$ZI 56% YoY Growth

$ZI 56% YoY Growth

Market for B2B data is exploding as businesses look for data-driven B2B leads

Market for B2B data is exploding as businesses look for data-driven B2B leads $ZI is leading the B2B market data

$ZI is leading the B2B market data It counts over 120m professionals and 14m businesses in its data bases

It counts over 120m professionals and 14m businesses in its data basesHere is an EASY thread

$ZI ZoomInfo was founded in 2007

It sells access to its database containing information about business people and companies

It sells access to its database containing information about business people and companies

First named DiscoveryOrg, it acquired several competitors such as RainKing in 2017 and NeverBounce in 2018

First named DiscoveryOrg, it acquired several competitors such as RainKing in 2017 and NeverBounce in 2018

It went public in June 2020

It went public in June 2020

It sells access to its database containing information about business people and companies

It sells access to its database containing information about business people and companies First named DiscoveryOrg, it acquired several competitors such as RainKing in 2017 and NeverBounce in 2018

First named DiscoveryOrg, it acquired several competitors such as RainKing in 2017 and NeverBounce in 2018  It went public in June 2020

It went public in June 2020

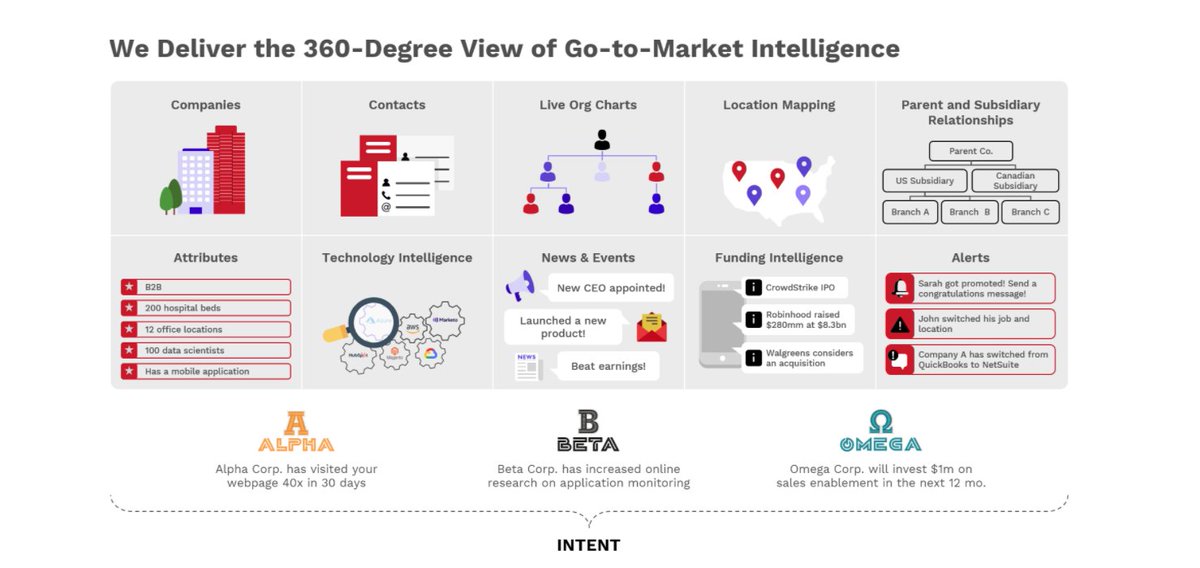

In simple terms, $ZI is a go-to-market intelligence platform for B2B sales and marketing teams

They scrape information online and then process the collected data using machine learning

They scrape information online and then process the collected data using machine learning

This data is then sold to marketing agencies and corporate sales departments

This data is then sold to marketing agencies and corporate sales departments

They scrape information online and then process the collected data using machine learning

They scrape information online and then process the collected data using machine learning This data is then sold to marketing agencies and corporate sales departments

This data is then sold to marketing agencies and corporate sales departments

“This “360-degree view” enables sellers and marketers to shorten sales cycles and increase win rates by delivering the right message, to the right person, at the right time, to hit their number.”

