What's happening to housing and the Real Estate market under COVID?

Here's insights and data from Zillow about:

-What happened

-What's happening

-What's going to happen

A THREAD

Here's insights and data from Zillow about:

-What happened

-What's happening

-What's going to happen

A THREAD

First of all, we're well aware of the crazy rise in unemployment.

We're right around 13% right now, which we haven't seen since the Great Depression.

For those that are working, many are working from home.

We're right around 13% right now, which we haven't seen since the Great Depression.

For those that are working, many are working from home.

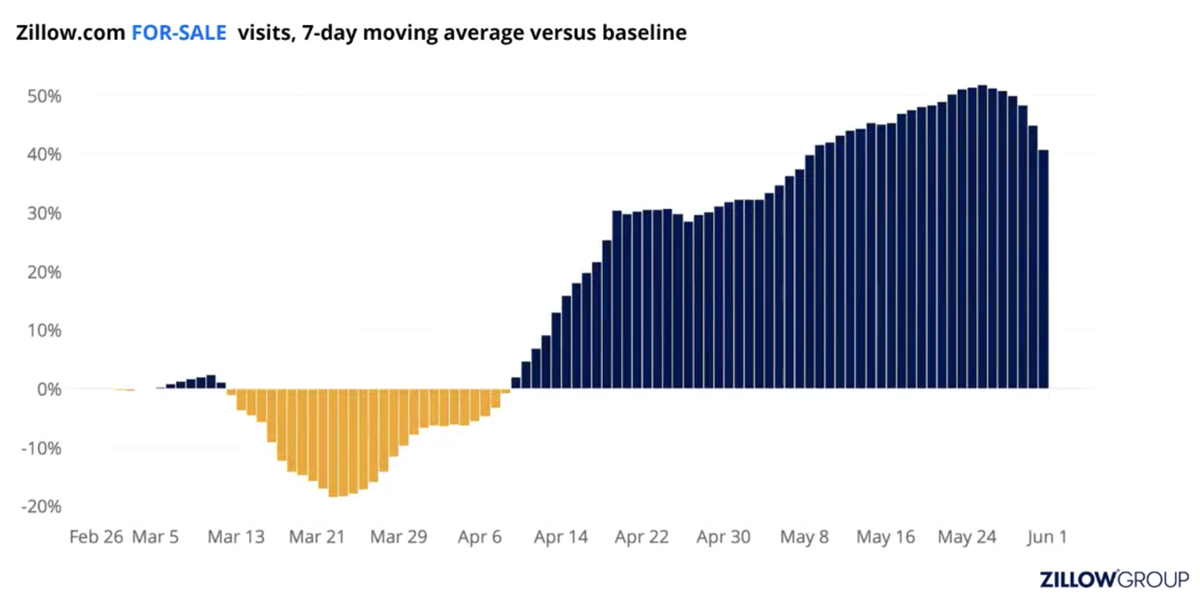

After a pullback right when COVID hit (during the prime home shopping season)

Search traffic for FOR SALE properties on Zillow have risen since early April.

Search traffic for FOR SALE properties on Zillow have risen since early April.

