Today's Labour Force Survey:

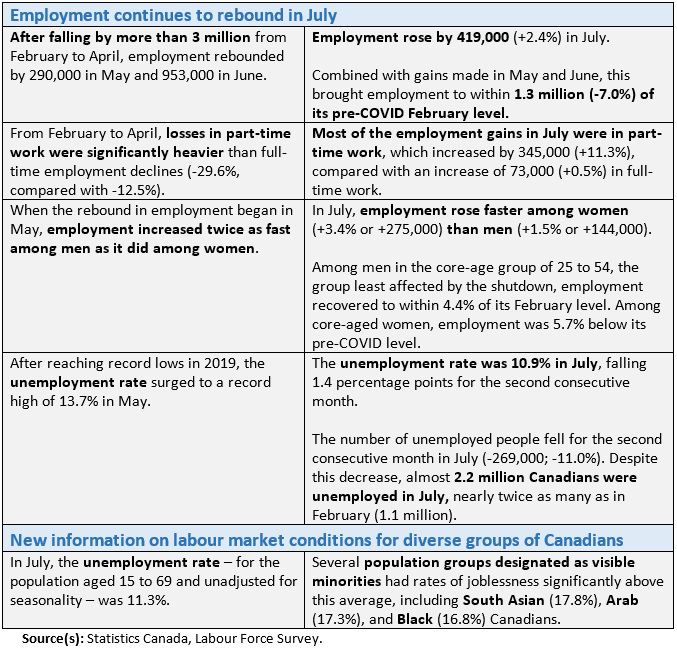

• #CdnEcon added 419k jobs in July (mostly part-time), which brings employment now to 1.3 million jobs (or 7%) below pre-COVID levels

https://www150.statcan.gc.ca/n1/daily-quotidien/200807/dq200807a-eng.htm #CdnEcon

• #CdnEcon added 419k jobs in July (mostly part-time), which brings employment now to 1.3 million jobs (or 7%) below pre-COVID levels

https://www150.statcan.gc.ca/n1/daily-quotidien/200807/dq200807a-eng.htm #CdnEcon

• Of the ~5.5 million Canadian workers impacted by COVID disruptions in March and April, there are still ~2.3 million impacted (or 42%).

• Of these impacted workers, ~1.3 million jobs haven't been recovered yet and ~1 million jobs are still working far less hours than usual.

• Of these impacted workers, ~1.3 million jobs haven't been recovered yet and ~1 million jobs are still working far less hours than usual.

...Here's the #CdnEcon employment chart:

So far we've drawn 55% of the "V".

The key question going forward is whether this pace of recovery continues, or slows further in the fall with the return to school.

So far we've drawn 55% of the "V".

The key question going forward is whether this pace of recovery continues, or slows further in the fall with the return to school.

