What are behavioural biases?

Behavioural biases are irrational beliefs or behaviours that can unconsciously influence our decision-making process.

Types of behavioural biases

Types of behavioural biases

Impact of biases in investing and real life

Impact of biases in investing and real life

Thread below

#BehavioralScience

Behavioural biases are irrational beliefs or behaviours that can unconsciously influence our decision-making process.

Types of behavioural biases

Types of behavioural biases Impact of biases in investing and real life

Impact of biases in investing and real life Thread below

#BehavioralScience

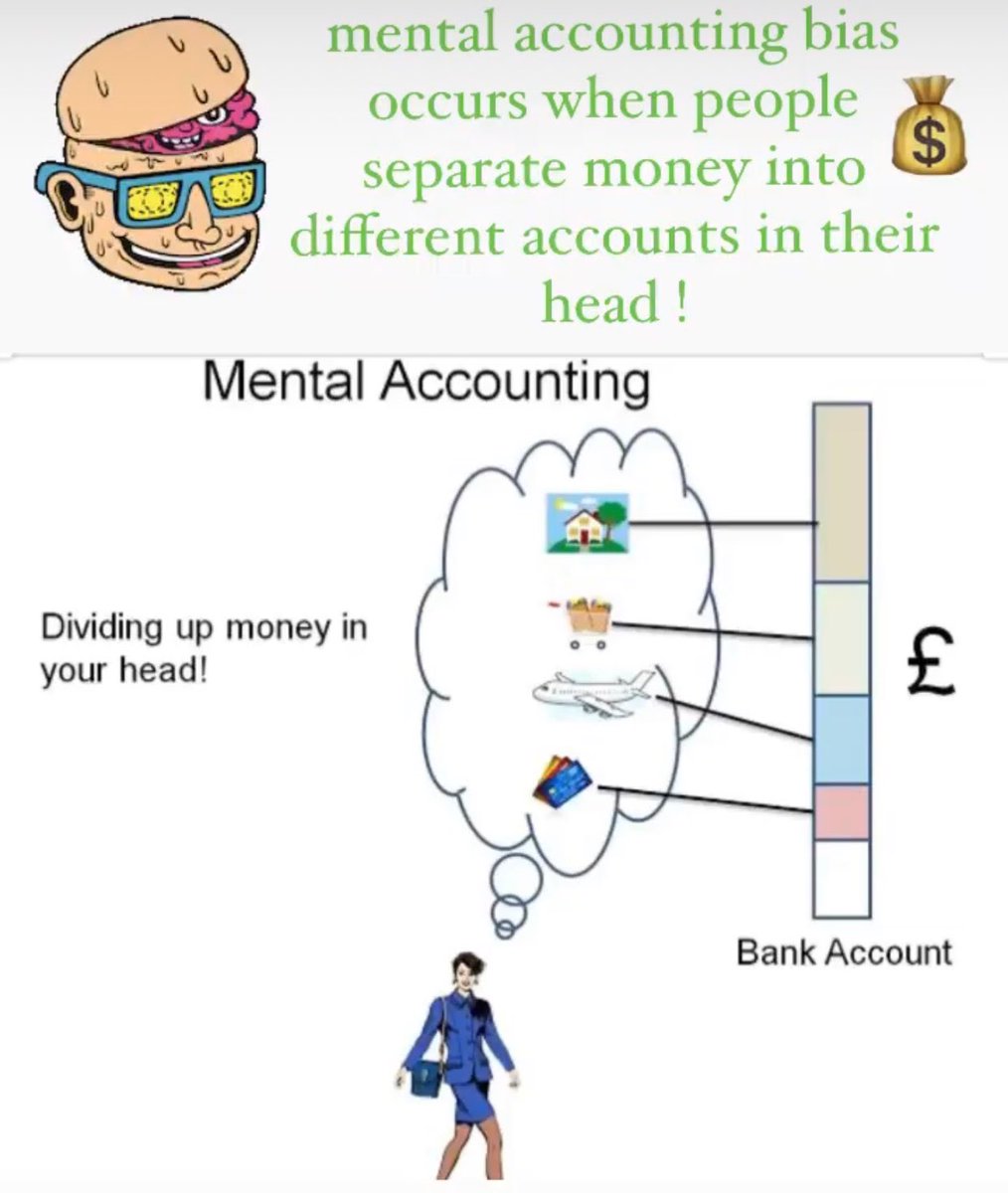

1) Mental Accounting bias occurs when people treat one sum of money  different from another depending on its source or expected use.

different from another depending on its source or expected use.

e.g. In real life we allocate same money which is fungible to different sources for grocery, travel, home etcetra.

