With its nearly 50% run-up in the last two days, Acuity Ads has officially become my largest holding

So, it is probably time to do a thread

Acuity Ads is a programatic ads DSP similar to $TTD

The difference: Acuity Ads has a market cap of about $540mm

$ACUIF $AT.TO

(THREAD)

So, it is probably time to do a thread

Acuity Ads is a programatic ads DSP similar to $TTD

The difference: Acuity Ads has a market cap of about $540mm

$ACUIF $AT.TO

(THREAD)

Overview:

$ACUIF helps companies set up programatic ad campaigns

When you are scrolling on a website or using CTV, the advertiser sends all of the DSPs info on you and allows their clients to bid to show you an ad

This all happens in a split second and seems instantaneous

$ACUIF helps companies set up programatic ad campaigns

When you are scrolling on a website or using CTV, the advertiser sends all of the DSPs info on you and allows their clients to bid to show you an ad

This all happens in a split second and seems instantaneous

Value proposition:

$ACUIF tracks whether the consumer clicks on the ad and buys anything from you.

It provides clear information to its clients calculating their ROI on advertising spend.

With a higher level of precision and tracking, ROI is superior to traditional analog ads

$ACUIF tracks whether the consumer clicks on the ad and buys anything from you.

It provides clear information to its clients calculating their ROI on advertising spend.

With a higher level of precision and tracking, ROI is superior to traditional analog ads

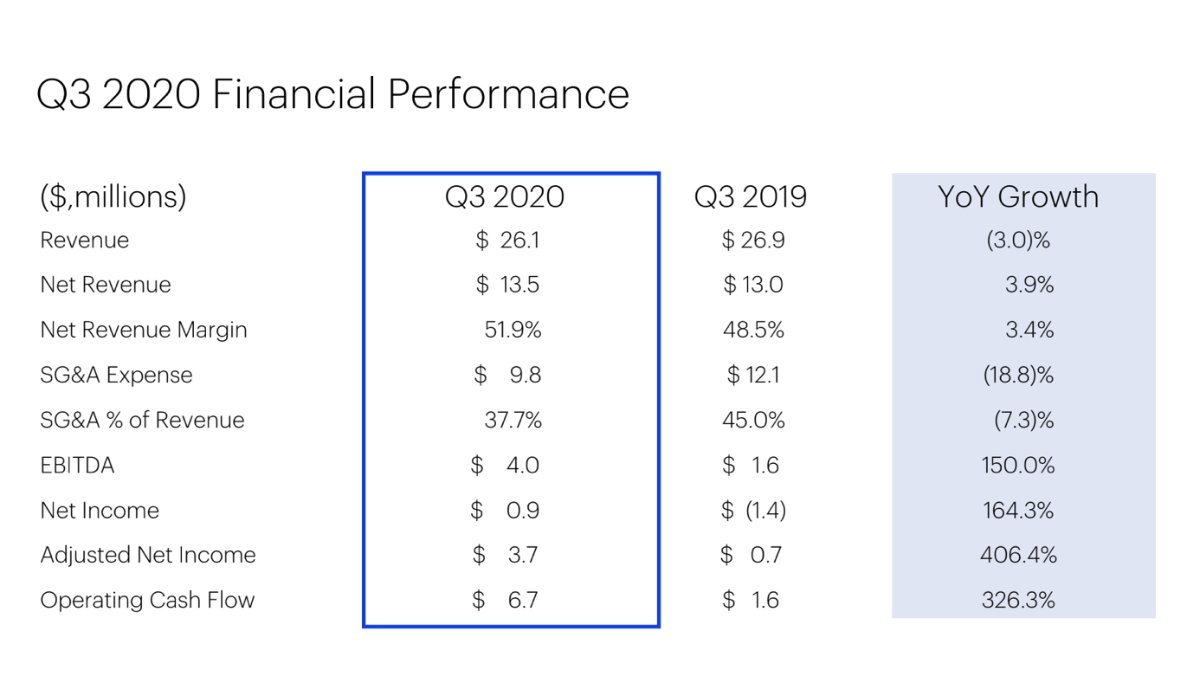

Revenue growth:

Since its inception, $ACUIF has grown revenues at an 82% CAGR.

