The one thing CoVID didn't phase:

Statistical Arbitrage...

Statistical Arbitrage...

The Difficult Arises From Trying To Figure Out How To Piece The Puzzle Together....

I'll Let You Solve That Problem ;)

I'll Let You Solve That Problem ;)

What is this?

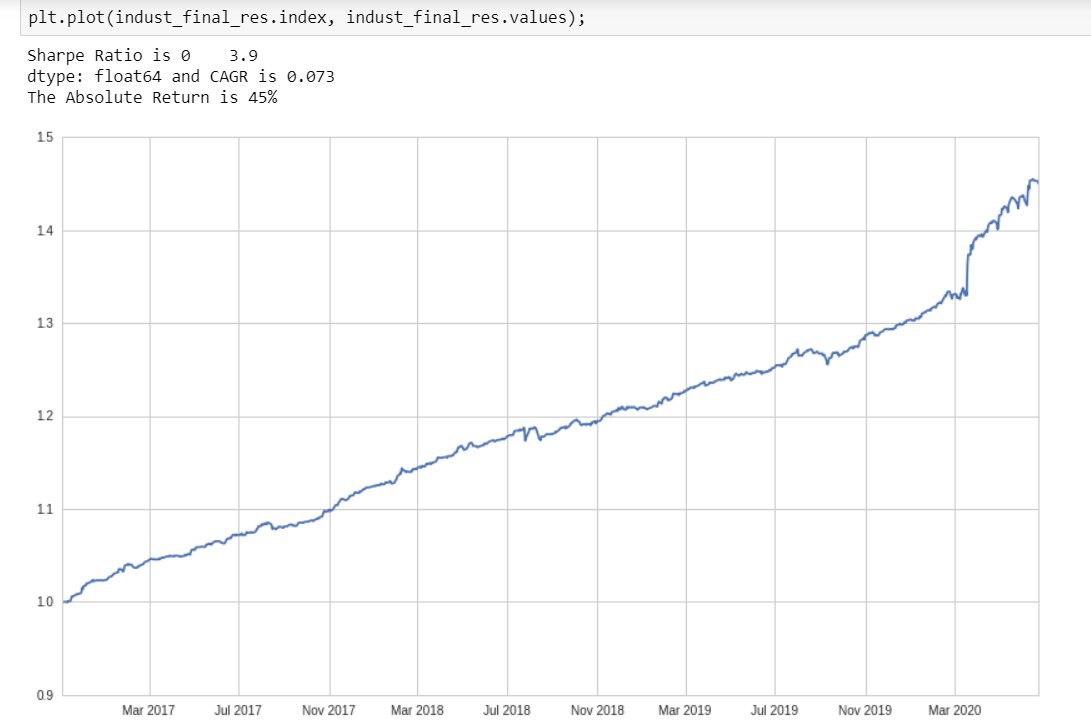

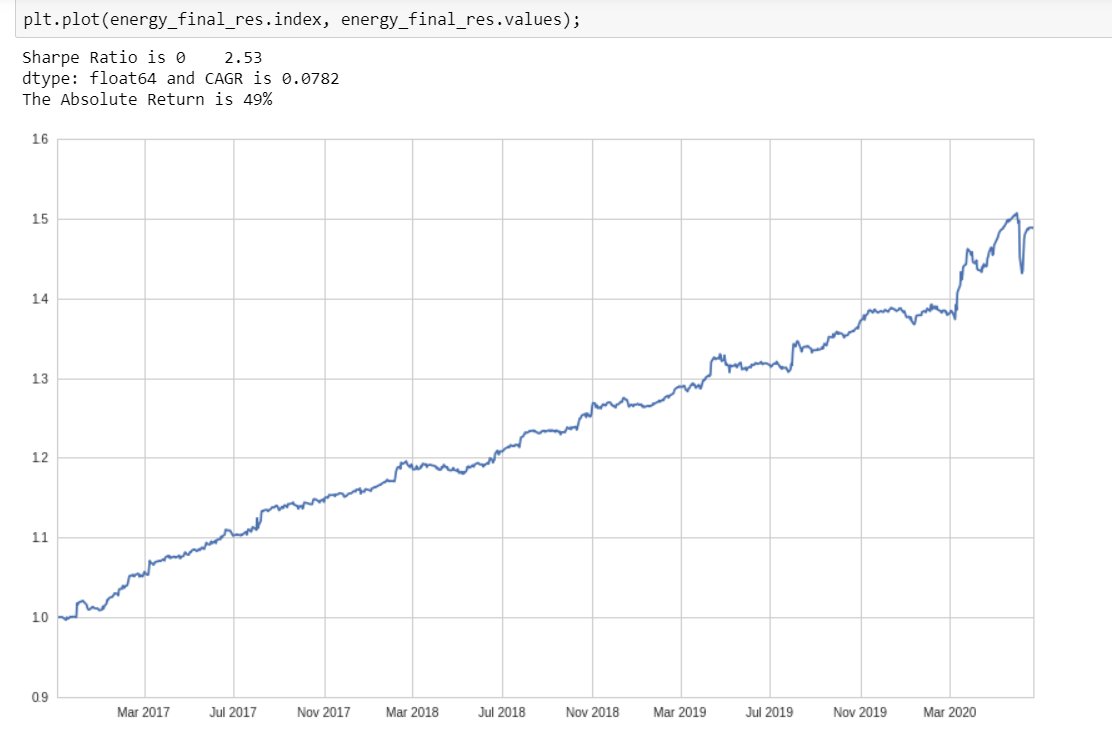

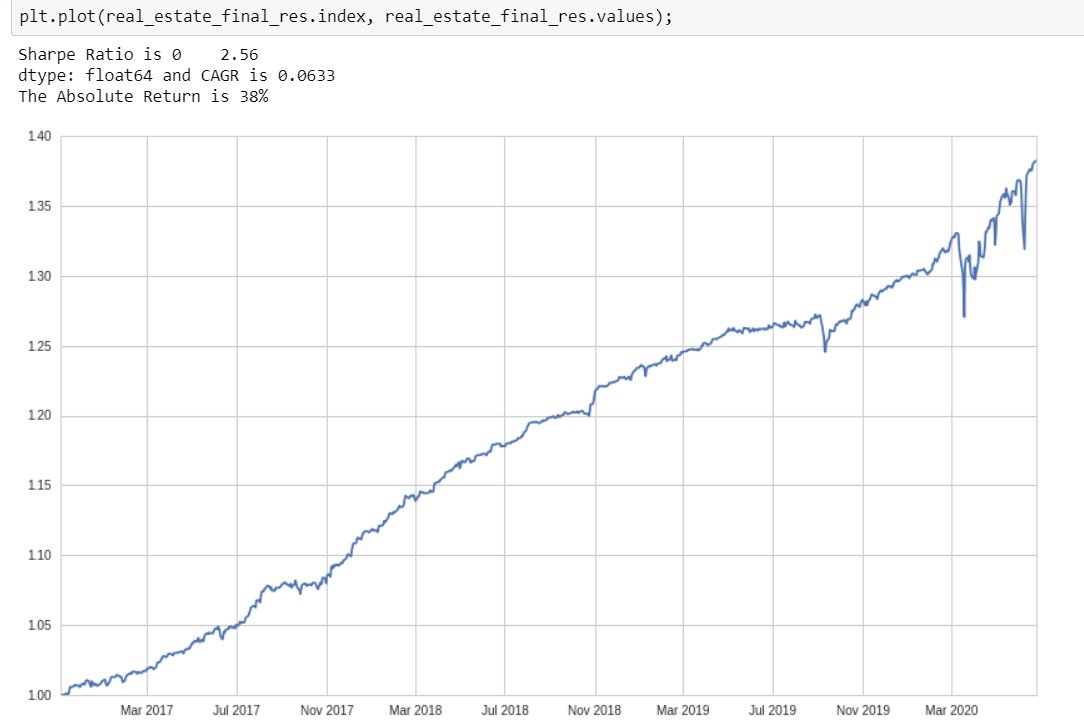