@ipo_mantra

different from another depending on its source or expected use.

different from another depending on its source or expected use. e.g. In real life we allocate same money which is fungible to different sources for grocery, travel, home etcetra.

@ipo_mantra

2) Framing bias where decision is made based on how information is presented.

e.g. In investing the same opportunity viewed differently depending on whether it is stated in domains of losses or domain of gains.

@SouravSenguptaI @StocksResearch @position_trader

#Framing

e.g. In investing the same opportunity viewed differently depending on whether it is stated in domains of losses or domain of gains.

@SouravSenguptaI @StocksResearch @position_trader

#Framing

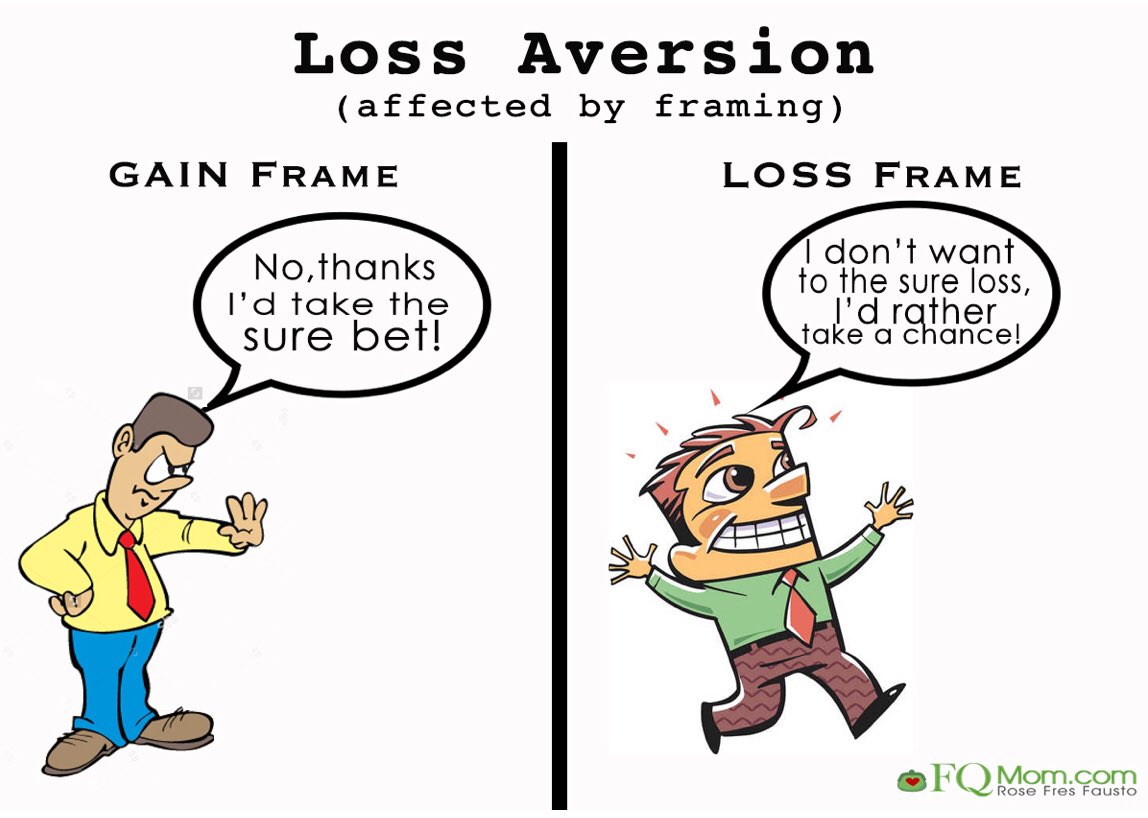

3) Loss aversion bias where people prefer avoiding losses to scoring gains and end up incurring additional risk to avoid losses.

e.g. Sells Winners early, hold losers in hope of reversion

@IndiaER @Rishikesh_ADX @nid_rockz

#lossaversion

e.g. Sells Winners early, hold losers in hope of reversion

@IndiaER @Rishikesh_ADX @nid_rockz

#lossaversion

4)Hindsight bias is when people are wrong about the outcome of an event, but claim they knew it was going to go the opposite they originally stated.

