1/

Call me crazy but I've taken a starter position in a cannabis producer.

Company: $GTEC.V

Market Cap / TEV ($mm): $20 / $25

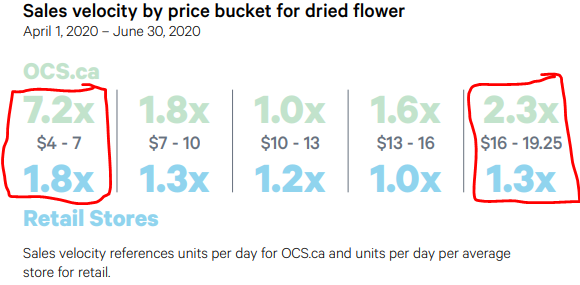

Description: Cannabis producer, focused on sales to the retail channel, with a focus on premium products, rather than high-volume sales

Call me crazy but I've taken a starter position in a cannabis producer.

Company: $GTEC.V

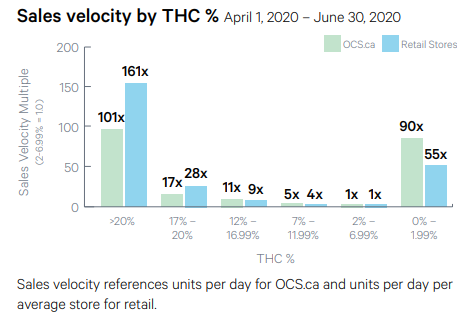

Market Cap / TEV ($mm): $20 / $25

Description: Cannabis producer, focused on sales to the retail channel, with a focus on premium products, rather than high-volume sales

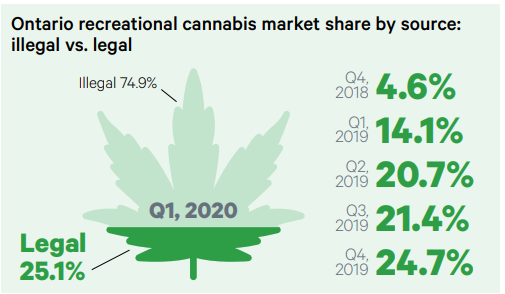

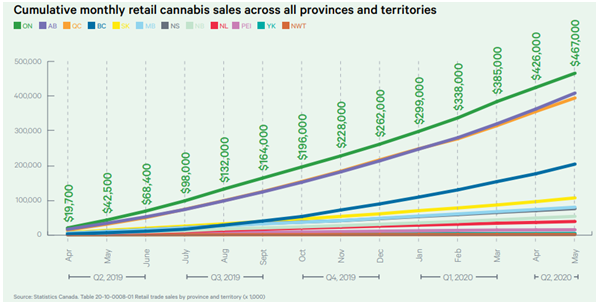

2/ Long-term growth is expected in terms of cannabis usage, with continued increases in consumption per capita. Furthermore, sales will benefit from a continued shift in sales from the black-market to legal sources (i.e. gov website and retail outlets)

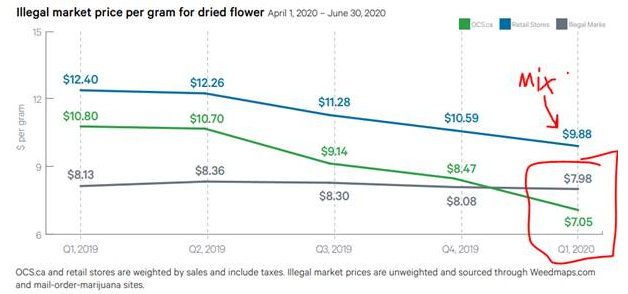

3/ Largest drivers of mix shift towards legal are: (i) increased accessibility; and (ii) more importantly, the price per gram has declined materially over time for legal sources, relative to the illegal market, and for the first time has seen the price being lower

4/ $GTEC.V premium product should prevent them from seeing pricing pressure as low-cost entrants flood the market, driven by what I view to be limited barriers to entry in terms of production (i.e. it’s not a question about if there will be oversupply in the market but when)

5/ $GTEC.V gross margins are ~70% which is industry-leading and compares to $VFF.V margins of 40%. For reference, $VFF.V is the lowest-cost producer among Canadian producers and competes on the ultra-discount side of the market, and is viewed as the margin leader in that segment.