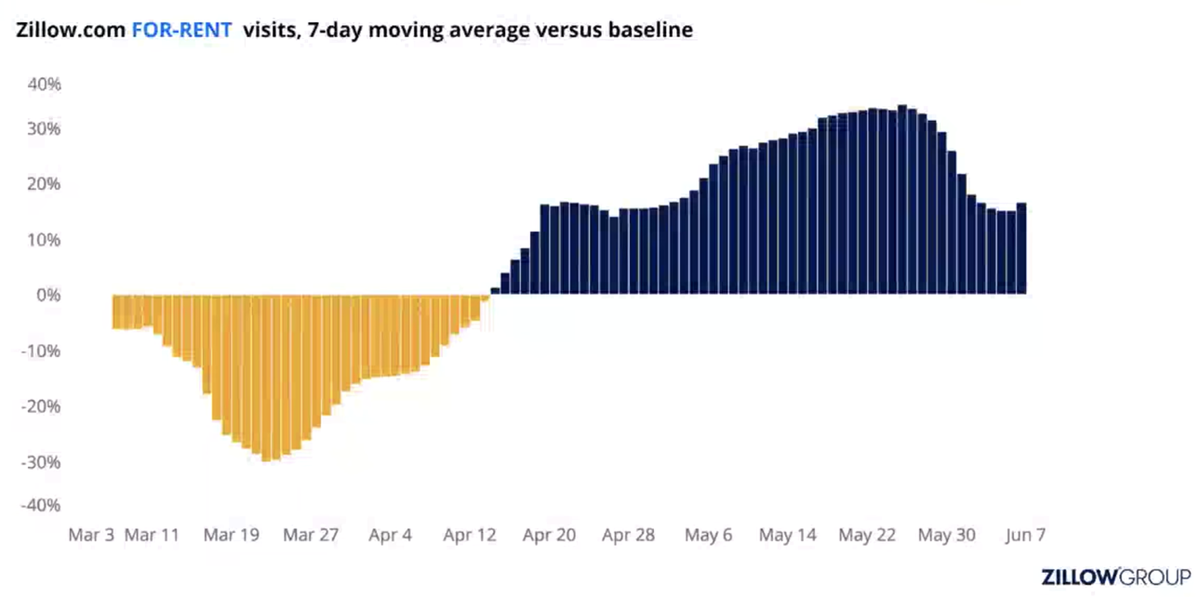

Search traffic for FOR RENT properties are ALSO up since early April.

A lot of this...is because we're stuck in our homes. And we're experiencing out living situation differently than ever.

Personally I moved to a new apartment in May. Found a great opportunity and jumped on it

A lot of this...is because we're stuck in our homes. And we're experiencing out living situation differently than ever.

Personally I moved to a new apartment in May. Found a great opportunity and jumped on it

Pending Sales

New For Sale Listings

Both plummeted right when COVID hit, but there's been a pretty dramatic return since the end of April.

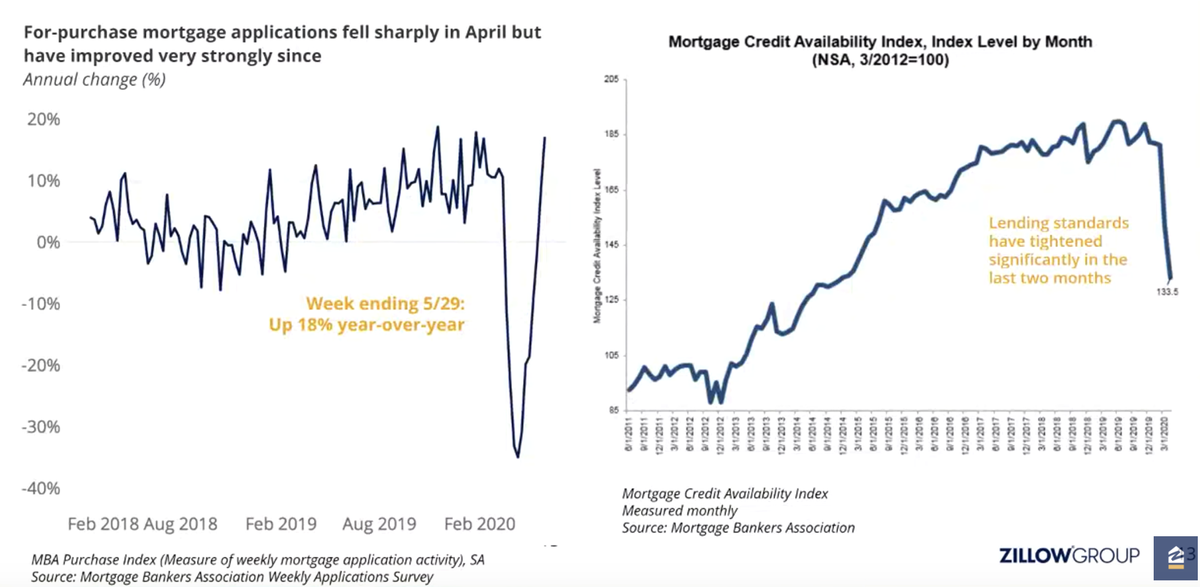

Pending sales up 11% YOY

Inventory still down 27%

New For Sale Listings

Both plummeted right when COVID hit, but there's been a pretty dramatic return since the end of April.