This year, however, revenues are essentially flat.

Why?

Many of its clients in the travel industry have significantly cut ad spend.

It has made up for lost revenue by expanding its D2C clientele.

Since its inception, $ACUIF has grown revenues at an 82% CAGR.

This year, however, revenues are essentially flat.

Why?

Many of its clients in the travel industry have significantly cut ad spend.

It has made up for lost revenue by expanding its D2C clientele.

Gross Margins:

When you look at their financials, you’ll notice that they have gross margins of 51%.

Not too impressive, right? Especially compared to $TTD’s 76%

But these are not measuring the same things. $TTD reports net revenues and $ACUIF reports gross revenues

When you look at their financials, you’ll notice that they have gross margins of 51%.

Not too impressive, right? Especially compared to $TTD’s 76%

But these are not measuring the same things. $TTD reports net revenues and $ACUIF reports gross revenues

Net Revenues:

This difference means that $ACUIF’s gross margin is actually comparable to $TTD’s reported revenue

$TTD reports revenues as everything it collects from the client minus cost of the ad

$ACUIF reports revenues as everything with its COGS being the cost of the ad

This difference means that $ACUIF’s gross margin is actually comparable to $TTD’s reported revenue

$TTD reports revenues as everything it collects from the client minus cost of the ad

$ACUIF reports revenues as everything with its COGS being the cost of the ad

Profitability:

Despite revenue growth being flat, $ACUIF has made significant strides in profitability

OCF increased to $6.7 million in the most recent quarter, up from $1.6 million in the year-ago quarter

YTD it has $16 million in OCF, up from a negative $5 million last year.

Despite revenue growth being flat, $ACUIF has made significant strides in profitability

OCF increased to $6.7 million in the most recent quarter, up from $1.6 million in the year-ago quarter

YTD it has $16 million in OCF, up from a negative $5 million last year.

