Thread → Cryptocurrency Derivatives & Leveraged Margin Trading

As most people just post ref.-links here regarding this matter, without ever explaining wtf it is about or what risks there might be, here we go!

As most people just post ref.-links here regarding this matter, without ever explaining wtf it is about or what risks there might be, here we go!

What are derivatives?

→ Derivative = financial contract between two or more parties based on the future price of an underlying asset

→ One of the most popular financial instruments

→ Value of the contract is determined by changes or fluctuations in the price of one asset

→ Derivative = financial contract between two or more parties based on the future price of an underlying asset

→ One of the most popular financial instruments

→ Value of the contract is determined by changes or fluctuations in the price of one asset

What is the purpose of derivatives?

→ Hedging/protection from price fluctuations

→ Speculation on future prices of certain assets

→ Especially in the cryptocurrency sector it's main purpose is rather speculation

→ Hedging/protection from price fluctuations

→ Speculation on future prices of certain assets

→ Especially in the cryptocurrency sector it's main purpose is rather speculation

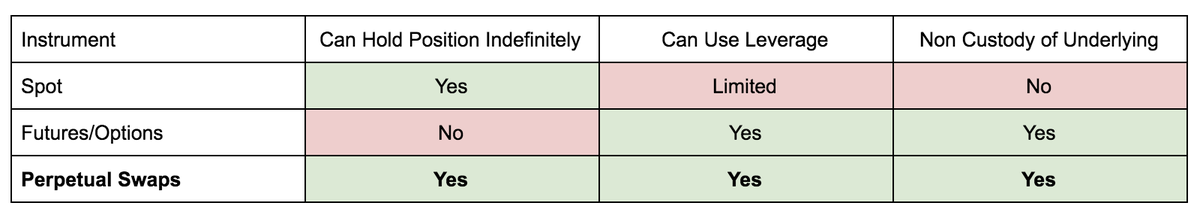

What are perpetual contracts & futures?

→ Futures: Contracts obligating the buyer to purchase an asset (or vice versa) to a predetermined future date and price

→ Perpetual: Contracts similar to futures without expiration date or settlement, can be held or traded any time

→ Futures: Contracts obligating the buyer to purchase an asset (or vice versa) to a predetermined future date and price

→ Perpetual: Contracts similar to futures without expiration date or settlement, can be held or traded any time

