1)

$GRO – @growthdefi

Circ: 147K of 1M Total (MCap $3M)

550 Holders

Recent launch of live product dashboard

Today the project´s yield generating “gTokens” were successfully audited by Consensys Dilligence which could attract big $$$.

Here´s an intro thread to basics:

$GRO – @growthdefi

Circ: 147K of 1M Total (MCap $3M)

550 Holders

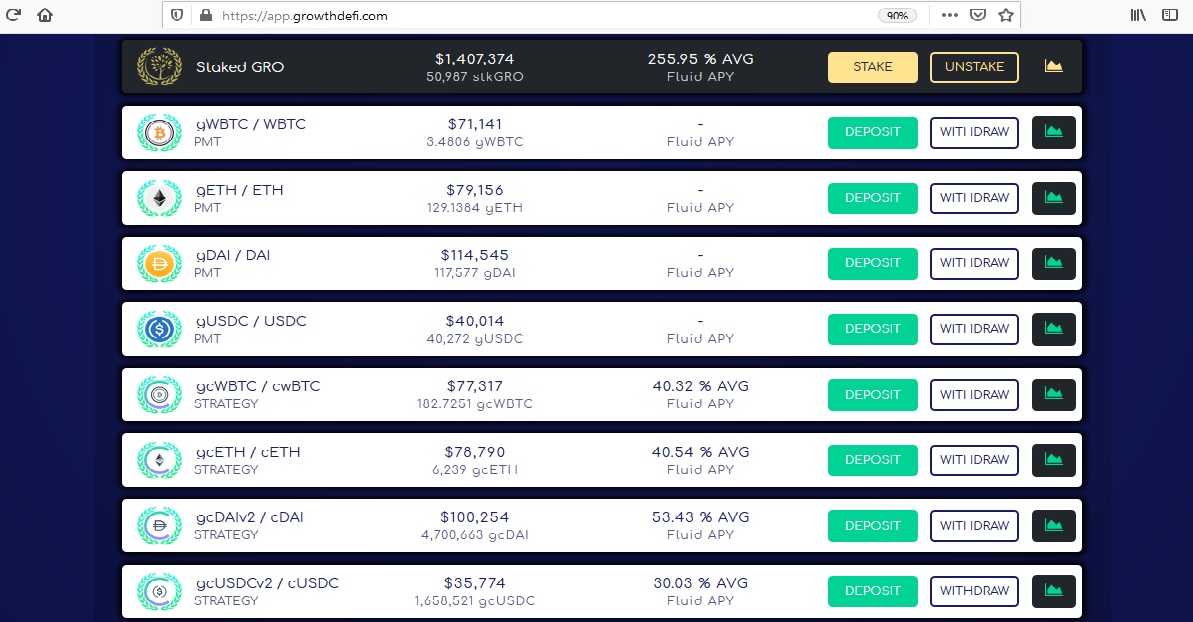

Recent launch of live product dashboard

Today the project´s yield generating “gTokens” were successfully audited by Consensys Dilligence which could attract big $$$.

Here´s an intro thread to basics:

2)

Today the project´s integral yield generating “gTokens” were successfully audited by ConsenSys Dilligence today (one of the most respected auditors in the space). Growth Defi could now start to get lots of attention from whales looking for safe sustainable yield…

Today the project´s integral yield generating “gTokens” were successfully audited by ConsenSys Dilligence today (one of the most respected auditors in the space). Growth Defi could now start to get lots of attention from whales looking for safe sustainable yield…

3)

One word that is regularly associated with this project is “Complex”. The reality is, it is complex - so in this thread I´ll try and explain in layman’s terms, the basics of the ecosystem and the value it offers.

One word that is regularly associated with this project is “Complex”. The reality is, it is complex - so in this thread I´ll try and explain in layman’s terms, the basics of the ecosystem and the value it offers.

4)

The projects goal is to offer yield generating strategies on crypto assets while removing risks such as impermanent loss or inflation, which are a problem with many other “yield farming” / inflationary farming projects that investors use to get ROI on their crypto assets.

The projects goal is to offer yield generating strategies on crypto assets while removing risks such as impermanent loss or inflation, which are a problem with many other “yield farming” / inflationary farming projects that investors use to get ROI on their crypto assets.

5)

The result is an ecosystem where investors can deposit crypto assets and receive a sustainable ROI, while simultaneously removing much of risk to their initial investment that is associated with other projects. This is done via gTokens not $GRO (which is the governance token).

The result is an ecosystem where investors can deposit crypto assets and receive a sustainable ROI, while simultaneously removing much of risk to their initial investment that is associated with other projects. This is done via gTokens not $GRO (which is the governance token).

6)

Ok great… that all sounds amazing, but how can I benefit from Growth Defi?

