What is $YFI? What is @iearnfinance? Where is the 500%-5000%APR coming from?

YFI has been changing on a day-by-day basis and here is a thread on $YFI - the governance token for yearn - Why it isn’t a ponzi and how it could bring the BTC scarcity meme to yield farming hype.

YFI has been changing on a day-by-day basis and here is a thread on $YFI - the governance token for yearn - Why it isn’t a ponzi and how it could bring the BTC scarcity meme to yield farming hype.

YFI originally started with a supply of 20K tokens to be distributed through liquidity mining rewards over 7 days.

Rewards were split between the ycurve pool on @CurveFinance and the DAI-YFI pool on @BalancerLabs.

2

Rewards were split between the ycurve pool on @CurveFinance and the DAI-YFI pool on @BalancerLabs.

2

Within 72 hours a new YFI governance liquidity pool was introduced to bring another 10K of YFI rewards to mine.

In these first days, APR (based on price of YFI) ranged as follows had the following:

Ycurve pool - 700-1600%

Balancer pool - 3500-5000%

Gov pool - 600-900%

3

In these first days, APR (based on price of YFI) ranged as follows had the following:

Ycurve pool - 700-1600%

Balancer pool - 3500-5000%

Gov pool - 600-900%

3

More recently a staking dynamic for YFI was created. With 1000 BPT in the governance tool, and voting, you can stake your $YFI for fee rewards that are paid out in yCR. Current APR is about 40%. You can now use YFI to farm the token that farms YFI. 5-dimensional farming!

4

4

What has the outcome been? A surge in AUM across protocols. @iearnfinance accumulated over 250mil AUM in under four days. This has only continued to grow.

@Weeb_Mcgee beautifully illustrates the virtuous yield farming cycle that drove this growth https://twitter.com/Weeb_Mcgee/status/1285397420373708801?s=2

5

@Weeb_Mcgee beautifully illustrates the virtuous yield farming cycle that drove this growth https://twitter.com/Weeb_Mcgee/status/1285397420373708801?s=2

5

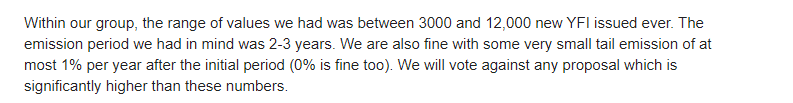

What is maybe less known to outsiders is that YFIs future supply cap was up for a vote. There were two main proposals, one to cap the supply at 30K, and one to inflate the supply further to a future decided amount.

6

6

So what happened next? The vote to print more supply passed and it was decided by the community that YFI farming would continue on. MUH INFLATION

7

7

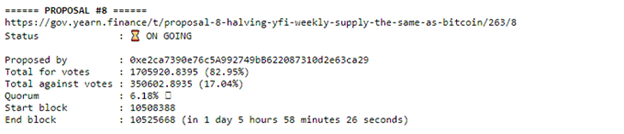

The outstanding question is how this affects the supply going forward. This is the current leading proposal. Essentially the argument is to take the BTC halving meme and apply it into DeFI through yieldfarmings new darling governance token. This vote is likely to pass.

8

8

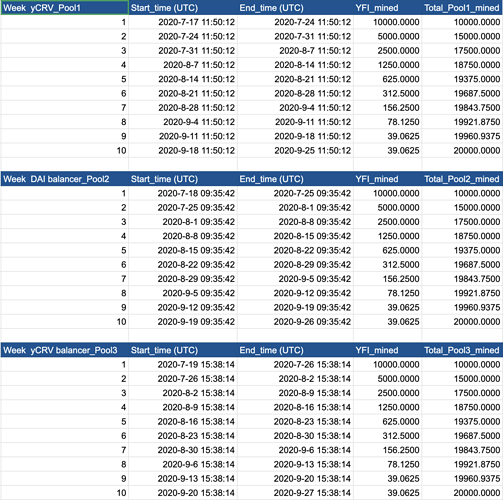

What does this emission schedule look like? Well its pretty fascinating. The decision is essentially "lets keep inflation going for 10 more weeks and have a weekly halving" See below for proposed emissions schedule of YFI:

9

9

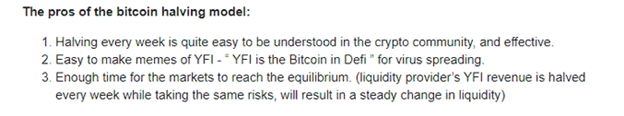

What about the community and idea? Well here is a snippet of the argument made for the proposal.

Education + BTC meme.

Full proposal here: https://gov.yearn.finance/t/proposal-8-halving-yfi-weekly-supply-the-same-as-bitcoin/263

10

Education + BTC meme.