From ZoomInfo S-1 Filling

ZoomInfo S-1 Filling

From

ZoomInfo S-1 Filling

ZoomInfo S-1 Filling

ZoomInfo’s execution is impressive, they have collect data on:

120m professionals

120m professionals

14m companies

14m companies

And they count:

202k paid users

202k paid users

15k corporate clients

15k corporate clients

It also collects data from its users:

50m contact records events are collected each day

50m contact records events are collected each day

120m professionals

120m professionals 14m companies

14m companiesAnd they count:

202k paid users

202k paid users 15k corporate clients

15k corporate clientsIt also collects data from its users:

50m contact records events are collected each day

50m contact records events are collected each day

Great but how large is their market?

$ZI had identified over 740k global businesses that are active in the B2B space and that have more than 10 employees

$ZI had identified over 740k global businesses that are active in the B2B space and that have more than 10 employees

With a Life-time value of around $32k, this gives a TAM of around $ 24B

With a Life-time value of around $32k, this gives a TAM of around $ 24B

$ZI had identified over 740k global businesses that are active in the B2B space and that have more than 10 employees

$ZI had identified over 740k global businesses that are active in the B2B space and that have more than 10 employees With a Life-time value of around $32k, this gives a TAM of around $ 24B

With a Life-time value of around $32k, this gives a TAM of around $ 24B

Leaving plenty of headroom for $ZI as it now counts 15.000 customers

Leaving plenty of headroom for $ZI as it now counts 15.000 customers As a side-note, they currently have 630 customers that spend $ 100.000 / year and 15 customers that spend over $ 1m / year

As a side-note, they currently have 630 customers that spend $ 100.000 / year and 15 customers that spend over $ 1m / year

But what is their market?

This is the data brokers market Which can be a though one:

Which can be a though one:

Privacy issues and additional regulations may hamper data broker’s activities

Privacy issues and additional regulations may hamper data broker’s activities

Many companies have now developed the ability to scrape data online and focus on their own niche

Many companies have now developed the ability to scrape data online and focus on their own niche

This is the data brokers market

Which can be a though one:

Which can be a though one: Privacy issues and additional regulations may hamper data broker’s activities

Privacy issues and additional regulations may hamper data broker’s activities Many companies have now developed the ability to scrape data online and focus on their own niche

Many companies have now developed the ability to scrape data online and focus on their own niche

“Those include big names in people search, like Spokeo, ZoomInfo, White Pages, PeopleSmart, Intelius, PeopleFinders, and the numerous other websites they operate; credit reporting, like Equifax, Experian, and TransUnion; […]

[…] and advertising and marketing, like Acxiom, Oracle, Innovis, and KBM”

By Steven Melendez and Alex Pasternack for FastCompany https://www.fastcompany.com/90310803/here-are-the-data-brokers-quietly-buying-and-selling-your-personal-information

By Steven Melendez and Alex Pasternack for FastCompany https://www.fastcompany.com/90310803/here-are-the-data-brokers-quietly-buying-and-selling-your-personal-information

And who is the giant in this market? ACXIOM LLC which was sold by $RAMP to $IPG for $ 2.3B following the Cambridge Analytica scandal

It’s data encompasses more than 62 countries, 2.5B consumers and +10.000 attributes

It’s data encompasses more than 62 countries, 2.5B consumers and +10.000 attributes

Representing 68% of the world’s online population

Representing 68% of the world’s online population

It’s data encompasses more than 62 countries, 2.5B consumers and +10.000 attributes

It’s data encompasses more than 62 countries, 2.5B consumers and +10.000 attributes Representing 68% of the world’s online population