Pending sales up 11% YOY

Inventory still down 27%

Why are buyers returning?

Maybe because many buyers that have been stuck on the sidelines for years, trying to buy a house, have enough capital and financing...are finally finding opportunities in this unique market.

Maybe because many buyers that have been stuck on the sidelines for years, trying to buy a house, have enough capital and financing...are finally finding opportunities in this unique market.

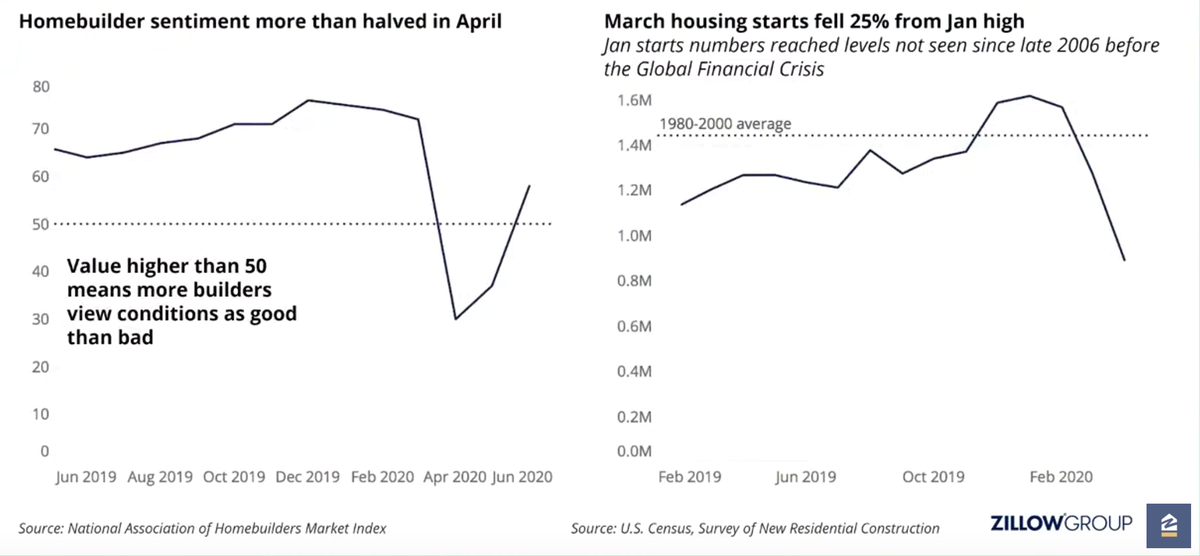

Based on the data, however, Sellers aren't as confident.

New Listings are still down 19% year over year.

High buyer confidence + low seller onfidence = declining inventory

New Listings are still down 19% year over year.

