Grab some coffee, it’s deep dive time.

The business is Procore $PCOR

Not sure I’ve ever been this excited about an investment.

Here’s why

The business is Procore $PCOR

Not sure I’ve ever been this excited about an investment.

Here’s why

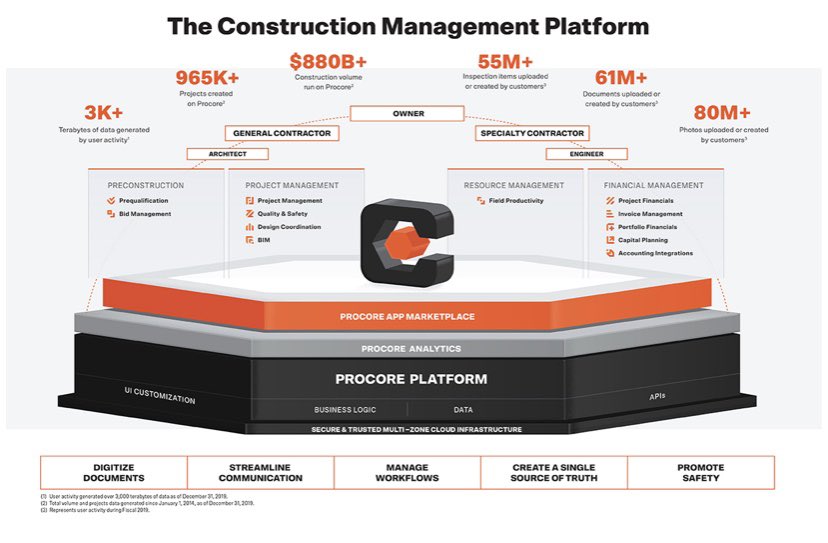

What does $PCOR do:

In short, they’re a construction management (CM) SaaS platform.

Procore provides work flow software for all stakeholders & all stages of the construction management process.

In short, they’re a construction management (CM) SaaS platform.

Procore provides work flow software for all stakeholders & all stages of the construction management process.

The opportunity:

MASSIVE addressable market.

The construction industry accounts for ~13% of Global GDP (~$11 Trillion).

$PCOR estimates that the construction industry spends ~$9.2B annually on application software.

MASSIVE addressable market.

The construction industry accounts for ~13% of Global GDP (~$11 Trillion).

$PCOR estimates that the construction industry spends ~$9.2B annually on application software.

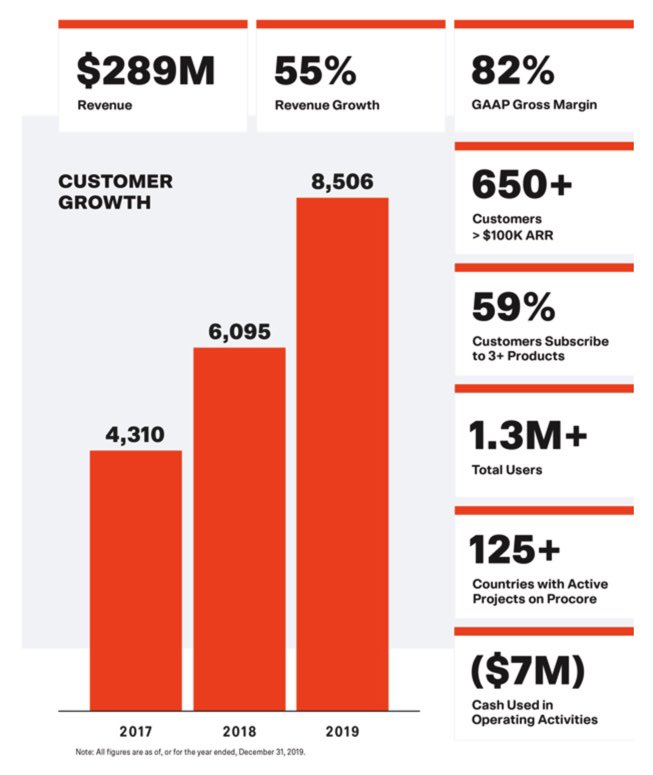

Current financials:

- $289M in TTM revenue, up 55% YoY

- 82% gross margins

- 117% Net revenue retention rate

- 650+ customers >$100k ARR

- $289M in TTM revenue, up 55% YoY

- 82% gross margins

- 117% Net revenue retention rate

- 650+ customers >$100k ARR

Who are the stakeholders in the CM process?

- Owners

- General contractors

- Specialty contractors

- Architects

- Engineers

On any given project, these parties need to collaborate. Often times that collaboration is remote.

- Owners

- General contractors

- Specialty contractors

- Architects

- Engineers

On any given project, these parties need to collaborate. Often times that collaboration is remote.

You ever wonder why construction projects takes so long?

For communication between stakeholders, most of the CM industry still relies on legacy systems. Paper, fax, email, on-prem software, etc.

This leads to delays, rework, and cost overruns.

For communication between stakeholders, most of the CM industry still relies on legacy systems. Paper, fax, email, on-prem software, etc.

This leads to delays, rework, and cost overruns.

Historically, the construction management (CM) industry has been slow to digitize due to internet, WiFi, & connectivity constraints.

However, thanks to the proliferation of the internet and mobile devices, $PCOR has an opportunity to drive the digital transformation.

However, thanks to the proliferation of the internet and mobile devices, $PCOR has an opportunity to drive the digital transformation.

Quick anecdote...

I’ve got a friend that works for a CM company and I asked him about $PCOR & here’s what he said,

“Everyone I know is switching to it. If you’re working with 3 or 4 different teams on a project and one of them isn’t on it, they slow everything down.”

I’ve got a friend that works for a CM company and I asked him about $PCOR & here’s what he said,

“Everyone I know is switching to it. If you’re working with 3 or 4 different teams on a project and one of them isn’t on it, they slow everything down.”

Now think about the inherent network effects.

The collaborative nature of construction implies that all parties need to be on a uniform system to optimize performance.

And pretty much every construction business is running multiple projects at once.

The collaborative nature of construction implies that all parties need to be on a uniform system to optimize performance.

And pretty much every construction business is running multiple projects at once.

$PCOR filed their S-1 in February, but delayed the IPO in favor of taking a $150M private financing round at a $5B valuation.

They said they may still look to list publicly before year end, if the markets stabilize.

They said they may still look to list publicly before year end, if the markets stabilize.

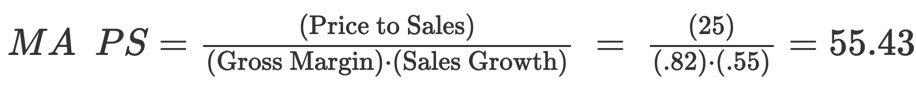

What price would I pay?

The inherent network effects of Procore’s business model should imply sustainability in revenue growth.

B/c of this, I feel much more inclined to pay a “premium”.

The inherent network effects of Procore’s business model should imply sustainability in revenue growth.

B/c of this, I feel much more inclined to pay a “premium”.

Read on Twitter

Read on Twitter