I've been inspired by this awesome thread by Jason, and I've decided to disseminate a few of my takeaways from crypto investing in 2020.

Thread

https://twitter.com/mrjasonchoi/status/1343830925805686787

https://twitter.com/mrjasonchoi/status/1343830925805686787

Thread

https://twitter.com/mrjasonchoi/status/1343830925805686787

https://twitter.com/mrjasonchoi/status/1343830925805686787

FDV

Considering a project's FDV prior to investing is essentially a rite of passage for anyone conducting due diligence on tokens. While an important consideration, bullish sentiment and price movements negate the market's reflexes to FDV.

Considering a project's FDV prior to investing is essentially a rite of passage for anyone conducting due diligence on tokens. While an important consideration, bullish sentiment and price movements negate the market's reflexes to FDV.

A fallacy associated with FDV is making side by side comparisons of different projects' FDVs without taking into account the receiving tranches in the supply curve. I fell into this mindset earlier in the year when looking at SOL.

While its important to know how much of a token's supply is allocated to investors, what price they paid for tokens, and what the vesting schedule looks like, there's still a large portion of irrational capital that moves the market. Taking that into account was why I bought GRT.

You can't analyze FDVs across assets due to token ownership of future supply. In some instances, supply is allocated to pre-sale investors. In other instances, its distributed to the consumer/user through incentive programs such as yield farming.

The latter token allocation will have stronger network effects and value accrual in my opinion. YFI was the tip of the spear, and it's success imo was largely due to riding on the ethos-derived tailwind of a token allocated to the end user without pre-sale investor allocations.

