Fixed income ETFs are a $1 trillion market built on the pitch of turning the illiquid into the liquid.

There are those who argue FI ETFs are where the next crisis will emerge - while I'm not in that camp yet, here's the evidence I've gathered so far:

There are those who argue FI ETFs are where the next crisis will emerge - while I'm not in that camp yet, here's the evidence I've gathered so far:

First, a quick primer.

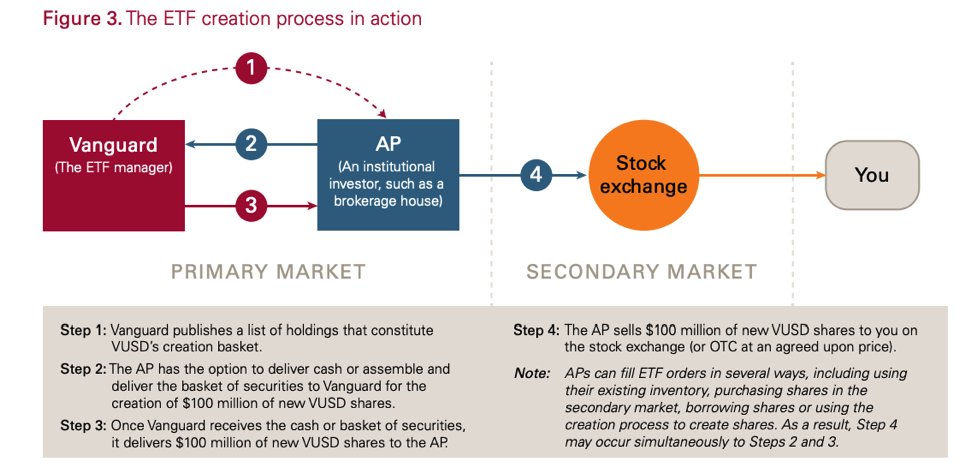

ETFs are managed by sponsors and authorized participants working together to create & redeem ETF shares throughout the day, matching secondary market demand for their fund.

Below graphic from Vanguard adds context:

ETFs are managed by sponsors and authorized participants working together to create & redeem ETF shares throughout the day, matching secondary market demand for their fund.

Below graphic from Vanguard adds context:

ETFs thrive on arbitrage. Authorized participants engage in the create/redeem process because they profit from differences in the price of the ETF and its underlying assets.

APs are not forced to support an ETF, and only a small fraction of registered APs actively participate.

APs are not forced to support an ETF, and only a small fraction of registered APs actively participate.

This is especially true for fixed income ETFs. The top 3 APs - Bank of America, JP Morgan, and Goldman Sachs - accounted for 82% of all ETF create/redeem activity in 2019:

Why is the fixed income ETF market so concentrated? Because so is the cash market. The top 3 APs are also large bond dealers, and are able to manage an ETF book with their bond book to better capture efficiencies.

With that backdrop, let's set the stage: a $1 trillion ETF market built on illiquid securities with 3 big banks as the primary gatekeepers exhibits a credit shock.

What happens?

What happens?

APs are unable to profit from arbitrage - the underlying bonds of an ETF cease to trade freely, meaning the banks can't create or redeem new shares. The primary market freezes, but the secondary ETF market keeps trading.

Illiquidity discounts begin to form in the ETF.

Illiquidity discounts begin to form in the ETF.

We saw this exact dynamic happen in March 2020 - near the bottom, some large fixed income ETFs were trading at 5%+ discounts to the value of their underlying assets. Fears of a "liquidity doom loop" began to emerge…

Until the Fed saved the day.

Until the Fed saved the day.

I tell this story to point out that, like past unstable financial products, ETFs are reliant on "selective liquidity" from banks to function. When banks decline to support the market, the Fed has to step with greater speed & size to keep the peace.

FIN

FIN

Read on Twitter

Read on Twitter