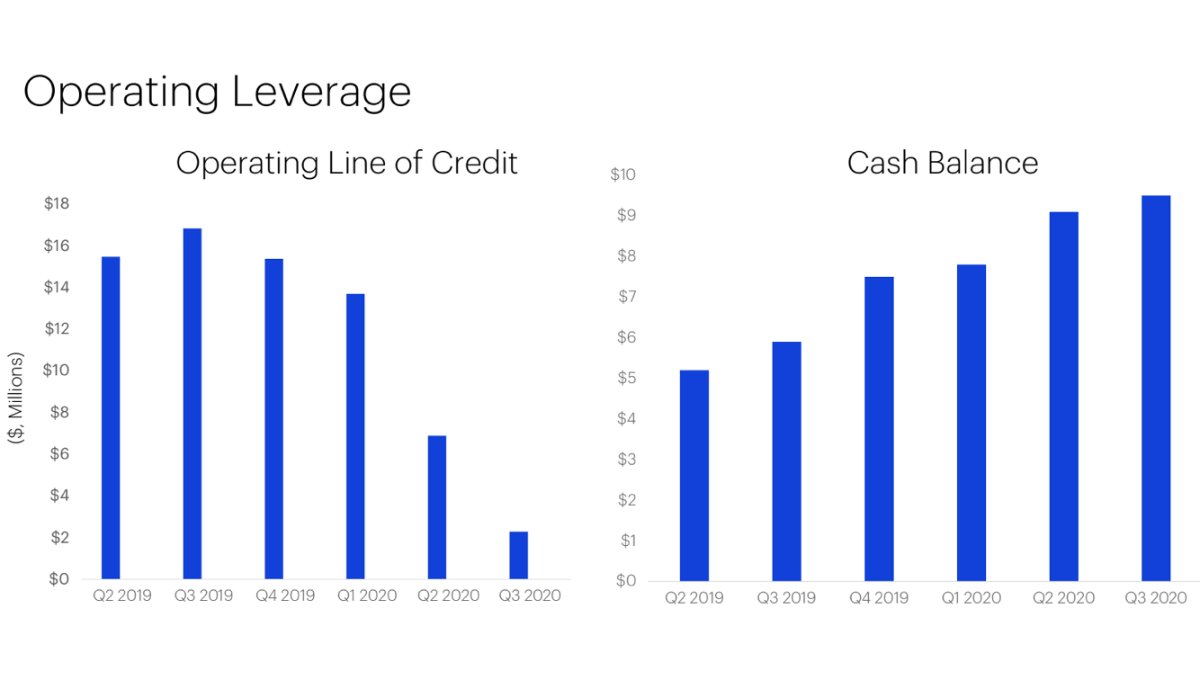

Balance Sheet:

On the most recent balance sheet, $ACUIF has a net debt position of about $3 million

This is a significant YoY improvement as it worked to strengthen the balance sheet

It recently issued additional stock raising about $12 million and further strengthening the BS

On the most recent balance sheet, $ACUIF has a net debt position of about $3 million

This is a significant YoY improvement as it worked to strengthen the balance sheet

It recently issued additional stock raising about $12 million and further strengthening the BS

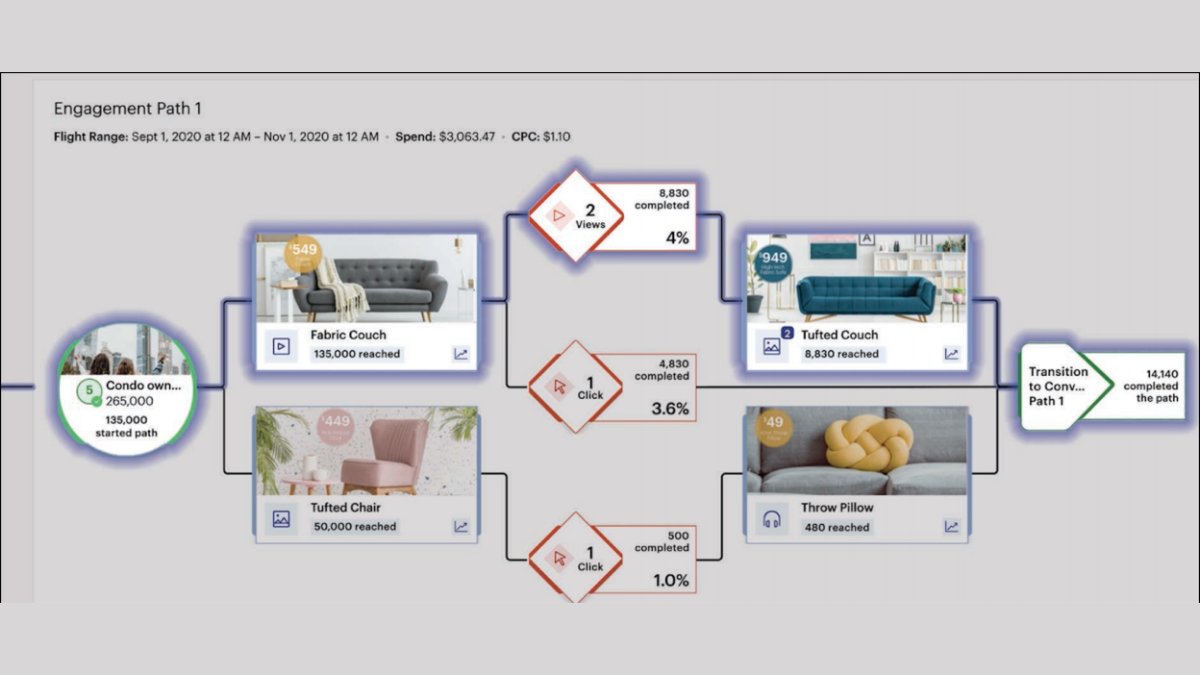

Illumin (1/2):

$ACUIF recently launched a self-service platform called Illumin which it considers a revolutionary platform