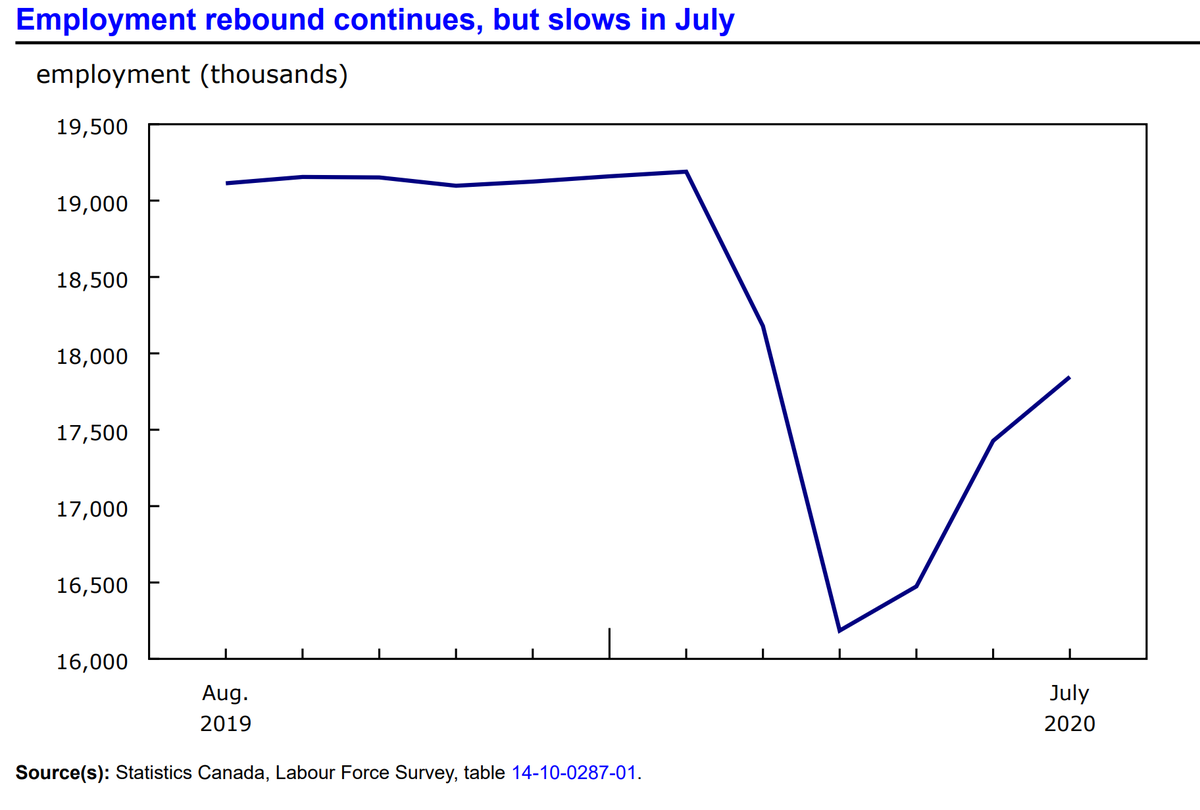

...Part-time work is now closer to its pre-COVID level (-5.0%) than full-time employment (-7.5%).

But there's been a noticeable increase in part-time workers who want full-time work (now 30% vs. 22% last July), which is consistent with fewer hours being offered by employers.

But there's been a noticeable increase in part-time workers who want full-time work (now 30% vs. 22% last July), which is consistent with fewer hours being offered by employers.

