OK, I'll comment!

I don't know if that data for higher education was net or list, but there are larger issues about defining affordability. Let's start with the big uncontroversial fact...

The relative price of a year in college has clearly gone up since the early 1980s. https://twitter.com/jselingo/status/1339581869453574151

I don't know if that data for higher education was net or list, but there are larger issues about defining affordability. Let's start with the big uncontroversial fact...

The relative price of a year in college has clearly gone up since the early 1980s. https://twitter.com/jselingo/status/1339581869453574151

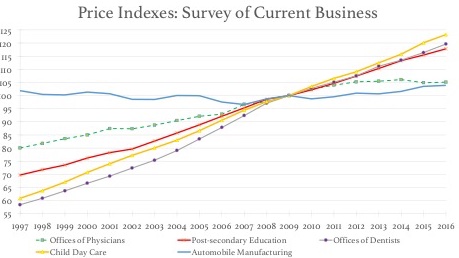

So has the "relative" price of most services. Their prices have risen compared to goods. From the Survey of Current Business, the price series for higher education tracks child daycare quite closely.

As an aside, how many people would claim that the "skyrocketing" price of daycare is driven primarily by prestige games, wasteful amenities arms races, lazy "tenured" teachers, and other dysfunctional behavior as opposed to normal competition in a labor-intensive service?

If the % change in price is bigger than the % rise in income, the family will indeed spend a bigger % of its income on education. But this doesn't necessarily make a year in college less affordable.

Americans spend a bigger fraction of their income on services now than in the past because the relative price of services has gone up. But national productivity growth has pushed up incomes enough so the average American can buy more services AND more goods than in the past.

The added complexity in higher education is that national averages for things like family income and list price are largely irrelevant. The net price of a year in college varies by what type of school you choose to attend and by your family income.

For families in the bottom income quintile, a year at highly selective colleges has become cheaper. But it has become more expensive at many non-selective public institutions suffering from appropriations cuts. The consequences have been well documented by @saragoldrickrab

By contrast, families in the top 2% (who mostly pay full list price at "elite" schools) have seen their incomes rise by much more than the list price at Yale. As list price rises, an elite education isn't less "affordable" if you can buy everything you bought before, and more.

Another aside: this idea of affordability (can you buy what you bought before and more) treats higher education like any other good you buy out of current income. It's an investment, of course, and its value has gone up relative to 1980. Borrowing isn't evil.

The stratospheric list price tuitions at "elite" private colleges grab headlines, but these sticker prices are substantially driven by rising income inequality coupled with the market power of these schools to capture some of that income growth through price discrimination.

This is another reason why you shouldn't compare the % rise in list price with the % change in family income. If Harvard's cost of attendance goes up 3% ($2.5K) and a high-income family earns "only" 2% more (say 10K), then Harvard isn't being pushed out of the family budget.

Truly middle income families making 60K-100K or so are likely facing serious affordability problems if their sons/daughters attend schools whose net cost of attendance AT THEIR INCOME LEVEL has been rising sharply. These families are also borrowing more to finance education.

Read on Twitter

Read on Twitter