Today, @liveink and I are thrilled to announce Farmstead’s oversubscribed Series A that we raised this year during the pandemic and shelter-in-place. Here’s our story  https://techcrunch.com/2020/11/18/farmstead-series-a/

https://techcrunch.com/2020/11/18/farmstead-series-a/

https://techcrunch.com/2020/11/18/farmstead-series-a/

https://techcrunch.com/2020/11/18/farmstead-series-a/

In 2016, my daughter turned two, had a growth spurt and started drinking so much milk that my wife and I found ourselves at grocery stores three times a week.

@liveink and I were running out of time juggling work and family life. Automating our family's grocery shopping using apps just didn’t work.The existing grocery delivery apps were taking more time and money, instead of giving it back.

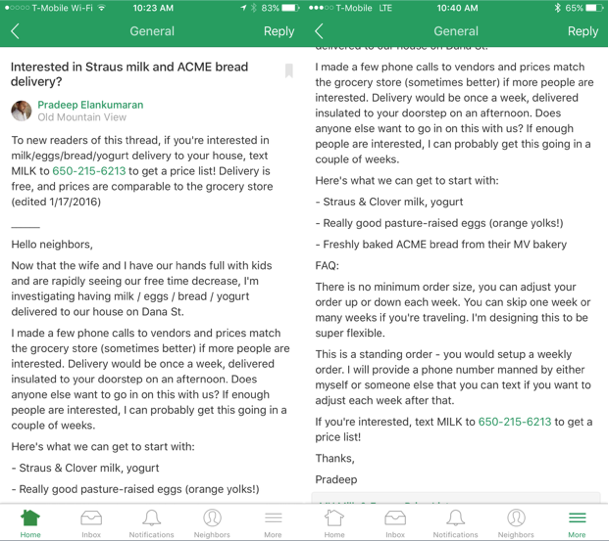

Curious if other folks had this problem, we posted on Nextdoor. We got 200 sign ups in 2 days for a weekly milkman-like grocery delivery offering.

Customer research uncovered secrets. The market assumed that online grocery adoption was 3% in a $1 trillion space because people preferred to pick produce in-store versus outsourcing it. This was false. The opposite was true - they wanted lower prices and higher reliability.

Nobody had actually given the 70% of people in the US who shop at multiple supermarkets a week (Safeway, Kroger, Trader Joe’s, etc.) a path to spend exactly what they already spend at stores, while getting the promise of e-commerce delivered.

The answer was deceptively simple: help online grocery customers stick to their weekly shopping budget to unlock the $750 billion grocery market.

That meant same prices as the store, no service or delivery fee.

That meant same prices as the store, no service or delivery fee.

To have profitable unit economics and no service or delivery fees, we needed to operate our own warehouses, a model completely overlooked by analysts, press and grocers who fixated on replicating or competing with Instacart.

We solved this problem with tech - using our own data to orchestrate best-in-the-industry food waste, efficient manual picking at warehouses with a path to automation, and dense last-mile logistics to doorsteps. Today, we’re close to profitability in the cutthroat Bay Area market

Unlike supermarket stores which cost $10M to open the doors, Farmstead hubs are fast and inexpensive to spin up at just under $100K to open the doors. https://twitter.com/pradeep24/status/1328406014161420289

Farmstead's online grocery hubs get to profitability in months, not years, driving accessibility and equity across a 50 mile radius, while eradicating existing food deserts.

We found like-minded partners in our new cohort of investors, led by new board member and behind-the-scenes force of nature Tim Reynders of Aidenlair Capital. Tim's a behind-the-scenes force of nature, @liveink and I can’t think of a better partner we go national.

Farmstead's Series A also includes the finest of the new breed of emerging fund operators in VC - @TurnerNovak, @acharoo, @tomwilliams, 19 York, Red Dog Capital, along with prior investors @ycombinator @svangel and @artisventures.

Farmstead customers pay less than stores, skip multiple trips with one order, and get free delivery and no other fees. We are bringing this low-cost, highly accessible model to everyone, and are opening hubs all across the country in 2021!

P.S. If you're looking for Farmstead's first and true believers - @VCMike and @raanan at @ResoluteVC took this bet when the industry didn't get what we were doing. Any founder raising (pre)-seed, if they're not your first call, you're doing it wrong.

Read on Twitter

Read on Twitter