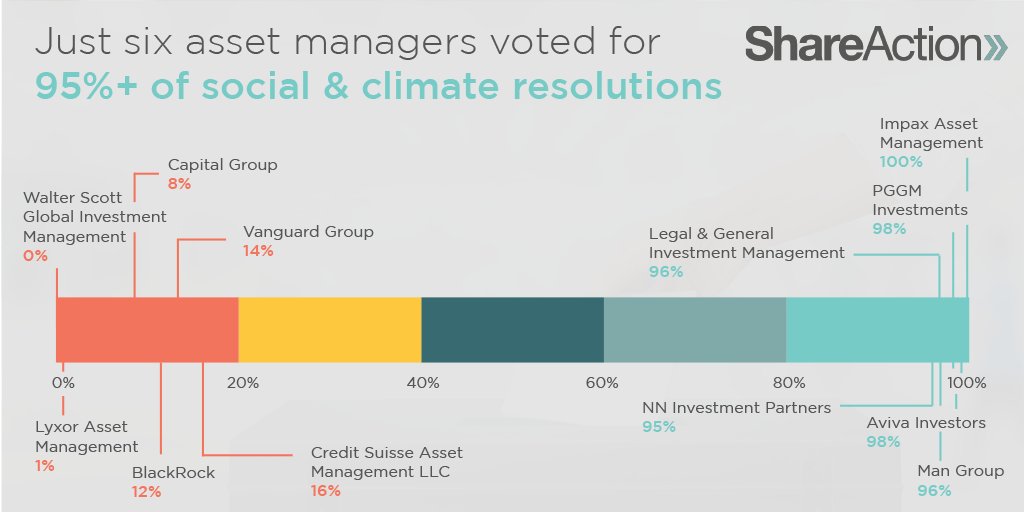

Today @ShareAction publishes an analysis of how 60 top asset managers voted on climate & social resolutions in the 2020 AGM season

We found that asset managers are still not effectively using their proxy voting power when it comes to ESG

A thread https://bit.ly/Voting-2020

https://bit.ly/Voting-2020

We found that asset managers are still not effectively using their proxy voting power when it comes to ESG

A thread

https://bit.ly/Voting-2020

https://bit.ly/Voting-2020

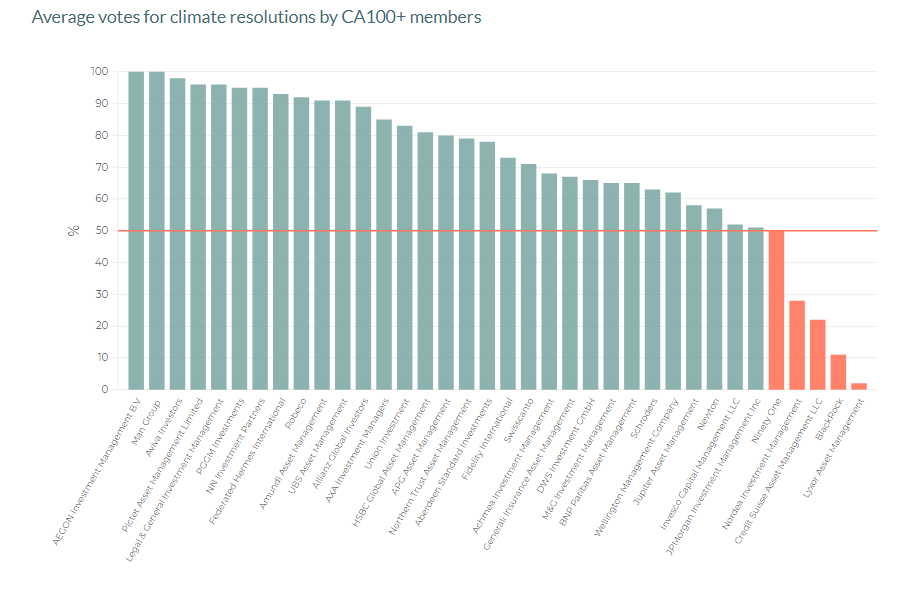

#1 European asset managers continue to outperform US asset managers, w the top 17 best performers all based in Europe