#Hindsight

@10kdiver @behaviorgap @GRPWarwickBBS @LSEBehavioural

#Hindsight

@10kdiver @behaviorgap @GRPWarwickBBS @LSEBehavioural

5) Illusion of Control bias occurs when people believe they have more control or influence than they actually have.

e.g. Investors hold ESOPs in company which contributes large chunk of portfolio and believe they knew about company’s business & growth trajectory.

@SahilBloom

e.g. Investors hold ESOPs in company which contributes large chunk of portfolio and believe they knew about company’s business & growth trajectory.

@SahilBloom

6) Confirmation bias results when people notice only belief confirming information and disregard, ignore or fail to adequately weight contradictory info.

e.g. ITC shareholders favour and notice only positive information and ignore all negative news about price.

@WeekendInvestng

e.g. ITC shareholders favour and notice only positive information and ignore all negative news about price.

@WeekendInvestng

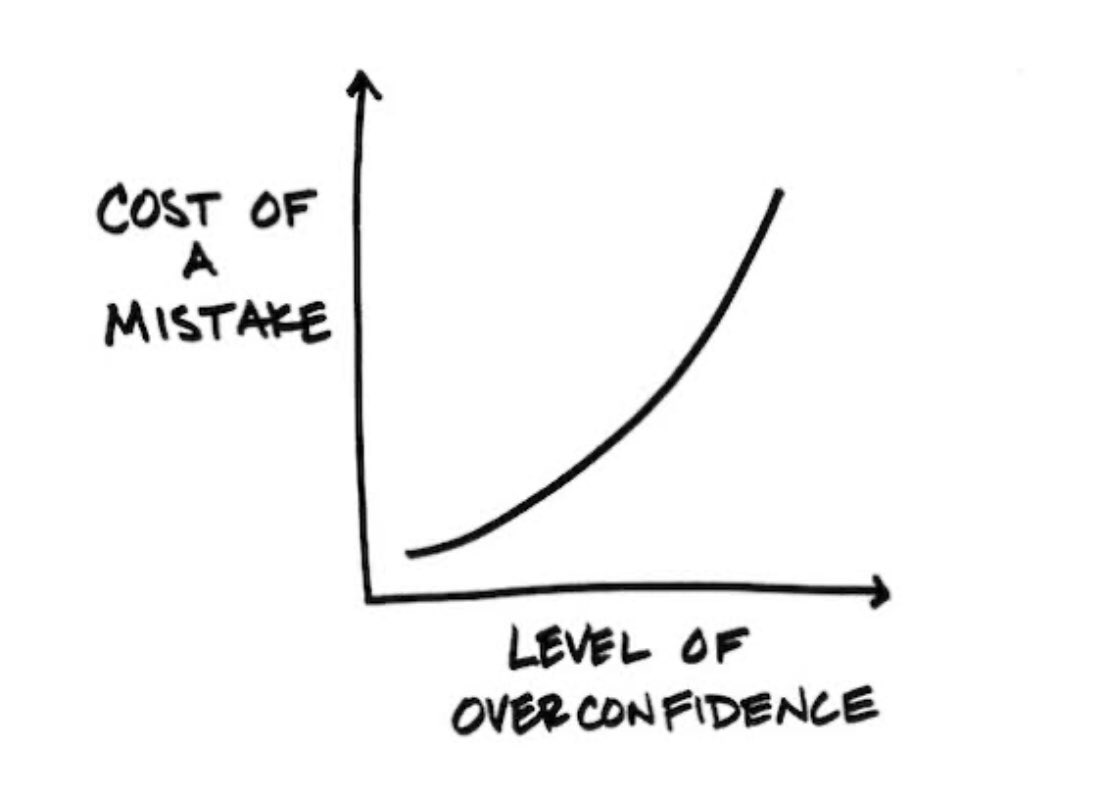

7) Overconfidence bias is a tendency to hold a false and misleading assessment of our skills, intellect or talent. It results when people overestimate their analytical abilities and judgement.

@SJosephBurns @RichifyMeClub @orangebook_ @ChanakyaBot @AnInvesting @TraderHarneet

@SJosephBurns @RichifyMeClub @orangebook_ @ChanakyaBot @AnInvesting @TraderHarneet

8) Thanks for your valuable time and determination to read this thread.

Please share your feedback on the content !

Happy Weekend !!

@UnrollThread

Please share your feedback on the content !

Happy Weekend !!

@UnrollThread

Read on Twitter

Read on Twitter