1/15 A long & very interesting thread on  enterprise SaaS! A closer look at the rough adoption of the leading domestic & int'l SaaS companies across numerous verticals

enterprise SaaS! A closer look at the rough adoption of the leading domestic & int'l SaaS companies across numerous verticals

Survey from Nov '20 of 1,973 enterprise companies (>$100M in rev.) Completed by: https://www.biztex.co.jp/

enterprise SaaS! A closer look at the rough adoption of the leading domestic & int'l SaaS companies across numerous verticals

enterprise SaaS! A closer look at the rough adoption of the leading domestic & int'l SaaS companies across numerous verticalsSurvey from Nov '20 of 1,973 enterprise companies (>$100M in rev.) Completed by: https://www.biztex.co.jp/

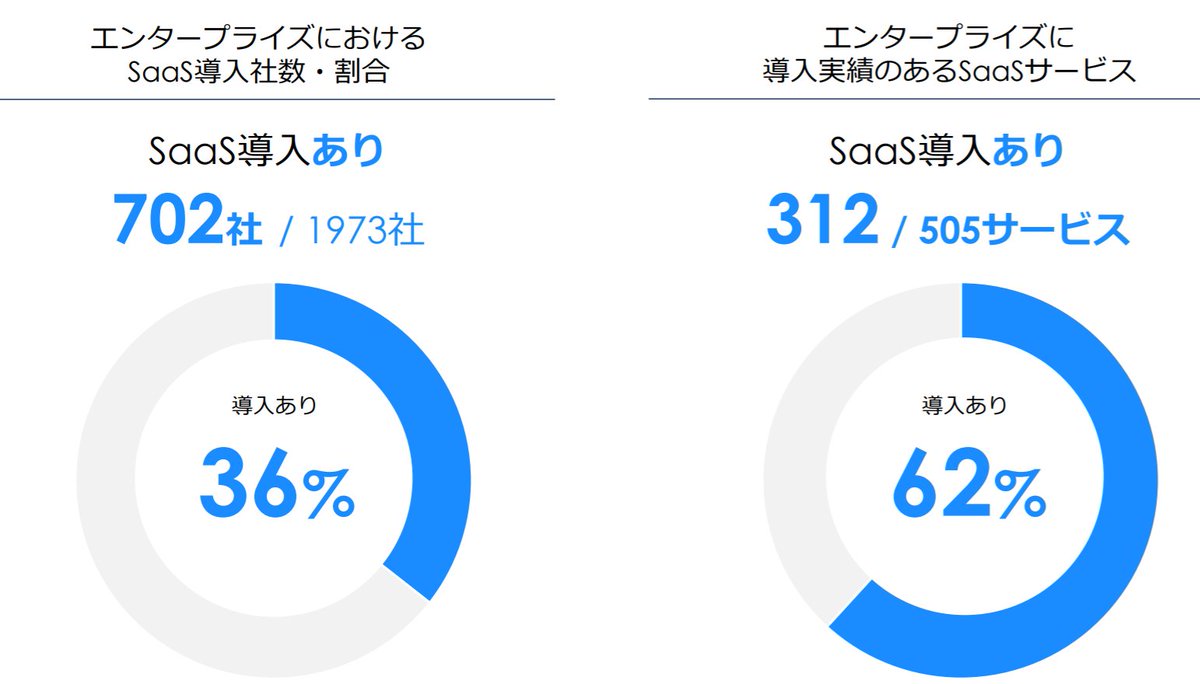

2/15 Of the 1,973 enterprise companies surveyed, just 36% have so far introduced SaaS products into their business

Of the 505 SaaS companies in the survey, 62% offer an enterprise product w/proven a track record

Of the 505 SaaS companies in the survey, 62% offer an enterprise product w/proven a track record

3/15 The three most used enterprise SaaS products are:

1) Dr. Sum - business intelligence

2) @SAPConcur - expense mgmt

3) @Sansan_HQ ($4443) - $CRM + @LinkedIn

The #'s in the far right column = the number of surveyed enterprises using the tool today

1) Dr. Sum - business intelligence

2) @SAPConcur - expense mgmt

3) @Sansan_HQ ($4443) - $CRM + @LinkedIn

The #'s in the far right column = the number of surveyed enterprises using the tool today

