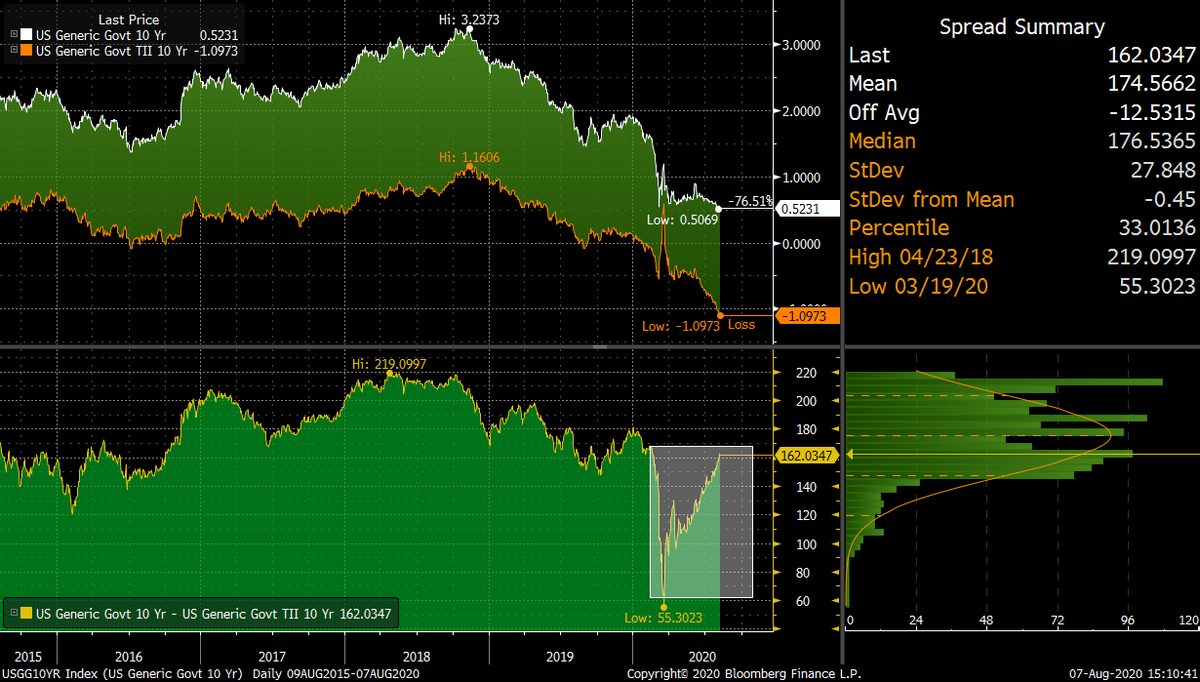

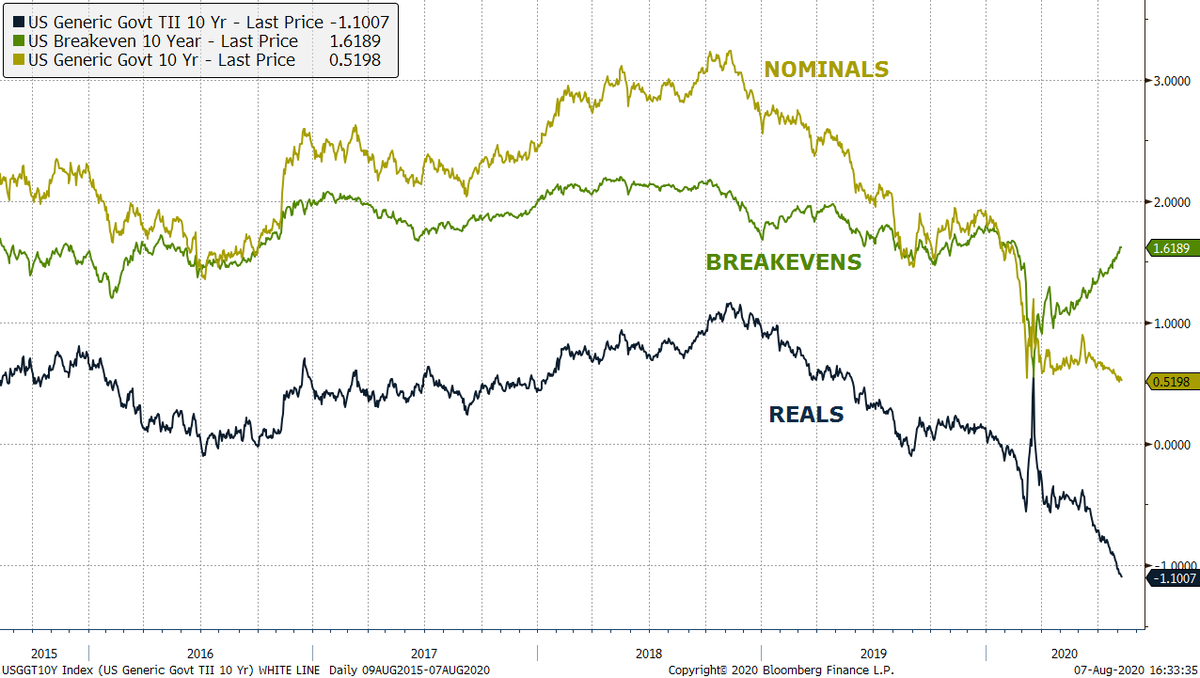

I mentioned previously that real rates are a great asset to trade and that you would have made good money on them in the last month. In fact, compared to nominals, reals have been blowing them away since the March equity rout and at a consistency and pace not seen before.

2/

2/

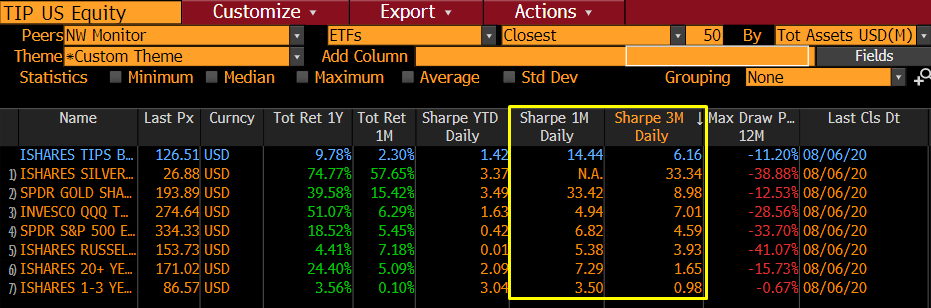

Recently, reals have had some of the best risk-adjusted returns across the market. And yet everyone talks about them as an input only, shame.

3/

3/

The correlation between reals and nominals has broken down as we have hit the effective lower bound. The market has begun pricing in inflation through reals instead of nominals. Why? Partly because the Fed's policy is explicitly in reference to nominal rates.

4/

4/

Also, think of BEs as compensation for holding nominals rather than "inflation expectations".

We're pretty close to 5yr average and we've gone there in a near straight line.

5/

We're pretty close to 5yr average and we've gone there in a near straight line.