6/ I see pricing pressure as less likely on the high-end as greater barriers. $GTEC.V continues to expand its leadership as it has continued to increase THC levels (recently it announced a batch that had reached >30% THC levels, a rare feat)

7/ Demand continues to be driven by high THC products, as well as low THC (would represent CBD products, which are not a competitor as they are used for different purposes). This demand can be seen from recent Gov. data. $GTEC.V products fall in the >20% category (far left).

8/ I believe that the premium market will continue to grow in size as retail users become more familiar with brands, the impact of quality and “trade-up” as they age. Parallels can be drawn to the wine and liquor market which has seen all three of these factors materialize

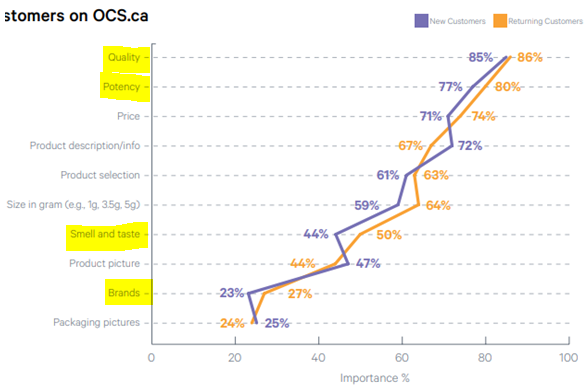

9/ The below shows the focus areas by new and returning visitors. This goes against my views above about what experienced users find important (quality + potency). The data is still positive for the thesis and my hypothesis is these will diverge as "returning" cohorts mature

10/ Recent wins will drive growth, with further opportunities for geographic expansion.

Recent wins:

- Ontario: August 2020 they sent their first shipment. Rolled out more SKUs due to demand.

- Manitoba: August 2020 was first shipment

- Yukon: September 2020 was first shipment

Recent wins:

- Ontario: August 2020 they sent their first shipment. Rolled out more SKUs due to demand.

- Manitoba: August 2020 was first shipment

- Yukon: September 2020 was first shipment

11/ $GTEC.V is working to secure agreements with the Alberta and Quebec government. Based on the size of the market, adding Quebec + Alberta would be a large catalyst, although the Ontario / Manitoba / Yukon win should help drive organic growth without these new wins.

12/ Strong balance sheet. Unlike most cannabis players, $GTEC.V BS is relatively clean with only ~$2mm of converts outstanding and ~$3mm in bank debt. I believe they can re-pay the bank debt over the next several quarters as its CF needs reduce. The bank debt is costly (18%).

13/ Strong financial profile.

The most recent quarter (Q3 2020) showed: Gross margins of ~70%, revenue of $2.4mm (+60% QoQ) and Adj. EBITDA of $560k (~25% margins). I believe these results will benefit further from the recent wins that likely aren't run-rate in Q3.

The most recent quarter (Q3 2020) showed: Gross margins of ~70%, revenue of $2.4mm (+60% QoQ) and Adj. EBITDA of $560k (~25% margins). I believe these results will benefit further from the recent wins that likely aren't run-rate in Q3.

14/ Reasonable valuation

Annualizing Q3 EBITDA ($560k), results in $2.2mm of EBITDA and implies a valuation of ~11x EBITDA. I think profitability can be sustained / grow as they continue to focus on the retail side and they take advantage of the significant capacity they

Annualizing Q3 EBITDA ($560k), results in $2.2mm of EBITDA and implies a valuation of ~11x EBITDA. I think profitability can be sustained / grow as they continue to focus on the retail side and they take advantage of the significant capacity they

15/ $GTEC.V also has high insider ownership, comprising ~15% of the shares outstanding, with the CEO owning ~10% of the Business.

16/ Key Catalysts that I'll be looking for: (i) seeing Q4 results and what run-rate order volumes are like from new wins, (ii) new wins (Quebec+Alberta), (iii) finalizing construction on its JV facility, (iv) op. leverage as topline grows; and (v) potential takeout candidate (?)

Read on Twitter

Read on Twitter