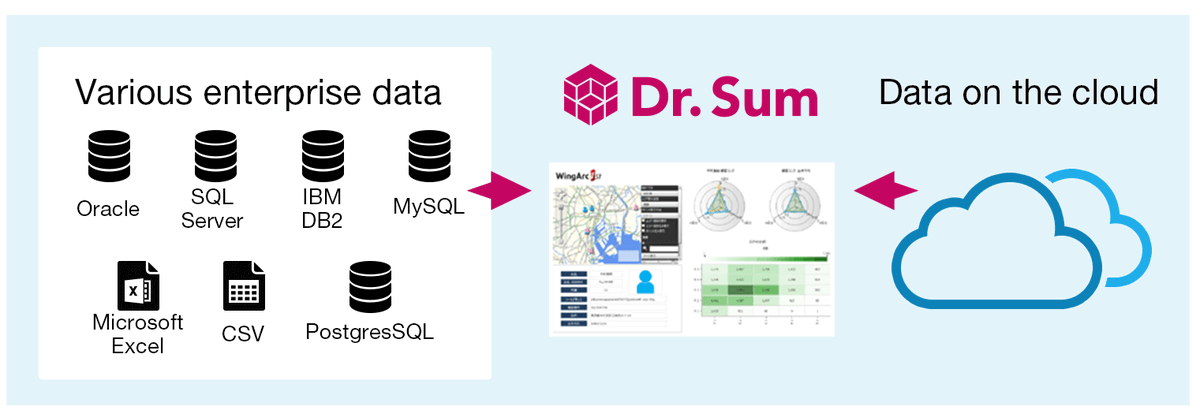

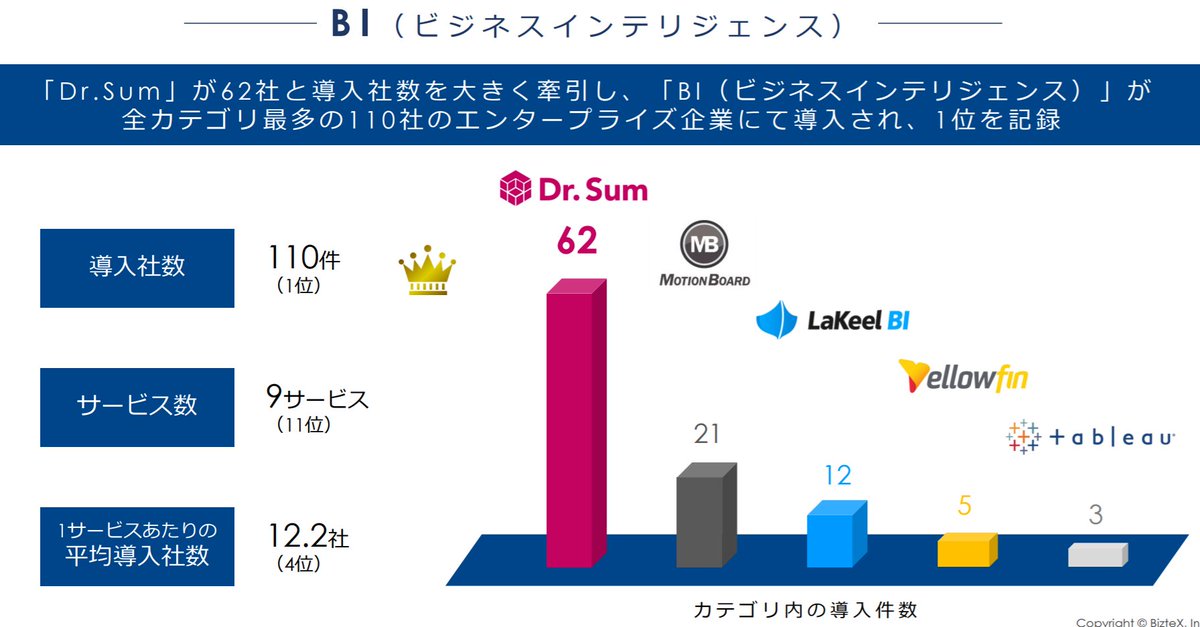

4/15 Dr. Sum is a product of @WingArc, which is owned by $CG (Carlyle), Itochu, @Sansan_HQ & two other  corporates. 20k customers, 500 staff & 250 partners

corporates. 20k customers, 500 staff & 250 partners

It is a database engine designed to optimize integration & aggregation of data. Closest comparable is likely @tableau

comparable is likely @tableau

corporates. 20k customers, 500 staff & 250 partners

corporates. 20k customers, 500 staff & 250 partnersIt is a database engine designed to optimize integration & aggregation of data. Closest

comparable is likely @tableau

comparable is likely @tableau

5/15 A bit dated now, but more on Sansan  https://twitter.com/willschoebs/status/1265475975472713735

https://twitter.com/willschoebs/status/1265475975472713735

https://twitter.com/willschoebs/status/1265475975472713735

https://twitter.com/willschoebs/status/1265475975472713735

6/15 Most popular vertical for SaaS tools are:

1) Business Intelligence

2) Employee Engagement / Productivity

3) Workflow

1) Business Intelligence

2) Employee Engagement / Productivity

3) Workflow

7/15 As established, the leading BI tool, by a large margin, is Dr. Sum

- 110 surveyed enterprises use a BI SaaS tool

- 9 SaaS companies offer an enterprise BI tool

- 12.2 average customers each (skewed by Dr. Sum)

by Dr. Sum)

- 110 surveyed enterprises use a BI SaaS tool

- 9 SaaS companies offer an enterprise BI tool

- 12.2 average customers each (skewed

by Dr. Sum)

by Dr. Sum)

