Pivotal Investment ($PIC) / XLFleet DD thread

We are convinced that this is going to be huge for a few reasons, and we have a position.

The EV sector has ran up huge in value the last few days/weeks, and this has barely moved. Should be a good buy before it takes off.

We are convinced that this is going to be huge for a few reasons, and we have a position.

The EV sector has ran up huge in value the last few days/weeks, and this has barely moved. Should be a good buy before it takes off.

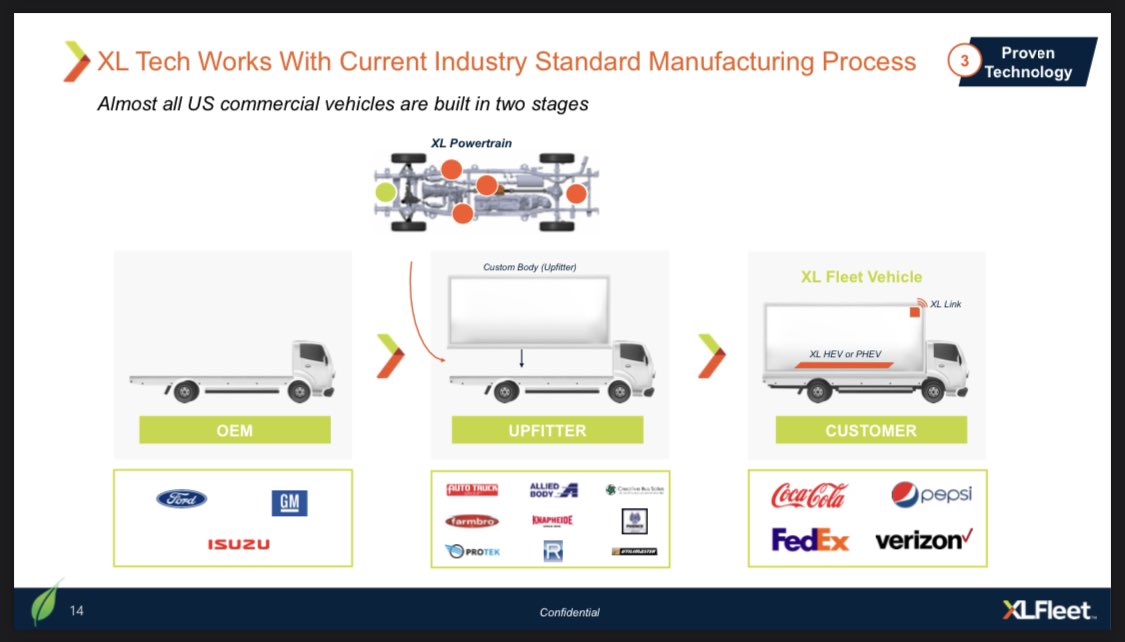

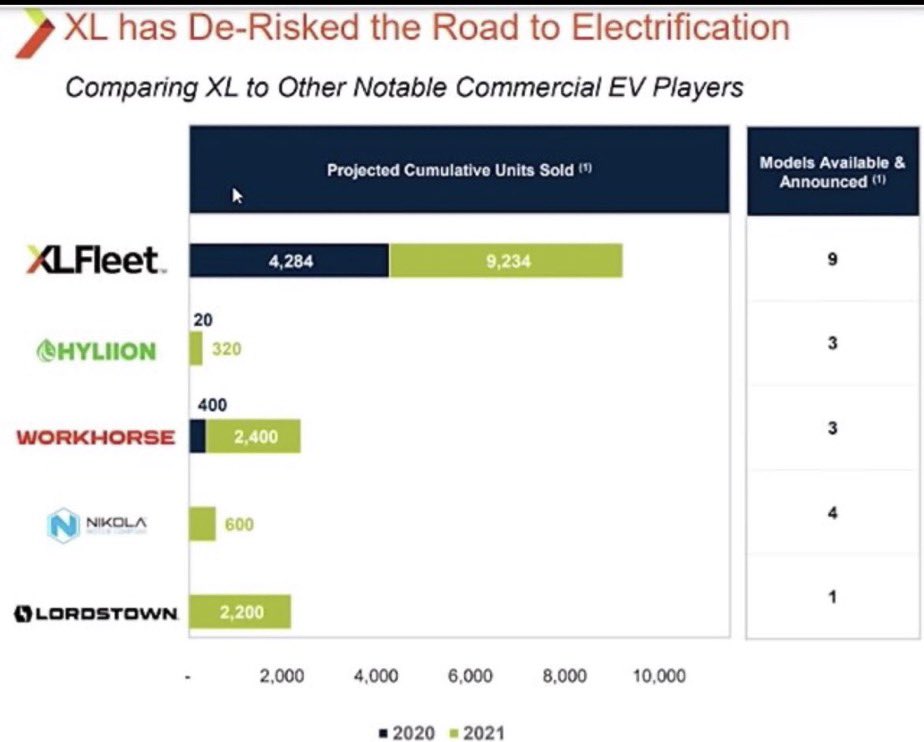

They lead their market, and are positioned to scale production higher when needed. They have a capital efficient production model so they won’t be burning through cash.