High buyer confidence + low seller onfidence = declining inventory

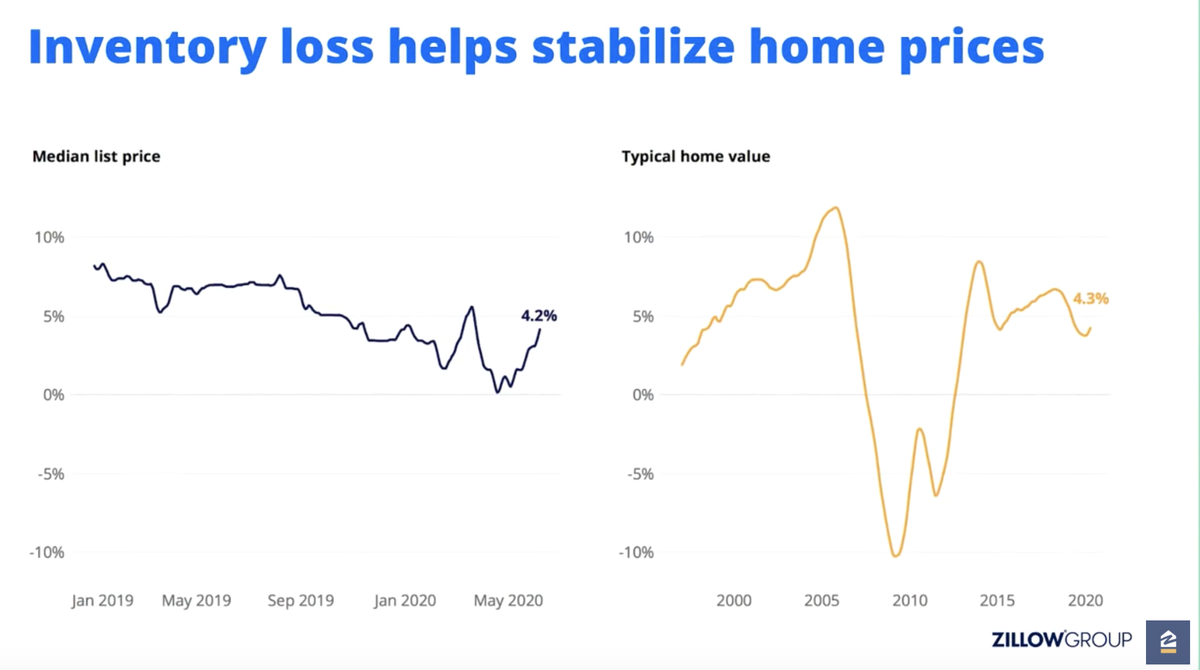

You may think during these times prices would have, or will drop

But inventory shortage, has helped stabilize home prices.

But inventory shortage, has helped stabilize home prices.

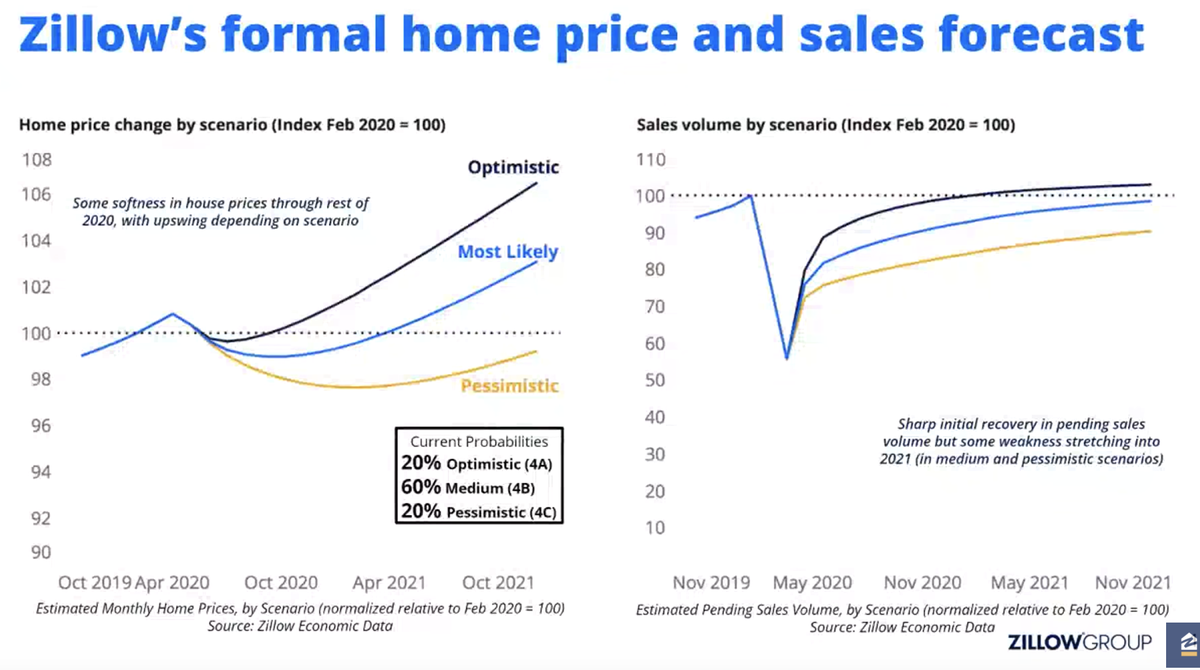

Here's a forecast of Zillow's home price change and sales volume.