Full proposal here: https://gov.yearn.finance/t/proposal-8-halving-yfi-weekly-supply-the-same-as-bitcoin/263

10

The next thing to understand is how actively yearn and YFI community governance is growing.

There is highly active unofficial discord and telegram. Andre is a mad man of a developer and has given all governance to this community.

Source below: https://twitter.com/iearnfinance/status/1285881619585339392?s=20…

11

There is highly active unofficial discord and telegram. Andre is a mad man of a developer and has given all governance to this community.

Source below: https://twitter.com/iearnfinance/status/1285881619585339392?s=20…

11

Two critical lessons here:

1. Aligning financial and governance incentives with equitable distribution catalyze a scaling up of assets and shareholder participation.

2. YFI is shaping up to be a serious, community driven project with some bright minds for incentives.

12

1. Aligning financial and governance incentives with equitable distribution catalyze a scaling up of assets and shareholder participation.

2. YFI is shaping up to be a serious, community driven project with some bright minds for incentives.

12

Takeaway is that YFI is more sophisticated of a project than it may seem and has been compressing an amazing token governance experiment into a matter of months when most projects have taken years.

YFI is one of the most interesting experiments happening on ETH and crypto.

13

YFI is one of the most interesting experiments happening on ETH and crypto.

13

This likely has a few implications for price and those "trading" YFI. 1- YFI will continue to inflate at these rates for 10 weeks. By next week, supply will have doubled. This has been the norm so far.

Sell side pressure will continue to dominate here most likely.

14

Sell side pressure will continue to dominate here most likely.

14

YFI’s growth in Mcap continues to be the metric to watch currently for strong price action.

After next week, the newly farmed supply will begin to halve weekly and within a few weeks inflation will suddenly fall off a cliff, the the incentive structures will carry on.

15

After next week, the newly farmed supply will begin to halve weekly and within a few weeks inflation will suddenly fall off a cliff, the the incentive structures will carry on.

15

I believe this is some of the most bullish news to date for YFI and future YFI price action.

In the coming weeks the market will start to price in the inflation curve, lower supply, value of the protocol in the ecosystem, and the “BTC halving” schedule.

16

In the coming weeks the market will start to price in the inflation curve, lower supply, value of the protocol in the ecosystem, and the “BTC halving” schedule.

16

Likelihood of strong, forceful upwards price action increases each week as the momentum behind YFI grows.

Supply starts getting crunched and demand picks up the same time the community, memes, and education campaigns are being rolled out. This meme is only starting

17

Supply starts getting crunched and demand picks up the same time the community, memes, and education campaigns are being rolled out. This meme is only starting

17

This experiment in token governance through YFI has just begun. There are still 10 more weeks in this crypto socioeconomic experiment and I can't be more excited.

I expect a lot of interesting lessons to be learned from YFI in 2020, and it is extremely exciting.

18

I expect a lot of interesting lessons to be learned from YFI in 2020, and it is extremely exciting.

18

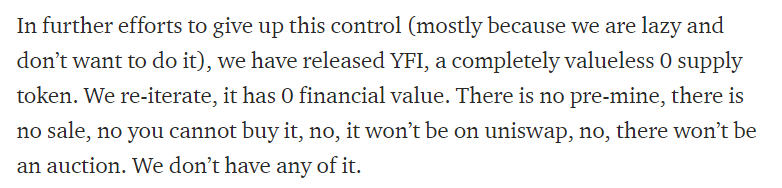

Best to conclude with a huge thank you to

@AndreCronjeTechfor this experiment and the

@iearnfinance community for carrying it forward in true crypto fashion. But regardless of this, please remember: YFI is a governance token with literally zero value.

19/19

@AndreCronjeTechfor this experiment and the

@iearnfinance community for carrying it forward in true crypto fashion. But regardless of this, please remember: YFI is a governance token with literally zero value.

19/19

cc & learning credits around YFI this week to: @Weeb_Mcgee (farmer chad) & @ChainLinkGod for the twitter convo & resources.

@DegenSpartan cause this meme this more visibility.

@DegenSpartan cause this meme this more visibility.

After talking with some folks in yearn discord it was flagged for me this vote likely wont meet the 33% quorum.

I was likely WRONG on the supply emission schedule.

BTC scarcity meme is here to stay likely regardless.

see: https://gov.yearn.finance/t/yfi-whale-proposals-list/348

I was likely WRONG on the supply emission schedule.

BTC scarcity meme is here to stay likely regardless.

see: https://gov.yearn.finance/t/yfi-whale-proposals-list/348

Another key threading re: Governance and proposals moving forward! https://gov.yearn.finance/t/request-for-comment-proposal-for-yfi-inflation-and-supply-mechanics/230

Its critical to understand how rapidly evolving all this is and thats what makes it so fascinating.

Its critical to understand how rapidly evolving all this is and thats what makes it so fascinating.

Read on Twitter

Read on Twitter