1/ I am massively bullish on #Bitcoin  , but I think the next big move is likely down.

, but I think the next big move is likely down.

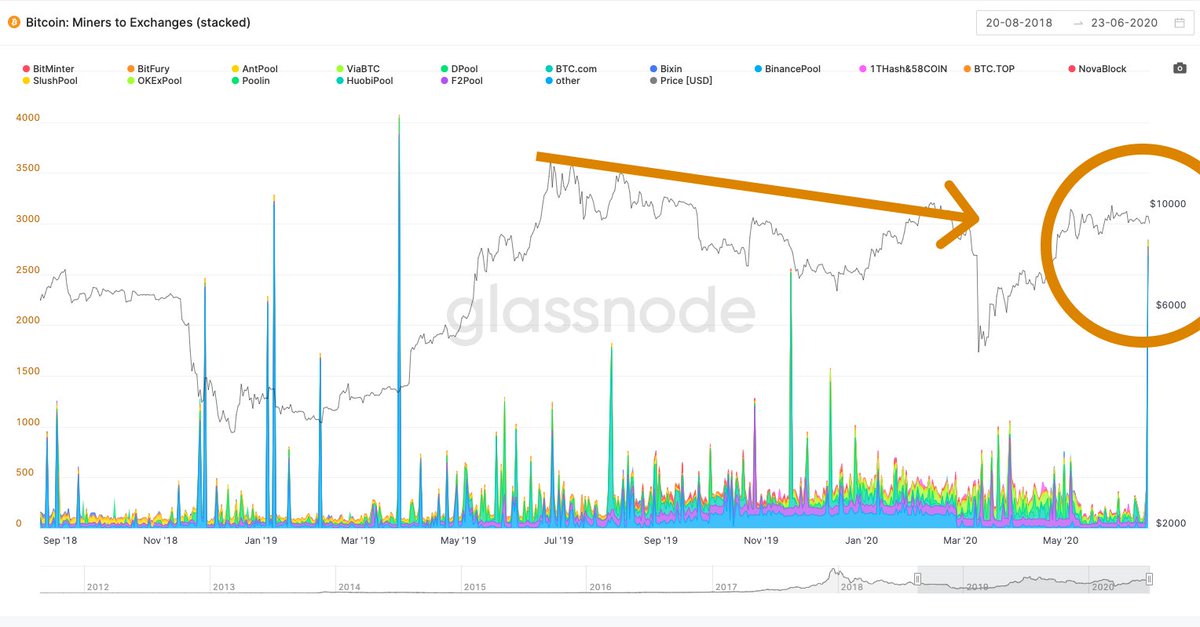

@glassnode just reported the largest $BTC transfer from miners to exchanges in over a year.

, but I think the next big move is likely down.

, but I think the next big move is likely down.@glassnode just reported the largest $BTC transfer from miners to exchanges in over a year.

2/ And CME commitment of traders shows institutions are massively net short $BTC, and have been for many weeks.

They've only been this net short once before: the last time $BTC hovered around this same price.

They've only been this net short once before: the last time $BTC hovered around this same price.