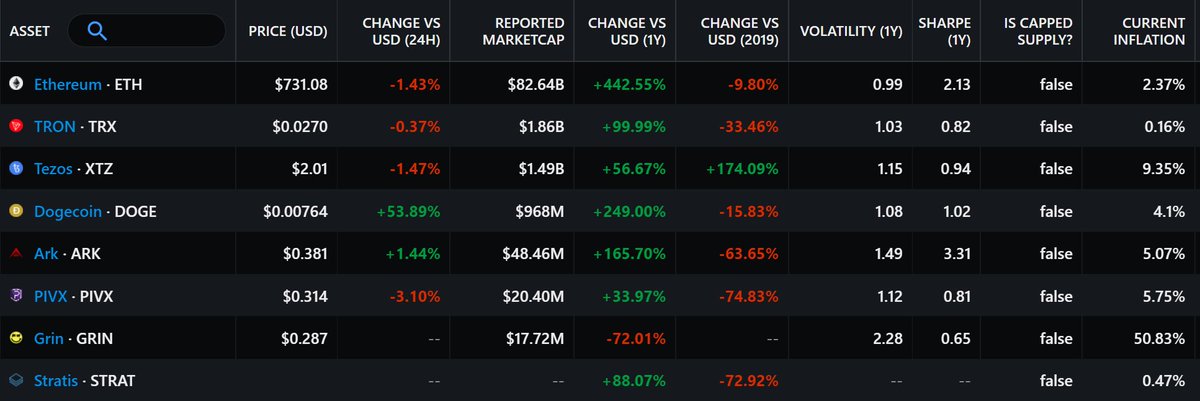

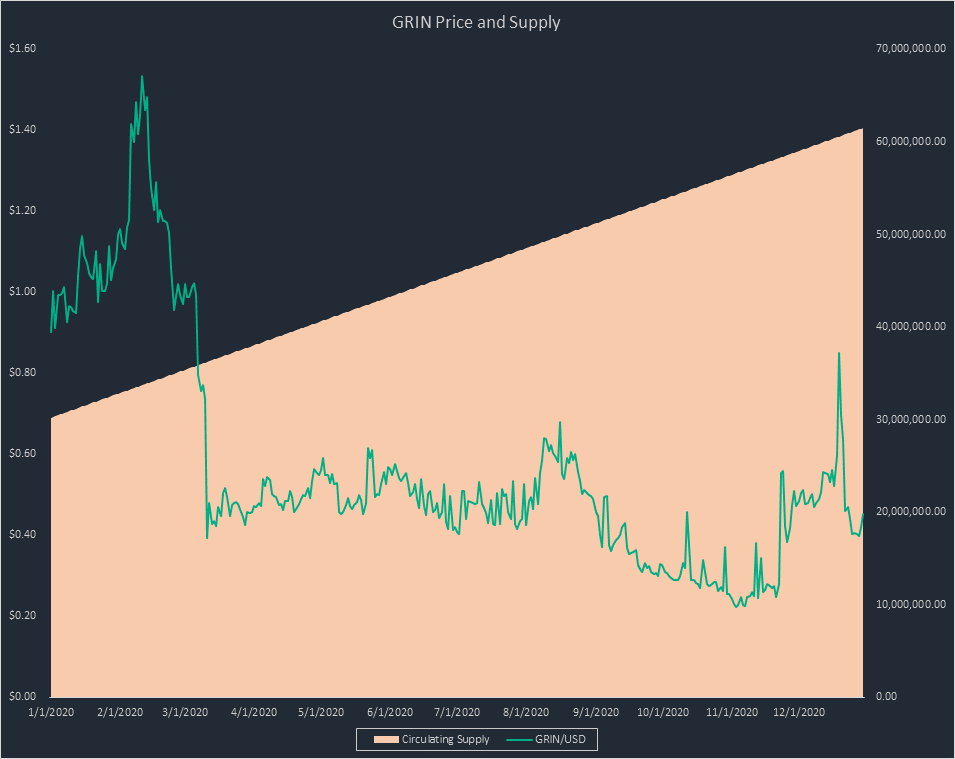

It's critical to understand who the receiving tranches in the supply curve are, why they intrinsically value the token, and will not liquidate received tokens. This is why I'm generally bearish on inflationary tokens with uncapped supplies and linear token issuance such as GRIN.

