Some thoughts on Indian economy:

India currently experiencing a solid convergence of tailwinds: Low Interest Rates, Political stability, Stable Crude, Stable INR, Strong FX Reserves, solid Reforms push, Good monsoons, adequate Reservoir storage, Adequate Liquidity... 1/n

India currently experiencing a solid convergence of tailwinds: Low Interest Rates, Political stability, Stable Crude, Stable INR, Strong FX Reserves, solid Reforms push, Good monsoons, adequate Reservoir storage, Adequate Liquidity... 1/n

Other factors: Made in India push by citizens, China+1 strategy of global buyers, Digitization push globally giving tailwind for Indian IT (hence Exports/Jobs) - 2/n

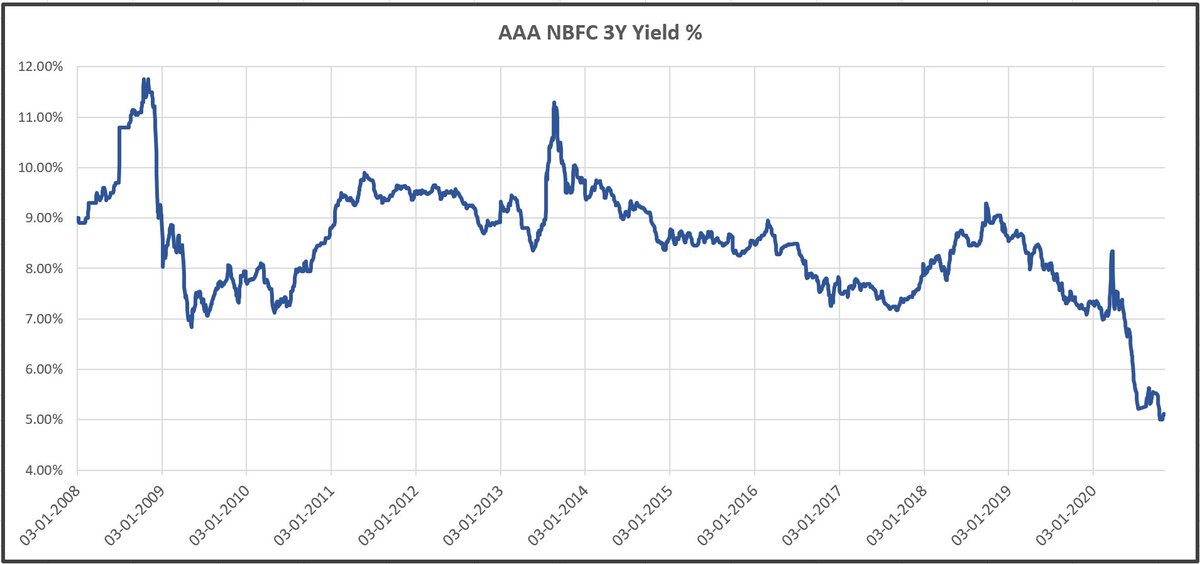

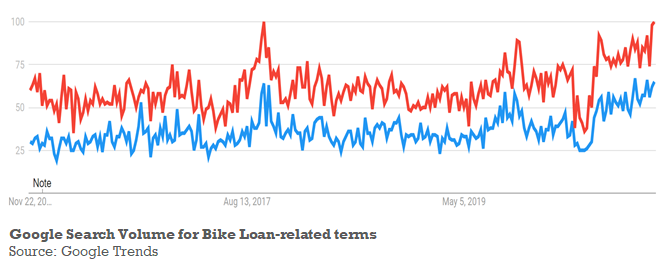

Low Rates (record low Int % for high quality Corps, should trickle down to others) may not be getting adequate attn. They act with lag & in multiple ways. Except for savers, a massive tailwind for rest of the economy: Borrowing for Housing/Auto, Capex plans, NBFCs, Fisc - 3/n

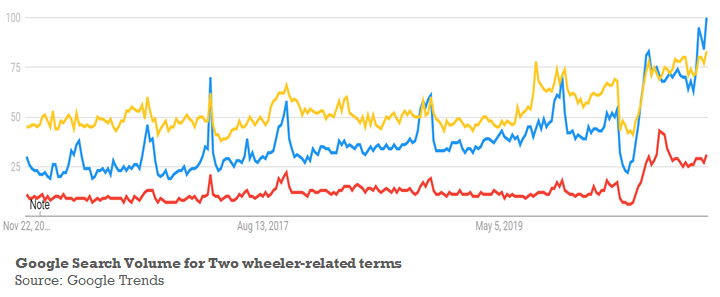

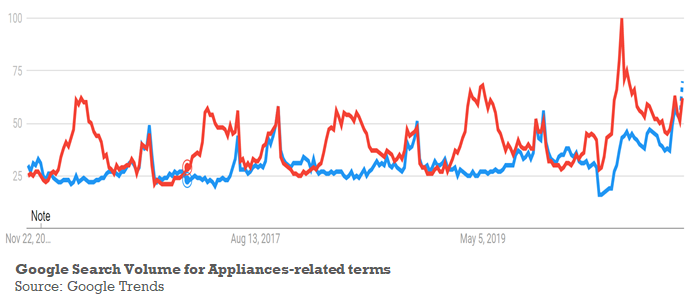

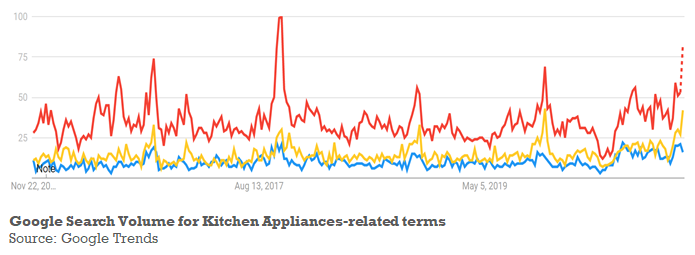

Low Home Loan rates & appreciation of a good Home may be some of the factors driving Housing. Cement output has been on a tear in Oct/Nov. Growth in Housing can lead to multiple segments of the economy doing well: Labour, Cement, Home Fin, Housing Cos, constn materials etc - 4/n

Political stability. Bihar elections may be signalling growing maturity of the electorate, in appreciating good development/governance work done on the ground (sabka Saath, Sabka Vikaas), in spite of strong anti-incumbency, and massive setback for the nation in form of Covid

Risks appear more from external front. Covid is surging in EU/US, and it appears to be posing more risks due to oncoming winter. Would stricter lock-downs affect economic activity and investing sentiment? - 6/6

Read on Twitter

Read on Twitter