I know it's Friday and everyone is trying to avoid thinking about anything heavy, but at the Senate Finance and Public Administration References Committee right now, reps from Australia's insurers are sitting around talking about the end of the world (climate change). (Thread)

The committee is looking at what's going on within insurance after the summer's bushfires and so far the insurers have said:

1) This year has been one of their most unprofitable in living memory

2) They have no faith in government to stop catastrophic climate change

1) This year has been one of their most unprofitable in living memory

2) They have no faith in government to stop catastrophic climate change

3) Climate change is already being priced into people's premiums

4) Some parts of the country are on their way to becoming uninsurable

5) Short term, they're betting technology will mitigate the worst, but say at some point it's going to become overwhelmed

4) Some parts of the country are on their way to becoming uninsurable

5) Short term, they're betting technology will mitigate the worst, but say at some point it's going to become overwhelmed

6) When it comes to the politics climate change, they would prefer to talk about tax cuts.

Here's a clip I grabbed from an exchange before the break between Labor Senator Tim Ayres and the insurance industry chiefs where you can see their response.

Here's a clip I grabbed from an exchange before the break between Labor Senator Tim Ayres and the insurance industry chiefs where you can see their response.

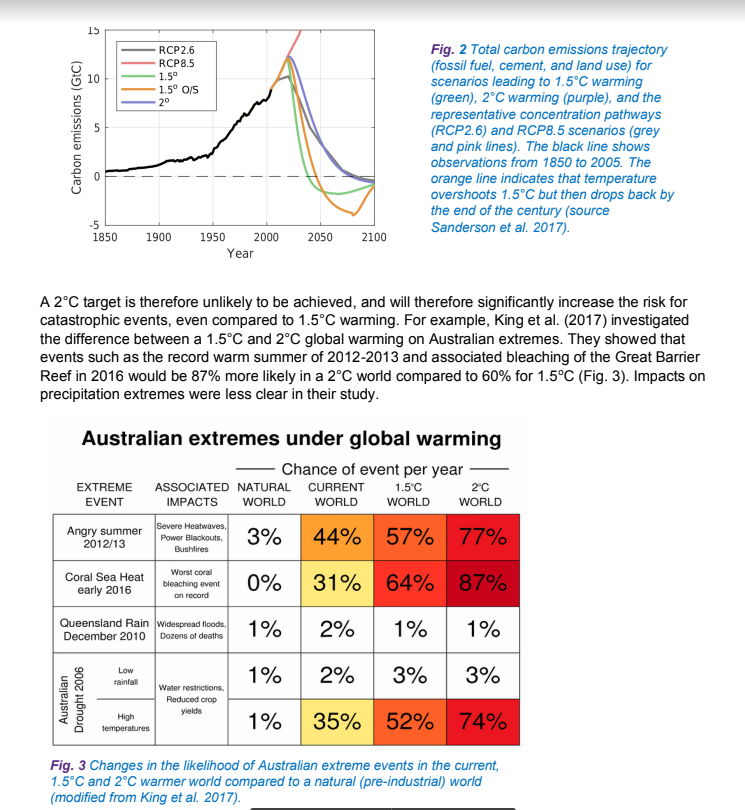

Talking now is Robert Whelan, CEO of the Insurance Council of Australia. Whelan is about to retire. Page 10 of the industry body's submission to the committee shows how they see our future.

Ayres is now asking Whelan about climate risk, citing an interview he did in an insurance news magazine earlier this month, that provides a window into the back-of-house interactions between government and the insurance business.

Whelan says in the early 20-teens the issue of climate change was highly politicised. Now that it's here, it's hard to ignore. Ayres now asking asking, "Who was telling you to stay out of the debate?"

Whelan responds by saying a view formed within the insurance industry that their presence in the "debate" would not have been "helpful".

Whelan now being asked about how recent destructive weather has had a huge impact on the industry's bottom line. Asked whether the industry should be clearly telling customers what's what, Whelan says the "blunt" instrument for doing so is pricing.

Whelan denies anyone in government directly said there would be consequences for talking about climate change. Says the reluctance was just part of the confused and "antagonistic" debate.

Says things have changed.

"The data does tell a different story from our point of view."

Says things have changed.

"The data does tell a different story from our point of view."

After an interlude for other senators to ask questions, we're back to Whelan who is asked about certain regions becoming uninsurable. The individual company reps were reluctant to name figures and so is Whelan.

"It's not in our interest to price ourselves out of a market," Whelan says, adding individual companies have different ideas. Bringing down the premiums means managing the risk.

I quickly grabbed this clip where Whelan talks about how the insurance industry decided to stay quiet when the "debate" around climate change was raging in the 20-teens.

Whelan's finished his evidence, so I'm going to go back through and pull out anything of interest.

An earlier exchange with insurance company reps has just finished uploading whether they are asked directly about the reality of focusing on mitigation when they will eventually be overwhelmed by climate change.

The insurance business has lost $5.3b over the last quarter from disasters linked to climate change. Here Rob Whelan is asked whether insurance companies should be more vocal about explaining the costs to customers. Whelan says they do it through pricing:

Anyway, I'll leave it there. But closing thoughts are that the last couple of hours have offered a rare window into how the masters of risk think about climate change -- and the picture is as bleak as you'd expect.

The insurers know it's bad and that what happened this summer is going to keep happening, but they haven't been pressing the argument. If money talks, this time around it's been silent and the rest of us are going to bear the cost.

But then I'm looking to talk about this more hopefully in an upcoming story somewhere, or at the very least at Raising Hell. If you like my work, want me or are interested in supporting me, throw me a sub: https://roycekurmelovs.substack.com/p/raising-hell-issue-8-austerity-blues

Read on Twitter

Read on Twitter