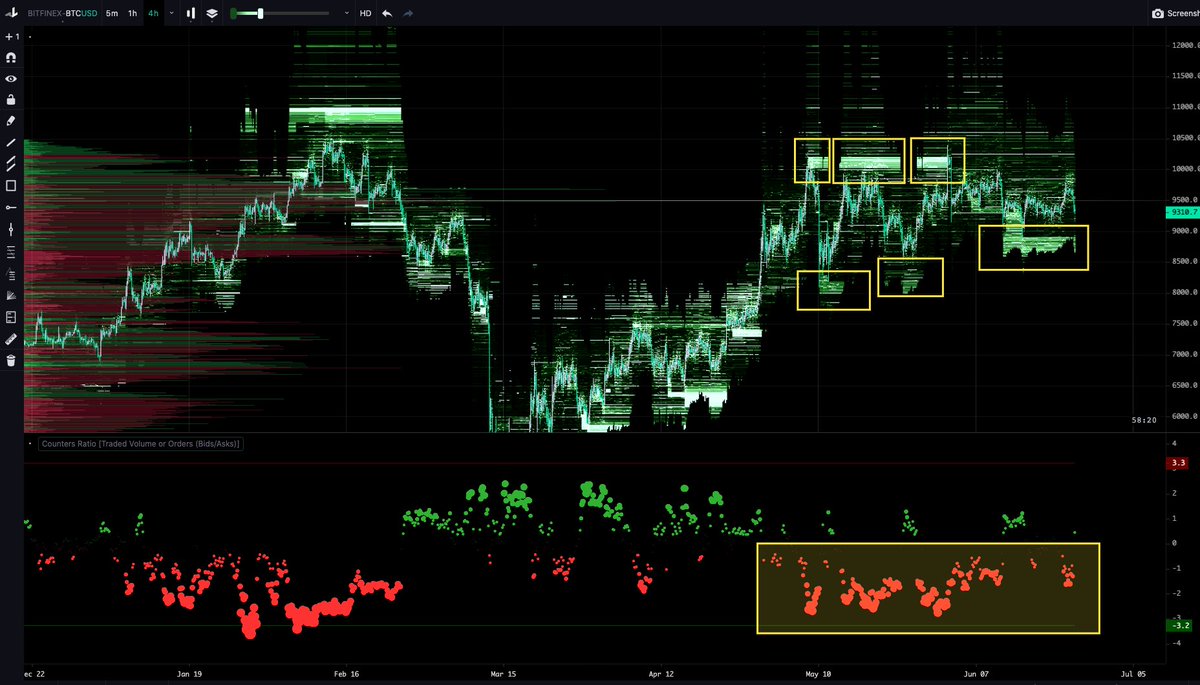

3/ Bitfinex whale's buywall is eroding, and hasn't been replenished yet.

And those $BTC transfers from miners to exchanges...they went to Bitfinex.

(platform is @tradinglite)

And those $BTC transfers from miners to exchanges...they went to Bitfinex.

(platform is @tradinglite)