5/

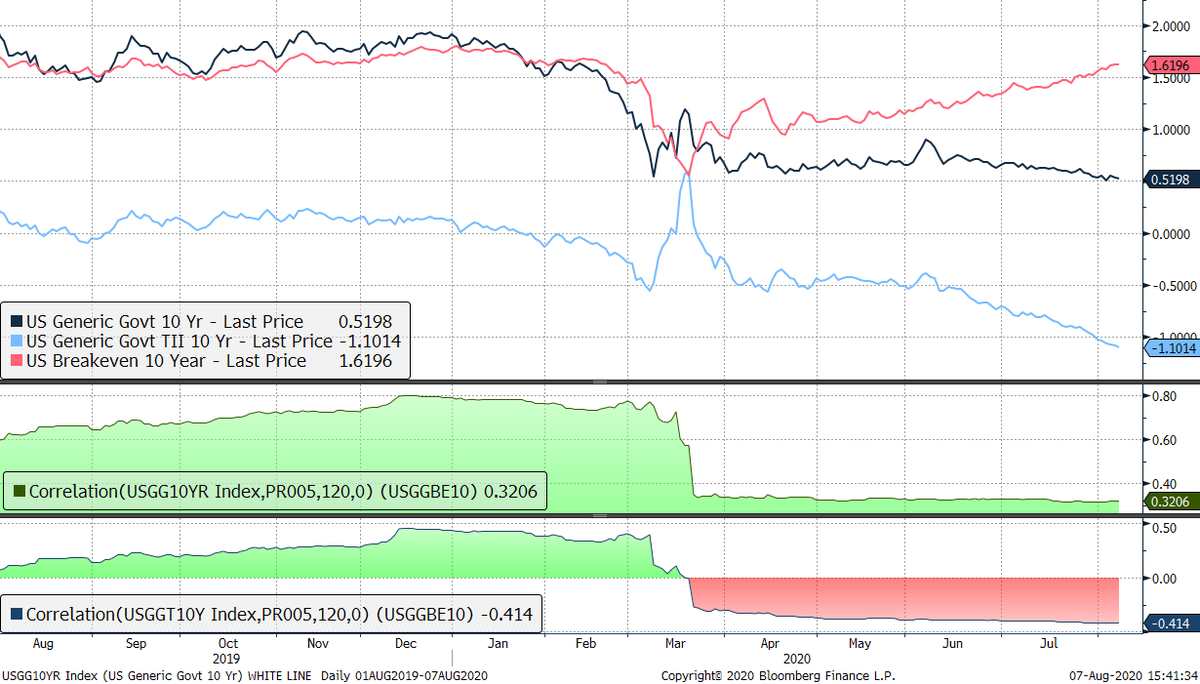

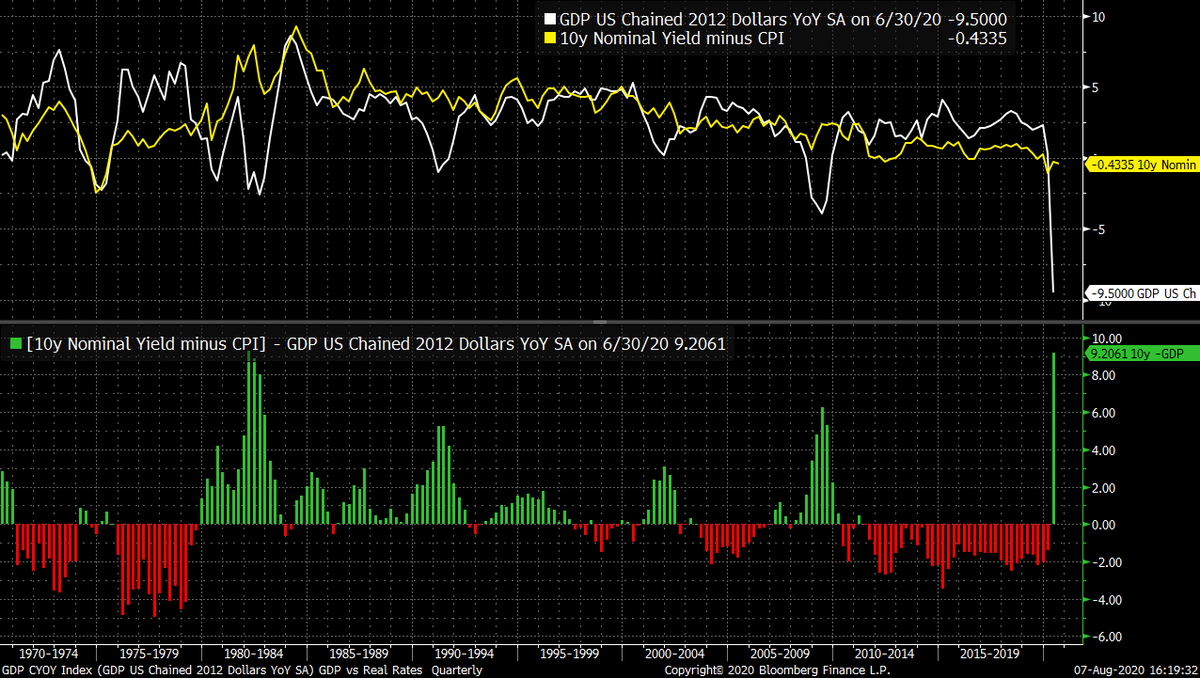

If we turn to breakevens- the difference between the nominal and real rate of interest- we can look at how this spread is driven by each component.

BEs were driven by nominals UP TO March and since then have been determined by REALS as nominals basically went into catatonia.

6/

BEs were driven by nominals UP TO March and since then have been determined by REALS as nominals basically went into catatonia.

6/

Real rates vs Breakevens. You can see how the plunge in real rates have driven the BE wider.

Keep in mind that because the BE is a spread, if it widens while tracking with reals then nominals are the ones moving more (relatively).

