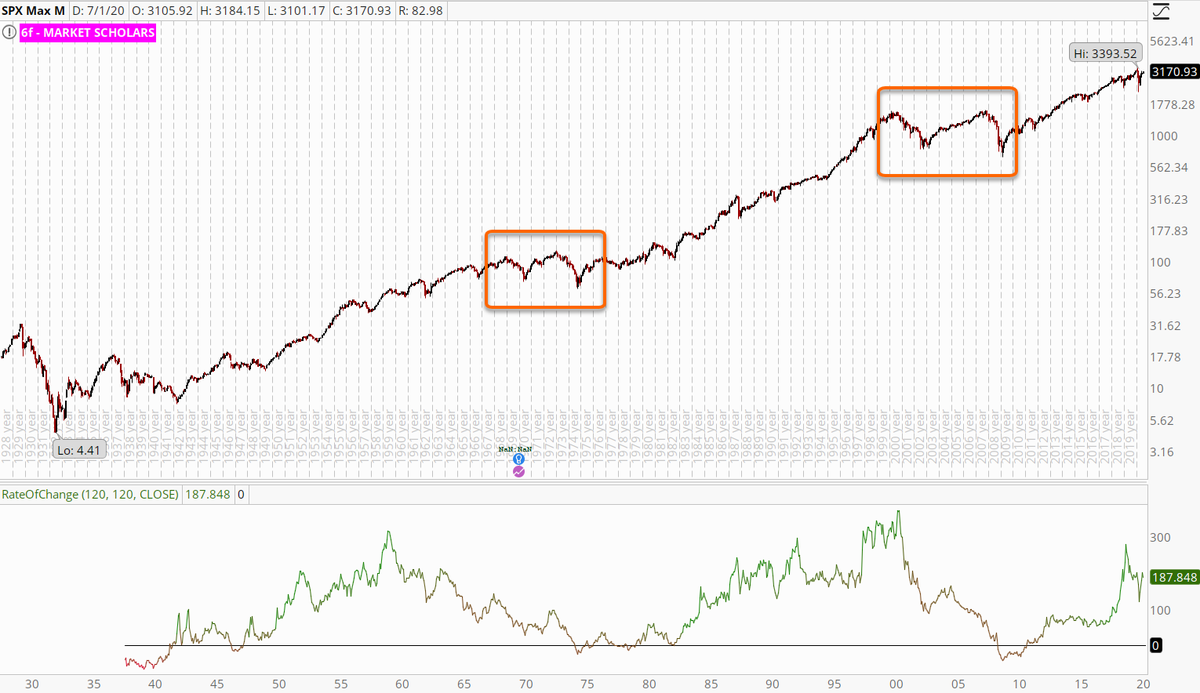

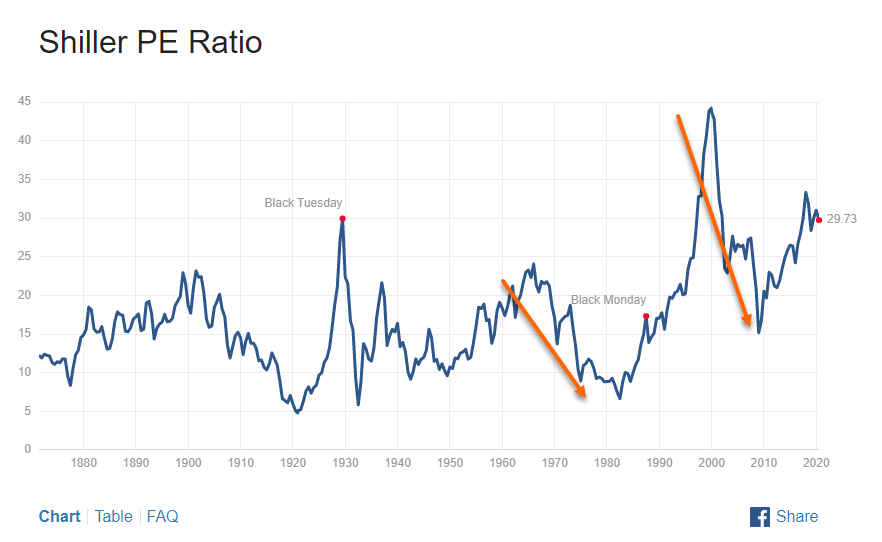

This is an important concept we cover frequently in my long-term Portfolio Management class @Market_Scholars. What brings down long-term avg annual returns? The possibility of a drawn-out bear market, e.g. 2000-03 and 2007-08 or 1968-70 and 1972-74...(1/4) https://twitter.com/awealthofcs/status/1281227036141457408

Those years get a lot of attention but all the other years around those timeframes were strongly bullish. So, it only takes a year or two (in a 10-year period) of a drawn out bear market to reduce 10-year returns to a low result...(2/4)

If you are always expecting the next year to be THE ONE, then you'll miss out on really good bullish years in between. The nice thing is those bear markets never come out of nowhere - like we just saw in March. Big long-term divergences develop and "death crosses" occur...(3/4)

We'll see it coming. There will be easy-to-see signs. So, just trade what you see and NOT what you think you should see based on what you think the Fed should do or not do. Manage risk so sharp moves don't kill you and manage your long-term return expectations accordingly (4/4)

Read on Twitter

Read on Twitter