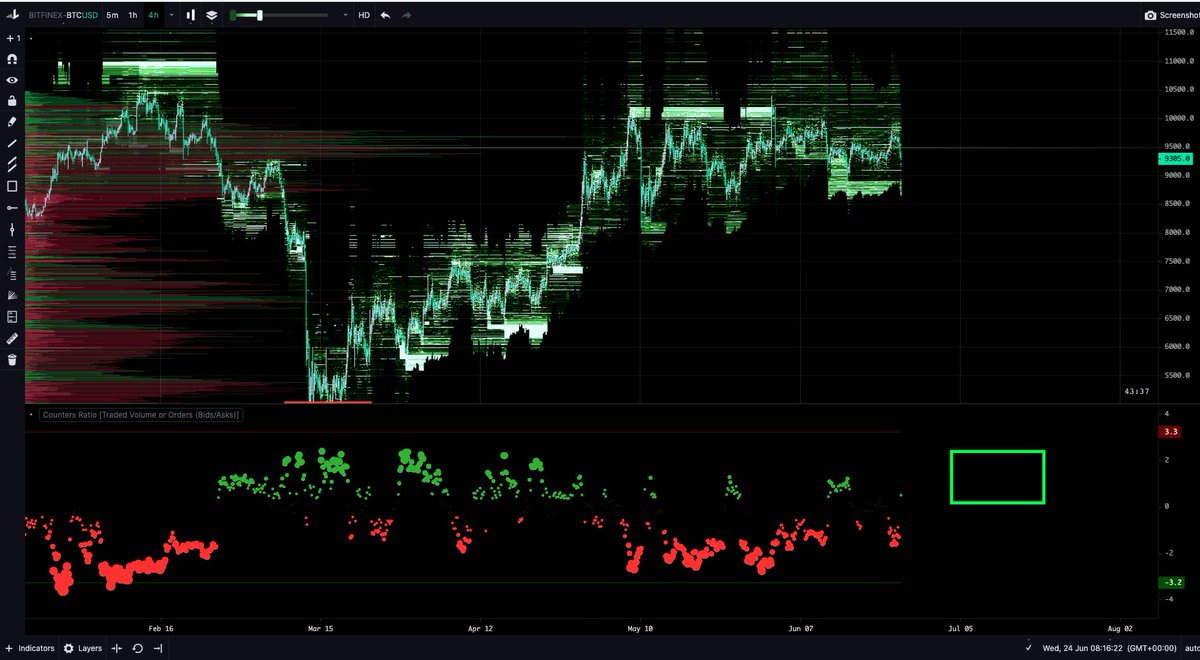

4/ More importantly, Bitfinex orderbook delta has been skewed massively to the sell side for almost six weeks.

The birds-eye-view of BFX's orderbook has been an accurate leading indicator of #Bitcoin 's next move nearly every swing for the past nine months.

's next move nearly every swing for the past nine months.

The birds-eye-view of BFX's orderbook has been an accurate leading indicator of #Bitcoin

's next move nearly every swing for the past nine months.

's next move nearly every swing for the past nine months.

5/ Technically we're still in bull market territory.

A break below the VWAP is a juicy buy the dip opportunity.

Could be the last $BTFD below $10k. Ever.

A break below the VWAP is a juicy buy the dip opportunity.

Could be the last $BTFD below $10k. Ever.

6/ If we break down, where am I a buyer?

It depends on how well global markets hold up.

$BTC’s correlation to the S&P is back at all time highs.

Chart h/t @caprioleio

It depends on how well global markets hold up.

$BTC’s correlation to the S&P is back at all time highs.

Chart h/t @caprioleio

7/ I’ll wait for bids to start stacking up on Bitfinex's orderbook.

I expect to see that happening before $BTC price even has a chance to locally bottom.

I expect to see that happening before $BTC price even has a chance to locally bottom.

8/ I suspect we'll see a drop to the $7800-$8200 area.

Outside chance it goes as low as the mid-$6k range.

I don't expect it to go lower.

Outside chance it goes as low as the mid-$6k range.

I don't expect it to go lower.

9/ This is *not* bad news, big picture. I expect a roaring bull market is right around the corner.

Grayscale is buying up $BTC faster than miners can mine.

And Fidelity reports record institutional interest in cryptoassets.

Report: https://bit.ly/3hVyVv3

Grayscale is buying up $BTC faster than miners can mine.

And Fidelity reports record institutional interest in cryptoassets.

Report: https://bit.ly/3hVyVv3

10/ Of course there's nothing bullish about that for censorship resistance.

But I do believe it's a natural step in the long arc of $BTC's adoption curve.

But I do believe it's a natural step in the long arc of $BTC's adoption curve.

11/ More good news: we're very close to a hash ribbons buy signal.

A hash ribbons buy is one of the highest-alpha on-chain signals I track.

They don't happen often -- and I expect this to be the last one for a long time. https://mobile.twitter.com/caprioleio/status/1274270815111000064

A hash ribbons buy is one of the highest-alpha on-chain signals I track.

They don't happen often -- and I expect this to be the last one for a long time. https://mobile.twitter.com/caprioleio/status/1274270815111000064

12/ If $BTC breaks down, I suspect alts crash.

As great as the pumps have been, $BTC dominance and the shitcoin index both look about ready to roll over.

Taking some profit isn’t a bad idea.

As great as the pumps have been, $BTC dominance and the shitcoin index both look about ready to roll over.

Taking some profit isn’t a bad idea.

13/ And if I'm wrong about all of this -- that couldn't make me happier.

My spot exposure has not changed. I will not sell.

I still think we see ATH's around the end of this year.

My spot exposure has not changed. I will not sell.

I still think we see ATH's around the end of this year.

Read on Twitter

Read on Twitter