Blue line = most likely

Expect some softness in house prices through the rest of 2020, with potential for upswing after.

Blue line = most likely

Expect some softness in house prices through the rest of 2020, with potential for upswing after.

Let's shift over to the RENTAL MARKET.

it's a lot more vulnerable and volatile.

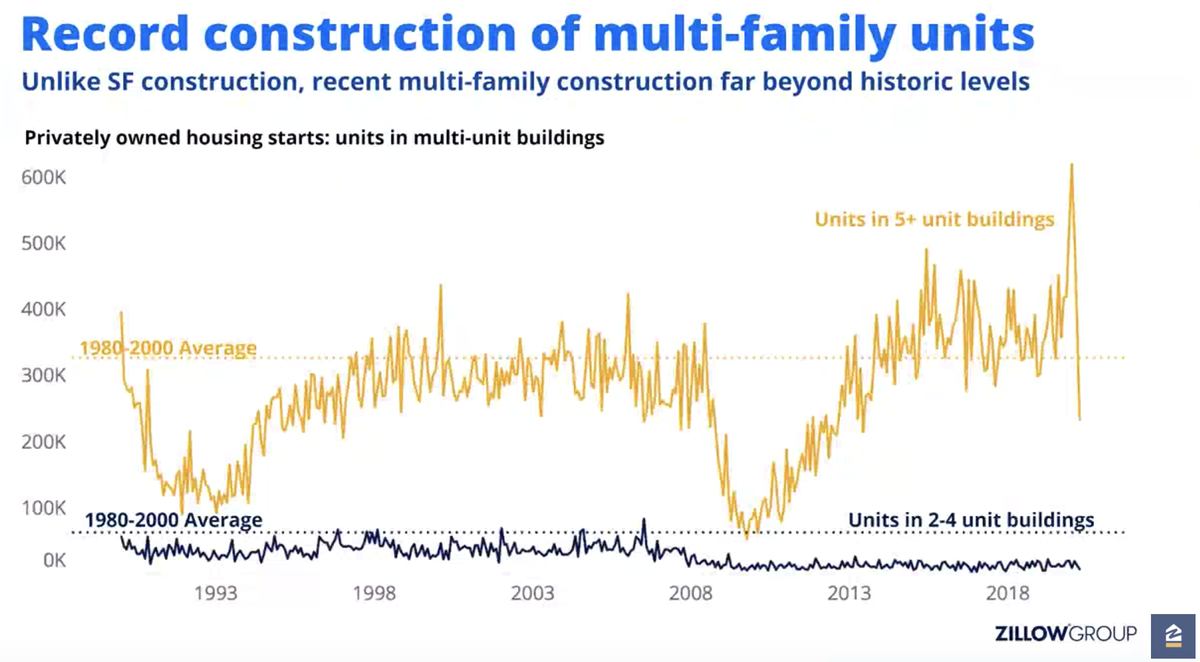

Multifamily construction was at RECORD highs

it's a lot more vulnerable and volatile.

