Q2 was DeFi’s breakout quarter

Liquidity mining took center stage bringing an influx of attention

TVL increased ~3x

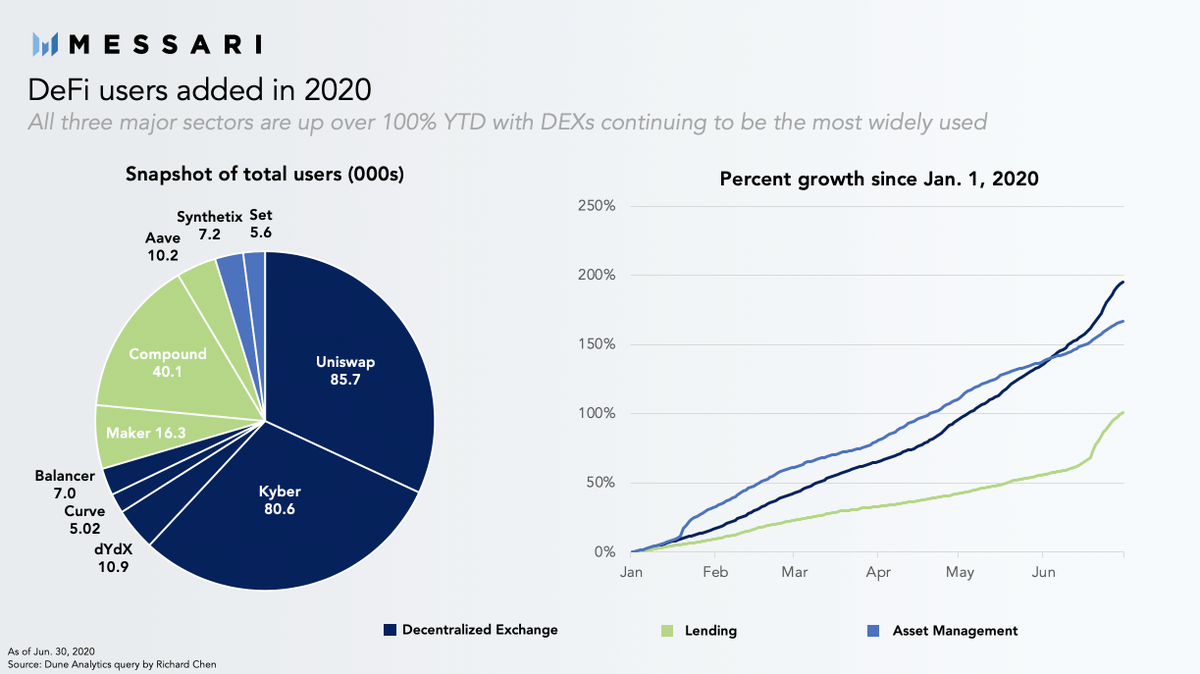

Total users were up 50%

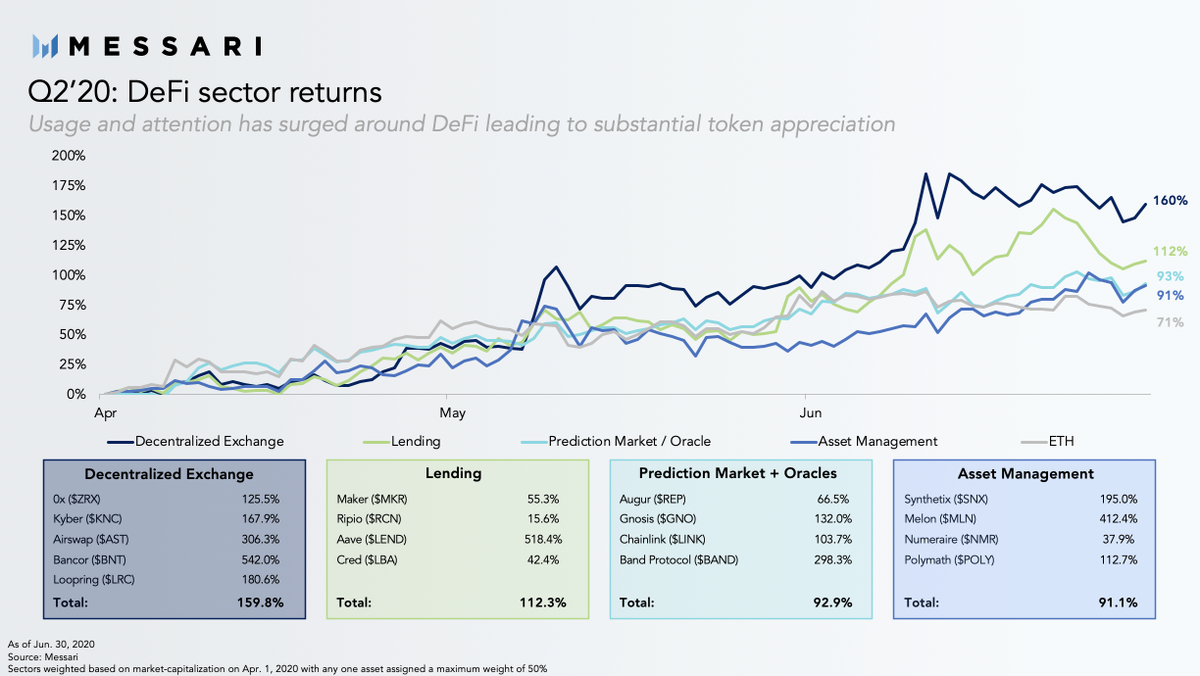

All this manifested itself in the prices of tokens themselves with every major sector outperforming ETH

Liquidity mining took center stage bringing an influx of attention

TVL increased ~3x

Total users were up 50%

All this manifested itself in the prices of tokens themselves with every major sector outperforming ETH

