1/ I won't give this any more engagement but since some likely haven't been following regulation on BTC, here is why the take is garbage: Bitcoin has been deemed a commodity by the CFTC since 2015 (!). I'll give you the sources and argue how the CFTC is still firmly in charge.

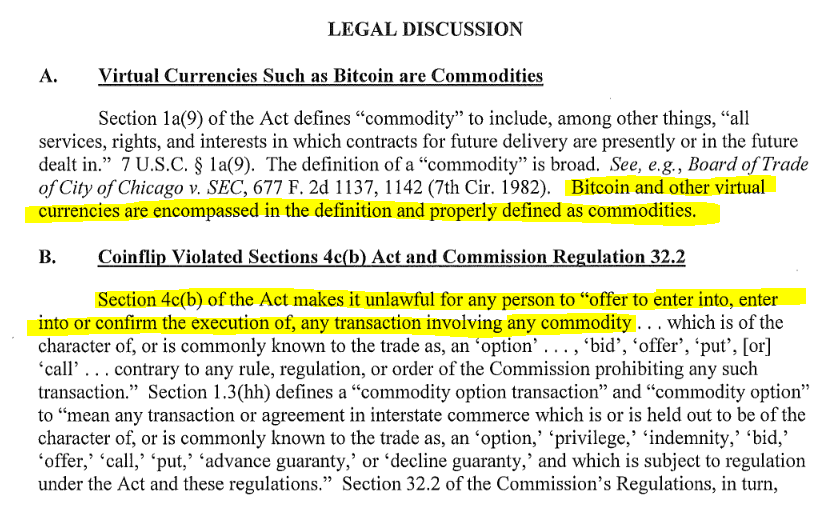

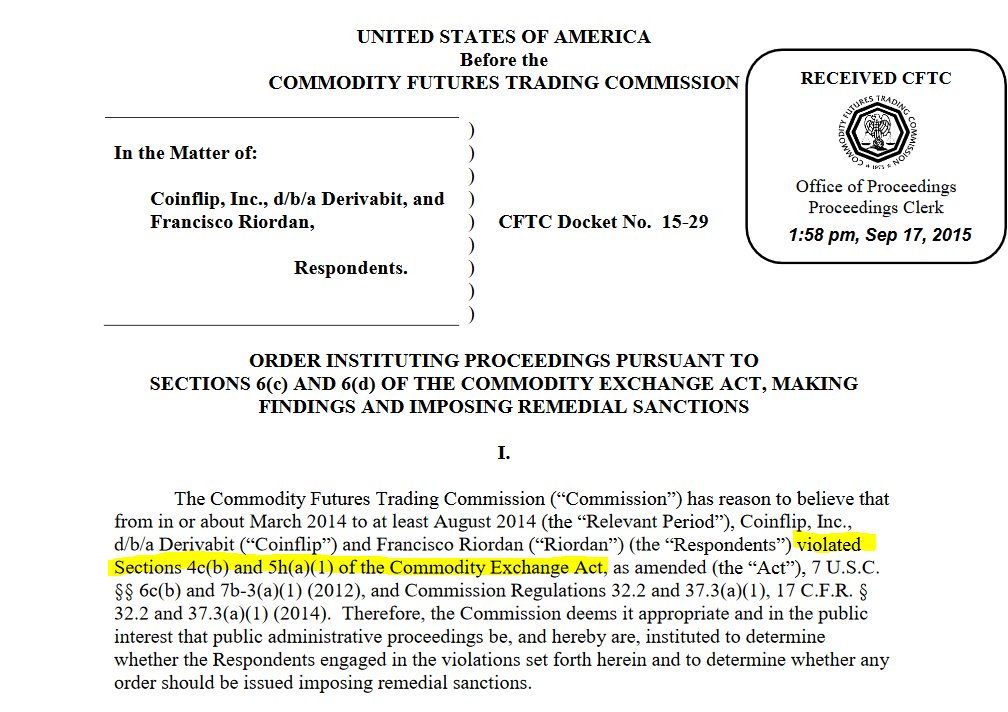

2/ Here is the order in the case against Coinflip and their options trading platform Derivabit from September 2015. They got charged for offering swaps on Bitcoin (a commodity in the eyes of the CFTC) without being registered: https://www.cftc.gov/sites/default/files/idc/groups/public/@lrenforcementactions/documents/legalpleading/enfcoinfliprorder09172015.pdf