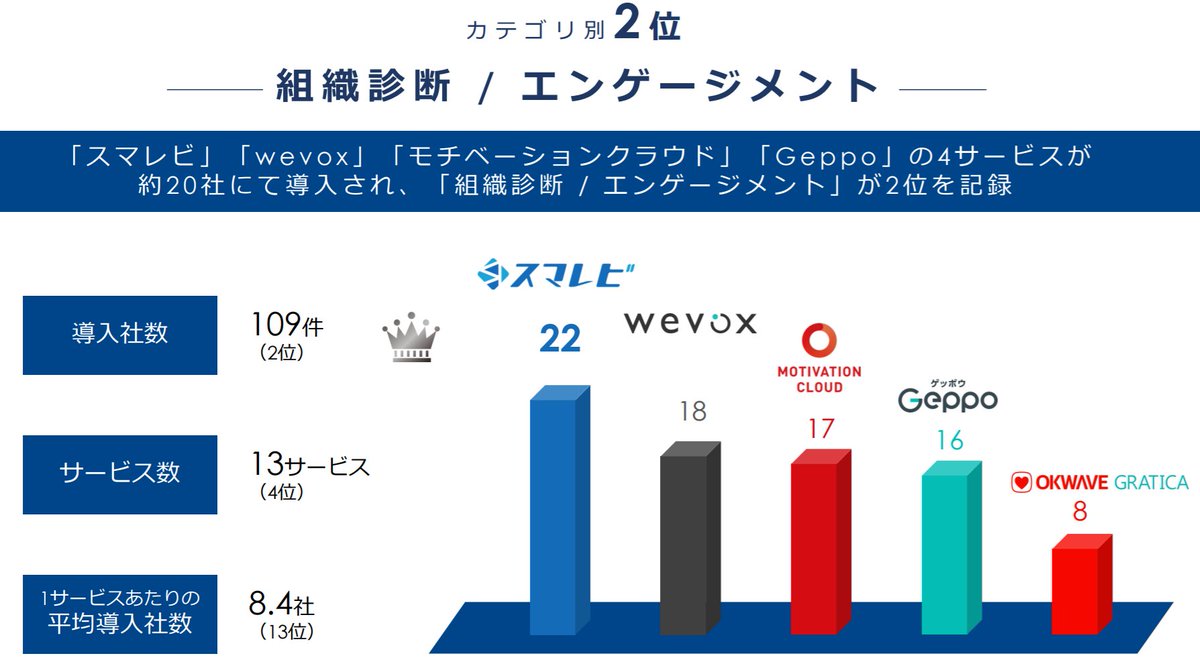

8/15 Within the employee engagement / productivity vertical, CBASE's ( https://www.cbase.co.jp/ ) product "Sumarebi" ( https://www.hrm-service.net/ ) leads a much more competitive market

Personal view that WeVox & Motivation Cloud will be #1 & #2 over time

Personal view that WeVox & Motivation Cloud will be #1 & #2 over time

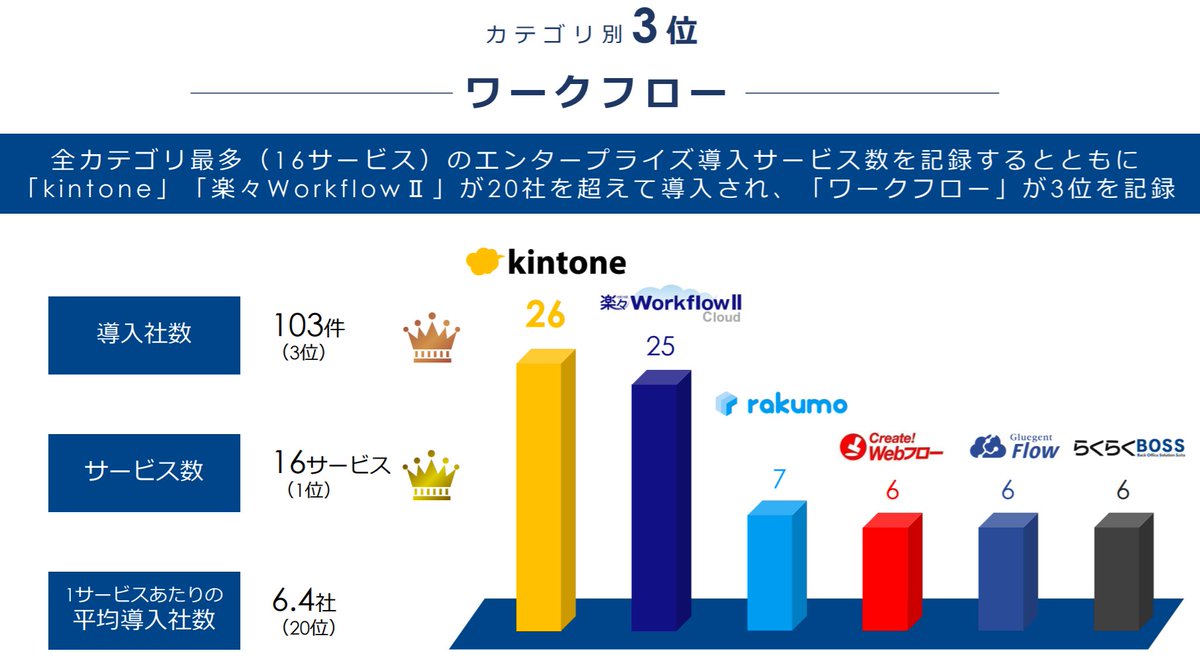

9/15 Kintone leads the pack within the "workflow" vertical. It is a unit within $1.2B MC @cybozu ($4776). Strong push to expand abroad among SMBs, w/an office in SF & listed on Capterra