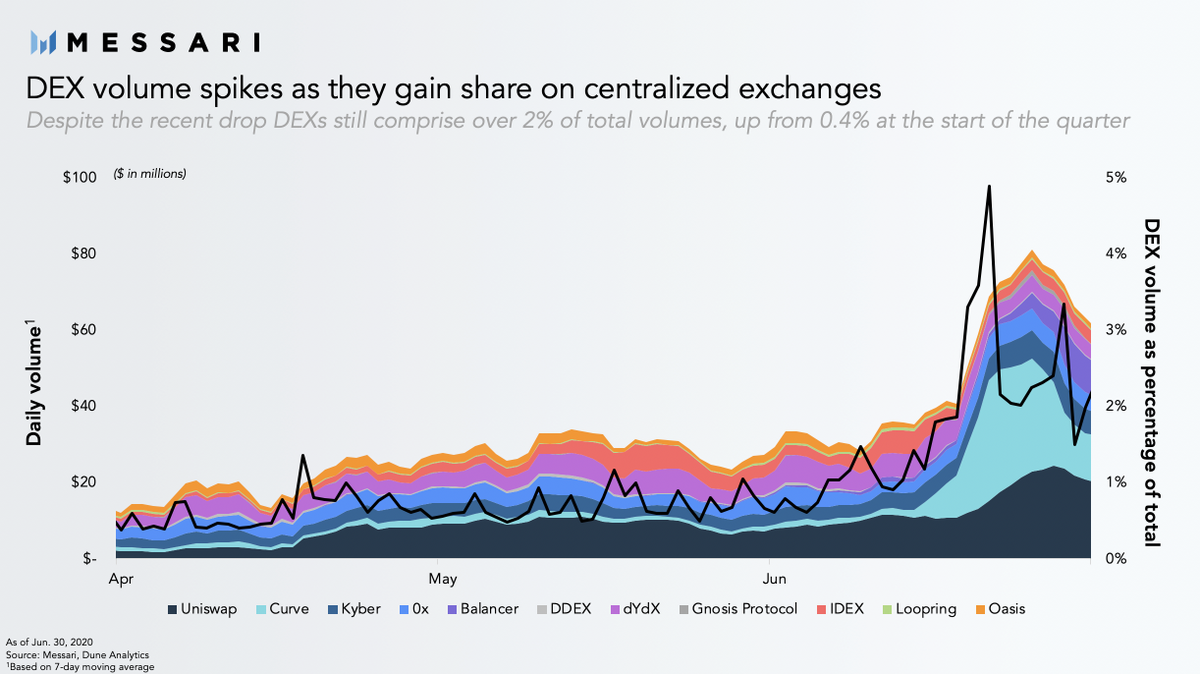

DEXs led the charge up 160% as they saw an explosion of usage

They now comprise almost 2% of total real volumes across all exchanges

They now comprise almost 2% of total real volumes across all exchanges

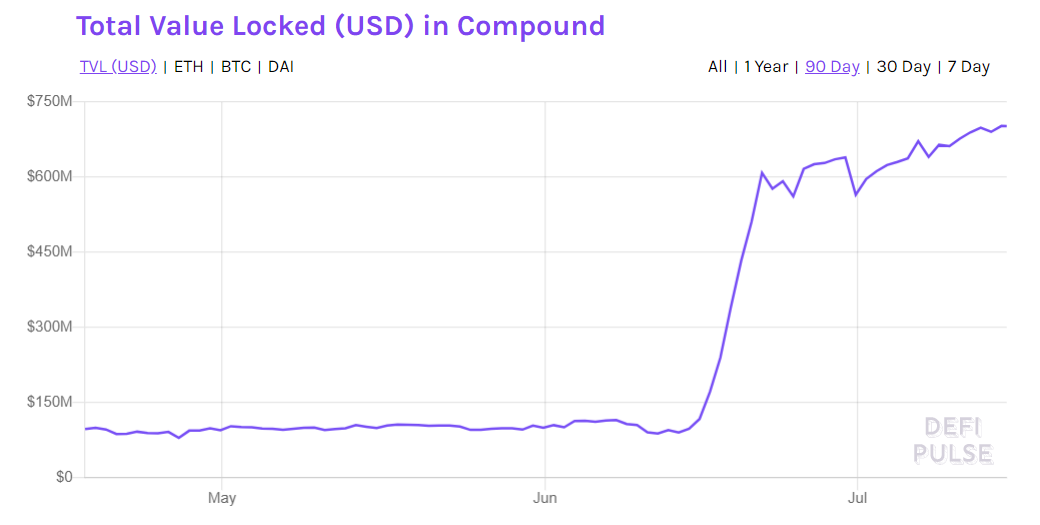

Lending markets also soared, a direct result of Compounds liquidity mining

This had implications for the rest of DeFi including providing tailwinds for other markets such as @AaveAave and @CurveFinance

This had implications for the rest of DeFi including providing tailwinds for other markets such as @AaveAave and @CurveFinance

While also causing Dai to once again stubbornly remain above its peg

Its been recycled for yield farming making it such that more Dai is supplied to compound than actually exists

But make no mistake this isn't new school fractional reserve banking https://twitter.com/jpurd17/status/1279846195855319041

Its been recycled for yield farming making it such that more Dai is supplied to compound than actually exists

But make no mistake this isn't new school fractional reserve banking https://twitter.com/jpurd17/status/1279846195855319041

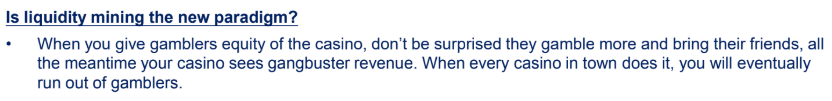

It’s obvious that liquidity mining can be an effective means of bootstrapping liquidity in early-stage protocols

We’re sure to see every project look to replicate

But as @MapleLeafCap said

We’re sure to see every project look to replicate

But as @MapleLeafCap said

Another trend that’s continuing to gain steam is aggregation, where platforms aggregate suppliers whose services become commoditized

Evidenced by @1inchExchange rapid rise to prominence as they now account for 20% of all DEX volume

Evidenced by @1inchExchange rapid rise to prominence as they now account for 20% of all DEX volume

We’re also seeing this with @staked_us RAY which aggregates fixed income products to optimize yield

And @mstable_ which aggregates stablecoins to reduce the idiosyncratic risk of any single token