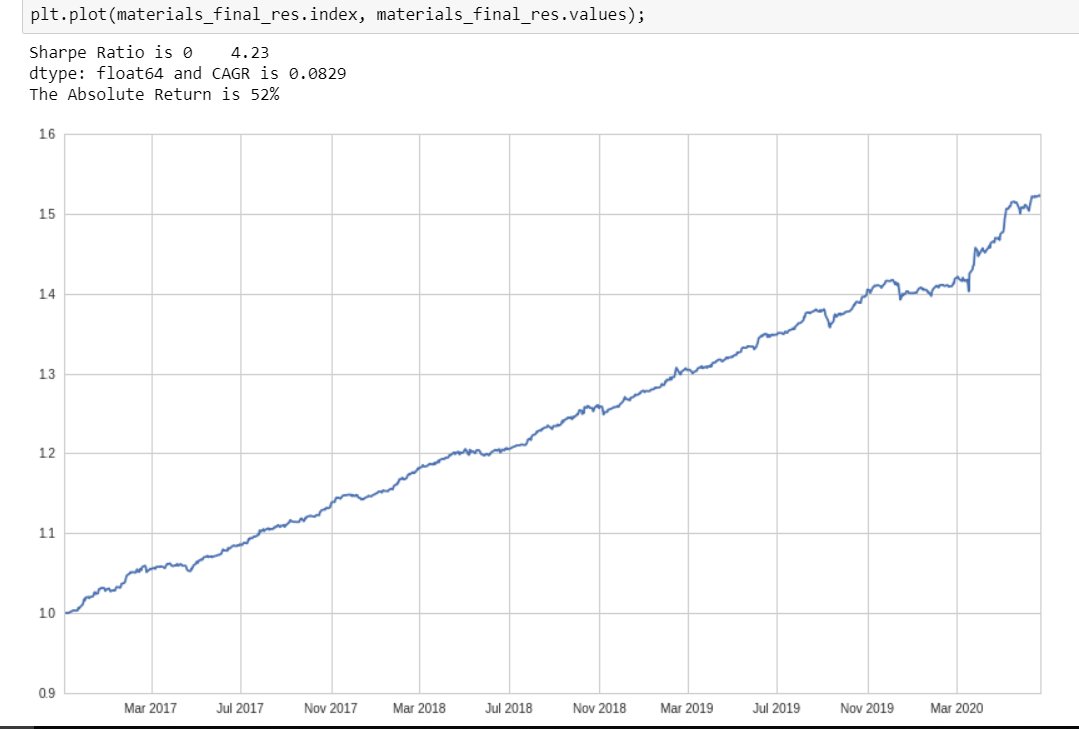

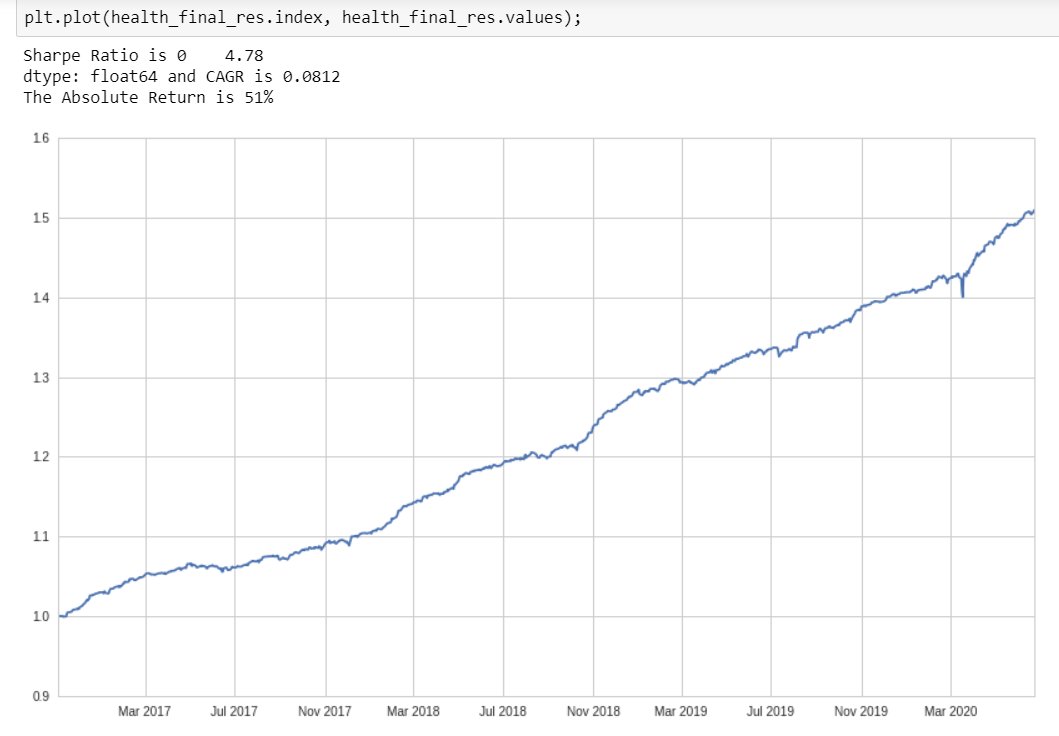

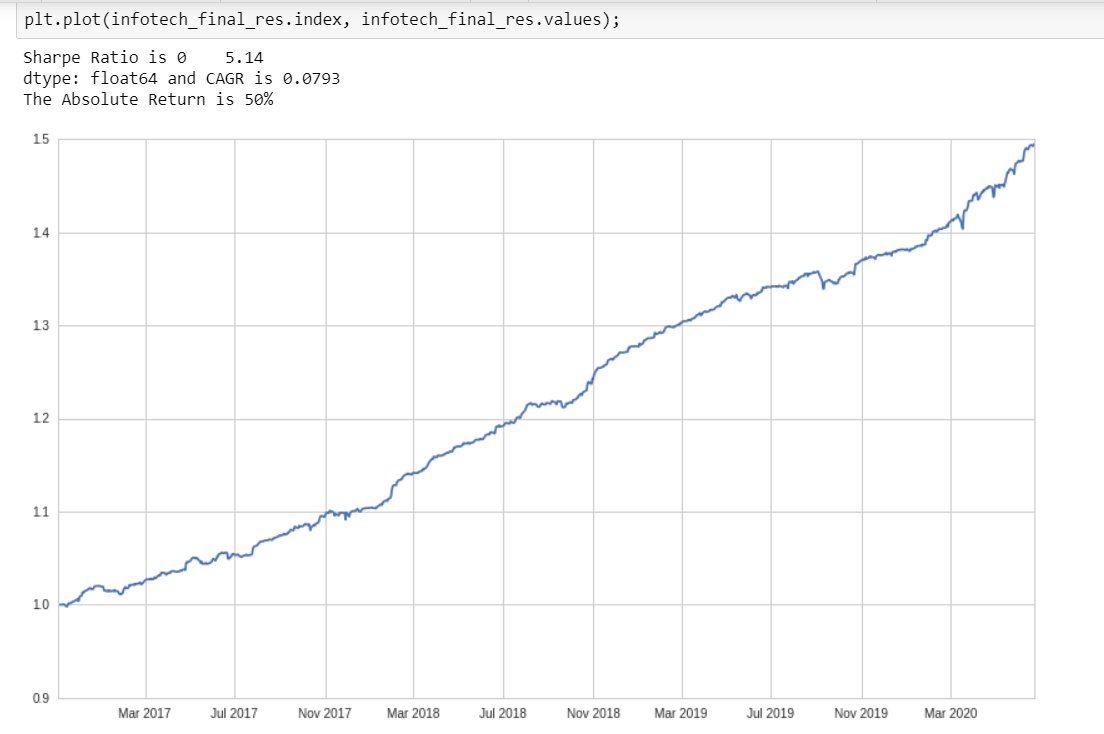