Fundamental catalysts for token upside

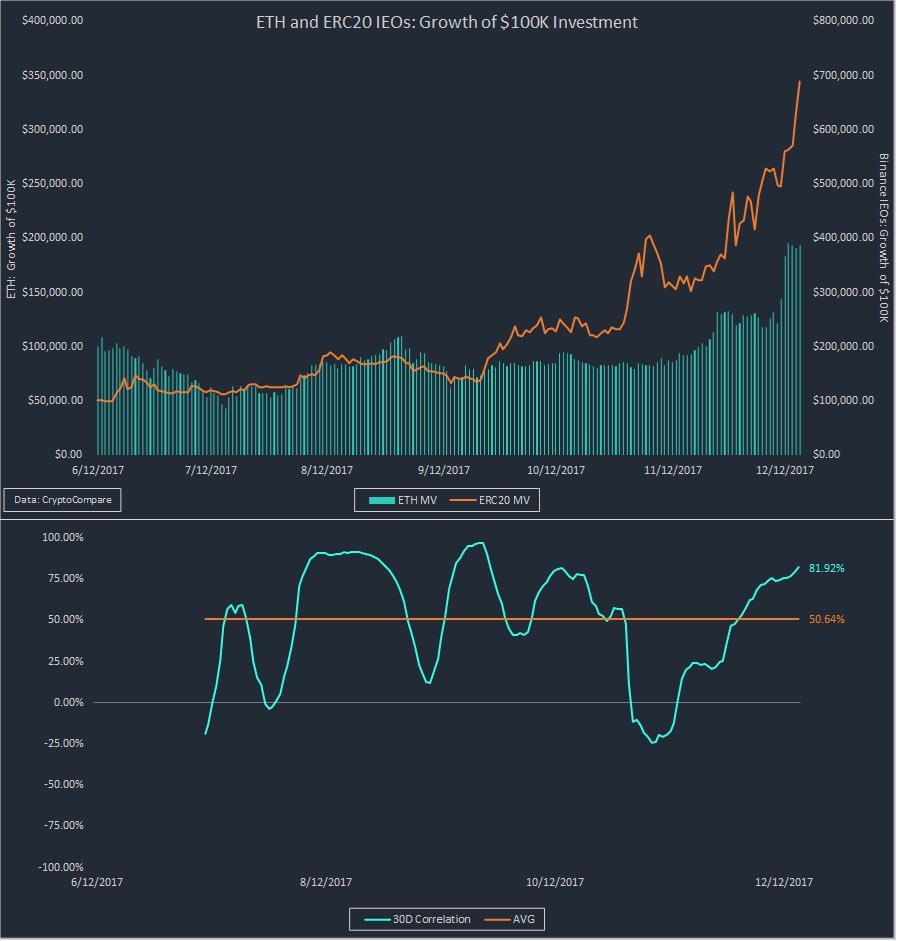

Historically, a large catalyst that drove token upside is when assets are used as monetary units. This occurred when ETH was used for ICO funding in 2017/2018 and BNB used for Binance IEO funding in 2019.

Historically, a large catalyst that drove token upside is when assets are used as monetary units. This occurred when ETH was used for ICO funding in 2017/2018 and BNB used for Binance IEO funding in 2019.

Similar to what we saw with ETH and BNB used as monetary units, in 2020 we saw DeFi assets used to bootstrap and incentivize platform usage and liquidity via yield farming. This created strong buy side demand for the assets accepted on these platforms.

An excellent example of this was UMA. There was no coincidence that the price hit its high mark in addition to daily trade counts and unique wallets buying on DEXs hitting high points was around the time SushiSwap launched.

Token comps

In 2020 we saw the emergence of phenomenal analytics platforms like @tokenterminal and @DuneAnalytics which enabled investors to analyze tokens side by side. This is a critical component in the cryptoasset research stack.

In 2020 we saw the emergence of phenomenal analytics platforms like @tokenterminal and @DuneAnalytics which enabled investors to analyze tokens side by side. This is a critical component in the cryptoasset research stack.

In 2017, alpha was generated through understanding there were capital inefficiencies that made you a ton of money through cross exchange arbing. Alpha now imo is inaccurately priced assets you have long exposure in and the more people piling in the more pnl for you.

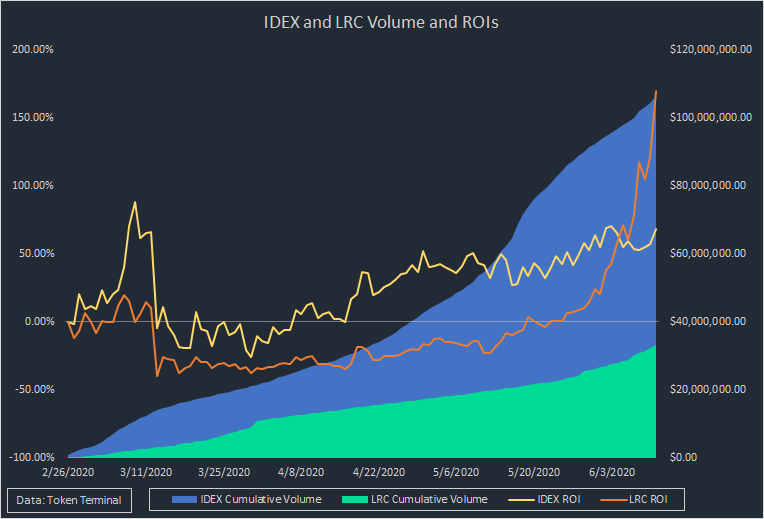

Given that the DEX space took off this year, conducting token comps to produce alpha derived from inefficient allocations of capital was a lucrative strategy. An example of this was LRC vs IDEX.

Back in June, IDEX's price appeared to be undervalued as IDEX had outpaced LRC by a daily average volume of 4.26x while trading at an average market cap of 21.08% of Loopring's. The market went on to reprice IDEX and the price increased 562% to its YTD high price in September.