Anecdotally, have heard colleagues ask one another to "kintone it", which is powerful

Anecdotally, have heard colleagues ask one another to "kintone it", which is powerful

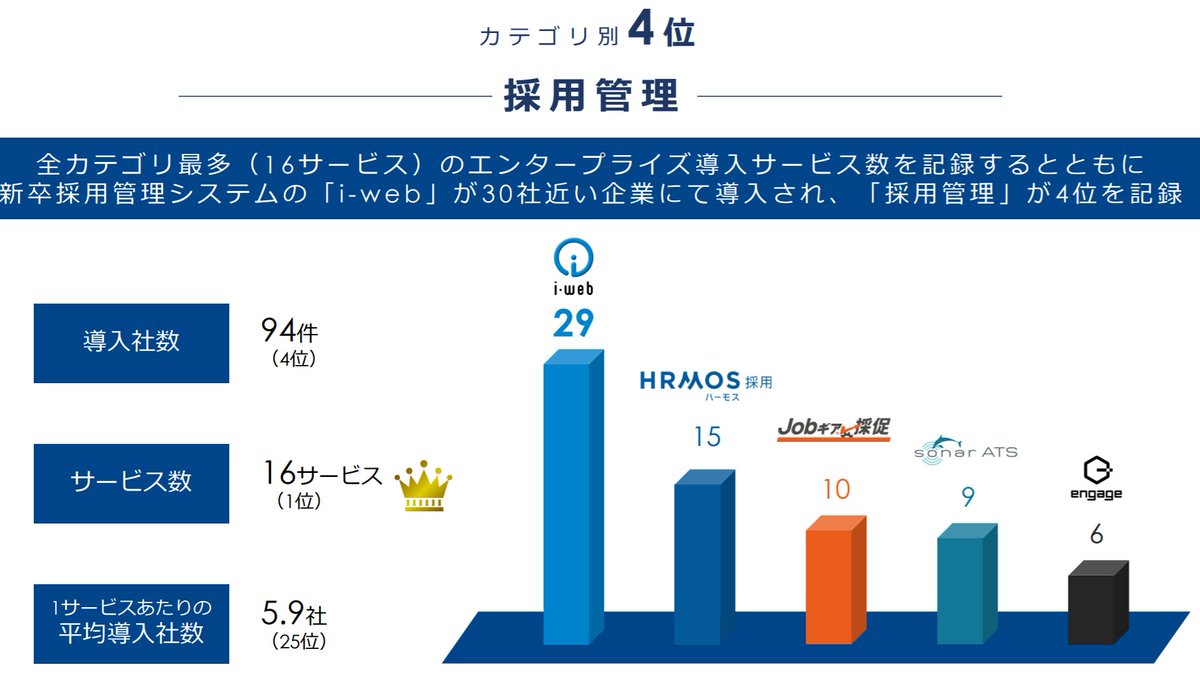

10/15 The recruiting management vertical is the most competitive w/16 different companies competing in the enterprise SaaS space. Recruiting more generally is a very large & lucrative mkt in  in particular

