New report: Embedded Finance is reshaping #fintech

* Banks core business model is broken

* New players are disintermediating the bank relationship

* Banks that that lean in can capture a $trillion opportunity

How? New @11FS report

https://11fs.com/insights-banking-as-a-service

tl;dr

* Banks core business model is broken

* New players are disintermediating the bank relationship

* Banks that that lean in can capture a $trillion opportunity

How? New @11FS report

https://11fs.com/insights-banking-as-a-service

tl;dr

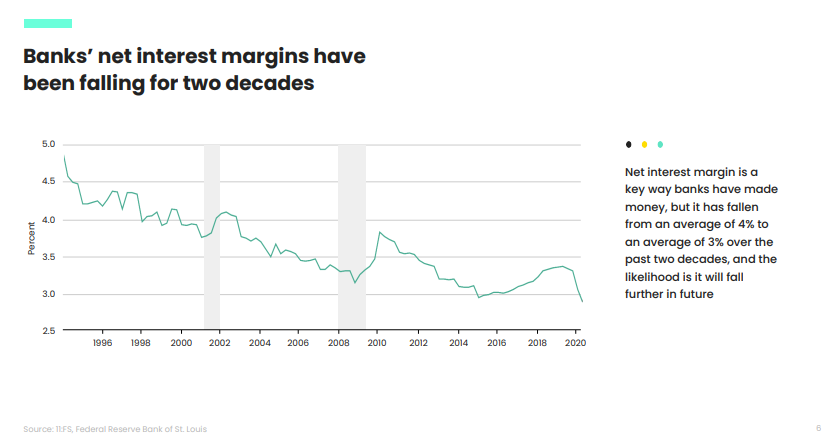

2. Banks business model is broken

* Over two decades net interest margin has been falling

* Way to make money for banks falls with interest rates

* It's more likely to get worse than get better

* Over two decades net interest margin has been falling

* Way to make money for banks falls with interest rates

* It's more likely to get worse than get better

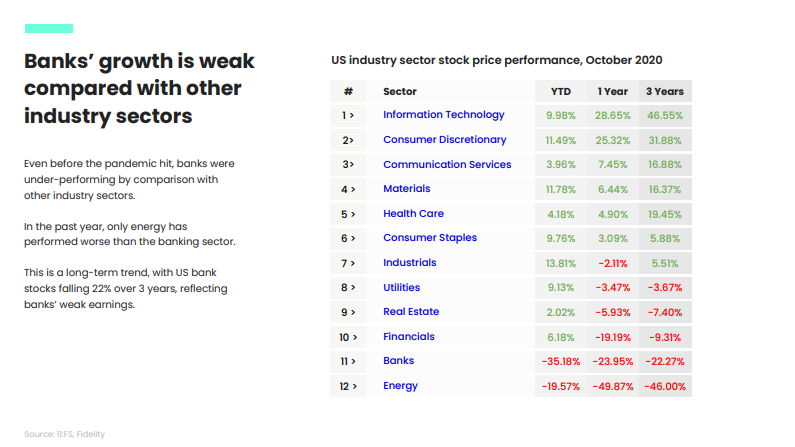

3. This is why bank share prices are suffering

* Only energy performed worse than bank stocks over 3yrs

* Banks the worst performing stock of 2020

* Only energy performed worse than bank stocks over 3yrs

* Banks the worst performing stock of 2020

4. The pandemic has made this worse

* Consumers now used to operating 100% digitally

* Banks carry the cost of obsolete infrastructure like ATMs and branches

- And setting aside massive amounts for loan losses