DCA

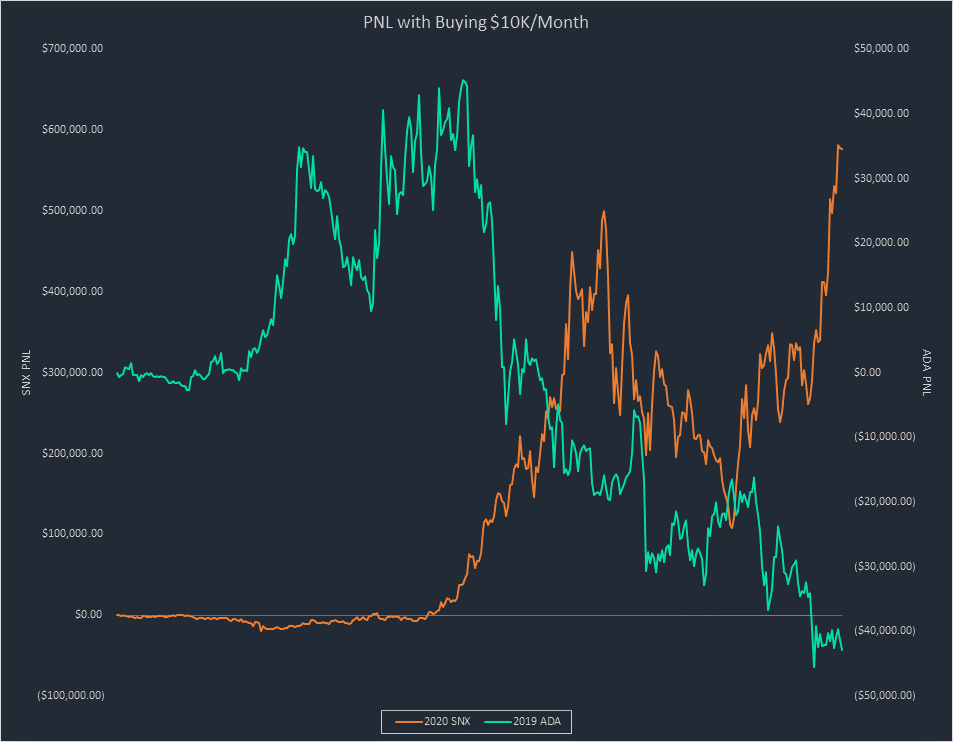

Averaging into losers/reallocating gains from winners into losers can be extremely costly. In 2019 I fell victim to this with ADA, a coin I frequently purchased due to having a perceived low price. In 2020, I changed my narrative and was buying SNX on a regular basis.

Averaging into losers/reallocating gains from winners into losers can be extremely costly. In 2019 I fell victim to this with ADA, a coin I frequently purchased due to having a perceived low price. In 2020, I changed my narrative and was buying SNX on a regular basis.

This year has seen a proliferation in people deeply embedded in the space who have generously provided invaluable insights here. Here is a quick alpha leak of some I have gained considerable understanding from:

@Rewkang

@mrjasonchoi

@ceterispar1bus

@MapleLeafCap

@Arthur_0x

@Rewkang

@mrjasonchoi

@ceterispar1bus

@MapleLeafCap

@Arthur_0x

It's also been incredibly encouraging to see meaningful analytical work coming from companies such as @MessariCrypto and @Delphi_Digital. Imo a critical component to moving crypto along the adoption curve is producing insightful and transparent data/commentary on the space.

These people are on the forefront of analyzing the investability of crypto projects, and as more insightful data is thoughtfully distributed, the more mature this space will become to outsiders. I've thoroughly enjoyed reading the work of @RyanWatkins_, @WilsonWithiam, and co.

Each year I spend in this space makes me all the more bullish and excited about what is being built and shipped in crypto, excited for what 2021 has in store and what new never before conceived protocols and platforms come to market.

Read on Twitter

Read on Twitter