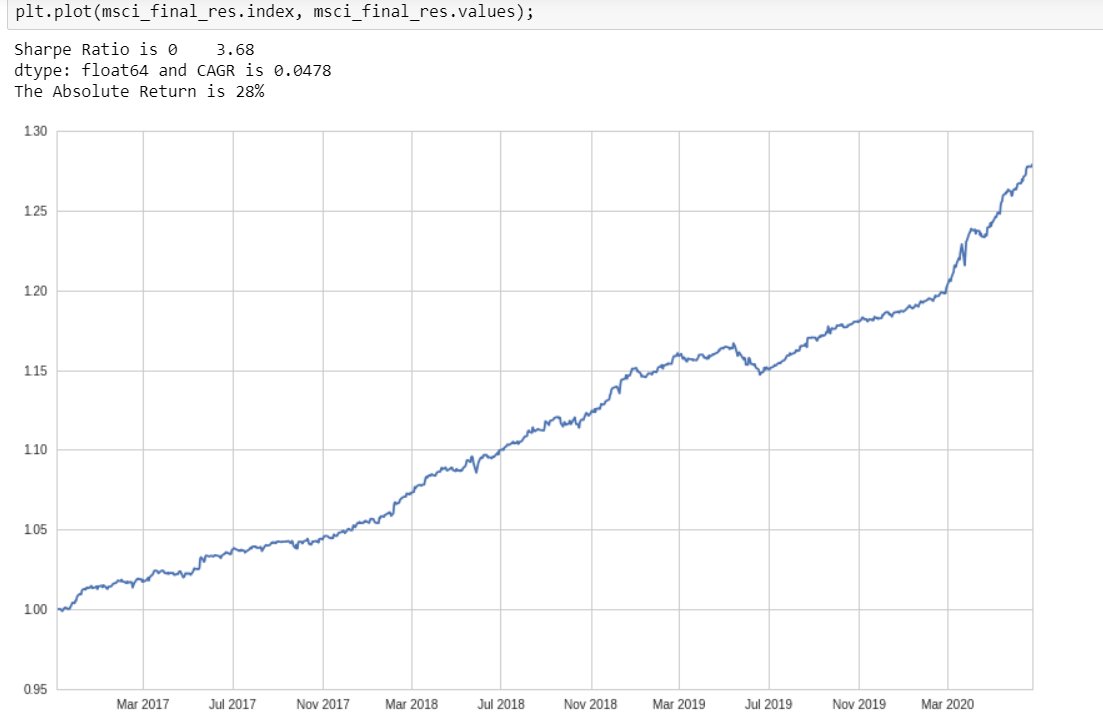

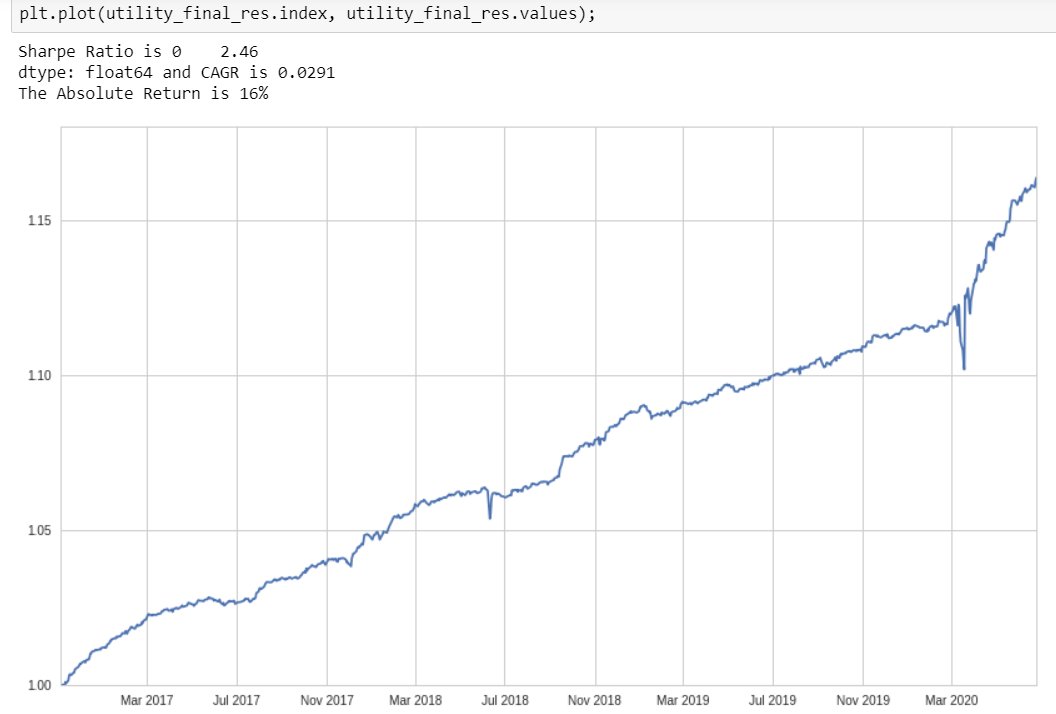

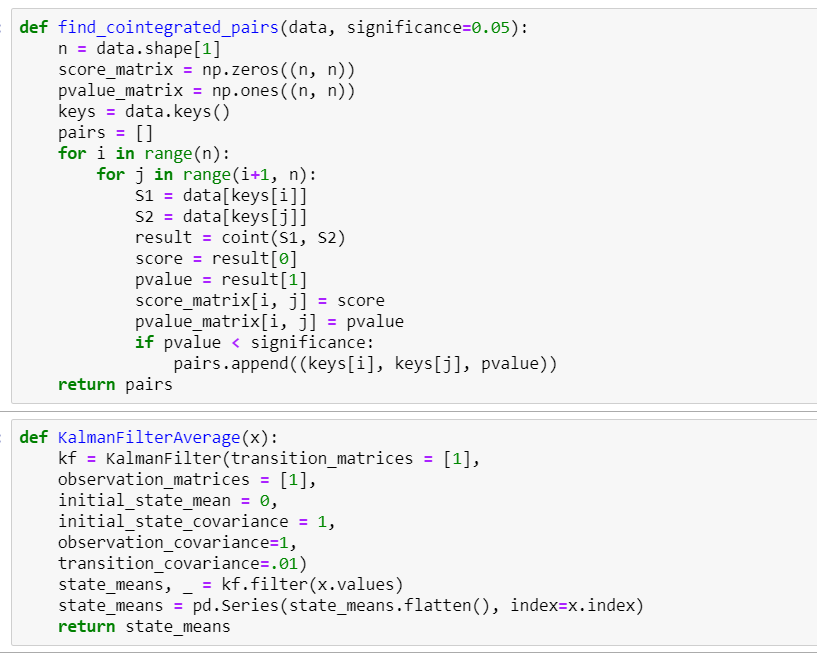

