continued to advance, and that seemed certain, two-hundred year old banking oligopolies controlling the custody, loan, and exchange of money would be irrecoverably shattered"

Dee Hock would certainly be a crypto fan today.

Dee:

"If electronic technology continued to advance, and that seemed certain, two-hundred year old banking oligopolies controlling the custody, loan, and exchange of money would be irrecoverably shattered"

"Nation-state monopolies on the issue and control of currency would erode.. The vast preponderance of the system would fall to those who were most adept at handling and guaranteeing alphanumeric value data in the form of arranged particles of energy"

No better way to guarantee alphanumeric value data than on a Blockchain no?

Will continue to update this thread as I learn more

Will continue to update this thread as I learn more

5) Operating Principles

Dee knew that in order for banks to join, the network had to be credibly neutral.

That's why Visa was formed as a jointly-owned organization (no stocks, dividends) and all accumulated net revenue was used to finance the ongoing work of the operation.

Dee knew that in order for banks to join, the network had to be credibly neutral.

That's why Visa was formed as a jointly-owned organization (no stocks, dividends) and all accumulated net revenue was used to finance the ongoing work of the operation.

The member banks were competitors at heart.

It was crucial to create an organizational structure that would balance out incentives and assure that even small banks had a say in decision making.

It was crucial to create an organizational structure that would balance out incentives and assure that even small banks had a say in decision making.

Thus, at core, the Visa network consists of operating regulations:

A series of rules and regulations that governed everything from the physical design of the card, to the fees each party must pay, to the rights and responsibilities each party had during a transaction dispute.

A series of rules and regulations that governed everything from the physical design of the card, to the fees each party must pay, to the rights and responsibilities each party had during a transaction dispute.

These rules along with Visa's role as a judiciary created the necessary trust between the members that was necessary for the system to function and grow.

Blockchain's have these operating principles baked into the protocol and remove the need for mediation in disputes.

Blockchain's have these operating principles baked into the protocol and remove the need for mediation in disputes.

Moreover, they're global and participation in these networks is not reserved to banks.

For me, it seems obvious that crypto is the next step in the evolution of money and finance.

For me, it seems obvious that crypto is the next step in the evolution of money and finance.

@cryptotesters, we help people get started with their crypto journey.

We recommend them the best wallets or which exchange to use (loans soon) and explain the most important concepts. https://cryptotesters.com/

We recommend them the best wallets or which exchange to use (loans soon) and explain the most important concepts. https://cryptotesters.com/

A lot of people are asking about the book:

It’s called Electronic Value Exchange

I might be able to send you a digital copy if you send me a DM

It’s called Electronic Value Exchange

I might be able to send you a digital copy if you send me a DM

Read on Twitter

Read on Twitter