Multifamily construction was at RECORD highs

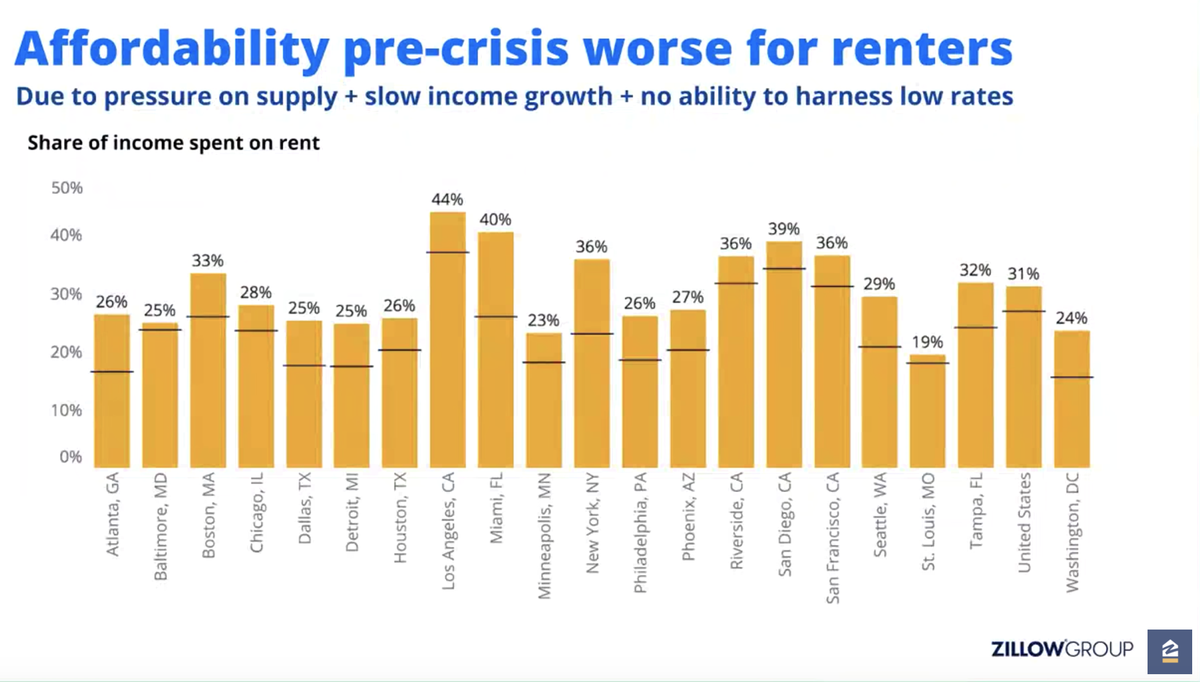

Here's pre-COVID rental affordability.

I see A LOT of California in the high 30s-40s in terms of share of income spent on rent.

I see A LOT of California in the high 30s-40s in terms of share of income spent on rent.

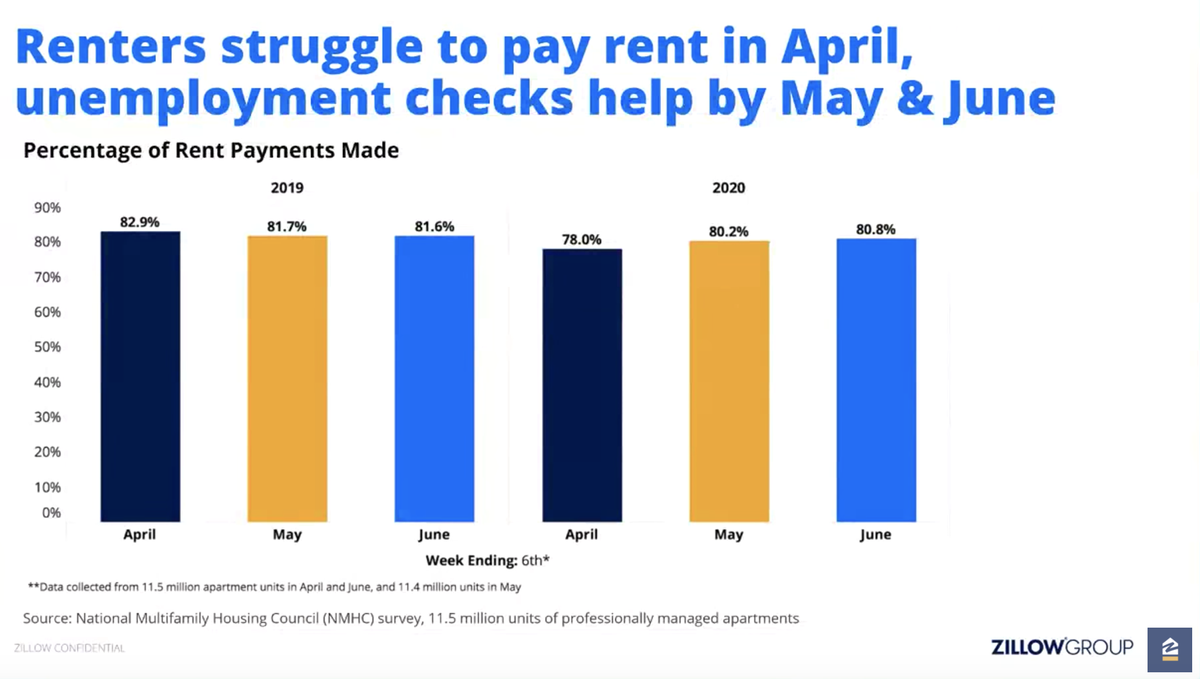

Rent collections were down in April.