in particular

The leader i-web focuses on recent university graduates

in particular

in particularThe leader i-web focuses on recent university graduates

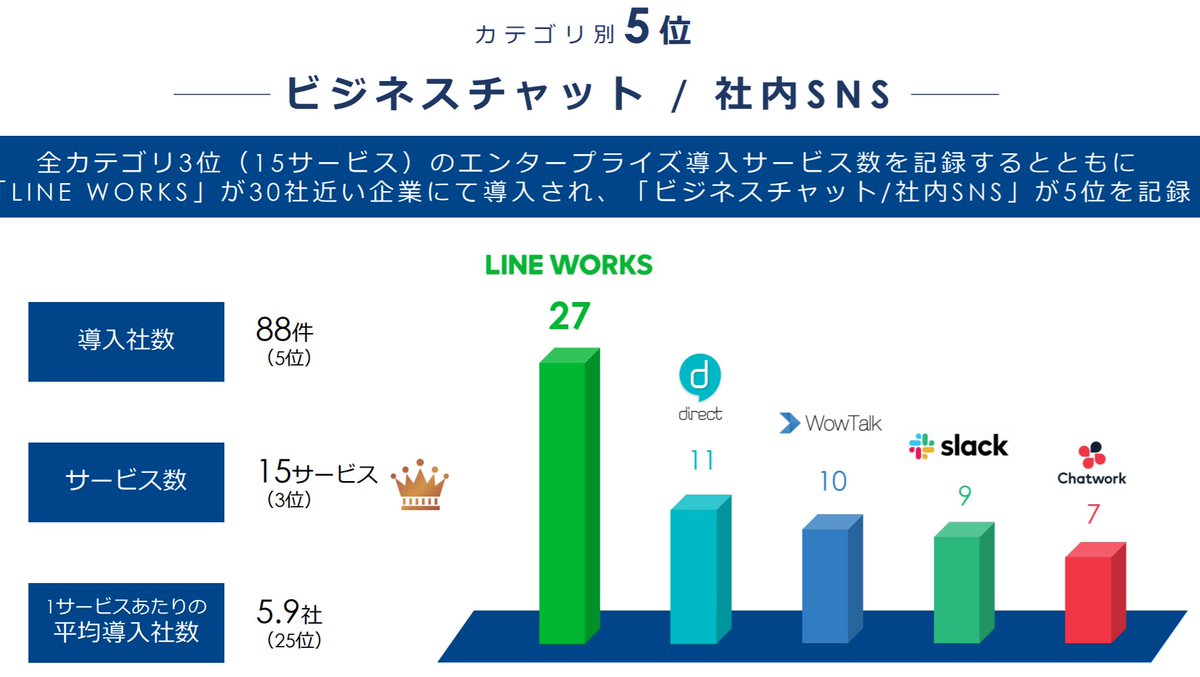

11/15 One of the more interesting areas is business collaboration software. Ubiquitous SuperApp LINE has the leading product w/ $WORK in the mix &, interestingly, home-grown @chatwork_en just making the cut

LINE mirrors that of $BABA's DingTalk & $TCEHY's WeCom in

LINE mirrors that of $BABA's DingTalk & $TCEHY's WeCom in

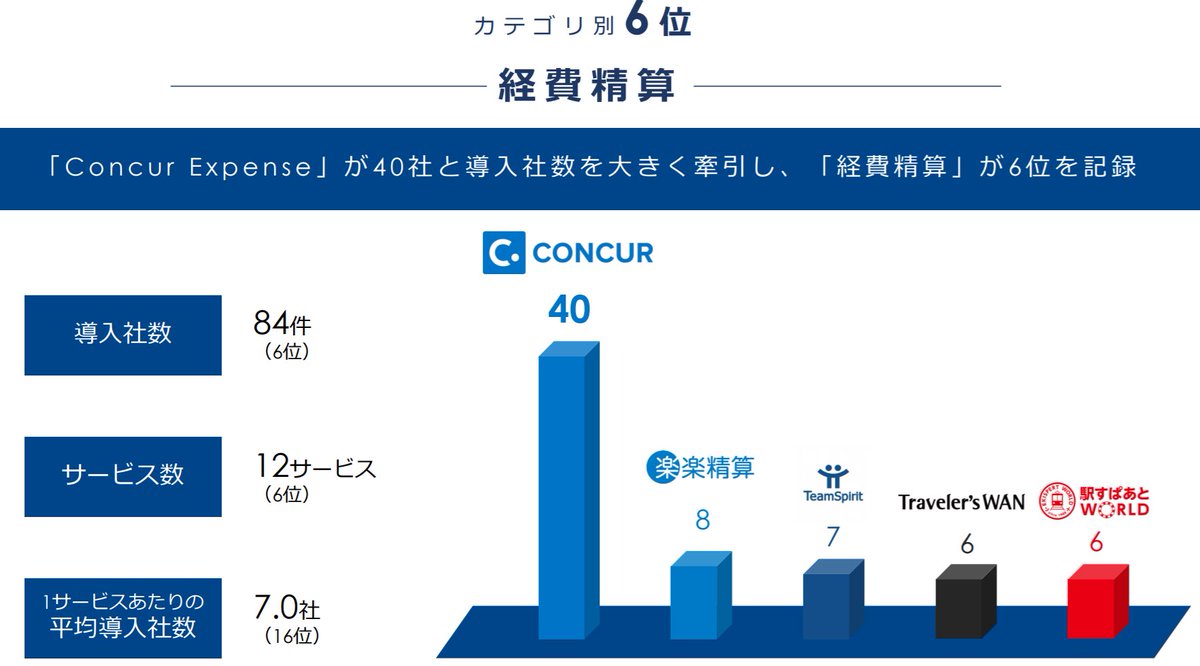

12/15 Disappointingly, Concur smashes domestic competitors TeamSpirit (4397) & Rakus (3923) in expense mgmt

However, those two have only just started pushing into the enterprise, w/TeamSpirit growing its enterprise seats at >50% YoY, now representing 44% of total

However, those two have only just started pushing into the enterprise, w/TeamSpirit growing its enterprise seats at >50% YoY, now representing 44% of total