7/

Keep in mind that because the BE is a spread, if it widens while tracking with reals then nominals are the ones moving more (relatively).

7/

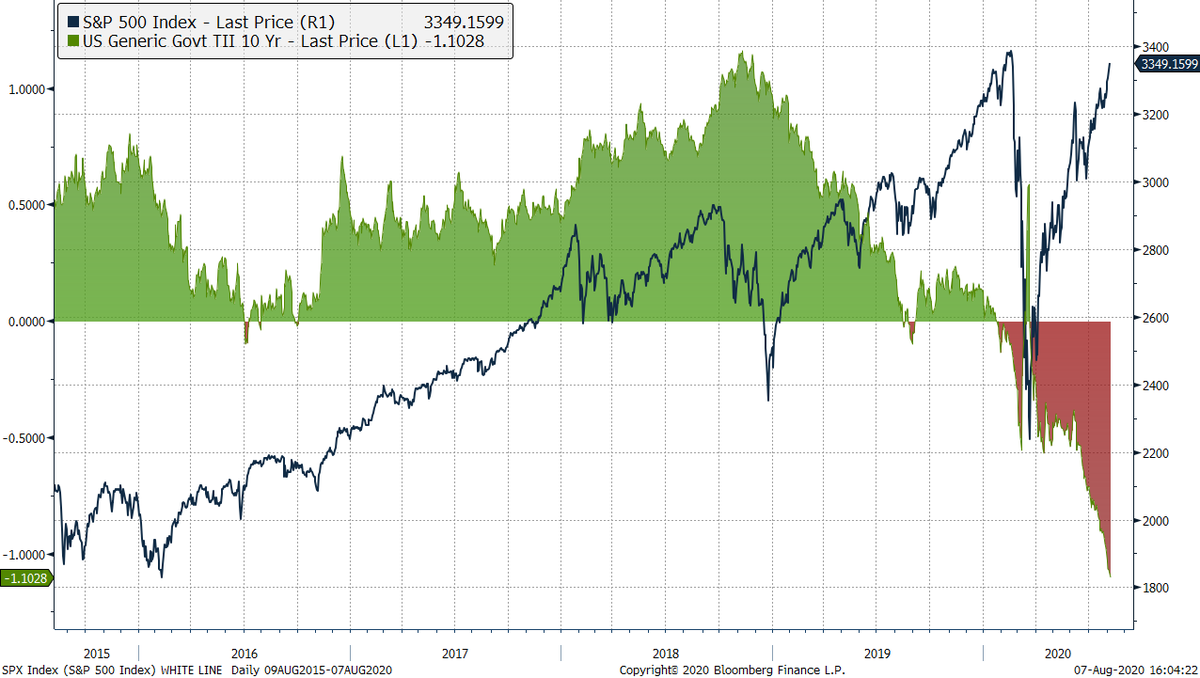

Real rates vs SPX. Assuming cash flows/revenues/growth don't fall or fall less than the discount rate...you can justify valuations at these (somewhat insane) levels.

