People who tout high ROAS aren't using Facebook for its intended strength: new customer acquisition at scale.

If you are looking for larger profit per customer your most likely making less overall gross profit than you should be.

If you are looking for larger profit per customer your most likely making less overall gross profit than you should be.

This is because Facebook acquires customers at a nominally lower cost even as you scale significantly.

How do I know this? I split tested it.

How do I know this? I split tested it.

We had a client who wanted a very high ROAS on new customers because they felt Facebook wasn't profitable enough. We explained that they were actually making less money with this approach. Their goals were limiting their ability to scale significantly.

While month over month results could guide understanding spend vs ROAS, that approach neglects seasonality & auction dynamics.

$100K spend in Aug will yield different results than $100K spend in Sep.

$150K spend in June will yield different results than $200K spend in July.

$100K spend in Aug will yield different results than $100K spend in Sep.

$150K spend in June will yield different results than $200K spend in July.

Instead we ran a split test to understand the impact of a larger budget in the same environment.

In cell one, we kept their typical budget.

In cell two, we increased their budget by over 60%.

In cell one, we kept their typical budget.

In cell two, we increased their budget by over 60%.

The larger investment generated 50% more purchases at a 9% higher CPA and 7% lower ROAS.

Based on their margins, the math showed investing more would drive more gross profit.

Based on their margins, the math showed investing more would drive more gross profit.

Why does FB only drive nominal changes in performance as you scale against new people?

2 primary reasons:

1) CPM's increase nominally compared to an increase in spend (if large enough audience)

2) Conversion rates don't dramatically decrease (if large enough qualified audience)

2 primary reasons:

1) CPM's increase nominally compared to an increase in spend (if large enough audience)

2) Conversion rates don't dramatically decrease (if large enough qualified audience)

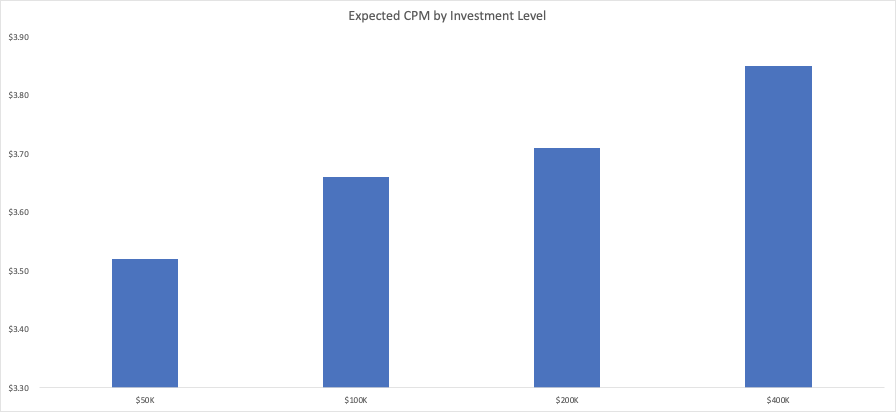

CPM's illustrated.

Let's say you used FB's campaign planner tool to project how CPM's would be impacted running a traffic campaign targeting everyone in the US at $50K/month vs $400K/month.

Your CPM's would only increase by ~9%.

Let's say you used FB's campaign planner tool to project how CPM's would be impacted running a traffic campaign targeting everyone in the US at $50K/month vs $400K/month.

Your CPM's would only increase by ~9%.

Because the addressable audience is so large, the cost to reach that next user is essentially the same as reaching the first one.

In the $50K to $400K budget increase, even though I'm spending 8X more, I would still only reach about 20% of my addressable audience.

In the $50K to $400K budget increase, even though I'm spending 8X more, I would still only reach about 20% of my addressable audience.

Spend only becomes a CPM factor when you look at it relative to audience penetration. That is, when you get close to about 60% - 70% audience penetration, you start to see significant increases in CPM's.

This is because now you're shifting to harder to reach people (e.g. people who visit FB/IG weekly or monthly instead of daily). Each new person costs incrementally more within your audience.

(In a conversions campaign, your addressable audience penetration threshold might be smaller than 60% - 70% as Facebook is looking at people likely to take your desired action. It's a lot easier to get someone to click than buy a $$$$ product.)

Conversion rates illustrated.

In the split test I mentioned, CVR's only decreased by 1%.

If you have a broader appeal product, the cost to acquire your next customer might not be that much more expensive than the first because both people are just as likely to buy.

In the split test I mentioned, CVR's only decreased by 1%.

If you have a broader appeal product, the cost to acquire your next customer might not be that much more expensive than the first because both people are just as likely to buy.

Where CVR's can dramatically increase is if you've already tapped out of your addressable audience as that level.

Example 1: You've converted all low hanging fruit.

Example 2: You've converted as many men 18-24 as you can, but need a more tailored ad/website for women 18-24.

Example 1: You've converted all low hanging fruit.

Example 2: You've converted as many men 18-24 as you can, but need a more tailored ad/website for women 18-24.

As long as your audience is large enough and qualified enough, you should have the ability to continue scaling at a nominal cost.

In other words, if you have the room in your margins, don't hold on to higher ROAS or lower CPA targets because you think you can be more profitable that way.

Chances are, you might actually be holding yourself back from more profitable growth.

Chances are, you might actually be holding yourself back from more profitable growth.

Read on Twitter

Read on Twitter