The Suez Canal was constructed between 1859 and 1869 and was officially opened on November 17, 1869. Dreams of building a canal between the Mediterranean and the Red Sea go back almost 4000 years, but until the 1800s, no one had succeeded in building a useable canal.

In 1856, Ferdinand Lesseps obtained a concession from Sa’id Pasha, the Khedive of Egypt and Sudan to create a company that would construct a canal open to ships from every nation.

The Suez Canal Co. was founded on December 1858 with the Egyptian government owning 44% of the shares, and French and Egyptian investors owning the rest.

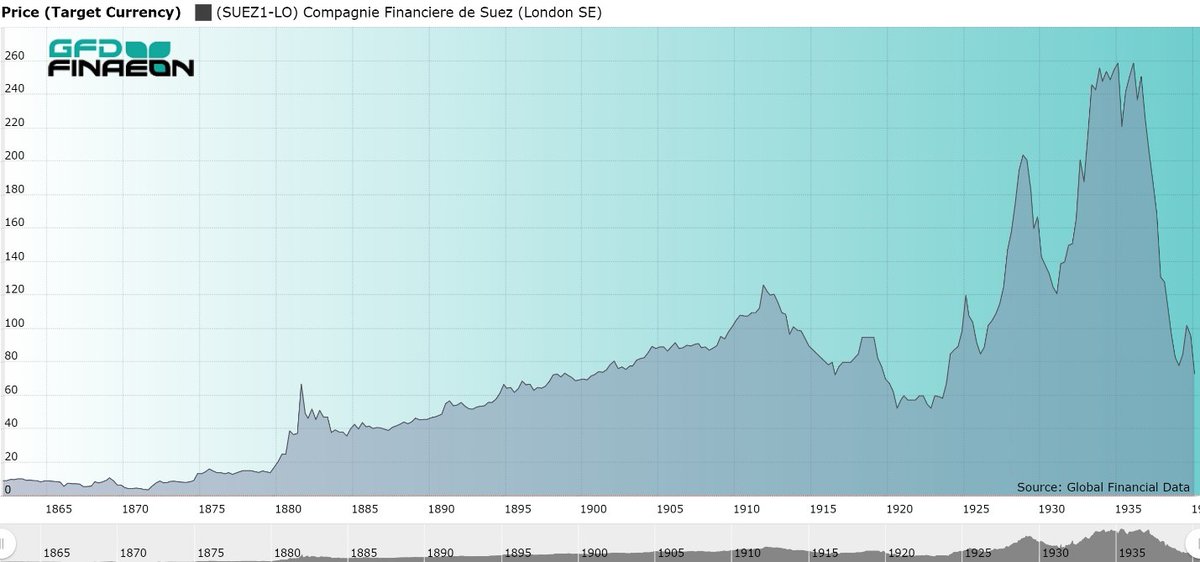

As can be seen, shares in the Suez Canal rose in price from 1858 until World War I, declined in price until the early 1920s, then made a dramatic rise until 1939 when World War II caused the price of Suez Canal Co. shares to crash back to the level of the 1920s.