Representing 68% of the world’s online population

What’s more, well we’re just at the start of the B2B data market  As reported by Gartner:

As reported by Gartner:

“[…] Reveals that 60% of B2B sales organizations will transition from experience- and intuition-based selling to data-driven selling by 2025” https://www.gartner.com/smarterwithgartner/future-of-sales-2025-data-driven-b2b-selling/

As reported by Gartner:

As reported by Gartner:“[…] Reveals that 60% of B2B sales organizations will transition from experience- and intuition-based selling to data-driven selling by 2025” https://www.gartner.com/smarterwithgartner/future-of-sales-2025-data-driven-b2b-selling/

So where are we now?

$ZI projects its TAM to be in the $ 24B, and they currently only have captured 2% of their 740k addressable targets

$ZI projects its TAM to be in the $ 24B, and they currently only have captured 2% of their 740k addressable targets

$ZI projects its TAM to be in the $ 24B, and they currently only have captured 2% of their 740k addressable targets

$ZI projects its TAM to be in the $ 24B, and they currently only have captured 2% of their 740k addressable targets

MenaFN further reports that the data broker market is set to rise by 16% over the 2020 - 2026 period

MenaFN further reports that the data broker market is set to rise by 16% over the 2020 - 2026 period Driven by the constant increase in data on a global scale as the IDC forecasts worldwide data to grow by 61% by 2025 to 175 ZetaBytes

Driven by the constant increase in data on a global scale as the IDC forecasts worldwide data to grow by 61% by 2025 to 175 ZetaBytes

What makes $ZI interesting?

B2B corporates and marketing agencies need to SELL

B2B corporates and marketing agencies need to SELL

They need a powerful tool that can give them everything they needs to know about their leads

They need a powerful tool that can give them everything they needs to know about their leads

Organisational chart, connections, contact details, location mapping

Organisational chart, connections, contact details, location mapping

B2B corporates and marketing agencies need to SELL

B2B corporates and marketing agencies need to SELL They need a powerful tool that can give them everything they needs to know about their leads

They need a powerful tool that can give them everything they needs to know about their leads Organisational chart, connections, contact details, location mapping