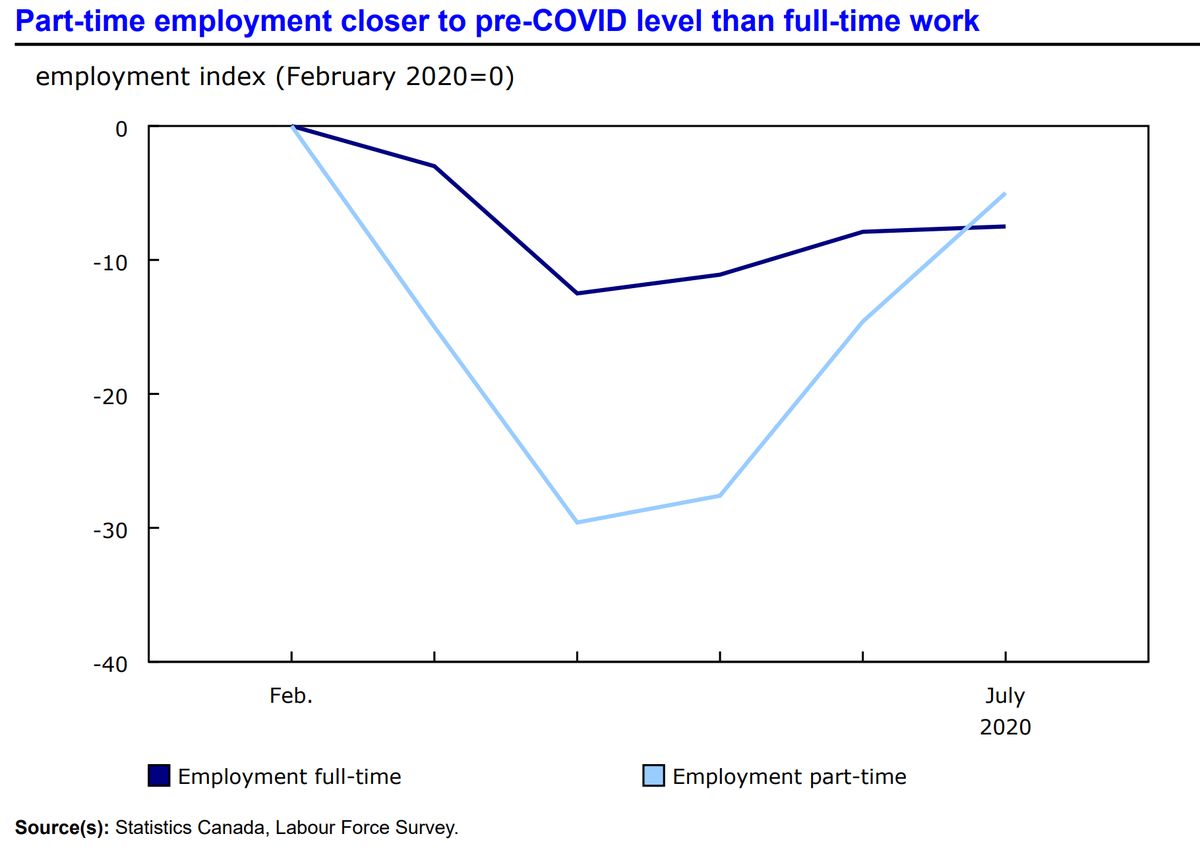

...Youth jobs have taken the biggest proportional hit.

On the #shecession #shecovery, women's employment has been hit harder.

Among the core-working-age population (25-54), women's employment remains farther below pre-COVID levels than men's (5.7% vs. 4.4%). #CdnEcon

On the #shecession #shecovery, women's employment has been hit harder.

Among the core-working-age population (25-54), women's employment remains farther below pre-COVID levels than men's (5.7% vs. 4.4%). #CdnEcon

