YouTube updated their Terms of Service and one of the changes is that earnings will now be classified as royalty income.

This doesn't change anything in how this income should be reported (1/7)

This doesn't change anything in how this income should be reported (1/7)

In fact, Twitch broadcasters already receive income classified as royalty.

A common mistake when I work with individuals in new media is this income is reported incorrectly on Schedule E and not Schedule C in prior years (2/7)

A common mistake when I work with individuals in new media is this income is reported incorrectly on Schedule E and not Schedule C in prior years (2/7)

Well, what's the big deal?

When you report it on Schedule E and not Schedule C, you do not subject these earnings to self-employment (SE) tax.

SE tax is roughly 15%. (3/7)

When you report it on Schedule E and not Schedule C, you do not subject these earnings to self-employment (SE) tax.

SE tax is roughly 15%. (3/7)

So, if you misreport $10,000 in royalty income that means you have underreported your taxes by about $1,500.

If you have a very successful channel and you have made this mistake, then you could owe the back tax + significant penalties and interest (4/7)

If you have a very successful channel and you have made this mistake, then you could owe the back tax + significant penalties and interest (4/7)

The accuracy related penalty is 20% of the unpaid tax.

The late payment penalty and interest goes back to when the tax should have been paid (usually April 15th).

And usually this sort of thing isn't discovered for a couple of years. (5/7)

The late payment penalty and interest goes back to when the tax should have been paid (usually April 15th).

And usually this sort of thing isn't discovered for a couple of years. (5/7)

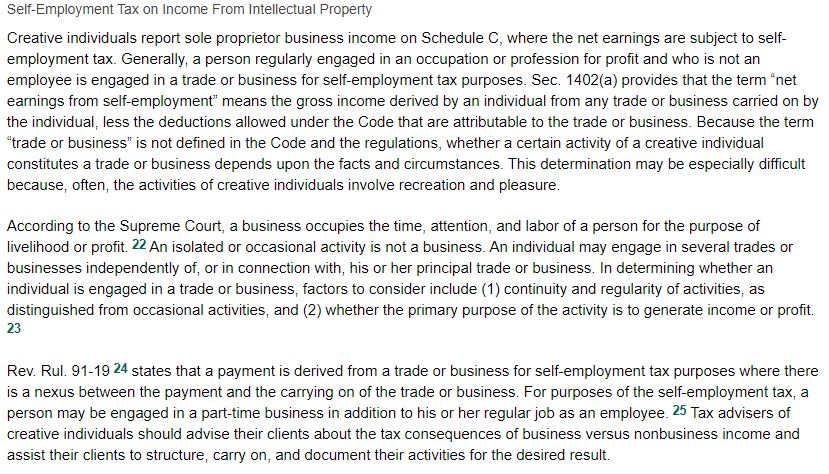

And yes, if you are actively creating content then your royalty income is subject to self-employment tax.

https://www.thetaxadviser.com/issues/2013/dec/kelley-dec2013.html (6/7)

https://www.thetaxadviser.com/issues/2013/dec/kelley-dec2013.html (6/7)

If you are a full time content creator / influencer, you need to know even more things than the avg business owner / sole proprietor because not everyone understands what you do and how you make money.

And that could up costing you significantly. (7/7)

And that could up costing you significantly. (7/7)

Read on Twitter

Read on Twitter