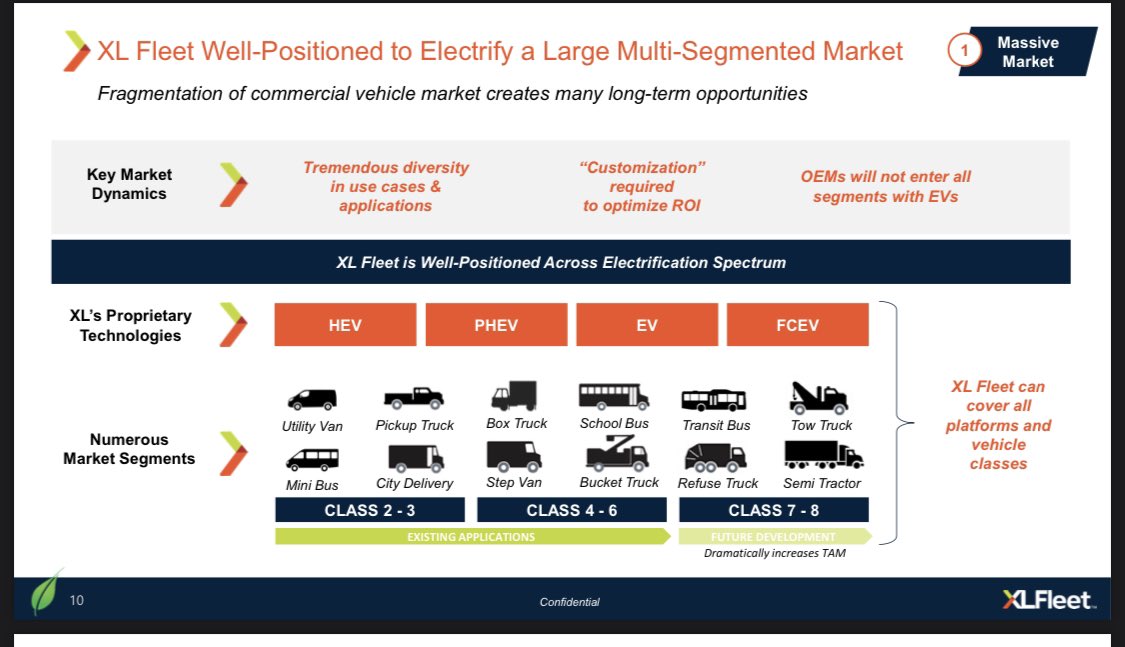

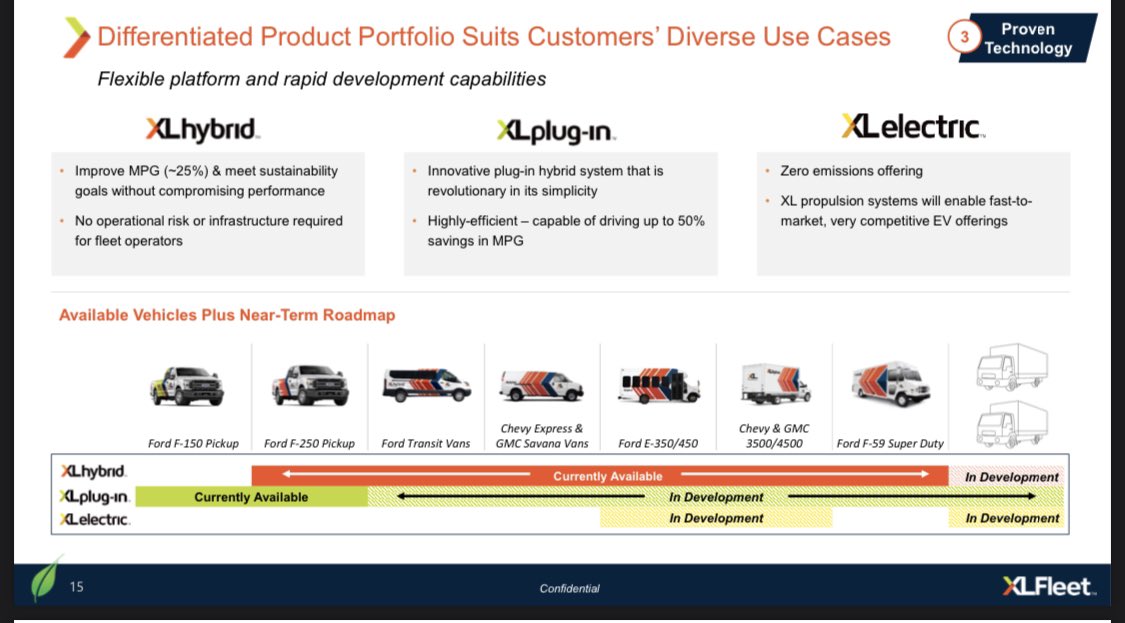

They have a large variety of products for their customers. We are a big fan of them requiring customization, which should help with profit.

