$LMND

Lemonade wants to disrupt the insurance industry with a brand purpose approach.

In the Global Consumer Insurance Survey, accountancy firm EY found that consumers ranked insurance companies below banks, car manufacturers and supermarkets for trustworthiness.

Thread

Lemonade wants to disrupt the insurance industry with a brand purpose approach.

In the Global Consumer Insurance Survey, accountancy firm EY found that consumers ranked insurance companies below banks, car manufacturers and supermarkets for trustworthiness.

Thread

A Refreshing New Approach to Insurance

Lemonade was created with a simple but effective counter-argument to this conflict – a company mission to “delight customers”.

From its name to its business model; nothing about Lemonade resembles a traditional insurance company.

Lemonade was created with a simple but effective counter-argument to this conflict – a company mission to “delight customers”.

From its name to its business model; nothing about Lemonade resembles a traditional insurance company.

"Our analyses led us to conclude that a new kind of insurance company, built from scratch on an unconflicted business model and cutting-edge technology, will enjoy structural advantages that will manifest ever more powerfully over time." - A letter from our cofounders

"$LMND offers home, renters and pet insurance it claims is "built for the 21st century." Customers are quoted for monthly premium rates in as little as 90" from the company's proprietary AI chatbot Maya, and claims get paid in as little as 3 minutes from its other chatbot, Jim."

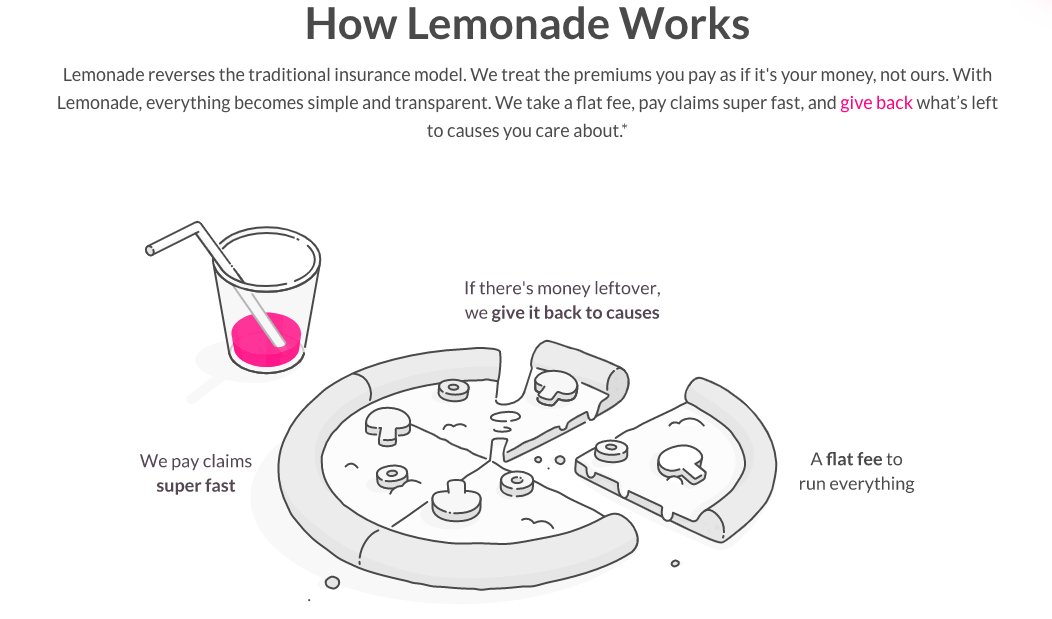

The main diference between $LMND and traditional insurance companies is that it has nothing to gain by denying/delaying claims. While other insurance companies make a profit by keeping insurers premiums; $LMND takes a fixed fee, meaning they can make the claims process quicker.

Convenience. Transparency. Instant everything. All for a good cause.

$LMND is powered by a combination of AI and behavioral economics to disrupt the old insurance industry.

$LMND is powered by a combination of AI and behavioral economics to disrupt the old insurance industry.

$LMND set out to replace brokers and bureaucracy with bots and machine learning, aiming for zero paperwork and instant everything.

They have been building a service that fits seamlessly into the new generations of consumers. Not only in terms of technology, but also in terms of putting people over profit, because $LMND solves customer needs but also takes into account society as a whole.

Convenience:

State-of-the-art AI platform.

Lemonade’s user experience is built around their chatbots. They’re a great solution for a consumer who want to get things done quickly but don’t want to spend time on the phone with a real person.

State-of-the-art AI platform.

Lemonade’s user experience is built around their chatbots. They’re a great solution for a consumer who want to get things done quickly but don’t want to spend time on the phone with a real person.

As a result, the process appeals to young consumers who don’t want to spend hours filling in forms. 81% of Lemonade’s customers are aged between 25 and 44; and 87% have never bought insurance for their homes before.

Transparency:

In the age of information, authenticity and transparency go a long way to building trust with consumers. They’ve made it a priority to share stats about traditionally hush-hush internal data. They publish these findings in their blog, the “Transparency Chronicles”

In the age of information, authenticity and transparency go a long way to building trust with consumers. They’ve made it a priority to share stats about traditionally hush-hush internal data. They publish these findings in their blog, the “Transparency Chronicles”

All for a good cause:

Their mission is to take insurance from a “necessary evil and change it into a social good”.

Their mission is to take insurance from a “necessary evil and change it into a social good”.

The game changer is the fact that Lemonade treats premiums as the customer’s money and not as their own. Customers still pay a premium per month, but the big difference is that $LMND donates all unclaimed premium income to customer-selected charities at the end of each year.

By aligning themselves with this charitable giving, they are showing that they are doing their part to make the world a better place.

As a professional who works with brands, this is one of the best examples of a purpose-driven company.

At this stage, it is still very difficult to predict the future of $LMND but one thing is certain, they are doing things differently and if it works it can be a home run.

At this stage, it is still very difficult to predict the future of $LMND but one thing is certain, they are doing things differently and if it works it can be a home run.

"We are committed to planning, but not to plans. Uncharted territory is just that: we have state-of-the-art kit, an intrepid team and an ambitious destination, but no map."

"We are short term patient, but long term greedy. We believe opportunities such as ours are rare and fleeting. Industries like insurance are reinvented once every few centuries."

As a counter-argument, I cannot clearly see what $LMND MOAT might be.

For now, it is "just" a frictionless way to approach the category with a purpose driven mindset.

Disclosure: I've been following $LMND since before the IPO and i still don't own shares.

For now, it is "just" a frictionless way to approach the category with a purpose driven mindset.

Disclosure: I've been following $LMND since before the IPO and i still don't own shares.

Can $LMND disrupt the Insurance industry?

Read on Twitter

Read on Twitter