Its drag and drop functionality allows marketers to carefully plan their consumers journey, ensuring that they get shown the right ad at the right time

$ACUIF recently launched a self-service platform called Illumin which it considers a revolutionary platform

Its drag and drop functionality allows marketers to carefully plan their consumers journey, ensuring that they get shown the right ad at the right time

Illumin (2/2):

Companies are now contacting $ACUIF rather than the other way around

It is already expecting to generate about $1 million in revenue this quarter

This could be the beginning of a transformative company in the adtech space

Companies are now contacting $ACUIF rather than the other way around

It is already expecting to generate about $1 million in revenue this quarter

This could be the beginning of a transformative company in the adtech space

Valuation:

This is the reason to invest for value investors and the cherry on top for growth investors

$TTD trades at 60x sales

$ACUIF trades at 12x sales

Will $ACUIF ever match that multiple? Maybe, but even if it doesn’t meet the multiple, it still appears to be undervalued

This is the reason to invest for value investors and the cherry on top for growth investors

$TTD trades at 60x sales

$ACUIF trades at 12x sales

Will $ACUIF ever match that multiple? Maybe, but even if it doesn’t meet the multiple, it still appears to be undervalued

Insider ownership:

Insiders own around 30-35% of the company

This ensures that their interests are aligned with shareholders, and I prefer to invest in companies where management has some skin in the game.

Insiders own around 30-35% of the company

This ensures that their interests are aligned with shareholders, and I prefer to invest in companies where management has some skin in the game.

Risks (1/2):

I typically invest in market leaders. $ACUIF is definitely not a market leader. That title belongs to $TTD

This means that $TTD has more resources to devote to R&D and S&M

I expect that it will work diligently to establish a technological advantage over $ACUIF

I typically invest in market leaders. $ACUIF is definitely not a market leader. That title belongs to $TTD

This means that $TTD has more resources to devote to R&D and S&M

I expect that it will work diligently to establish a technological advantage over $ACUIF

Risks (2/2):

This is a relatively small company that is fairly new to the public markets. It does not have a years-long track record to support our investing thesis.

Also, since it has a small market cap, it is typically thinly traded and can have significant volatility.

This is a relatively small company that is fairly new to the public markets. It does not have a years-long track record to support our investing thesis.

Also, since it has a small market cap, it is typically thinly traded and can have significant volatility.

Catalysts (1/2):

$ACUIF has announced that it has applied to be traded on the NASDAQ.

This would broaden its potential investor base and provide it with additional legitimacy.

$ACUIF has announced that it has applied to be traded on the NASDAQ.

This would broaden its potential investor base and provide it with additional legitimacy.

Catalysts (2/2):

It has also announced that it is considering changing its revenue reporting structure to match $TTD

I suspect this could happen in the new fiscal year

It has already started referring to its gross margin as net revenues in some investor presentations

It has also announced that it is considering changing its revenue reporting structure to match $TTD

I suspect this could happen in the new fiscal year

It has already started referring to its gross margin as net revenues in some investor presentations

My position:

This started as a 2% position for me

I first bought at $1.03 USD in July and have added a few times since

It is a classic, “Let your winners ride” for me, though, admittedly a faster ride than typical

It is now my largest position and about 12% of my portfolio

This started as a 2% position for me

I first bought at $1.03 USD in July and have added a few times since

It is a classic, “Let your winners ride” for me, though, admittedly a faster ride than typical

It is now my largest position and about 12% of my portfolio

This was my first research thread in a while. Thanks for reading!

I have done a lot of homework on this company, and I am happy to answer any questions.

As always, this is not any sort of recommendation. I am just sharing my research.

For more from me, check out my Substack!

I have done a lot of homework on this company, and I am happy to answer any questions.

As always, this is not any sort of recommendation. I am just sharing my research.

For more from me, check out my Substack!

Shout-out to @JimPGillies for first mentioning this one to me

They’re doing some great things at @TheMotleyFoolCA

They’re doing some great things at @TheMotleyFoolCA

Read on Twitter

Read on Twitter