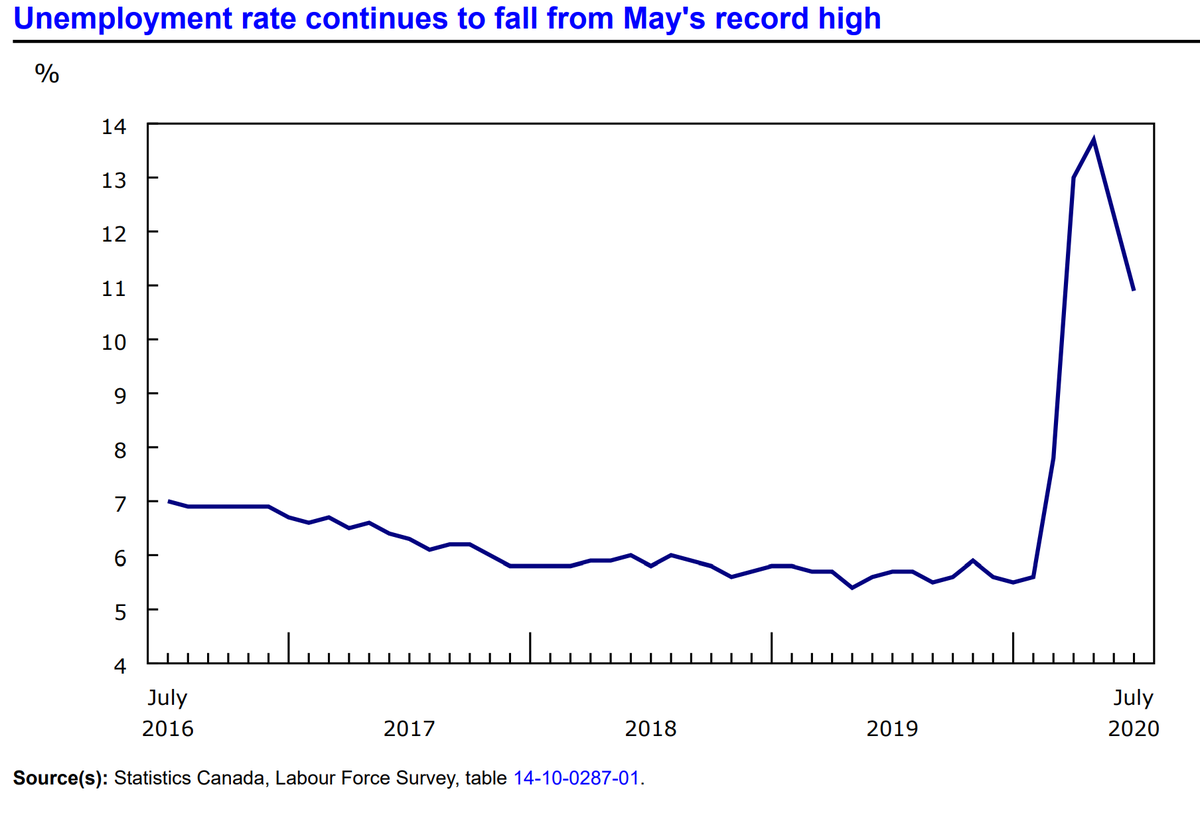

...Monthly reminder that the headline unemployment rate (now at 10.9%, down from its peak of 13.7%) isn't a terribly useful statistic right now.

The "labour underutilization rate" is a much better stat, which is still double its pre-COVID level:

Feb: 11.2%

Apr: 36.1%

Jul: 22.4%

The "labour underutilization rate" is a much better stat, which is still double its pre-COVID level:

Feb: 11.2%

Apr: 36.1%

Jul: 22.4%

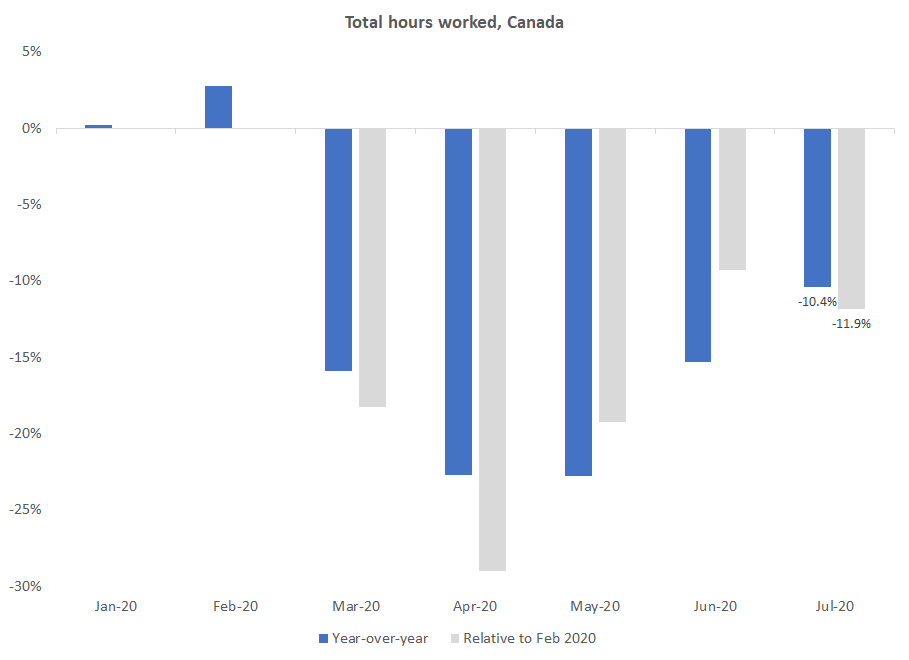

...Hours worked is another useful indicator of labour market health.

Whether you look at year-over-year changes (to address seasonality) or changes relative to February, this measure is down by ~10-12%, and remains farther away from a full recovery than employment (-7%).

Whether you look at year-over-year changes (to address seasonality) or changes relative to February, this measure is down by ~10-12%, and remains farther away from a full recovery than employment (-7%).

