1/ End of June 2020 top holdings:

$AMZN 8.9% of portfolio

$PYPL 8.1%

$SWKS 6.7%

$MSFT 6.5%

$MA 6.2%

$FB 6.0%

$SQ 5.4%

$GOOGL 5.3%

$SHOP 5.1%

$ADBE 4.0%

$HD 3.5%

$DIS 3.1%

$MELI 2.7%

$EA 2.6%

$PAYC 2.5% https://twitter.com/Matt_Cochrane7/status/1245099604888166401

$AMZN 8.9% of portfolio

$PYPL 8.1%

$SWKS 6.7%

$MSFT 6.5%

$MA 6.2%

$FB 6.0%

$SQ 5.4%

$GOOGL 5.3%

$SHOP 5.1%

$ADBE 4.0%

$HD 3.5%

$DIS 3.1%

$MELI 2.7%

$EA 2.6%

$PAYC 2.5% https://twitter.com/Matt_Cochrane7/status/1245099604888166401

2/ Ideally, I start positions small and slowly build them out as my conviction and confidence grow. When I find great companies, I will add to them slowly over years. I think of this as time diversification. These positions are rarely sold.

3/ I do have a number of smaller, speculative positions that I try on for size and either 1) Discard if I don't like after period of time, or 2) Add to them until they grow into core positions.

4/ Remember, I can't share everything as I did previously because of my role with @7investing. Something I can share: This quarter I have made the following sells after holding all of these positions for several years:

$GPN

$JPM

$KMI

Here's why...

$GPN

$JPM

$KMI

Here's why...

5/ Why I sold $JPM - Banks are just too hard w/much depending on macro conditions outside of their control. I think JPM is a great bank but decided I wanted to avoid the entire sector (only exception being $HDB). Sold at almost break even after holding for several yrs.

6/ Why I sold $KMI - Honestly was just holding for sake of diversification. Originally purchased in 2014 in the high $30s (d'oh!) b/c I thought there was little downside and solid dividend growth ahead (double d'oh!). Knew little about the co (pipeline) and sector. Good riddance.

7/ Why I sold $GPN - This was a tough sell and I'm still not sure if it was the right decision. This is a good co, but after coming across some scathing reviews of its "software", I realized it was not quite what I thought it was. Did very well in this name though for several yrs

8/ These sells tightened my portfolio, reducing the positions in my portfolio to 31 companies. I want to reduce this further and am thinking about trimming or selling some names that are looking a bit steep. If I do, I'll share more in my next quarterly portfolio update.

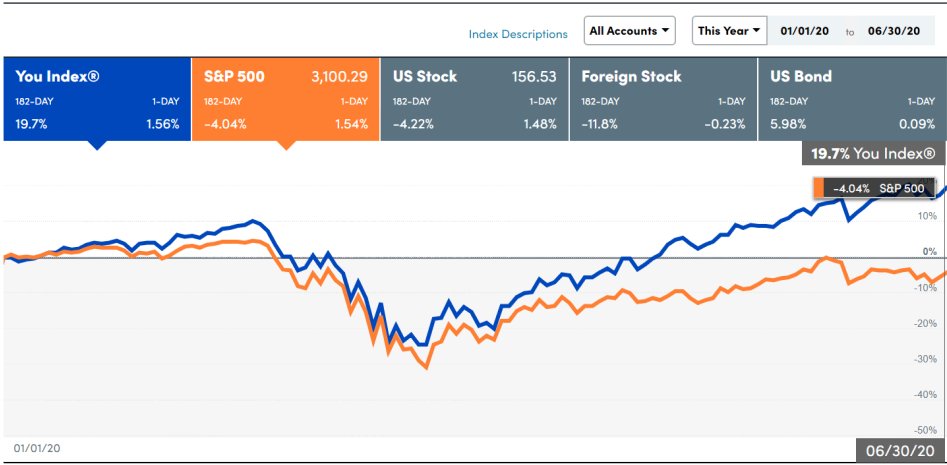

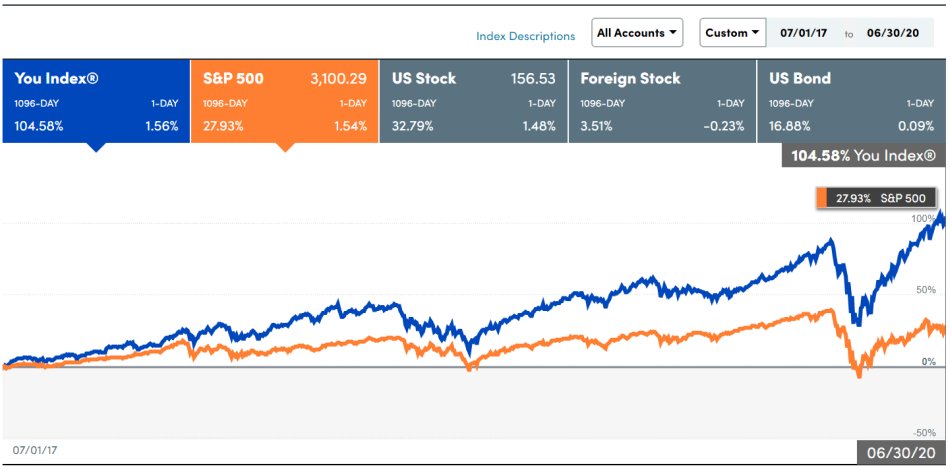

9/ YTD performance: +19.7% vs. S&P -4%

1-yr performance: +31.2% vs. S&P +5.4%

3-yr performance: +104.6% vs. S&P +28%

1-yr performance: +31.2% vs. S&P +5.4%

3-yr performance: +104.6% vs. S&P +28%

Read on Twitter

Read on Twitter