Organisational chart, connections, contact details, location mapping

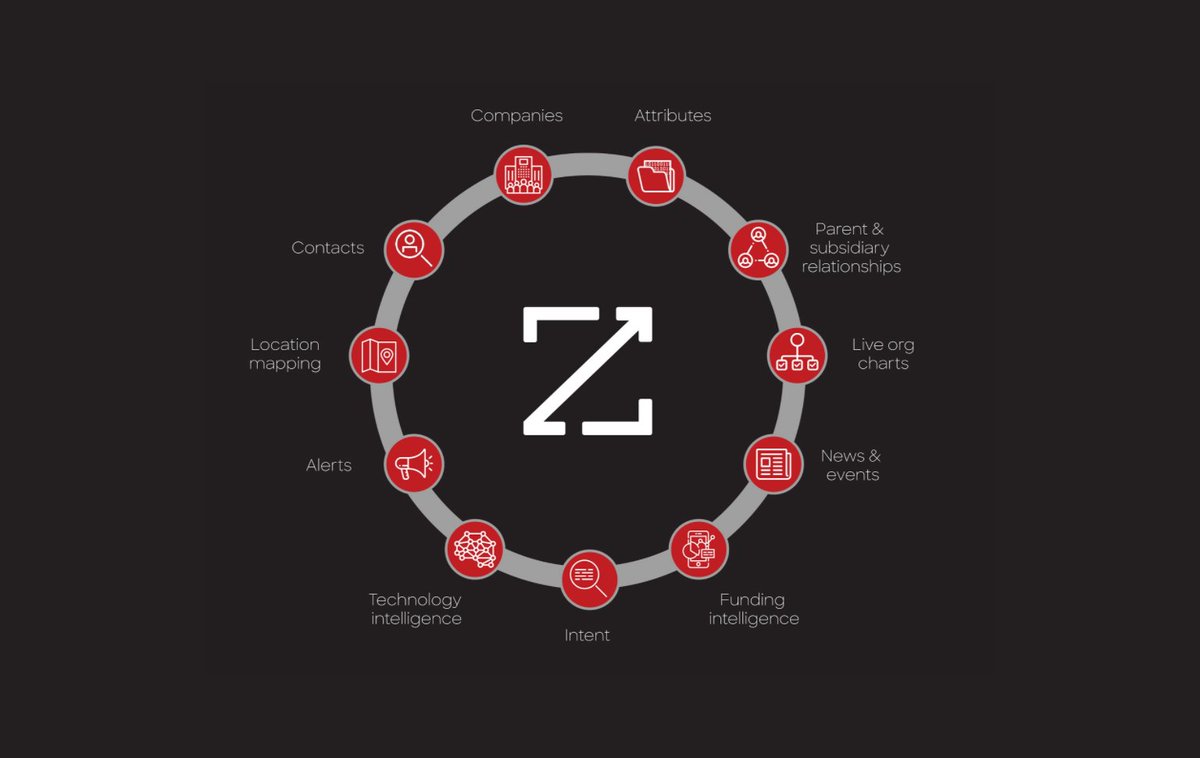

This is exactly what $ZI is providing as they provide:

Data on companies

Data on companies

Contact details

Contact details

Organisational chart

Organisational chart

Corporate structure

Corporate structure

Funding data

Funding data

… Much more

Data on companies

Data on companies Contact details

Contact details Organisational chart

Organisational chart Corporate structure

Corporate structure Funding data

Funding data… Much more

How does that translate to customers?

$DOCU DocuSign was seeking to increase the efficiency and effectiveness of its inbound and outbound pipeline generation and selling activities

$DOCU DocuSign was seeking to increase the efficiency and effectiveness of its inbound and outbound pipeline generation and selling activities

$DOCU DocuSign was seeking to increase the efficiency and effectiveness of its inbound and outbound pipeline generation and selling activities

$DOCU DocuSign was seeking to increase the efficiency and effectiveness of its inbound and outbound pipeline generation and selling activities

Since implementing ZoomInfo, DocuSign can automatically find and add contacts to target accounts in Salesforce

Since implementing ZoomInfo, DocuSign can automatically find and add contacts to target accounts in Salesforce It can also gain intelligence and insight on buyers across departments and functions, and access phone and email contact information easily

It can also gain intelligence and insight on buyers across departments and functions, and access phone and email contact information easily

$ZM Tasked with aggressive revenue growth targets, the Zoom Video sales team tried to increase penetration of target accounts and expand their influence within these accounts

$ZM Tasked with aggressive revenue growth targets, the Zoom Video sales team tried to increase penetration of target accounts and expand their influence within these accounts

Zoom Video chose the ZoomInfo platform for the level of depth and granularity of the data as well as real time insights. Using the ZoomInfo platform

Zoom Video chose the ZoomInfo platform for the level of depth and granularity of the data as well as real time insights. Using the ZoomInfo platform Zoom could identify the right people in the right department with minimal effort, get real-time insights, and close deals

Zoom could identify the right people in the right department with minimal effort, get real-time insights, and close deals

And what are their reviews telling us? Here is what http://G2.com tells us:

ZoomInfo has 4,071 reviews and 4.4 stars overall

ZoomInfo has 4,071 reviews and 4.4 stars overall

LinkedIn Sales Navigator has 1,189 reviews and 4.2 stars overall

LinkedIn Sales Navigator has 1,189 reviews and 4.2 stars overall

InsideView Insights has 693 reviews and 4.3 stars overall

InsideView Insights has 693 reviews and 4.3 stars overall

ZoomInfo has 4,071 reviews and 4.4 stars overall

ZoomInfo has 4,071 reviews and 4.4 stars overall LinkedIn Sales Navigator has 1,189 reviews and 4.2 stars overall