Current products range from utility vans to school busses, and they plan on expanding their vehicles.

Current products range from utility vans to school busses, and they plan on expanding their vehicles.

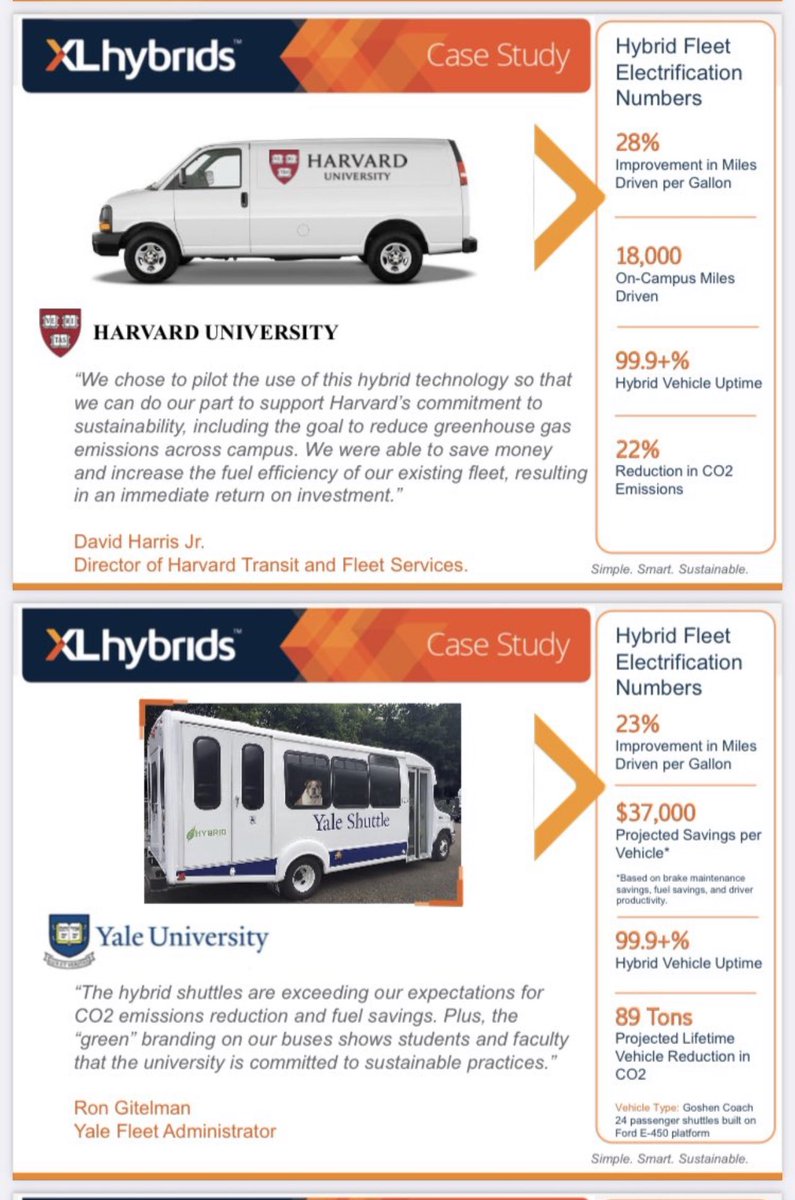

They already have a large group of established customers. Brands like Verizon, Coca Cola, and even universities like Harvard all actively work with them.

Some pictures of $PIC / XLFleet’s products.

We expect XLFleet to continue to work with and establish new customers, as they are in the best position to help companies convert their fleets.

XLFleet has different products for different businesses. Our favorite segment is XLelectric, which will help them be positioned for a global switch to EV.

$220 million in sales pipelines for the next 12 months. This number was BEFORE it’s largest partner decided to double it’s orders for 2021.

This is a low risk, high reward investment in our opinion. They have a great low risk plan in place for their future growth.

This is a low risk, high reward investment in our opinion. They have a great low risk plan in place for their future growth.

The ticker is currently $PIC, but it will become $XL once the merger is complete. The merger is expected to close before the end of the year. The DEF14A should be coming any day, hopefully Friday after hours.

Post merger, $XL will have a value of around $1 billion, and zero material debt.

We’ll likely add more to this. While doing research, I realized XLFleet’s building was only 45 minutes from me. I’ll try to go do some in person research and update this.

Read on Twitter

Read on Twitter