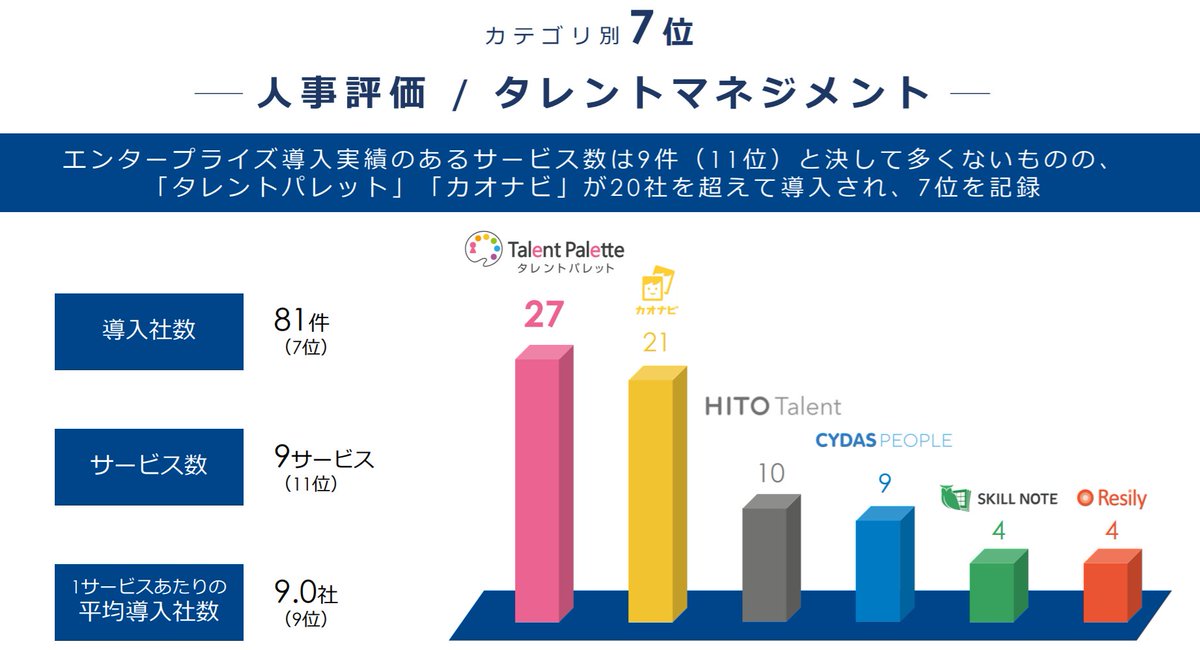

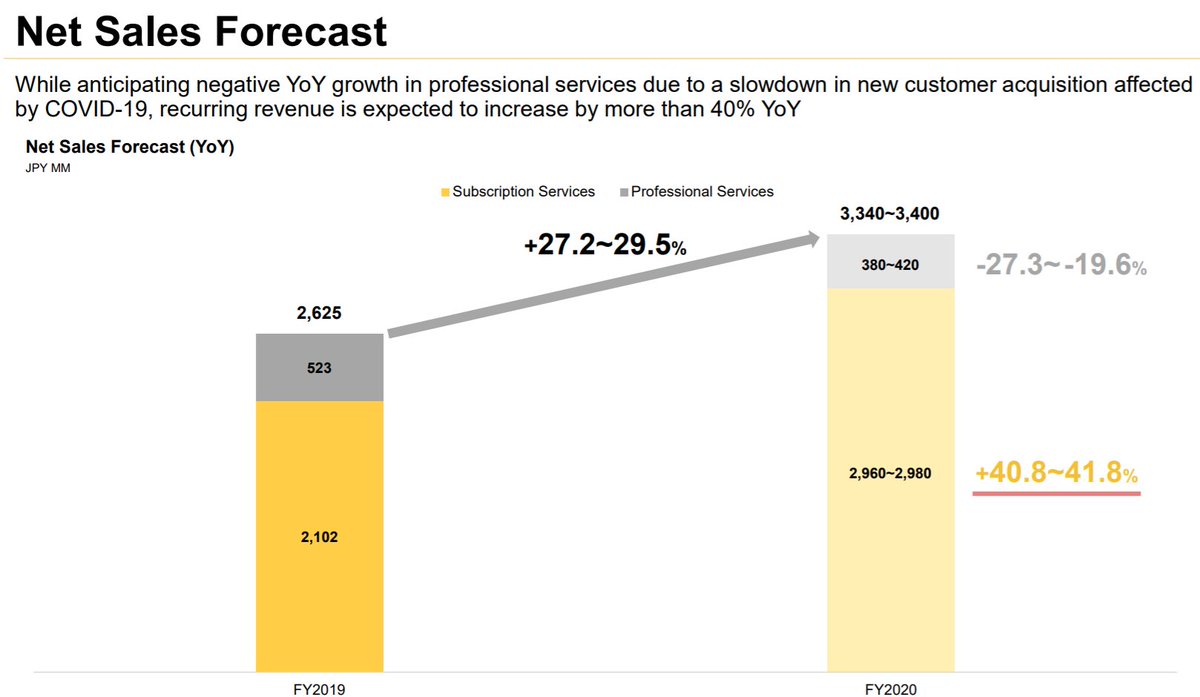

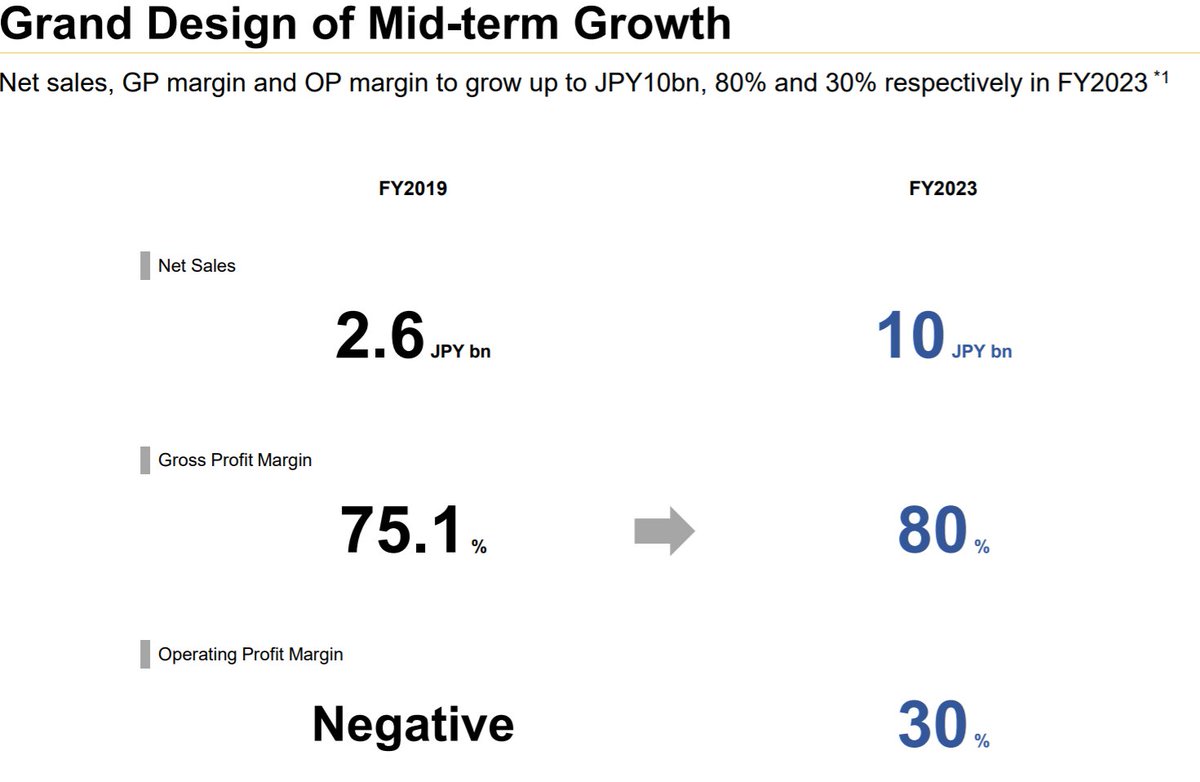

13/15 In the talent mgmt vertical, private Plus Alpha Consulting's Talent Palette & @kaonavi_jp (4435) lead. A rather competitive space, w/the likes of soon to IPO @HRBrain_hr (raised $~12M) biting at their heels, tho kaonavi is growing ARR at 40%, w/aims to triple sales by '23