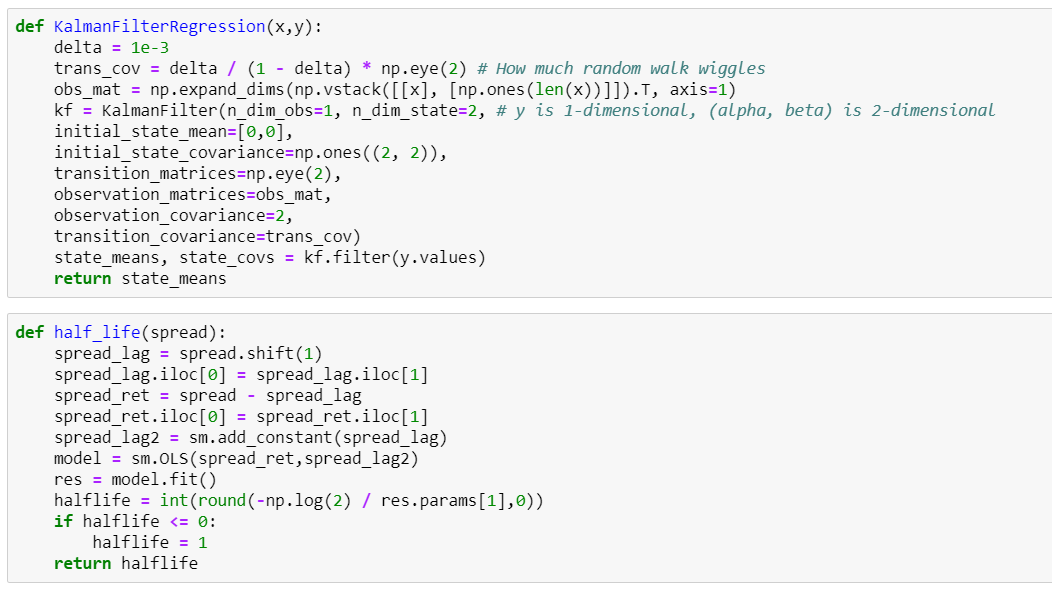

Co-integrated Pairs Trading with a Dynamic Hedging Ratio determined by a Bayesian Kalman Filter