* Consumers now used to operating 100% digitally

* Banks carry the cost of obsolete infrastructure like ATMs and branches

- And setting aside massive amounts for loan losses

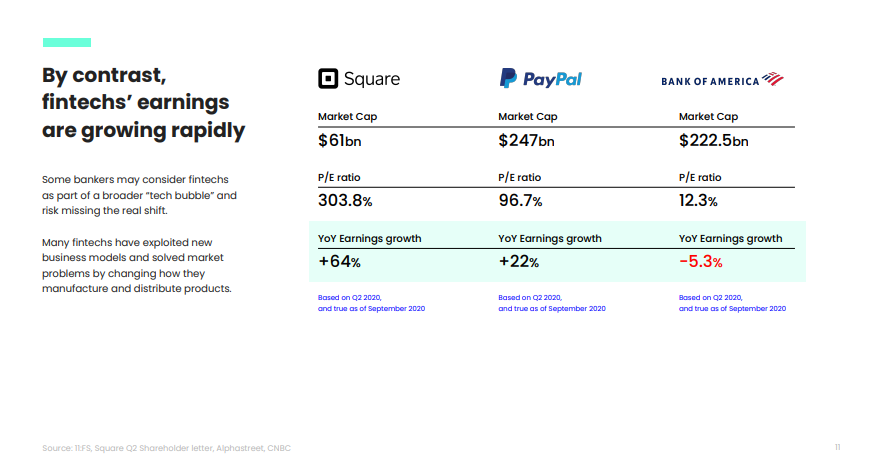

5. But fintech's are growing massively

* Ignore the share prices, look at the earnings line

* There is huge value creation in finance happening

* Banks aren't capturing it

* Ignore the share prices, look at the earnings line

* There is huge value creation in finance happening

* Banks aren't capturing it

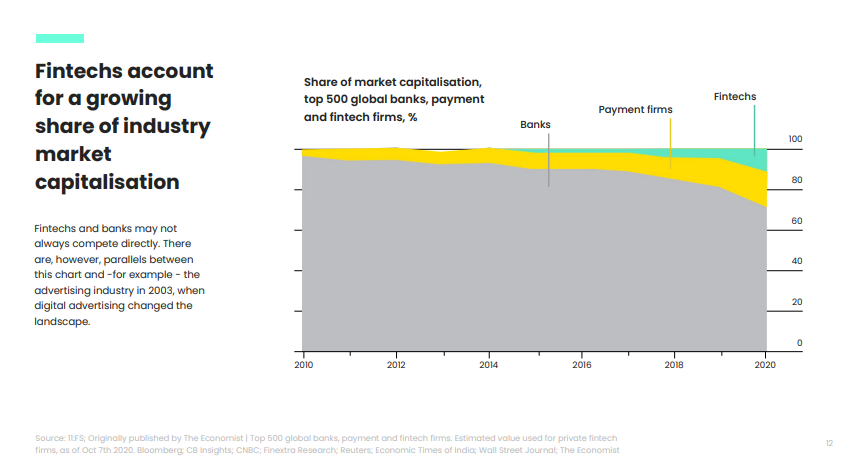

6. This is changing the shape of the market

* Again share prices aren't everything BUT

* This chart looks a lot like the advertising industry in 2003

* Change is slow then sudden

* Again share prices aren't everything BUT

* This chart looks a lot like the advertising industry in 2003

* Change is slow then sudden

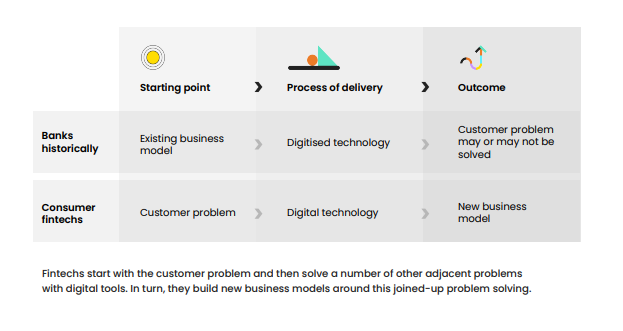

7. Because banks starting assumption is to sell a product

* Banks start at their business model

* Fintechs start at the customer problem

* Banks start at their business model

* Fintechs start at the customer problem

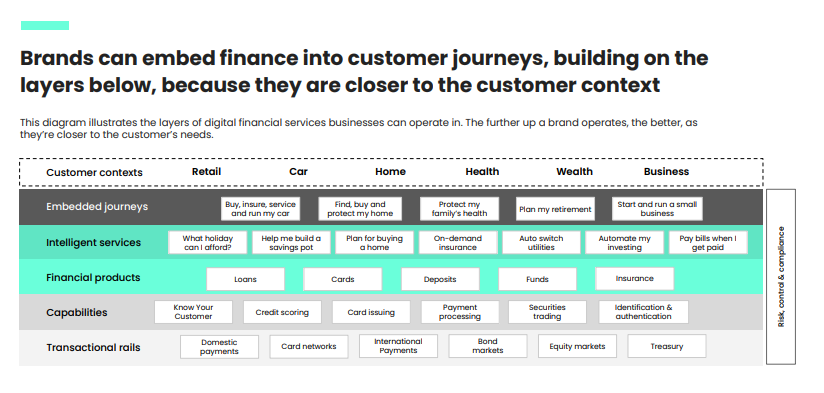

8. Two layers have emerged above banks

* Intelligent services: solve customer problems with digital

* Embedded journeys: Wrap services together into a context (e.g. Shopify, help me run a business)