And @mstable_ which aggregates stablecoins to reduce the idiosyncratic risk of any single token

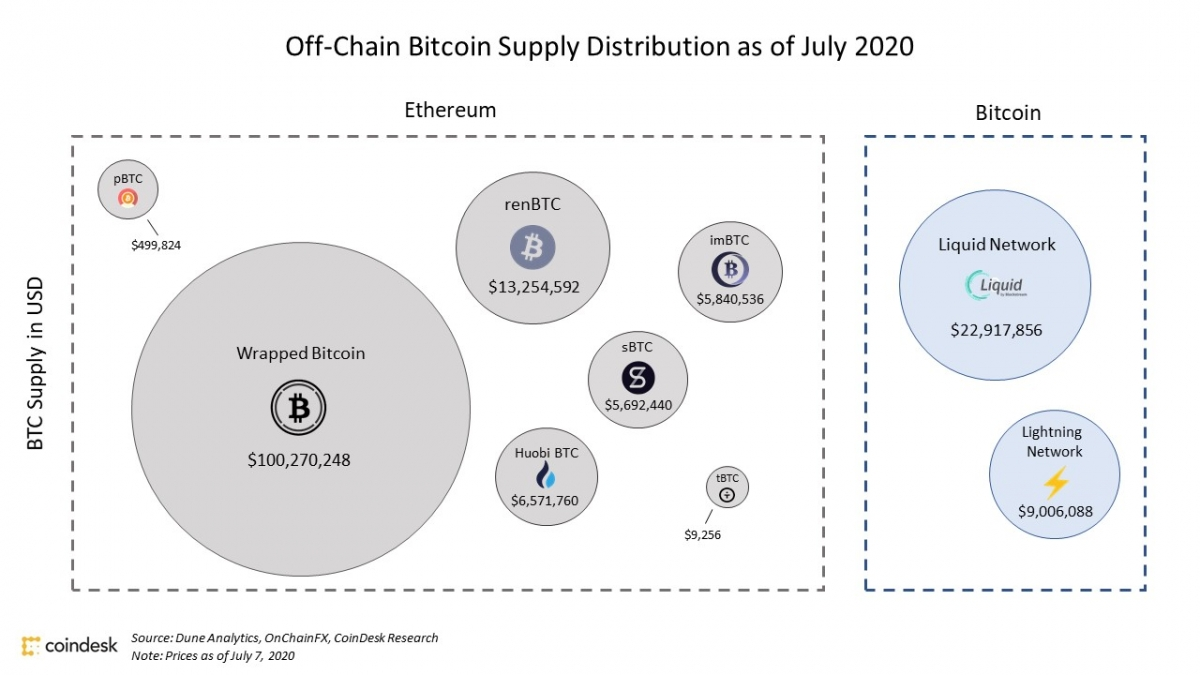

Q2 saw the rise of BTC on ETH with $140m of BTC making its way onto ETH

Similar to stablecoins, trusted versions have been able to scale faster, but the ever-present risk of censorship remains as we saw recently with USDC which could increase demand for more trustless versions

Similar to stablecoins, trusted versions have been able to scale faster, but the ever-present risk of censorship remains as we saw recently with USDC which could increase demand for more trustless versions

All of this attention on DeFi has led to a boost in user activity

More activity leads to more investment which leads to better products and once again more usage

It feels like DeFi has reached this critical mass where this reflexive cycle is now ready to kick into high gear

More activity leads to more investment which leads to better products and once again more usage

It feels like DeFi has reached this critical mass where this reflexive cycle is now ready to kick into high gear

Read all this and more in our Q2 recap  https://messari.io/article/q2-20-review-liquidity-mining-drives-defi-usage-and-token-prices-to-all-time-highs

https://messari.io/article/q2-20-review-liquidity-mining-drives-defi-usage-and-token-prices-to-all-time-highs

https://messari.io/article/q2-20-review-liquidity-mining-drives-defi-usage-and-token-prices-to-all-time-highs

https://messari.io/article/q2-20-review-liquidity-mining-drives-defi-usage-and-token-prices-to-all-time-highs

Read on Twitter

Read on Twitter