Understanding REITs

Understanding REITs

REITs also known as a Real Estate Investment Trust was originated in 1960 as a special tax entity within the RE sector.

REITs provide normal investors like you and me the opportunity to invest directly in Real Estate assets.

THREAD

THREAD

REITs allow investors looking to remain liquid and invest in Real Estate assets at the same time. Remaining liquid refers to having the ability to access your money quickly.

REITs must follow a set of rules to maintain their REIT status which exempts them from corporate taxes.

REITs must follow a set of rules to maintain their REIT status which exempts them from corporate taxes.

1) Invest 75% of assets in RE

2) 75%+ of revenue must be derived from RE

3) Distribute 90%+ of their taxable income in the form of dividends

4) Led by a Board of Directors

5) Maintain at least 100 shareholders

6) 50% or less of its shares may be owned by fewer than 6 shareholders

2) 75%+ of revenue must be derived from RE

3) Distribute 90%+ of their taxable income in the form of dividends

4) Led by a Board of Directors

5) Maintain at least 100 shareholders

6) 50% or less of its shares may be owned by fewer than 6 shareholders

You can find REITs in numerous different sectors

- Office

- Retail

- Healthcare

- Industrial

- Self Storage

- Specialty

- Net Lease

- Apartment

- Single Family Housing

- Manufactured Housing

- Hotel

- Data Center

And many more!

- Office

- Retail

- Healthcare

- Industrial

- Self Storage

- Specialty

- Net Lease

- Apartment

- Single Family Housing

- Manufactured Housing

- Hotel

- Data Center

And many more!

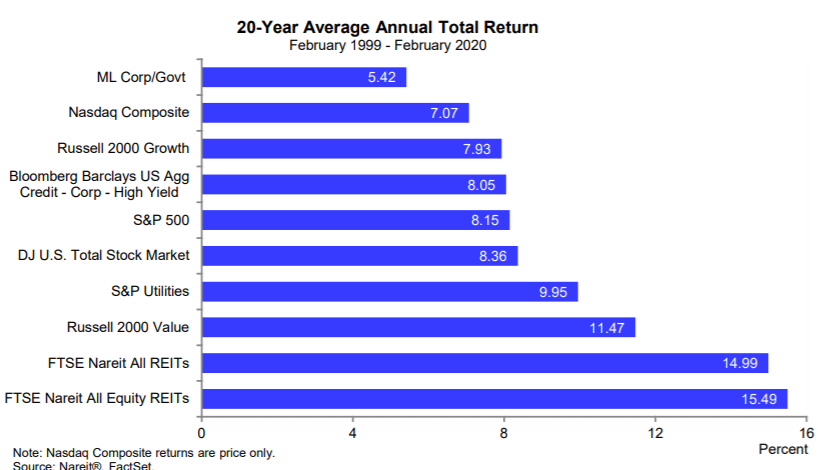

REITs have outperformed other major asset classes by a large margin over the past two decades. Equity REITs have returned an annual avg of 15% the past 20 years compared to the S&P 500 returning an avg of 8% per year.

REITs can be held in both taxable and retirement accounts.

REITs are a LARGE holding in my portfolio and RE is a sector I have worked in over the last 10+ years. If you have any questions regarding REITs in general, please feel free to DM at any time, happy to help!

REITs are a LARGE holding in my portfolio and RE is a sector I have worked in over the last 10+ years. If you have any questions regarding REITs in general, please feel free to DM at any time, happy to help!

Read on Twitter

Read on Twitter