* Intelligent services: solve customer problems with digital

* Embedded journeys: Wrap services together into a context (e.g. Shopify, help me run a business)

9. But not everyone lower down on this stack is losing

* Visa and Mastercard are doing very well serving the layers above

* Instead of competing with the new entrants, is there a better way?

* Visa and Mastercard are doing very well serving the layers above

* Instead of competing with the new entrants, is there a better way?

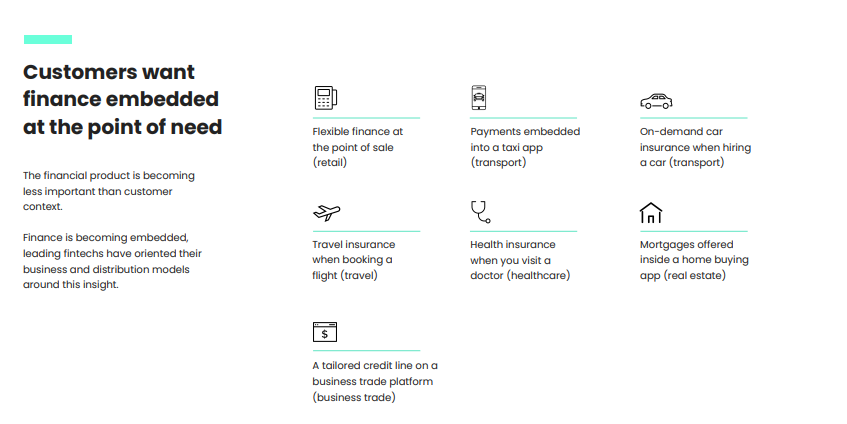

10. This could create massive opportunities for the whole market

* Customers want finance at the point of need

* Brands can use finance to create engagement

* Finance isn't engaging, but it enables engagement

* Understanding this shift is crucial

* Customers want finance at the point of need

* Brands can use finance to create engagement

* Finance isn't engaging, but it enables engagement

* Understanding this shift is crucial

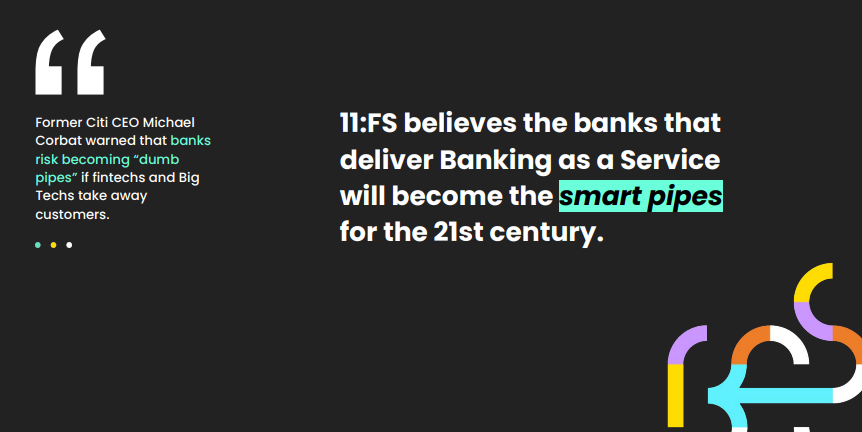

11. This is a multi $ trillion value creation opportunity

- Banks move from dumb pipes to smart pipes

- By enabling the layers above them

- And providing tools to manage regulated activity globally

- And see finance as supporting other products vs being the product

- Banks move from dumb pipes to smart pipes

- By enabling the layers above them

- And providing tools to manage regulated activity globally

- And see finance as supporting other products vs being the product

Read on Twitter

Read on Twitter