8/

8/

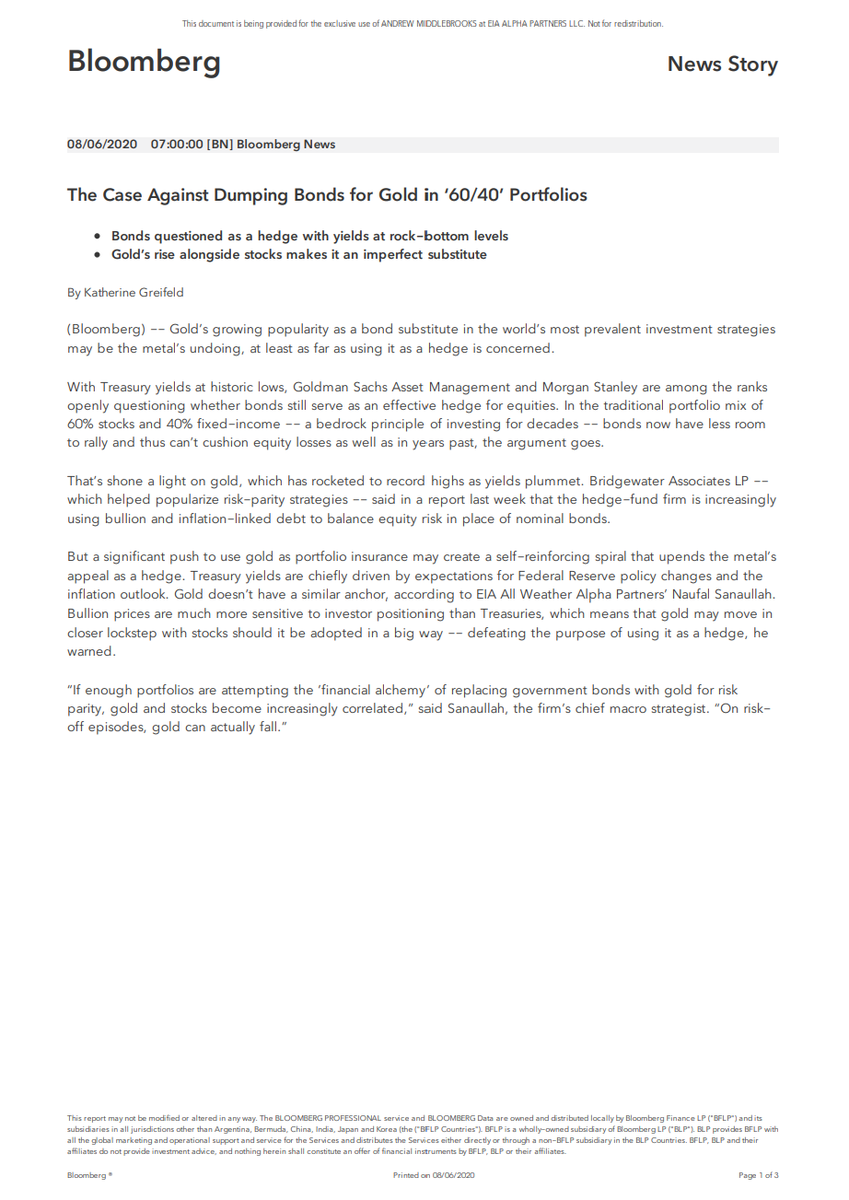

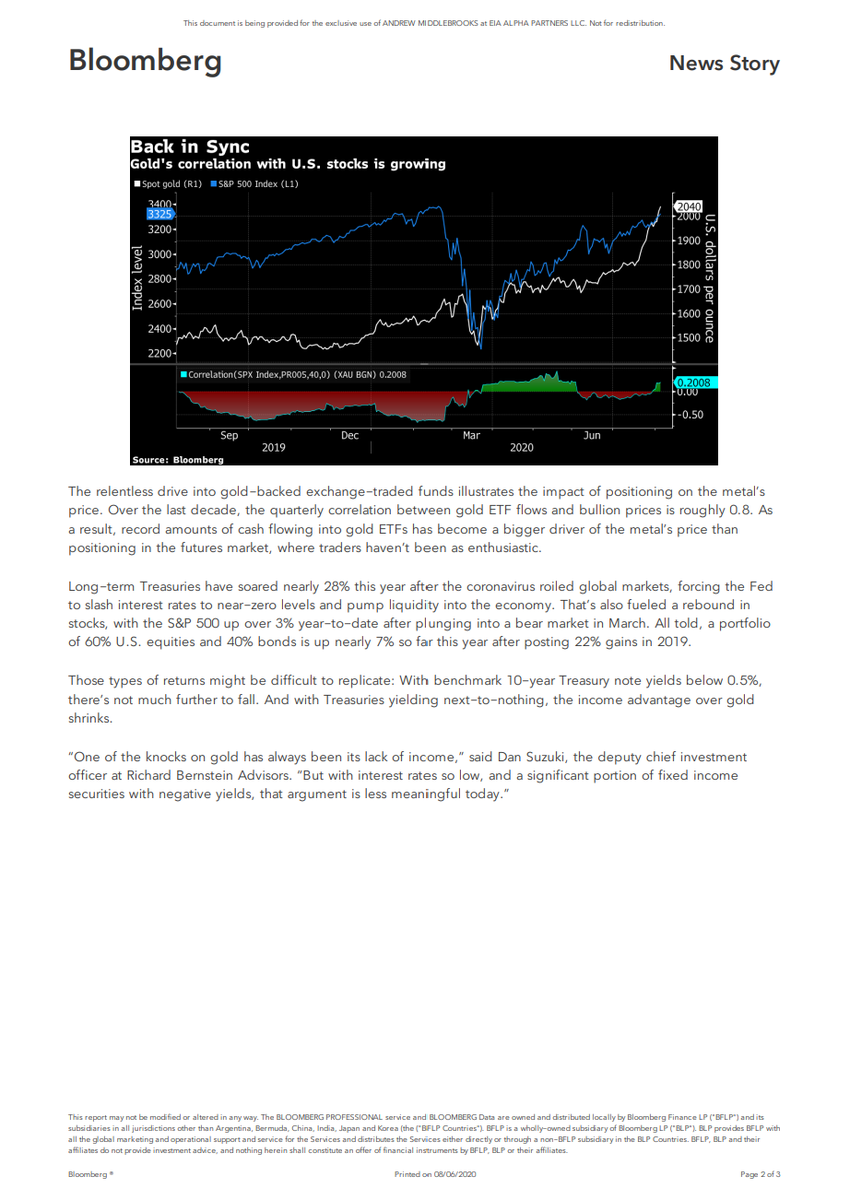

Probably a good time as well to plug my homeboy @naufalsanaullah and his comments on bond vs gold in a diversified portfolio.

9/

9/

Some key questions i also raised a couple of weeks ago on the efficacy of bonds as a hedge and its relationship to stocks, mega caps and gold.