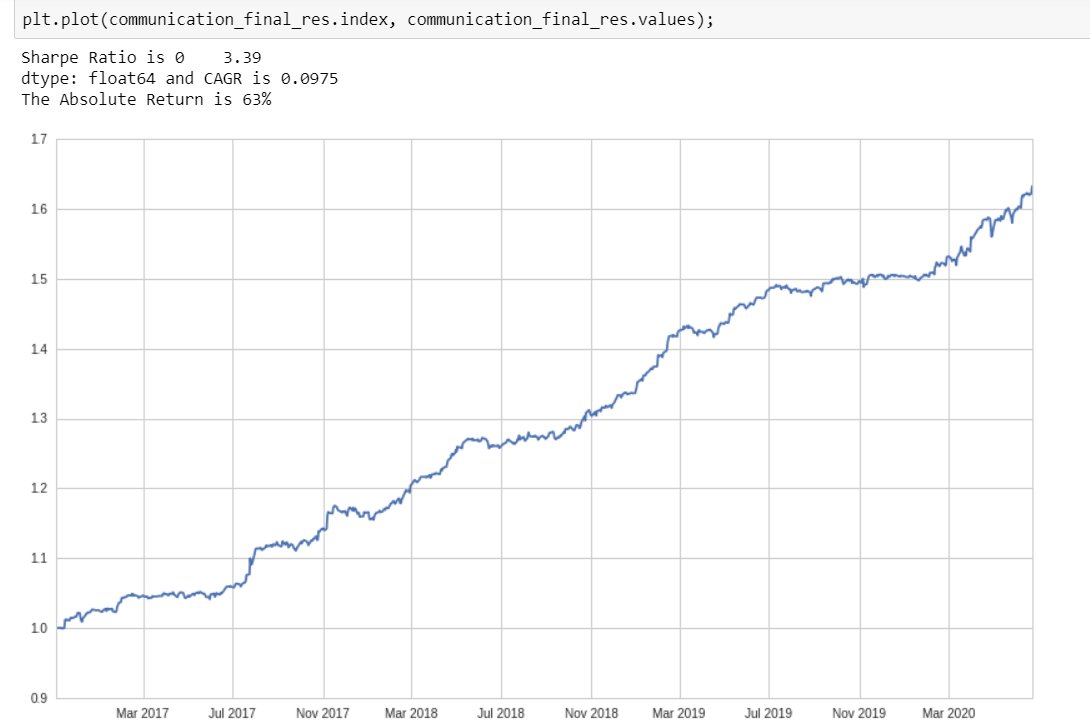

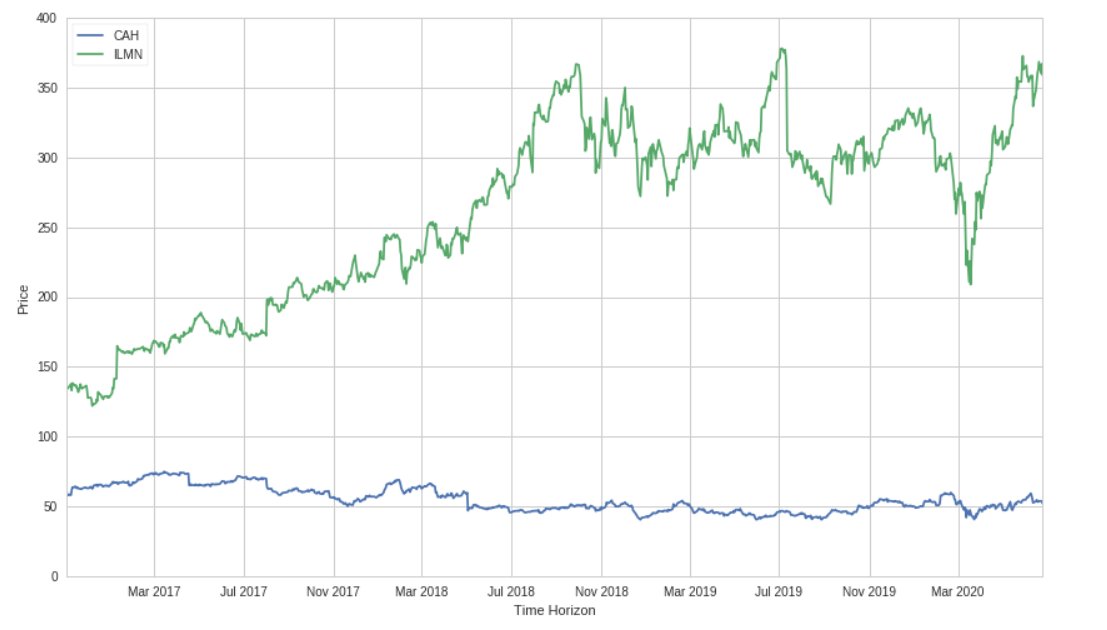

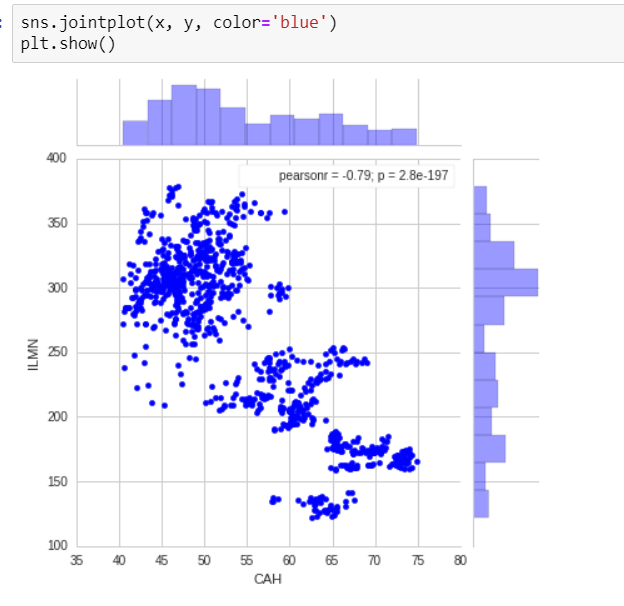

Graphical Representation Below:

Co-integrated Pairs Trading with a Dynamic Hedging Ratio determined by a Bayesian Kalman Filter

Graphical Representation Below:

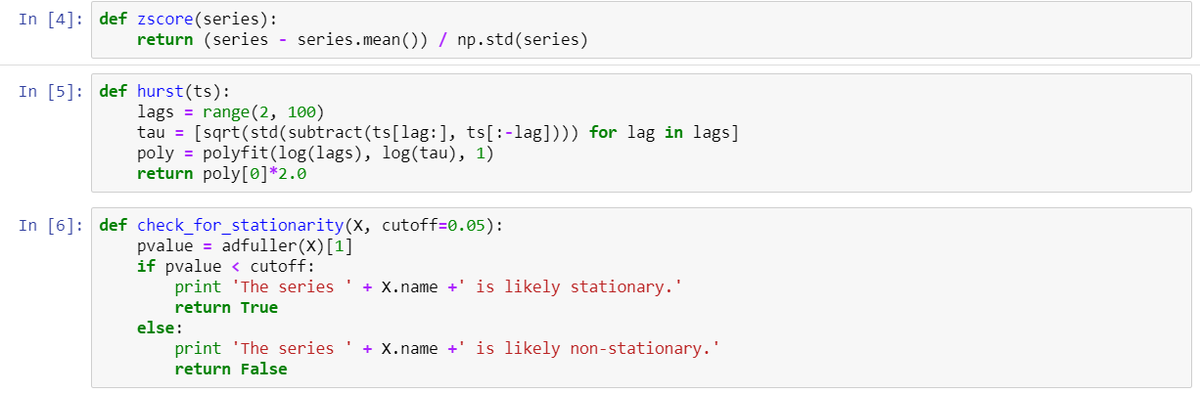

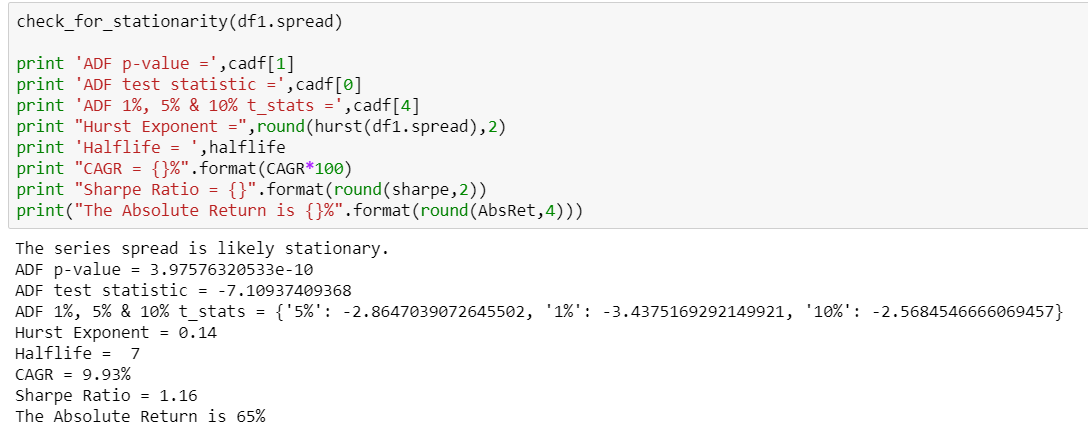

Determine the Half-Life of the Mean-Reversion Process (Ornstein-Uhlenbeck Methodology) & Create a Rolling Z-Score with the Rolling Window equal to the Half-Life

Simultaneously, determine the Price Spread with a Dynamic Hedging Ratio (found using a Kalman Filter https://www.quantstart.com/articles/State-Space-Models-and-the-Kalman-Filter/ )

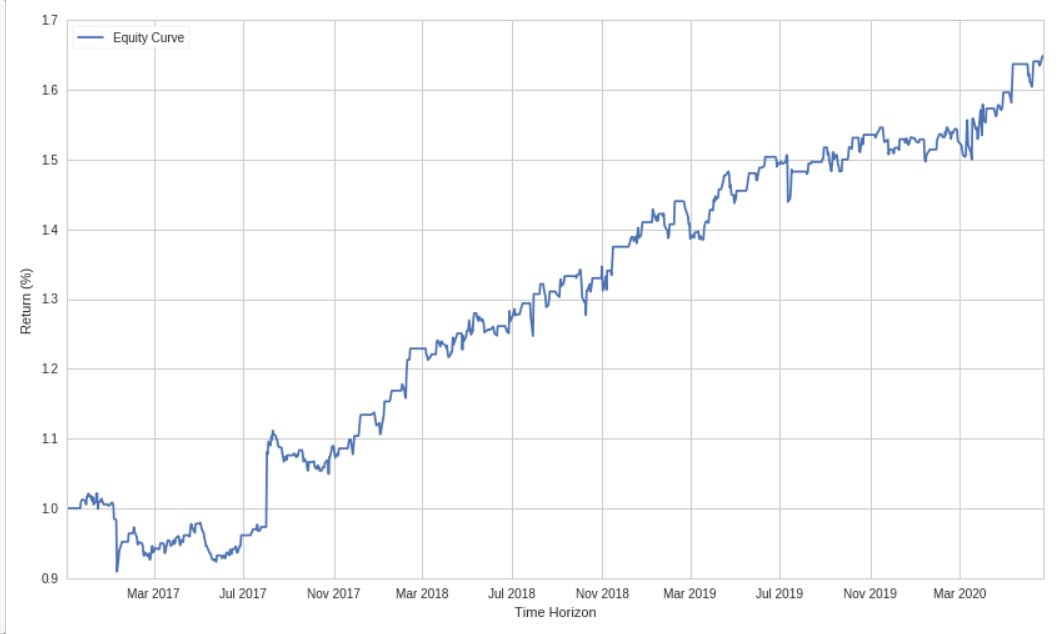

This is one way you can financially engineer returns, only requirement: volatility.... no expectations (illusions of grandeur) needed !

The mistake many traders make is trying to BEAT the market, which is the wrong approach, you want to EXTRACT what the market is giving you!

The market is the model.

The market is the model.

Read on Twitter

Read on Twitter