But a number of US asset managers are quickly catching up

For e.g. Northern Trust AM supported 79% climate resolutions this year, up from 21% last year

But a number of US asset managers are quickly catching up

For e.g. Northern Trust AM supported 79% climate resolutions this year, up from 21% last year

Pension fund clients of asset managers exposed as having a weak voting record must urgently challenge the gap between rhetoric & action on behalf of their beneficiaries said @ca_howarth

https://www.pionline.com/esg/some-managers-better-esg-shareholder-support-report-says #VotingMatters

https://www.pionline.com/esg/some-managers-better-esg-shareholder-support-report-says #VotingMatters

#2 One in six asset managers do not use their voting rights at over 10% of the resolutions they could have voted on

The number of asset managers choosing not to vote at AGMs should alarm asset owners who delegate their stewardship & voting activity to their asset managers

The number of asset managers choosing not to vote at AGMs should alarm asset owners who delegate their stewardship & voting activity to their asset managers

#3: 17 additional resolutions would have passed, if one or more of the Big Three had changed their vote

The breakdown of the 17 resolutions is as follows:

• 4 on climate issues

• 6 on climate-related lobbying

• 4 on human rights

• 2 on diversity

• 1 on pay gaps

The breakdown of the 17 resolutions is as follows:

• 4 on climate issues

• 6 on climate-related lobbying

• 4 on human rights

• 2 on diversity

• 1 on pay gaps

The votes cast by the Big Three truly matter as the trio account for around a quarter of votes cast on companies in the S&P 500 Index

“Asset managers must do ESG meaningfully, and that means opposing management when required,” said @ColinBaines1 https://bloom.bg/33AiyP8

“Asset managers must do ESG meaningfully, and that means opposing management when required,” said @ColinBaines1 https://bloom.bg/33AiyP8

#4: A number of Climate Action 100+ members fail to vote for climate action, although CA100+ members have better voting records on average than non-CA100+ members

#5: Analysis of the voting rationales provided by asset managers reveals that private engagement can stand in the way of climate action

For e.g. an asset manager stated that it didnt vote for a resolution bcs it would prefer “not to undermine good relationships in place”.

For e.g. an asset manager stated that it didnt vote for a resolution bcs it would prefer “not to undermine good relationships in place”.

Given the scale of the climate crisis, it is concerning that some investors shy away from voting on critical resolutions at high-carbon companies

Investors need to support resolutions pushing for greater ambition https://www.investmentnews.com/blackrock-vanguard-not-that-supportive-esg-resolutions-199836

Investors need to support resolutions pushing for greater ambition https://www.investmentnews.com/blackrock-vanguard-not-that-supportive-esg-resolutions-199836

#6: Banks are under pressure to act on climate change - with some managers voting for all climate resolutions at banks

This is significant as they tend to be more action-oriented in nature & focus on the banks’ financing of high-carbon industries.

This is significant as they tend to be more action-oriented in nature & focus on the banks’ financing of high-carbon industries.

#7: Despite the rhetoric on #Covid19 increasing the focus on the S of #ESG, there is little evidence of it affecting voting decisions

We found no correlation btwn support for resolutions on human rights before & after the WHO’s declaration

No rationales mentioned Covid19 either

We found no correlation btwn support for resolutions on human rights before & after the WHO’s declaration

No rationales mentioned Covid19 either

The report ends with a series of recommendations for asset managers, asset owners & investment consultants - do check it out

Webpage: https://shareaction.org/research-resources/voting-matters-2020/

Report: https://shareaction.org/wp-content/uploads/2020/11/Voting-Matters-2020.pdf

#VotingMatters #ESG #ProxyVoting

Webpage: https://shareaction.org/research-resources/voting-matters-2020/

Report: https://shareaction.org/wp-content/uploads/2020/11/Voting-Matters-2020.pdf

#VotingMatters #ESG #ProxyVoting

Read on Twitter

Read on Twitter