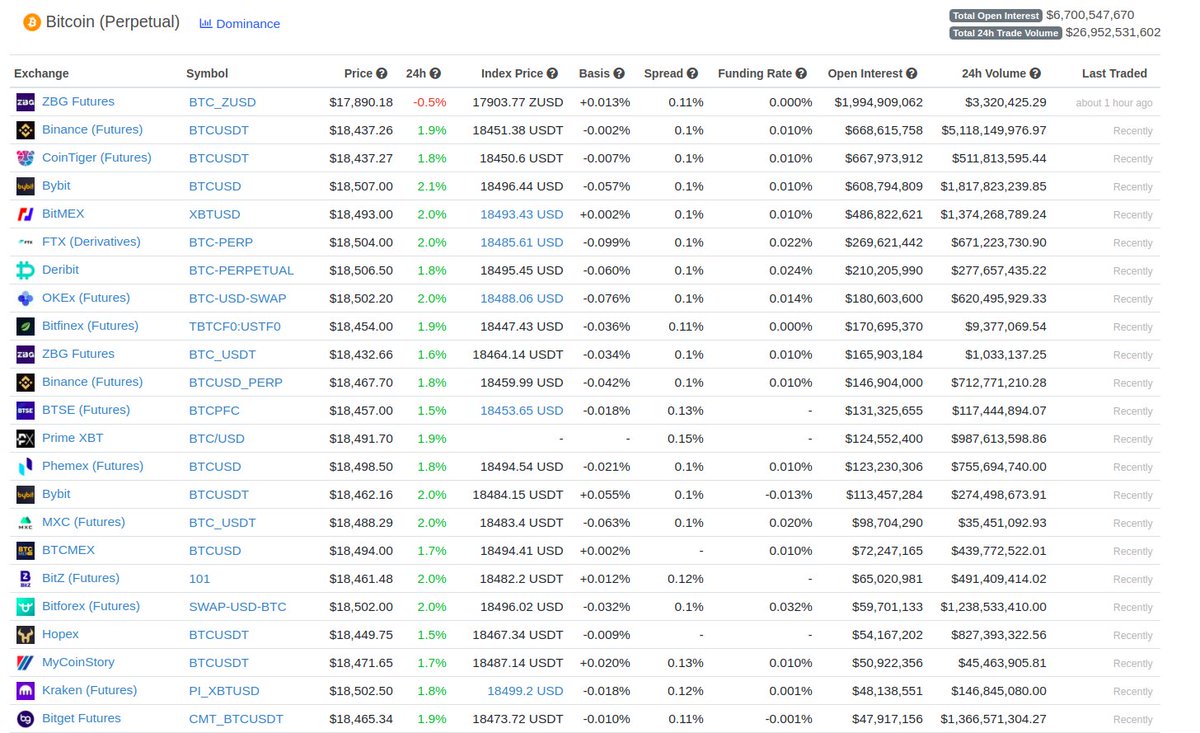

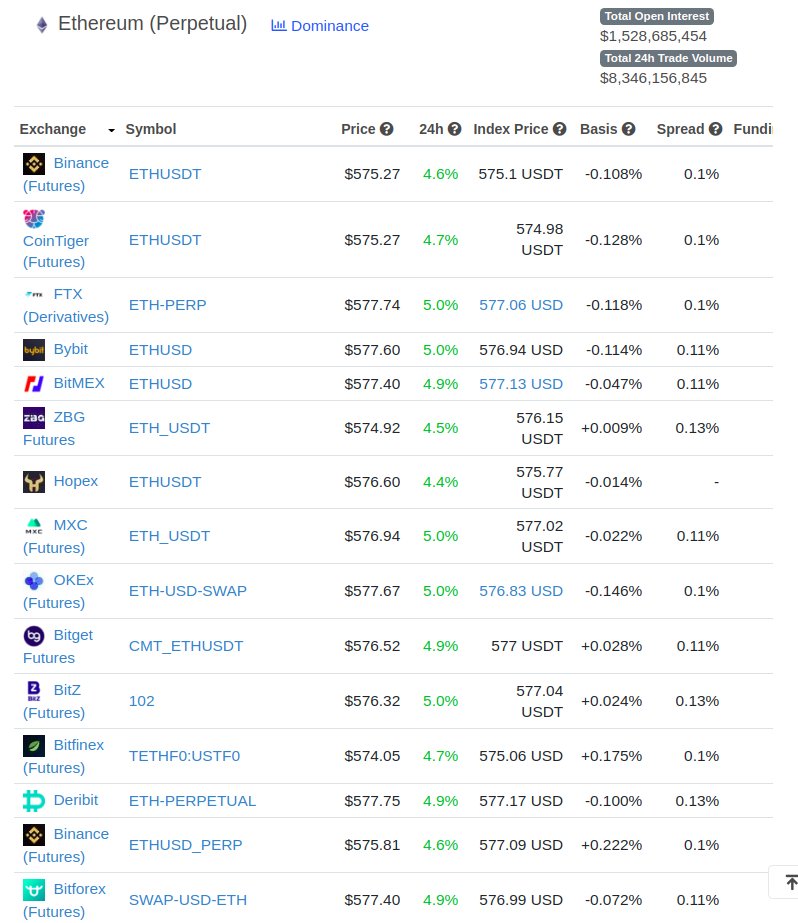

The amount of derivatives for #Bitcoin  and other cryptocurrencies has exploded over the last 2-3 years. A great overview you can find on @coingecko:

and other cryptocurrencies has exploded over the last 2-3 years. A great overview you can find on @coingecko:

https://www.coingecko.com/en/derivatives

and other cryptocurrencies has exploded over the last 2-3 years. A great overview you can find on @coingecko:

and other cryptocurrencies has exploded over the last 2-3 years. A great overview you can find on @coingecko: https://www.coingecko.com/en/derivatives

What is leveraged margin trading?

→Trading with leverage allows you to open a position that is larger than the original stake. The borrowed money is called "margin"

→Leverage is a very powerful tool because it can increase your profits, but it can also maximizes your losses

→Trading with leverage allows you to open a position that is larger than the original stake. The borrowed money is called "margin"

→Leverage is a very powerful tool because it can increase your profits, but it can also maximizes your losses

Example:

→ You want to put $1k into a #Bitcoin long position with x5 leverage

long position with x5 leverage

→ Effectively you are trading with $5k now

→ If you close this position at +10% BTC price you make +$500, not +$100

→ You want to put $1k into a #Bitcoin

long position with x5 leverage

long position with x5 leverage→ Effectively you are trading with $5k now

→ If you close this position at +10% BTC price you make +$500, not +$100

On the other way you are facing a liquidation of your position when the price goes into the 'wrong' direction.

Over 80% of all traders will lose in the long term. It is a dangerous game that you play against very smart individuals and algos. Don't expect to win directly.

Over 80% of all traders will lose in the long term. It is a dangerous game that you play against very smart individuals and algos. Don't expect to win directly.

To be a profitable trader, and most here will second this, you have to make mistakes first, period. And not everybody is made for being a potentially great trader.

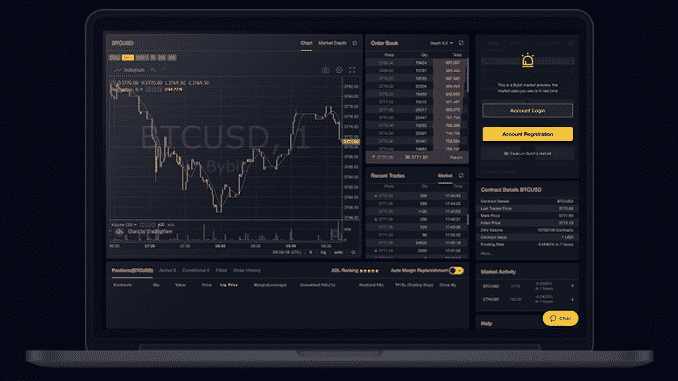

However: When you are experienced in trading spot since a longer time already or want to check it out at all, I am trading #Bitcoin  most times on ByBit.

most times on ByBit.

Always reliable, great 24/7 support & even altcoin derivatives.

Feel free to use my ref.:

http://bit.ly/ByBit1337

most times on ByBit.

most times on ByBit. Always reliable, great 24/7 support & even altcoin derivatives.

Feel free to use my ref.:

http://bit.ly/ByBit1337

Read on Twitter

Read on Twitter