Tom Engle taught me to build positions in great growth stocks at "better and better value points" over time

Here's how to do it:

Say I wanted to gradually build a position in $SBUX from scratch

1) Pull it up in Yahoo Finance. Click on "statistics"

Here's how to do it:

Say I wanted to gradually build a position in $SBUX from scratch

1) Pull it up in Yahoo Finance. Click on "statistics"

2) Pull up my "Buy/Sell" tab of my public spreadsheet

https://docs.google.com/spreadsheets/d/1y8quPLqAwNsBGvNUrJuMTqVwz-P59ms1A8ZDLE8Dc24/edit?usp=sharing

https://docs.google.com/spreadsheets/d/1y8quPLqAwNsBGvNUrJuMTqVwz-P59ms1A8ZDLE8Dc24/edit?usp=sharing

3) Assume I wanted to build my position in $1,000 increments

$SBUX price right now is $75.49

$1,000 buys me about 13 shares

$SBUX price right now is $75.49

$1,000 buys me about 13 shares

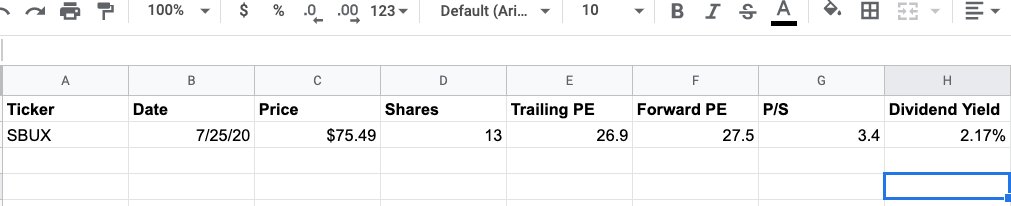

4) After I buy, I fill in the data in the spreadsheet

Making note of:

Ticker: $SBUX

Date: 7/25/20

Price: $75.49

Shares: 13

(Yahoo statistics data:)

Trailing P/E: 26.9

Forward P/E: 27.5

Price/Sales: 3.4

Forward Annual Dividend: 2.17%

Making note of:

Ticker: $SBUX

Date: 7/25/20

Price: $75.49

Shares: 13

(Yahoo statistics data:)

Trailing P/E: 26.9

Forward P/E: 27.5

Price/Sales: 3.4

Forward Annual Dividend: 2.17%

5) Then I wait & watch

If thesis = and I have new money to invest, I look to add

and I have new money to invest, I look to add

The goal of next purchase is to buy at a BETTER VALUE POINT ( P/E, P/S,

P/E, P/S,  dividend yield), which MAY OR MAY NOT be at a LOWER PRICE

dividend yield), which MAY OR MAY NOT be at a LOWER PRICE

If thesis =

and I have new money to invest, I look to add

and I have new money to invest, I look to addThe goal of next purchase is to buy at a BETTER VALUE POINT (

P/E, P/S,

P/E, P/S,  dividend yield), which MAY OR MAY NOT be at a LOWER PRICE

dividend yield), which MAY OR MAY NOT be at a LOWER PRICE

6) In other words, I'd want my next purchase to be at a

Trailing P/E < 26.9

Forward P/E < 27.5

Price / Sales < 3.4

Dividend Yield > 2.17%

This is possible in 2 primary ways

$SBUX financials = or & price

& price

or

$SBUX financials & price

& price  < financials

< financials

Trailing P/E < 26.9

Forward P/E < 27.5

Price / Sales < 3.4

Dividend Yield > 2.17%

This is possible in 2 primary ways

$SBUX financials = or

& price

& price

or

$SBUX financials

& price

& price  < financials

< financials

7) Ideally, you'd buy the same stock over and over again at better and better values, EVEN IF THE PRICE IS HIGHER EACH TIME

That's great, so long as revenue / net income / dividend are growing FASTER than the share price

That's great, so long as revenue / net income / dividend are growing FASTER than the share price

8) Sometimes, this isn't possible

With $SHOP, for example

If the business is

, you might have to add at worse value points

, you might have to add at worse value points

That's OK, so long as the business is vastly outperforming your expectation, or something has changed for the positive

With $SHOP, for example

If the business is

, you might have to add at worse value points

, you might have to add at worse value pointsThat's OK, so long as the business is vastly outperforming your expectation, or something has changed for the positive

9) Tom Engle is a big fan of using the Cash Flow Yield as a value point

Which is:

Free Cash Flow (Cash From Operations - Capital Expenditures) / Market Cap

This is not an easy metric to find/track, but he's smarter than me, so feel free to use it, too

Which is:

Free Cash Flow (Cash From Operations - Capital Expenditures) / Market Cap

This is not an easy metric to find/track, but he's smarter than me, so feel free to use it, too

10) I love this system

You're steadily building your position as your confidence & knowledge about the business grow

Remember: knowledge compounds too!

You're steadily building your position as your confidence & knowledge about the business grow

Remember: knowledge compounds too!

11) Tom Engle also scales OUT of a business in the same way

He wants to SELL at higher and higher value points over time

And then roll the proceeds into the next growth stock!

He wants to SELL at higher and higher value points over time

And then roll the proceeds into the next growth stock!

Read on Twitter

Read on Twitter