Picked back up in May and June.

Unemployment checks likely helped the past 2 months.

Picked back up in May and June.

Unemployment checks likely helped the past 2 months.

THE FUTURE

You can't ignore the shift to remote work.

Many people are not currently working in a dedicated workspace/office in their home.

That may prompt people to move and find a better living situation if the remote work trend continues.

You can't ignore the shift to remote work.

Many people are not currently working in a dedicated workspace/office in their home.

That may prompt people to move and find a better living situation if the remote work trend continues.

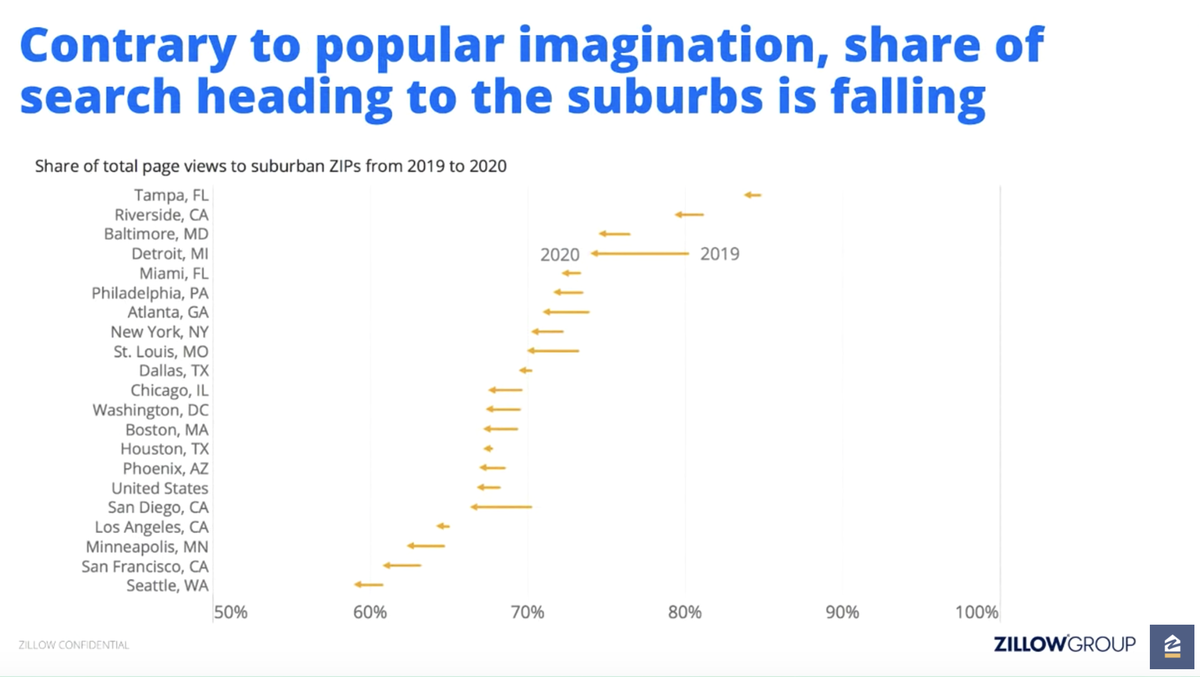

Many people are talking about the mass migration to the suburbs for more square footage at a more affordable price.

Data right now is showing the contrary.

Data right now is showing the contrary.

SO, what do you think?

Where's the market heading?

What are your investment plans?

What are your living plans?

COMMENT and discuss

Where's the market heading?

What are your investment plans?

What are your living plans?

COMMENT and discuss

Read on Twitter

Read on Twitter