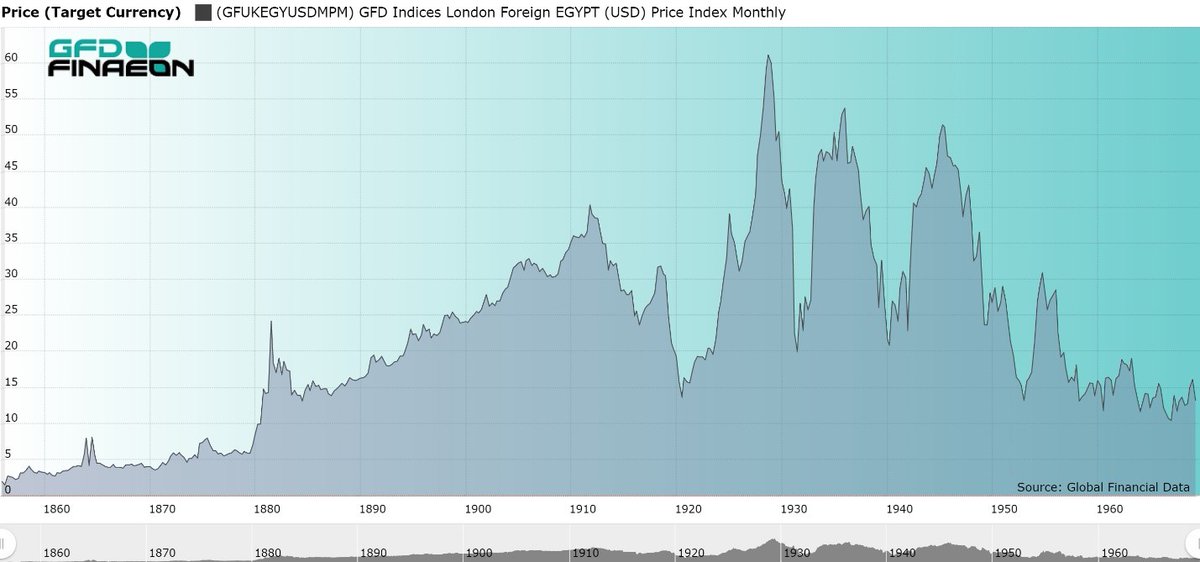

The index peaked in 1929 and had lower highs in 1937, 1945 and 1955 right before the Suez crisis. Between 1856 and 1969, Egyptian stocks increased in price at an annual rate of 2.31% and 7.55% on a return basis, giving a dividend yield of 5.12%.

But this obscures the huge variance in returns over time. 1856-1912, Egyptian stocks rose at an annual rate of 6.83% and by 5.82% 1846-1929. Add 5% for dividends, Egyptian stocks provided good returns during its heyday, though primarily due to the performance of Suez Co. shares.

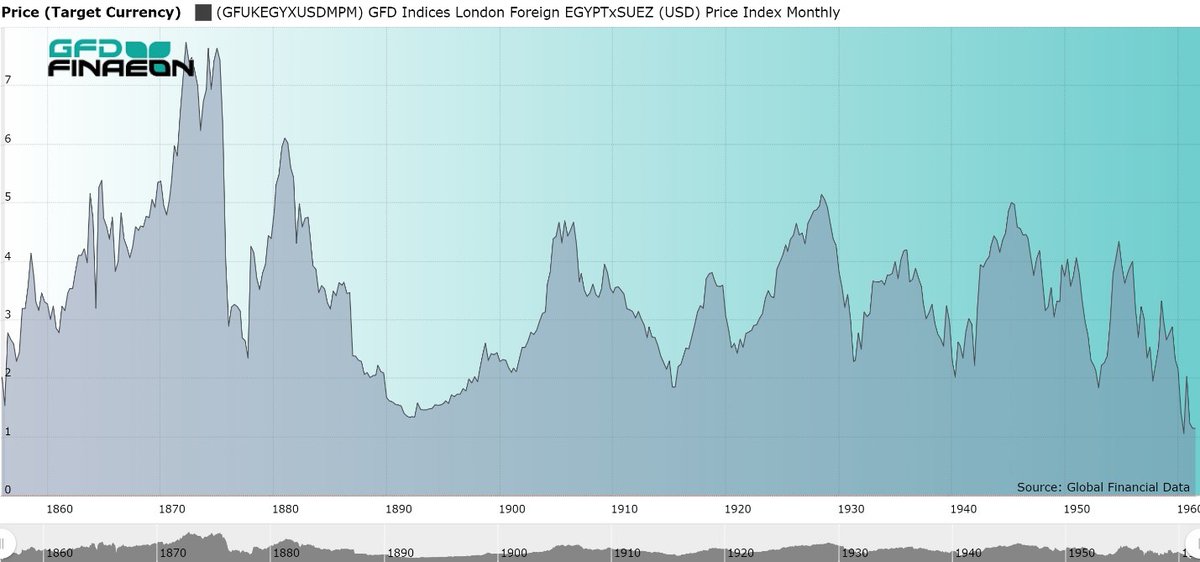

What does the Egyptian stock market look like if Suez is excluded from the index? To find this out, we calculated an Egypt x/Suez index. It peaks at similar times as the graph above, with the market topping out in 1929, 1937, 1945 and 1955.

But the total return is completely different with the index increasing only 0.14% per annum 1856 -1961 and 6.37% with dividends reinvested. Between 1856 and 1929, the annual increase in the price of Egyptian stocks was only 2.00% per annum versus 5.82% once Suez stock is included

In other words, without Suez stock, Egyptian shares behaved just like shares from any other country, fluctuating up and down, but providing little if no long-run return to shareholders. All the return came through dividends.

Read on Twitter

Read on Twitter