As we surpass $1 Billion, one could make an argument $PAR is reaching fair valuation. But given excellent execution this story is FAR from finished.

-Thread-

-Thread-

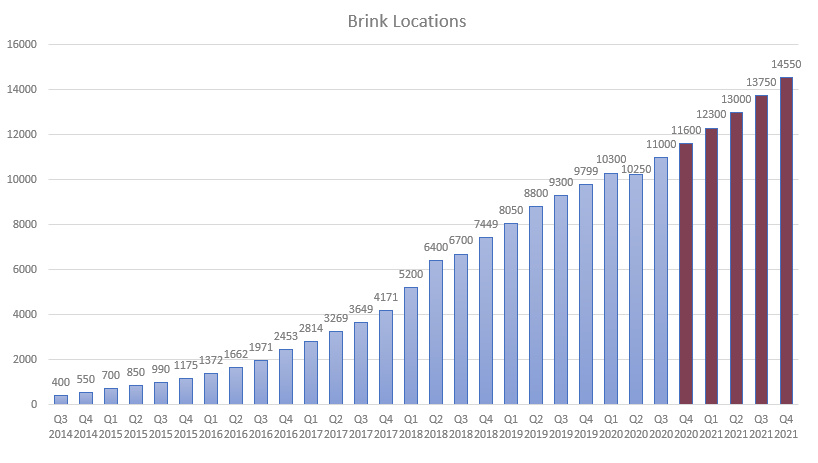

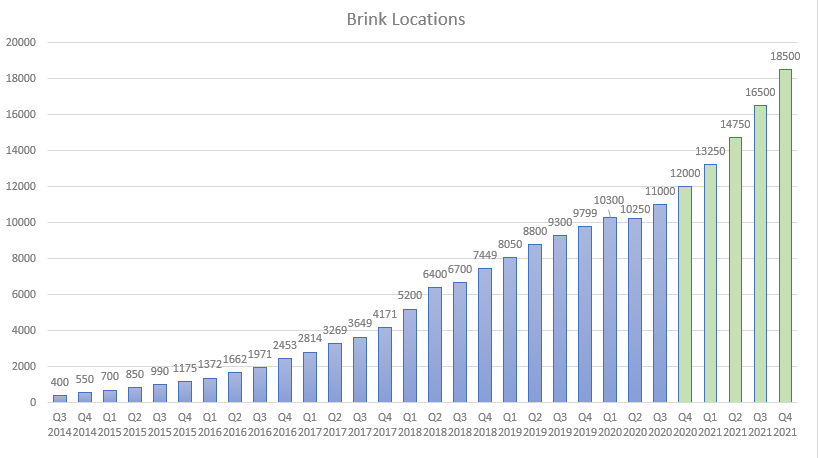

We know brink is extremely valuable. We experienced a pandemic that was cataclysmic for the restaurant industry. Yet YTD we are UP 2,201 locations (12.25% YTD). With 430 sites still temporarily closed.

Naturally $PAR had a slowdown of installs during hardest covid-19 months. However, when @SavneetS was asked during Q2 about value of brink, "those that had (brink) significantly outperformed those that didn't"

Brink gives you optionality as a restaurant, it allows you to adapt, it helps you organize, it improves the efficiency of a restaurant operation. It has all the traits of a desirable product. We know there will be demand for a product such as Brink.

# of Brink locations is probably one of the most important variables to look at when valuing $PAR

Getting brink installed is BIG. It starts a very long and mutually lucrative relationship with a restaurant.

Given current environment, install #'s are extremely impressive.

Getting brink installed is BIG. It starts a very long and mutually lucrative relationship with a restaurant.

Given current environment, install #'s are extremely impressive.

What can we expect for future installs? In latest earnings call @Adam_Wyden asks if it is realistic to see 2000/2500 installs in a quarter by Q4-21. Savneet's response was even-tempered but optimistic.

So the variable that is holding installs back is lack of resource allocation into MARKETING. As a shareholder this is very good news, as it is a variable that $PAR can control and expand. (maybe capital raise suggests more resource allocation into marketing)

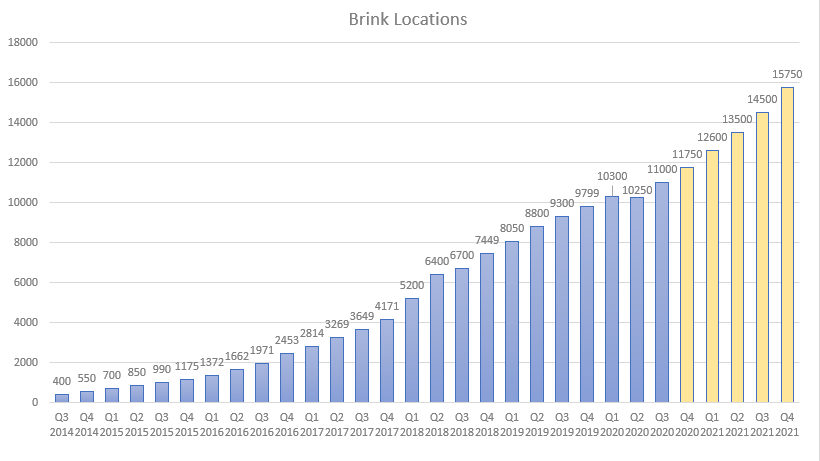

Forecasting three scenarios for brink installations by Q4-21. Bear-red, Base-yellow, Bull-green.

Bear case suggests ~710 new installs per Q

Base case suggests ~950 new installs per Q

Bull cases suggests ~1500 new installs per Q

Bear case suggests ~710 new installs per Q

Base case suggests ~950 new installs per Q

Bull cases suggests ~1500 new installs per Q

If $PAR allocates lots of resources into marketing, a bull case scenario of 2000 new installs per Q by Q4-21 isn't impossible.

We're currently sitting at an ARPU of ~$2000.

By Q4 2021, it's realistic to see 10% expansion with upselling.

Base: We see FWD ARR of brink push $35 million. With Restaurant Magic included $45 million is realistic.

We sit at a Brink/RM FWD P/S of ~22 without backing out assets.

By Q4 2021, it's realistic to see 10% expansion with upselling.

Base: We see FWD ARR of brink push $35 million. With Restaurant Magic included $45 million is realistic.

We sit at a Brink/RM FWD P/S of ~22 without backing out assets.

All this is ignoring the possibility of PAR Pay becoming a serious contributor to Brink ARR. Or the the possible sale of government business which would unlock more liquidity and resources for further growth.

Competitors such as Toast (pre-covid) generate large percentages of their revenue from Payments. We know payments can contribute serious revenue. And have reason to believe with $PAR execution that they can scale Par Pay.

$PAR has plenty of growth left in brands they already have Brink installments in. (10,000-12,000 locations).

Ramping marketing efforts, which could increase amount of partnered brands, can dramatically increase their immediate addressable market of MSA locations.

Ramping marketing efforts, which could increase amount of partnered brands, can dramatically increase their immediate addressable market of MSA locations.

Short-term we have 3 main possible bullish catalysts unfolding of:

1. Government Sale

2. PAR Pay development

3. Installation Acceleration.

Path of least resistance is higher for share price. $PAR

1. Government Sale

2. PAR Pay development

3. Installation Acceleration.

Path of least resistance is higher for share price. $PAR

Long-term you have a fairly valued business, with a kickass product, high quality and transparent management, and a massive TAM (restaurant industry).

Although, long-term risks of stalling installations, better products from other competitors, or a management departure.

Although, long-term risks of stalling installations, better products from other competitors, or a management departure.

Read on Twitter

Read on Twitter