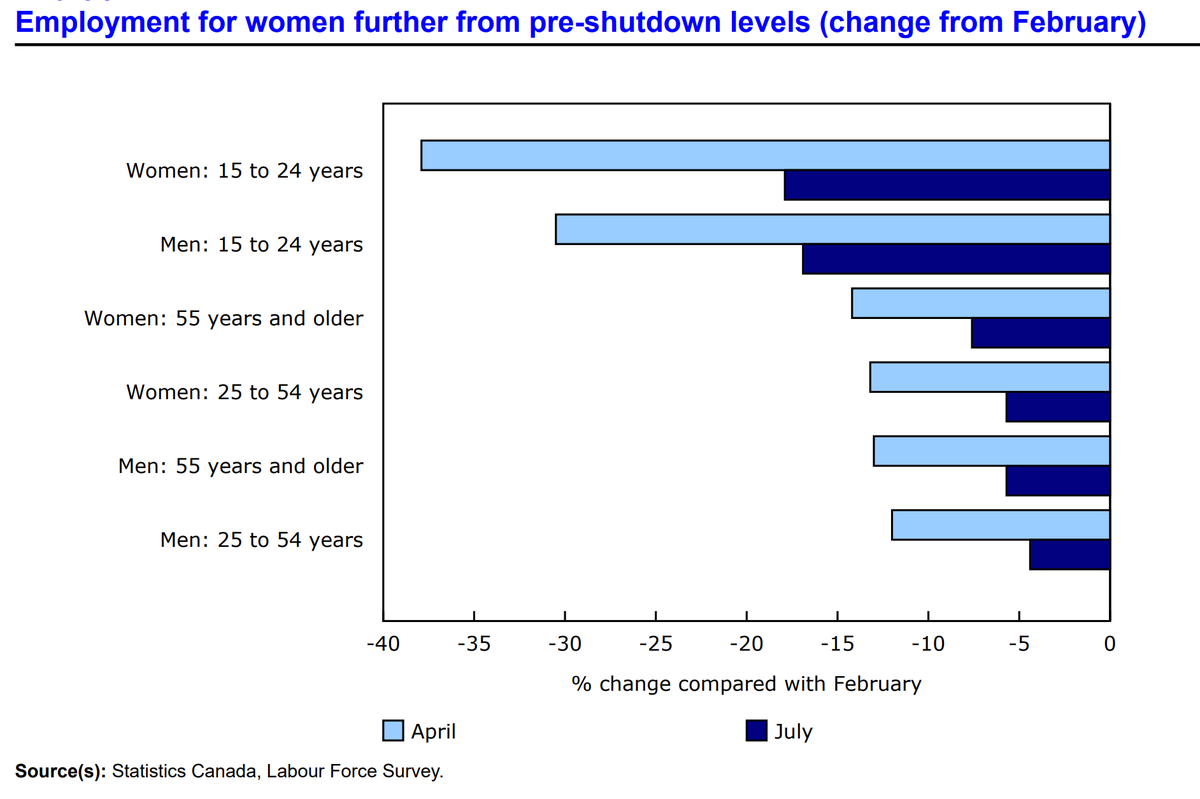

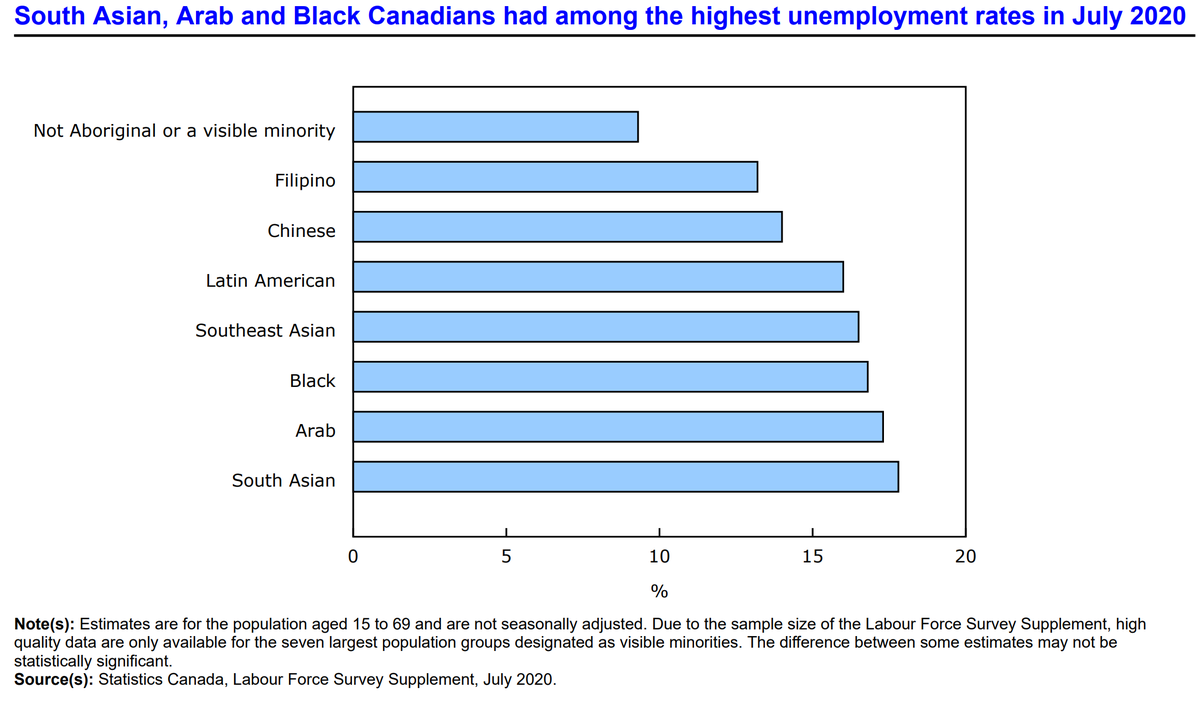

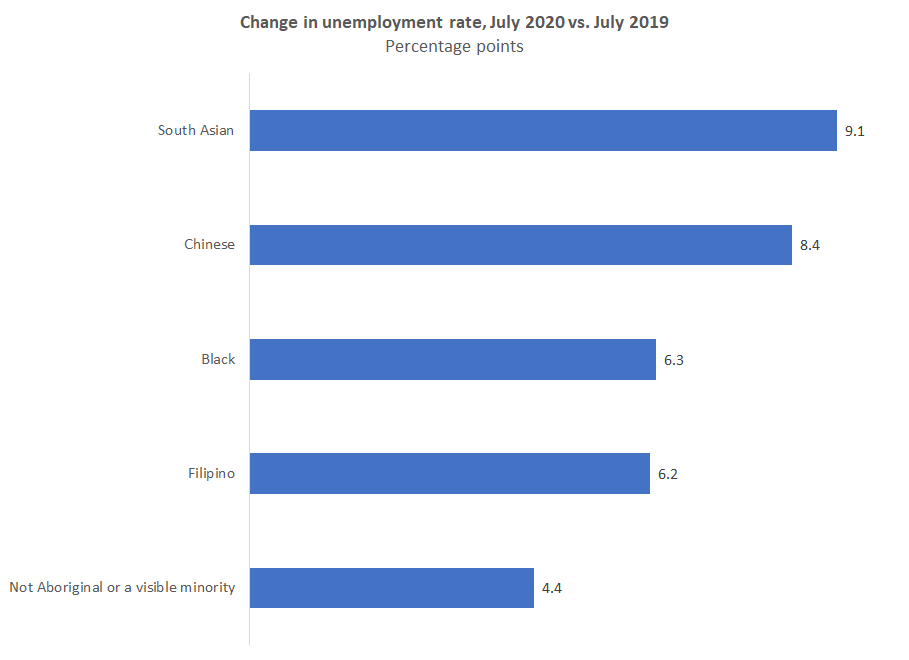

...One of the few positive developments from COVID has been better, timlier economic data.

Now for the first time @StatCan_eng is releasing LFS data on visible minorities, which shows they have significantly higher unemployment rates than other Canadians. #CdnEcon

Now for the first time @StatCan_eng is releasing LFS data on visible minorities, which shows they have significantly higher unemployment rates than other Canadians. #CdnEcon

...StatsCan's new experimental estimates strongly suggest that the COVID crisis hit the labour market much harder for visible minorities in Canada. #CdnEcon

