1/

Sunday Thread: #SILVER | #URANIUM | #GOLD

Sunday Thread: #SILVER | #URANIUM | #GOLD

Contrary to the fireworks in the #U3O8 sector, the #preciousmetals had a very quiet week as the drawn out consolidation continues.

Someone older and wiser than me once said to "accumulate quiet markets."....

Sunday Thread: #SILVER | #URANIUM | #GOLD

Sunday Thread: #SILVER | #URANIUM | #GOLD Contrary to the fireworks in the #U3O8 sector, the #preciousmetals had a very quiet week as the drawn out consolidation continues.

Someone older and wiser than me once said to "accumulate quiet markets."....

2/

Just as the #uranium sector was "quiet" and boring for several seemingly long months preceding its explosive move, the precious metals sector is now testing the patience of those bullish on #silver & #gold.

Just as the #uranium sector was "quiet" and boring for several seemingly long months preceding its explosive move, the precious metals sector is now testing the patience of those bullish on #silver & #gold.

3/

Last wk, $silver attempted to brk out fm its 4-mo downtrnd channel, but failed & now sits just < 50MA. A break abv the downtrnd channel, followed by $29.92, is likely to signal the next push higher, which I blv will be of = or > magnitude than the 50% rally witnessed in '20

Last wk, $silver attempted to brk out fm its 4-mo downtrnd channel, but failed & now sits just < 50MA. A break abv the downtrnd channel, followed by $29.92, is likely to signal the next push higher, which I blv will be of = or > magnitude than the 50% rally witnessed in '20

4/

I have full positions in my long-term accounts, but will look to add long dated Jan '22 Call Options on $WPM and/or $AG if we do see one more push lower. (Not expected, but anything is possible in the very short-term.)

I have full positions in my long-term accounts, but will look to add long dated Jan '22 Call Options on $WPM and/or $AG if we do see one more push lower. (Not expected, but anything is possible in the very short-term.)

5/

Gold continues to look weaker than silver and now sits just above 200MA support. From my perspective, pullbacks equal opportunity.

Gold continues to look weaker than silver and now sits just above 200MA support. From my perspective, pullbacks equal opportunity.

6/

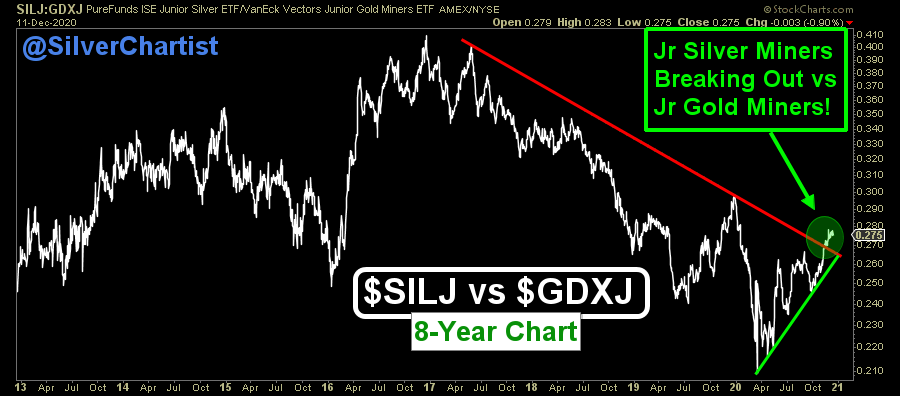

It is also especially noteworthy that $SILJ is staging a clean brkout against its Jr Gold Mining counterpart, $GDXJ. It is reasonable to expect $SILJ to outperform $GDXJ by a factor of roughly 2 on the next leg up in the precious metals.

My LT PF is positioned accordingly

It is also especially noteworthy that $SILJ is staging a clean brkout against its Jr Gold Mining counterpart, $GDXJ. It is reasonable to expect $SILJ to outperform $GDXJ by a factor of roughly 2 on the next leg up in the precious metals.

My LT PF is positioned accordingly

7/

Let's turn to the #Uranium sector, which has been on absolute !

!

The last two weeks have seen multi-year resistance levels cleared on record volume.

This bears absolutely no resemblance to the "false starts" long-suffering uranium bulls have grown accustomed to.

Let's turn to the #Uranium sector, which has been on absolute

!

!The last two weeks have seen multi-year resistance levels cleared on record volume.

This bears absolutely no resemblance to the "false starts" long-suffering uranium bulls have grown accustomed to.

8/

Institutional money is flowing into this sector, and this type of price action has all of the markings of the early stages of a major bull market.

The technicals are finally beginning to align with the wildly bullish fundamentals.

Institutional money is flowing into this sector, and this type of price action has all of the markings of the early stages of a major bull market.

The technicals are finally beginning to align with the wildly bullish fundamentals.

9/

Not wanting to chase, but also not wanting to get left behind, many with no exposure have asked for my thoughts on if they should buy now.

This is a wise question, as the prices of many miners are getting stretched and are due for a breather.

Not wanting to chase, but also not wanting to get left behind, many with no exposure have asked for my thoughts on if they should buy now.

This is a wise question, as the prices of many miners are getting stretched and are due for a breather.

10/

Of course, I cannot give personal advice, but here is a thought to consider

I had zero exposure to the sctr, I would personally scale in over the nxt few weeks and take an initial "starter position" on either a backtest of initial support or a break above last week's high

Of course, I cannot give personal advice, but here is a thought to consider

I had zero exposure to the sctr, I would personally scale in over the nxt few weeks and take an initial "starter position" on either a backtest of initial support or a break above last week's high

11/

That strategy allows one to take advantage of potentially lower prices, while also not being left behind if the sector goes parabolic, which is quite possible.

http://www.SilverChartist.com

http://www.SilverChartist.com

*We also have a premium service & the "Founding Member" $9/mo rate expires on Tuesday

That strategy allows one to take advantage of potentially lower prices, while also not being left behind if the sector goes parabolic, which is quite possible.

http://www.SilverChartist.com

http://www.SilverChartist.com *We also have a premium service & the "Founding Member" $9/mo rate expires on Tuesday

Read on Twitter

Read on Twitter