2 ways:

1. Via holding or staking Growth Defi governance token $GRO

2. Deposit your crypto assets to get ROI via gToken yield.

See below for more details on this…

Ok great… that all sounds amazing, but how can I benefit from Growth Defi?

2 ways:

1. Via holding or staking Growth Defi governance token $GRO

2. Deposit your crypto assets to get ROI via gToken yield.

See below for more details on this…

7)

1. $GRO – This is the governance token and is a tradable ERC20 token. It has a max supply of 1M and is deflationary. If you are bullish on Growth Defi & the gToken system in general and want to benefit you can buy $GRO. If you hold GRO you benefit via:

1. $GRO – This is the governance token and is a tradable ERC20 token. It has a max supply of 1M and is deflationary. If you are bullish on Growth Defi & the gToken system in general and want to benefit you can buy $GRO. If you hold GRO you benefit via:

8)

A. Fee´s from gToken withdraw / deposit tx´s are used to buy GRO for locked liq pools. This is 0.25% on deposit & 0.25% on withdrawal.

B. Deflationary GRO burning mechanism also occurs on gToken transactions.

A. Fee´s from gToken withdraw / deposit tx´s are used to buy GRO for locked liq pools. This is 0.25% on deposit & 0.25% on withdrawal.

B. Deflationary GRO burning mechanism also occurs on gToken transactions.

9)

C. Staking GRO is also available with rewards, although this is not suitable for short-term, as fees are purposefully aimed at motivating longterm holders.

D. Liquidity mining incentives (Not active atm)

C. Staking GRO is also available with rewards, although this is not suitable for short-term, as fees are purposefully aimed at motivating longterm holders.

D. Liquidity mining incentives (Not active atm)

10)

2. gTokens - gToken´s are the core of the project and are how investors can generate yield on crypto deposits. Atm you can deposit WBTC, ETH, DAI & USDC and mint a corresponding gToken which generates a yield. These yields are not a fixed APY and constantly change.

2. gTokens - gToken´s are the core of the project and are how investors can generate yield on crypto deposits. Atm you can deposit WBTC, ETH, DAI & USDC and mint a corresponding gToken which generates a yield. These yields are not a fixed APY and constantly change.

Live yield averages can be seen at http://app.growthdefi.com . IMPORTANTLY, the value of your initial deposit is much more SAFU compared to the other yield generating strategies as there is no risk of impermanent loss.

So, how do they work more or less?

So, how do they work more or less?

They are created by depositing an asset and minting a corresponding gToken. The basic functionality of all gTokens is that they generate value for longterm holders by collecting fees on deposit & withdrawal tx´s. Value relative to the asset always goes up – creating a base yield.

Depositing DAI for example, will mint corresponding gToken: “gDAI"

Tokens use this basic fee mechanism above, but go a step further which is where the “complexity” and special Growth sauce comes from.

Tokens use this basic fee mechanism above, but go a step further which is where the “complexity” and special Growth sauce comes from.

The underlying asset deposited (USDC, DAI, ETH, WBTC) is leveraged to generate additional yield via other yield generating platforms such as @compoundfinance or @AaveAave.

The mechanics of this are complex and can change depending on whether the deposited asset is a stablecoin (DAI or USDC) or non-stable (ETH or WBTC), please see below for more details. These tokens take on the following format:

Depositing DAI for example, leveraged with @compoundfinance will mint corresponding gToken “gcDAI”.

So, that´s the basics…. But am I bullish on Growth Defi?

Yes… Here´s why:

-Live product - http://app.growthdefi.com

-APY figures are live and very positive

-Low initial capital risk compared with competition

- More

Yes… Here´s why:

-Live product - http://app.growthdefi.com

-APY figures are live and very positive

-Low initial capital risk compared with competition

- More

- Completed audit from Consensys Diligence (Also audited $Aave & Uniswap)

- $GRO is $3M MCap & only 550 holders.

- TVL growing steadily

- Team is legit, professional & responsive (TG - https://t.me/growthdefi )

- Real value, being offered now – A rarity in crypto.

- $GRO is $3M MCap & only 550 holders.

- TVL growing steadily

- Team is legit, professional & responsive (TG - https://t.me/growthdefi )

- Real value, being offered now – A rarity in crypto.

In a nutshell, those are the basic concepts of the project, this thread is just a start if you are new to $GRO. This is an intentionally basic summary of the project… but If you would like more detail

Here is a link to a thread from one of the dev´s, or you can head over to the telegram where the team are always available to help:

https://twitter.com/Irvollo/status/1336022515315961856

https://t.me/growthdefi

https://twitter.com/Irvollo/status/1336022515315961856

https://t.me/growthdefi

Read on Twitter

Read on Twitter