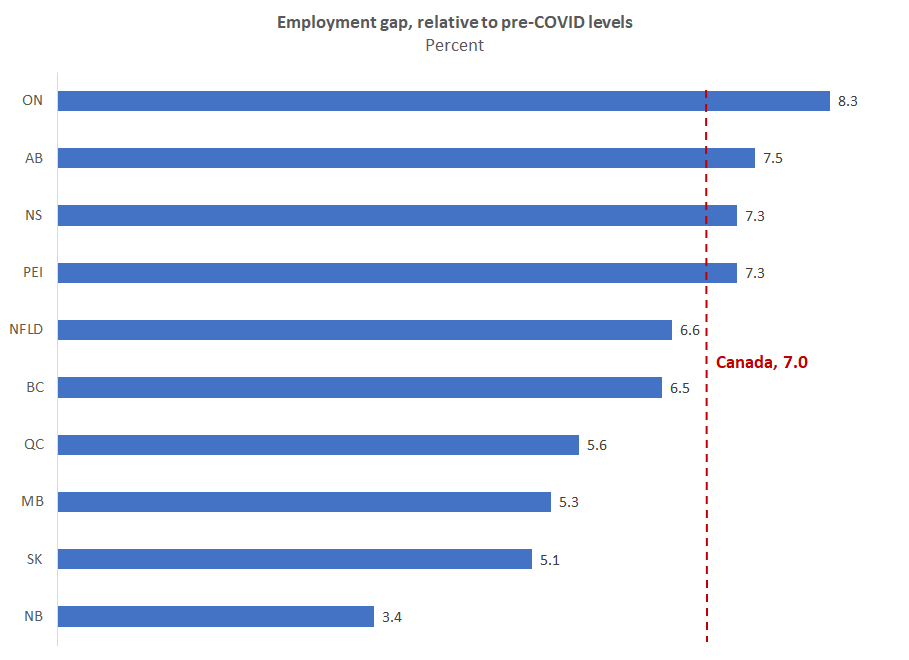

...Provincial data show the job recovery is lagging in Ontario and Alberta.

New Brunswick continues to lead the way. #CdnEcon

New Brunswick continues to lead the way. #CdnEcon

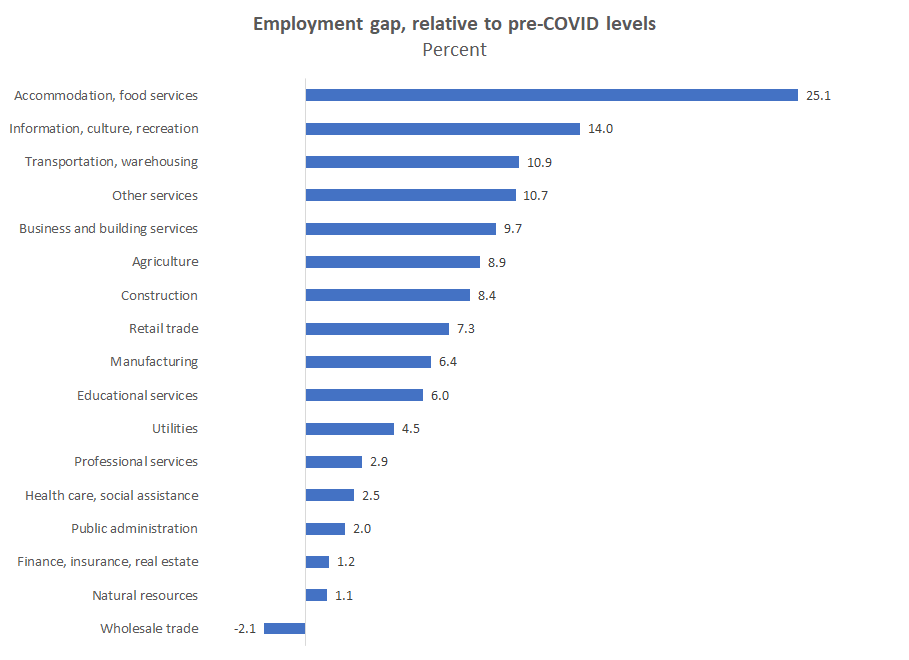

...Looking at sectoral employment, the gap between goods and services is gone.

The hardest hit sectors continue to be:

• Accommodation and food service

• Info, culture, recreation

• Transportation and warehousing

• Other personal services

#CdnEcon

The hardest hit sectors continue to be:

• Accommodation and food service

• Info, culture, recreation

• Transportation and warehousing

• Other personal services

#CdnEcon

...The labour market disruption from the COVID crisis continues to fall disproportionately on low-wage workers in Canada, especially women.

("Low-wage" is defined as earning $16/hr or less.)

High-wage workers' jobs have, for the most part, been quite resilient. #CdnEcon

("Low-wage" is defined as earning $16/hr or less.)

High-wage workers' jobs have, for the most part, been quite resilient. #CdnEcon

...The share of Canadian households reporting difficulties meeting basic financial needs (e.g., paying rent/mortgage, utilities, groceries) was little changed in July at 19.6%.

This rate not rising recently, suggests fiscal programs have largely replaced lost incomes thus far!

This rate not rising recently, suggests fiscal programs have largely replaced lost incomes thus far!

Read on Twitter

Read on Twitter