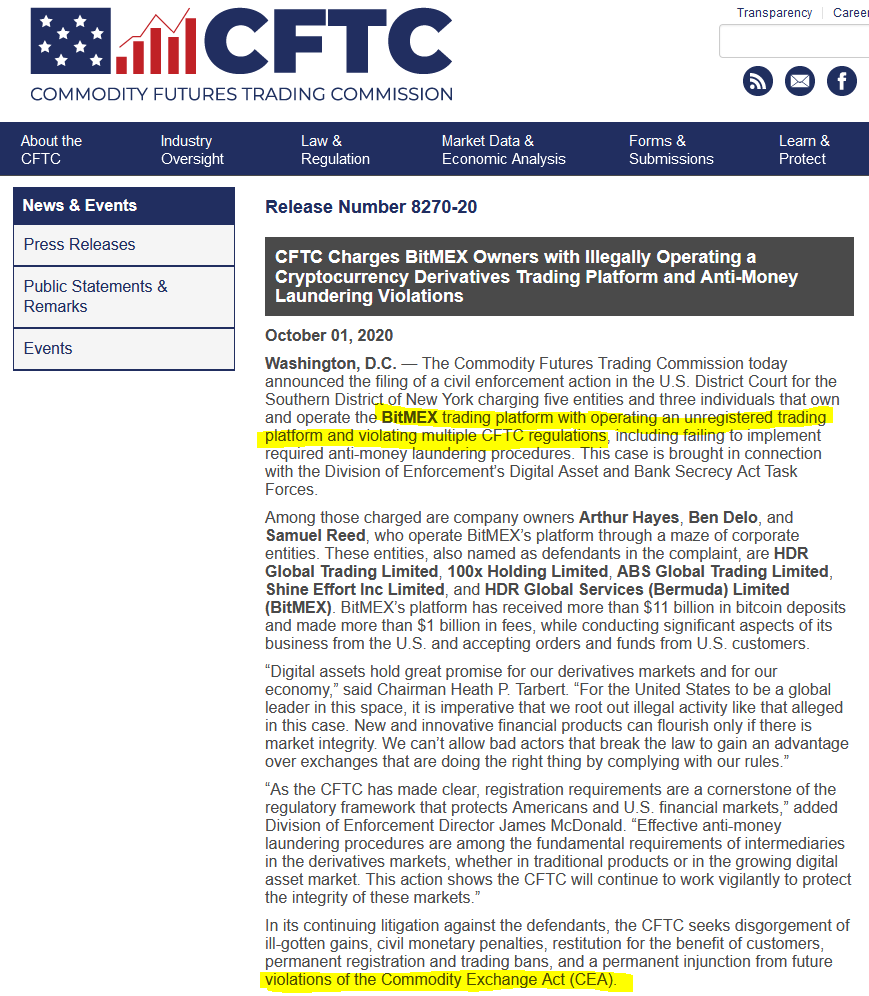

3/ Between 2015 and today the CFTC has confirmed this stance numerous times but actions speak louder than words. Who do you think persecuted Bitmex this year if Bitcoin is still deemed a commodity? Yes it's the CFTC: https://www.cftc.gov/PressRoom/PressReleases/8270-20

4/ If that isn't enough for you we can look at Ethereum which ICOed in 2014 so it arguably comes much closer to being considered a security than Bitcoin. CFTC Chairman Heath Tarbert also deemed it a security.

5/ The CFTC's statements on ETH came after they requested public comments on the matter back in 2018 ( https://www.cftc.gov/PressRoom/PressReleases/7855-18). Since this month, you can trade Ethereum futures on CME. You can legally trade BTC options there. That's because the CME is registered with the CFTC.

6/ This is the CFTC establishing power as a regulator over an asset class that's going to play a huge role in the markets of the future. They wouldn't let it slip through their fingers without putting up a fight.

Read on Twitter

Read on Twitter