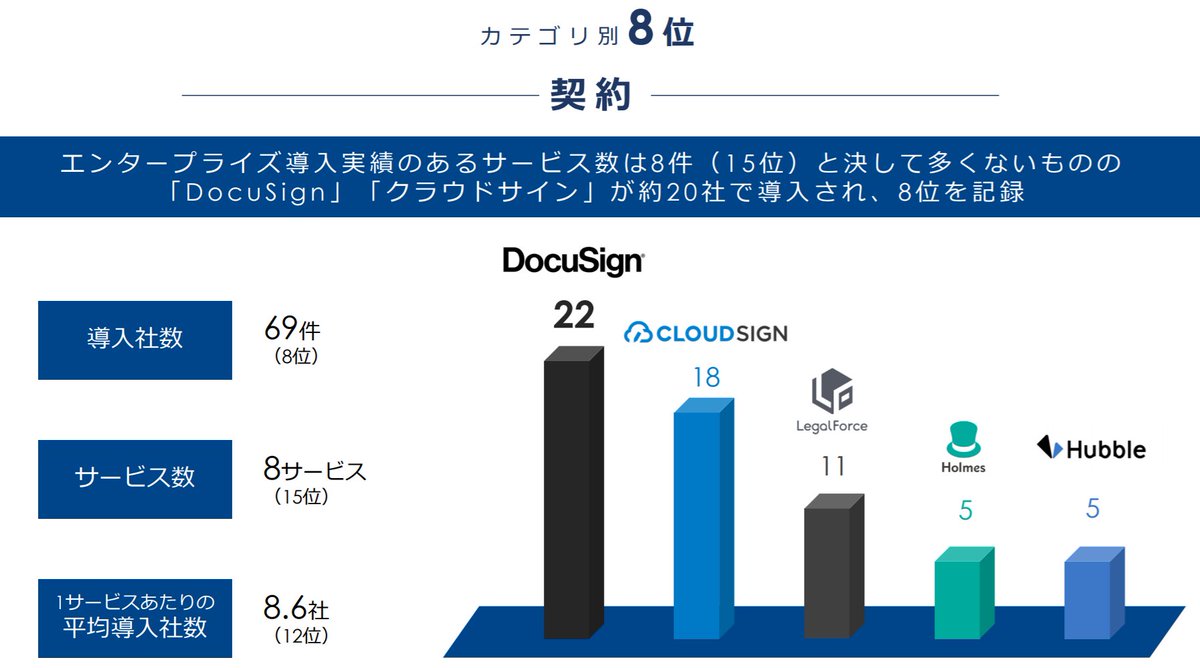

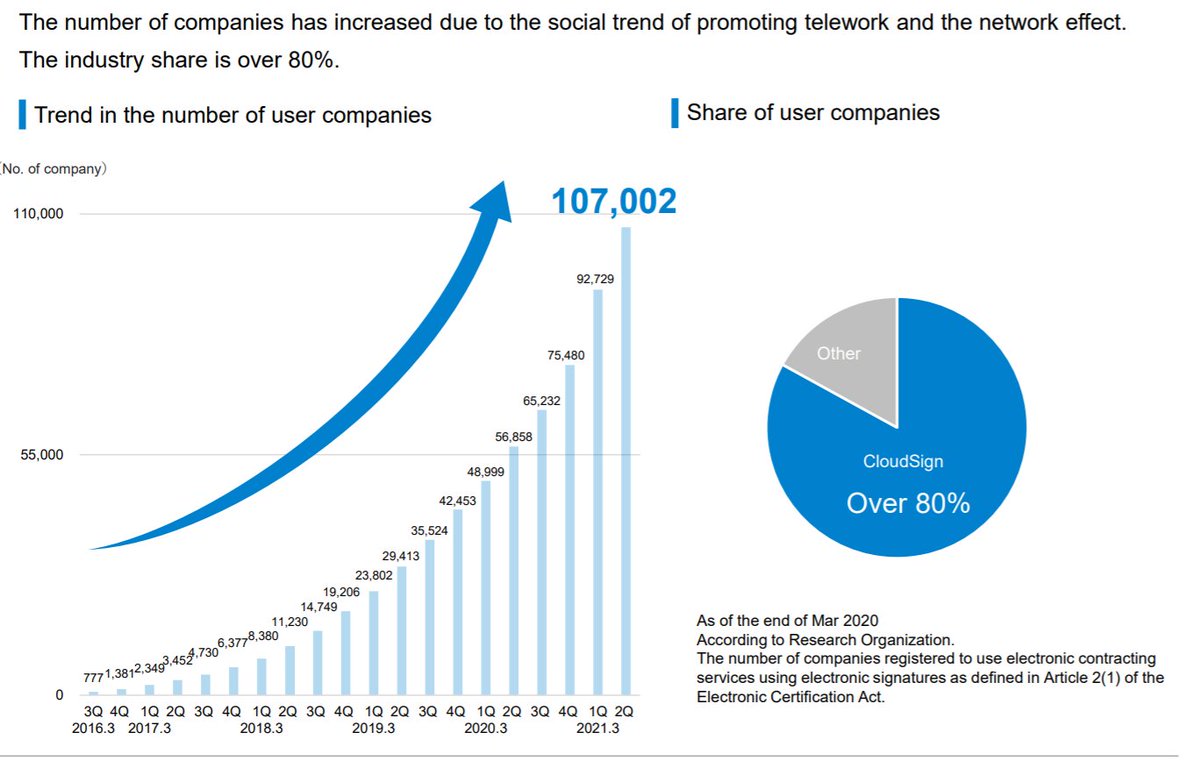

14/15 The digital signature / agreement space should be of interest to most, as $DOCU holds a narrow lead over @bengo4topics's (6027) fast-growing @cloudsign_jp product

15/15 There's some addt'l details around a few other verticals & SaaS adoption metrics by industry, but the above covers most. W/an est. ~19% growth CAGR thru '27, the  enterprise SaaS mkt (Asia's largest) remains in the early innings!

enterprise SaaS mkt (Asia's largest) remains in the early innings!

Pls add any other insights @djtokyo!

enterprise SaaS mkt (Asia's largest) remains in the early innings!

enterprise SaaS mkt (Asia's largest) remains in the early innings!Pls add any other insights @djtokyo!

Read on Twitter

Read on Twitter