LinkedIn Sales Navigator has 1,189 reviews and 4.2 stars overall InsideView Insights has 693 reviews and 4.3 stars overall

InsideView Insights has 693 reviews and 4.3 stars overall

D&B Hoovers has 346 reviews and 3.9 stars overall

D&B Hoovers has 346 reviews and 3.9 stars overall Lead411 has 245 reviews and 4.6 stars overall

Lead411 has 245 reviews and 4.6 stars overall $ZI leads by a wide margin

$ZI leads by a wide margin

Financials Check

Financials Check

Sales reached $ 123m in Q3 ’20 up 56% YoY up from 40% in the previous Q

Sales reached $ 123m in Q3 ’20 up 56% YoY up from 40% in the previous Q Gross Margins of 78% up from 77% a year earlier

Gross Margins of 78% up from 77% a year earlier Operating income reached $ 18.4m up from $ 13.1m a year earlier

Operating income reached $ 18.4m up from $ 13.1m a year earlier

Operating Margins of 15% down from 16.5% a year earlier

Operating Margins of 15% down from 16.5% a year earlier Current assets stood at $ 421m versus current liabilities of $ 247.5m

Current assets stood at $ 421m versus current liabilities of $ 247.5m

Here is $IPG vs $ZI ’s valuations  In order to give a directional senses of where $ZI could end

In order to give a directional senses of where $ZI could end

$IPG has an EV of $ 11.6B, Q sales of $ 2B and 12% EBIT margins - No growth pre-Covid

$IPG has an EV of $ 11.6B, Q sales of $ 2B and 12% EBIT margins - No growth pre-Covid

$ZI has an EV of $ 7.2B, Q sales of $ 123m and 15% EBIT margins - 56% YoY growth

$ZI has an EV of $ 7.2B, Q sales of $ 123m and 15% EBIT margins - 56% YoY growth

In order to give a directional senses of where $ZI could end

In order to give a directional senses of where $ZI could end $IPG has an EV of $ 11.6B, Q sales of $ 2B and 12% EBIT margins - No growth pre-Covid

$IPG has an EV of $ 11.6B, Q sales of $ 2B and 12% EBIT margins - No growth pre-Covid $ZI has an EV of $ 7.2B, Q sales of $ 123m and 15% EBIT margins - 56% YoY growth

$ZI has an EV of $ 7.2B, Q sales of $ 123m and 15% EBIT margins - 56% YoY growth

THE BOTTOM LINE

THE BOTTOM LINE

The market for B2B data is rising fast as companies leverage data in order to find new leads and customers

The market for B2B data is rising fast as companies leverage data in order to find new leads and customers $ZI has one of the best product in its niche and is innovating fast in order to grow its database and improve its user experience

$ZI has one of the best product in its niche and is innovating fast in order to grow its database and improve its user experience

This translates into fast growing sales (56% YoY) and is supported by an operating margin of 15%, giving the cash it needs to continue its expansion

This translates into fast growing sales (56% YoY) and is supported by an operating margin of 15%, giving the cash it needs to continue its expansion The market is under heavy scrutiny from regulators in Europe and North America

The market is under heavy scrutiny from regulators in Europe and North America

Marker is competitive with numerous local and niche competitors

Marker is competitive with numerous local and niche competitors We stay on the sidelines for now and will review their next earnings

We stay on the sidelines for now and will review their next earnings

$RKT is on our watchlist

$RKT is on our watchlist  To Be Reviewed SOON

To Be Reviewed SOON

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ IDC

✑ G2

✑ Fast Company

✑ MenaFN

Sources

✑ Investor presentation

✑ Company website

✑ IDC

✑ G2

✑ Fast Company

✑ MenaFN

Hope you liked this thread!

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

Read on Twitter

Read on Twitter