1/

Doing some calcs this morning on the #Havieron resource.

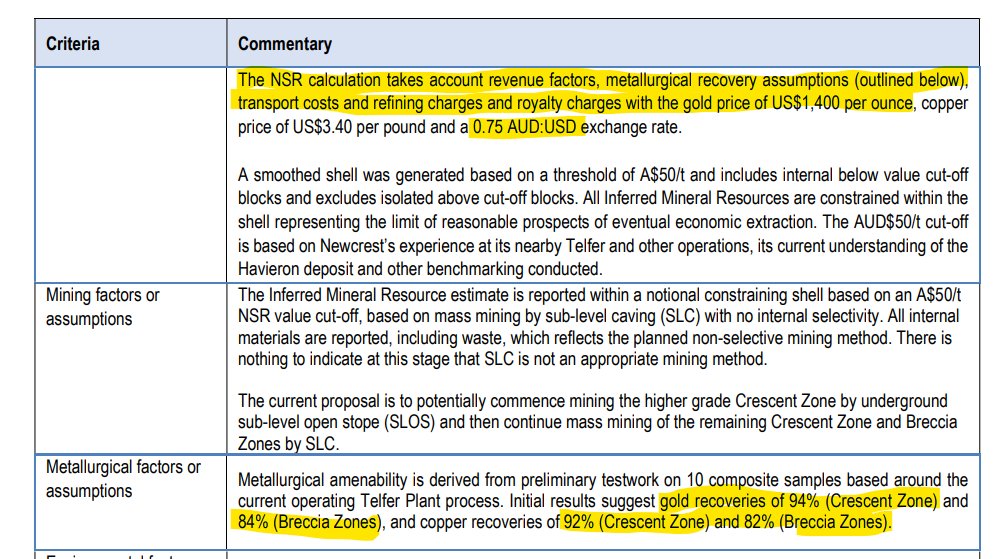

NCM use a NSR figure of AUD$50 / tonne. Look in the appendix of the MRE release in December.

https://greatlandgold.com/wp-content/uploads/2020/12/20201210_Havieron-Iniital-Resource-JORC.pdf

So the NSR value takes all costs into consideration.

#GGP $GGP.L @GreatlandGold

Doing some calcs this morning on the #Havieron resource.

NCM use a NSR figure of AUD$50 / tonne. Look in the appendix of the MRE release in December.

https://greatlandgold.com/wp-content/uploads/2020/12/20201210_Havieron-Iniital-Resource-JORC.pdf

So the NSR value takes all costs into consideration.

#GGP $GGP.L @GreatlandGold

2/

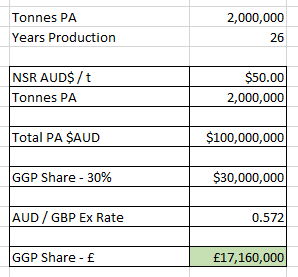

Plugged this into a spreadsheet to work out the #GGP percentage of profits.

Assuming 2Mtpa initially from a stoping operation and using current exchange rates then I get table 1.

Plugged this into a spreadsheet to work out the #GGP percentage of profits.

Assuming 2Mtpa initially from a stoping operation and using current exchange rates then I get table 1.

3/

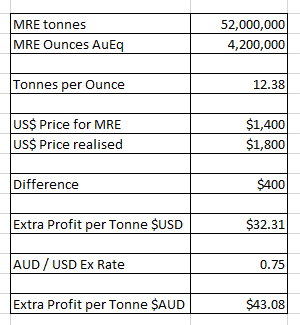

This is using NCM's assumption of USD$1,400 per ounce - I then worked out the increased profit per tonne if the "realised price" were USD$1,800 / ounce and the second table gives an idea of profits.

This is using NCM's assumption of USD$1,400 per ounce - I then worked out the increased profit per tonne if the "realised price" were USD$1,800 / ounce and the second table gives an idea of profits.

4/

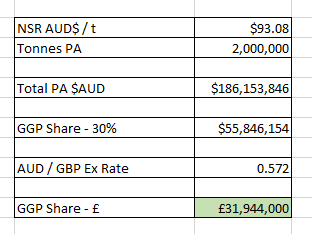

As NCM move from the stoping operation to Sub-Level Caving then the costs should improve and there will be higher production rates.

Hopefully there will be higher gold / copper prices then also.

It's easy to see why the II's are clamouring to get onboard.

As NCM move from the stoping operation to Sub-Level Caving then the costs should improve and there will be higher production rates.

Hopefully there will be higher gold / copper prices then also.

It's easy to see why the II's are clamouring to get onboard.

Read on Twitter

Read on Twitter