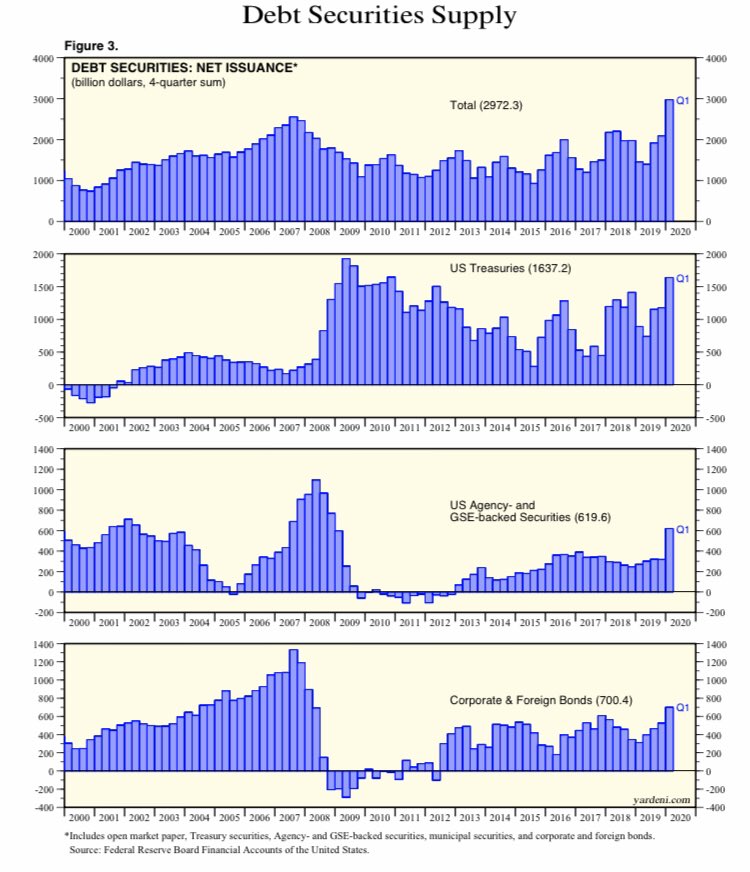

To the extent we have much larger securities issuance- and more relevant the net issuance across corporate bonds, MBS, equities, converts and especially treasuries. If you strip out fed purchases - the US is still the largest net creator of financial assets this year as % of gdp

What’s more important is the net issuance of AAA and investment grade paper for SWFs and central banks - because Europe and RoWs expansion has largely been through the banking system - the largest expansion of creation of financial assets has been in the US - this sucks liquidity

What’s more interesting is that US expected fiscal response - supposing we have a additonal stimulus with deficit impact of $1.5 trillion - the US is likely to have a $5.5 trillion deficit. Assuming Fed purchases this year total to $2.75 trillion in TY- net TY supply of $2.75 T

Given investors continue to shy away from local currency bonds- EM countries have also been strong issuers of USD bonds- this continues to create demand for USD or sucks liquid USD from around the world-

It’s important to remember the Fed programs provide necessary puts so buyers are enticed by the lower vol and a well as ample liquidity - mean this net issuance continues to be absorbed as folks continue to prefer US bond markets vol. adjusted

There’s been this enormous net creation of financial assets in the US- especially high quality paper across the board with government, GSE, Microsoft’s and Apples - there is this large demand for USD - likely to be sustained-

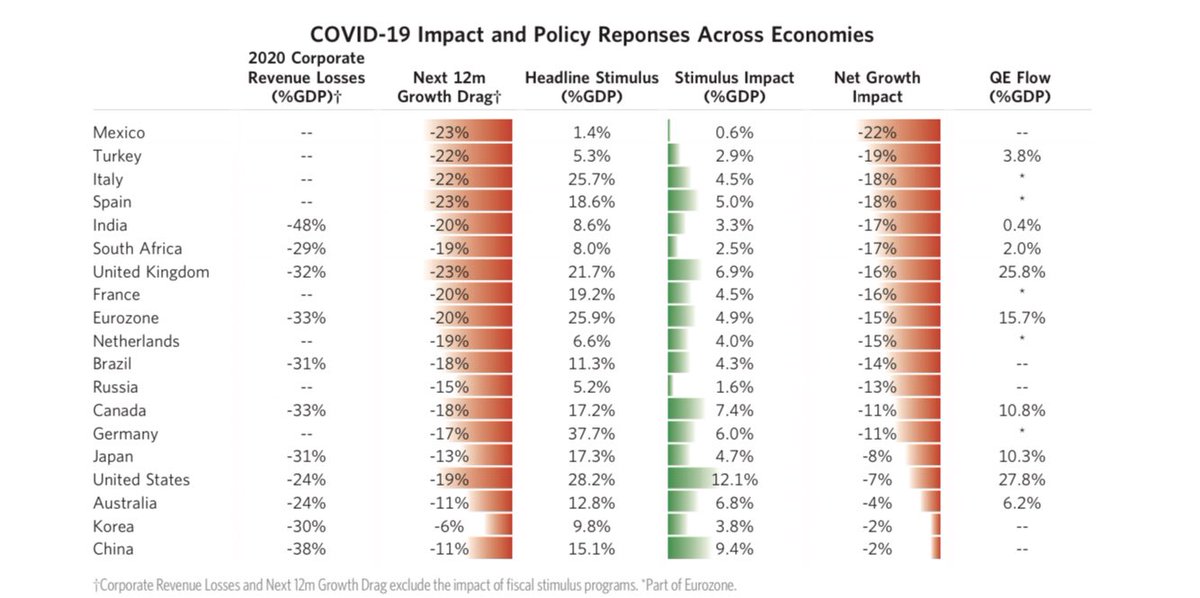

The US - especially in a dem sweep - will have large sustained deficits compared to other countries - will lead to stronger relative gdp performance to other regions such as Europe. UK continue to have more restrained fiscal response while BOE is much more aggressive than Fed

In light of the cheaper hedging costs - asset holders like Taiwanese and Japanese Insurers may decide to start hedging more of their investments pushing back against dollar appreciation. Nonetheless , large majority of investments - to the extent they are not Fx hedged are $ +ve

As such, FX directionality + other trades I continue to like are

Short USDJPY

Long USDBRL

Long USDZAR

Long USDGBP

Short AUDJPY

Italian 5s30s flatteners vs Germany 5s30s steepeners

Short DAX/ EUROSTOXX

Some version of credit flatteners 3s5s flatteners in US make sense

Short USDJPY

Long USDBRL

Long USDZAR

Long USDGBP

Short AUDJPY

Italian 5s30s flatteners vs Germany 5s30s steepeners

Short DAX/ EUROSTOXX

Some version of credit flatteners 3s5s flatteners in US make sense

(I believe peripheral Europe damage is being underestimated by the market and the proposals simply don’t go far enough in mitigating the downside damage in peripheral Europe+ export oriented economies will suffer tremendously) - you want to be positioned for earliercredit events

Read on Twitter

Read on Twitter