https://twitter.com/EffMktHype/status/1285865538401431552

10/

https://twitter.com/EffMktHype/status/1285865538401431552

10/

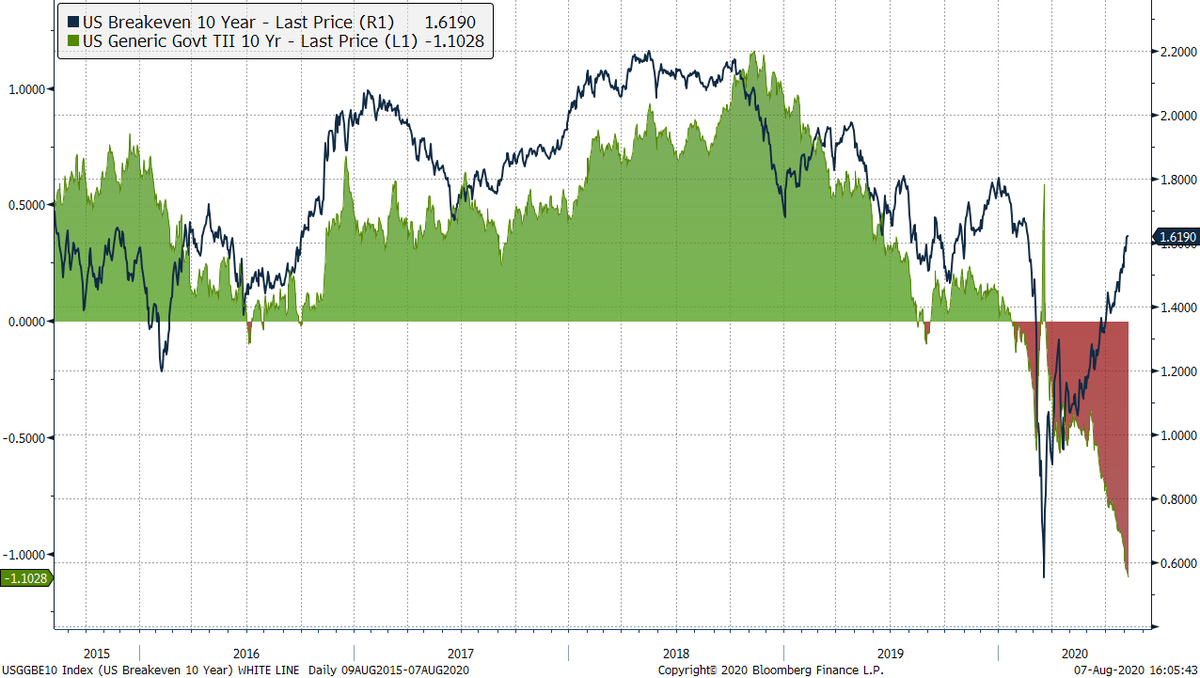

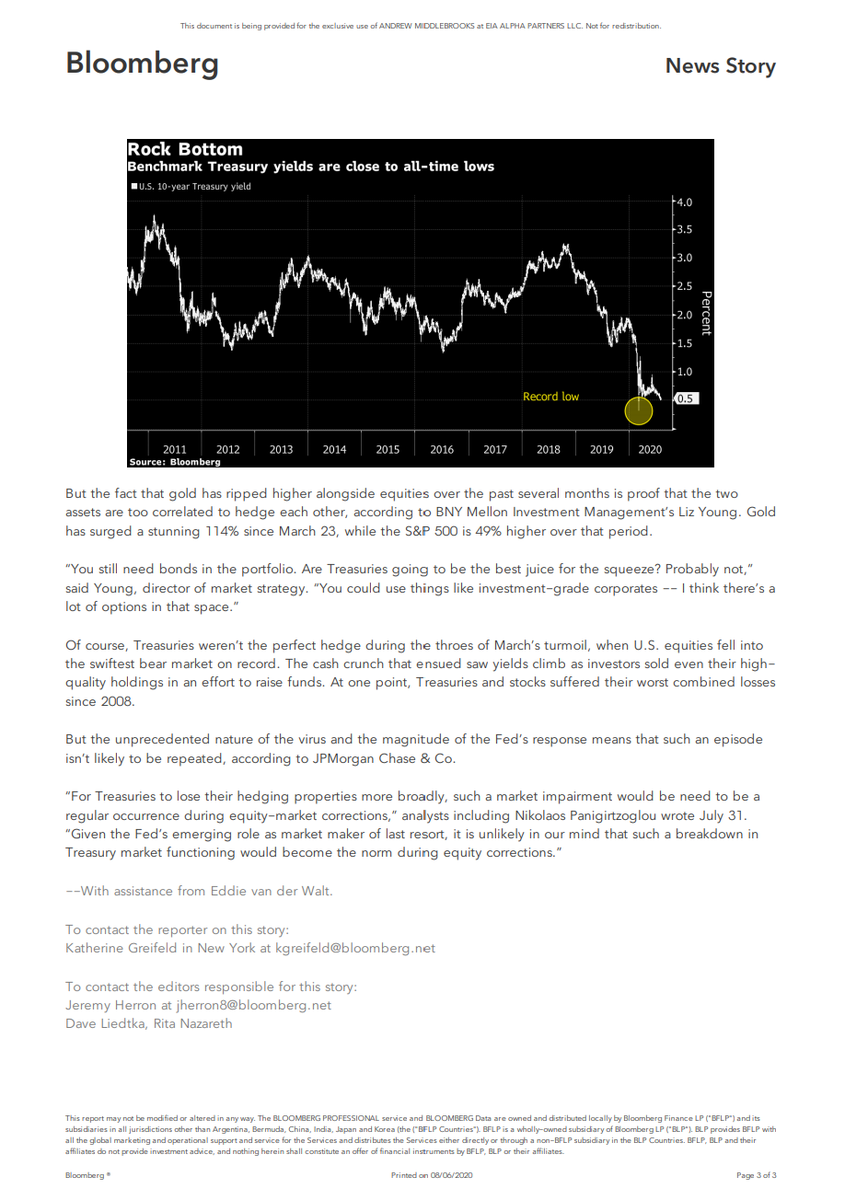

But back to the question of real rates and actually treating them as an instrument, not just an input. The collapse in real GDP was beyond modern reference and its reasonable to assume that real rates should follow suit.

Do you think GDP continues to print at -9%? I don't.

11/

Do you think GDP continues to print at -9%? I don't.

11/

10 nominals minus Core PCE run at -0.43% vs TIPS at -1.1% while GDP is down in hell's basement but HAS to correct higher (and i'll tell you why it's ok if it doesn't for some fucking reason).

Main thought here : TIPS are rich.

12/

Main thought here : TIPS are rich.

12/

I don't see much more upside in BEs, some but not a lot. It's already saying growth has to come back. So if BEs don't move much and the Fed is lower for longer - the reaction function imho has to be on reals.

The market brought it down, they have to bring it back.

13/

The market brought it down, they have to bring it back.

13/

And if growth doesn't happen? Or a risk off move happens? The BE should compress. Reals are already reflecting low growth so you'd likely see a flight to safety and nominals get bought.

So if you need to own duration and want protection, nominals > reals right now.

14/

So if you need to own duration and want protection, nominals > reals right now.

14/

I think reals are maxing out and if they keep going then nominals will outpace them lower. And given the correlations that real rates have with stocks and gold, a rise in reals could spoil the party there too.

15/15

Remember:

15/15

Remember:

Read on Twitter

Read on Twitter