Our take on $Curi

@yannis_tweets @InvestingMya @StockMarketNerd @GriffInvesting @yilmazdemirz1 @OphirGottli @BrettVanGorden @FreedomOrBust @plantmath1 @GetBenchmarkCo @antoniovelardo_ @MehdiFarooq2

Thread below

@yannis_tweets @InvestingMya @StockMarketNerd @GriffInvesting @yilmazdemirz1 @OphirGottli @BrettVanGorden @FreedomOrBust @plantmath1 @GetBenchmarkCo @antoniovelardo_ @MehdiFarooq2

Thread below

The company's ambition is to address a full category service within factual streaming and become what ESPN is to the complete sports category

The company's ambition is to address a full category service within factual streaming and become what ESPN is to the complete sports category Although it offers an elevated level of growth at present, its niche business model limits its TAM, in comparison to let's say $ROKU

Although it offers an elevated level of growth at present, its niche business model limits its TAM, in comparison to let's say $ROKU

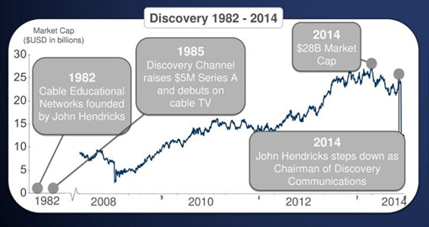

It has Solid management which has delivered before. The company was set up by @JohnSHendricks - the founder of Discovery Communications. Who took @Discovery to new levels (see share price below)

It has Solid management which has delivered before. The company was set up by @JohnSHendricks - the founder of Discovery Communications. Who took @Discovery to new levels (see share price below)

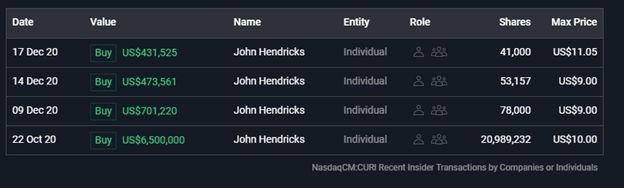

John Hendricks has been galloping some CURI share recently as well. To quote Peter Lynch

John Hendricks has been galloping some CURI share recently as well. To quote Peter Lynch "insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise."

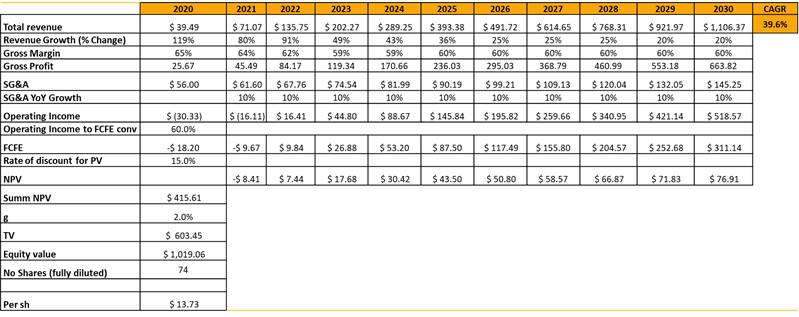

Hypergrowth with >100% Y/Y revenue growth in last three years with 50% CAGR estimated till 2023.

Hypergrowth with >100% Y/Y revenue growth in last three years with 50% CAGR estimated till 2023. #CURI also has an attractive gross margin of 60% due to cheaper average production cost. It cost $500-600k factual documentary to be produced - scripted shows cost $5-$6 million.

#CURI also has an attractive gross margin of 60% due to cheaper average production cost. It cost $500-600k factual documentary to be produced - scripted shows cost $5-$6 million.

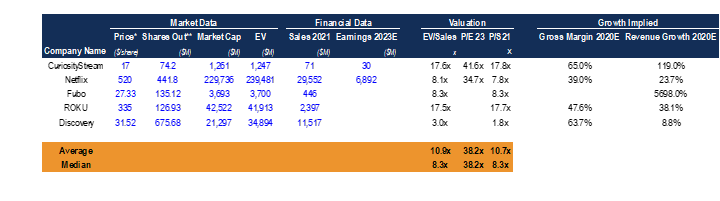

At these price levels, this growth and profitability are not trading at a reasonable price. It's trading at a higher multiple than $Fubo, which has a similar business model. Also, a slight premium compared to $Roku, which can be argued, addresses a significantly larger TAM.

At these price levels, this growth and profitability are not trading at a reasonable price. It's trading at a higher multiple than $Fubo, which has a similar business model. Also, a slight premium compared to $Roku, which can be argued, addresses a significantly larger TAM.

Risk of potential share capital dilution, assuming all warrants are converted, the fully diluted share count is estimated to be around 72.2M. An element market has paid less attention to

Risk of potential share capital dilution, assuming all warrants are converted, the fully diluted share count is estimated to be around 72.2M. An element market has paid less attention to Rapid growth is vital for $CURI – relying on management forecasts. Execution risk?

Rapid growth is vital for $CURI – relying on management forecasts. Execution risk?

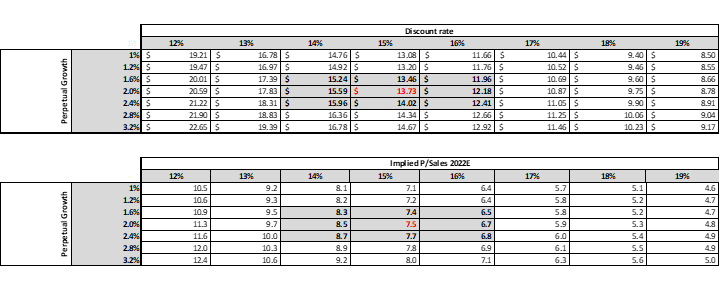

We believe at the current price level $CURI is a hold (USD 16.33 p/sh as of January 8 2021). Fair value based on our valuation model, comes at $13.73

We believe at the current price level $CURI is a hold (USD 16.33 p/sh as of January 8 2021). Fair value based on our valuation model, comes at $13.73

To decode the assumption of our model and for detailed analysis watch our video

To decode the assumption of our model and for detailed analysis watch our video Thank you.

Read on Twitter

Read on Twitter