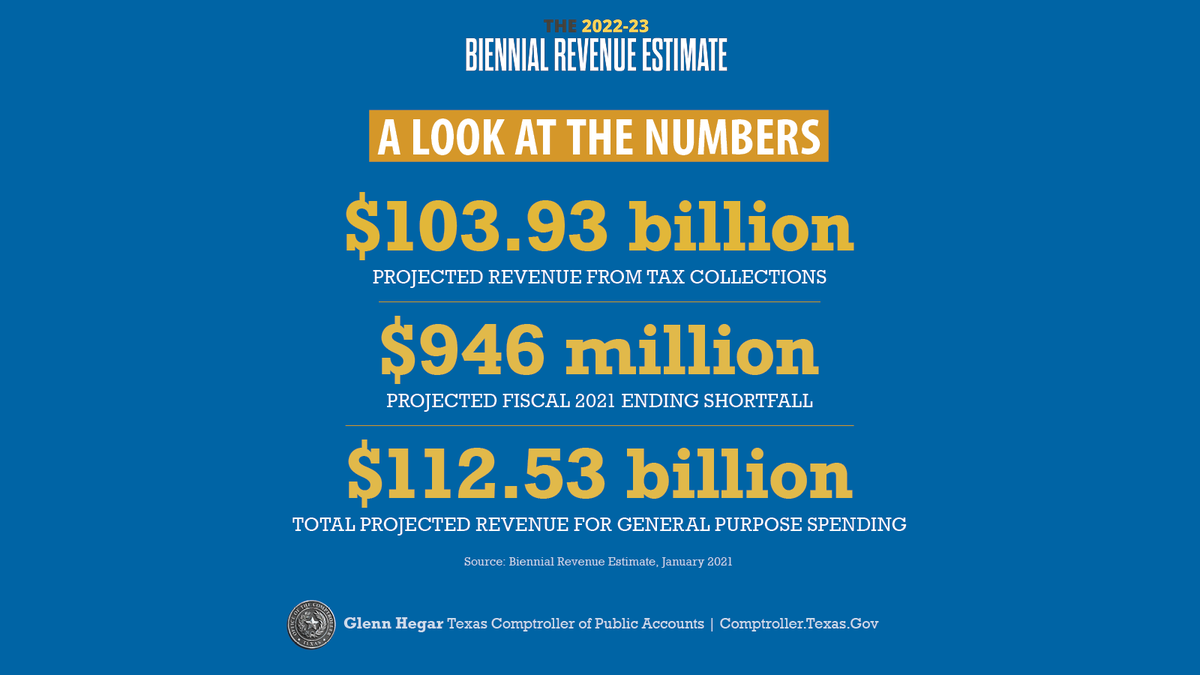

Here it is. Comptroller @Glenn_Hegar has just announced a $112.5 billion revenue projection for the 2022-23 biennium. http://bit.ly/txbre2223

The ending 2020-21 balance will be close to -$1 billion, a direct result of COVID-19’s effect on revenue collections. #BREMonday

The ending 2020-21 balance will be close to -$1 billion, a direct result of COVID-19’s effect on revenue collections. #BREMonday

We expect revenue collections to resume growth in the latter half of FY21 and to continue into the next biennium. Despite anticipated growth, we estimate the revenue available for ‘22-23 will be slightly less than ‘20-21 because of the projected deficit.

The revenue forecast is based on an assumption of continued economic growth through the next biennium, but there remains uncertainty about the ultimate course of the #txeconomy.

Here’s how the math shakes out:

+ $119.58 billion in total GR-R collections

- $946 million ending balance

- $5.83 billion for ESF & SHF transfers

- $270 million transfer to the Texas Tomorrow Fund

= $112.53 billion for general-purpose #txlege spending

#BREMonday

+ $119.58 billion in total GR-R collections

- $946 million ending balance

- $5.83 billion for ESF & SHF transfers

- $270 million transfer to the Texas Tomorrow Fund

= $112.53 billion for general-purpose #txlege spending

#BREMonday

Note, the estimate does not include any possible savings from the 5% cuts state agencies were asked to identify last summer.

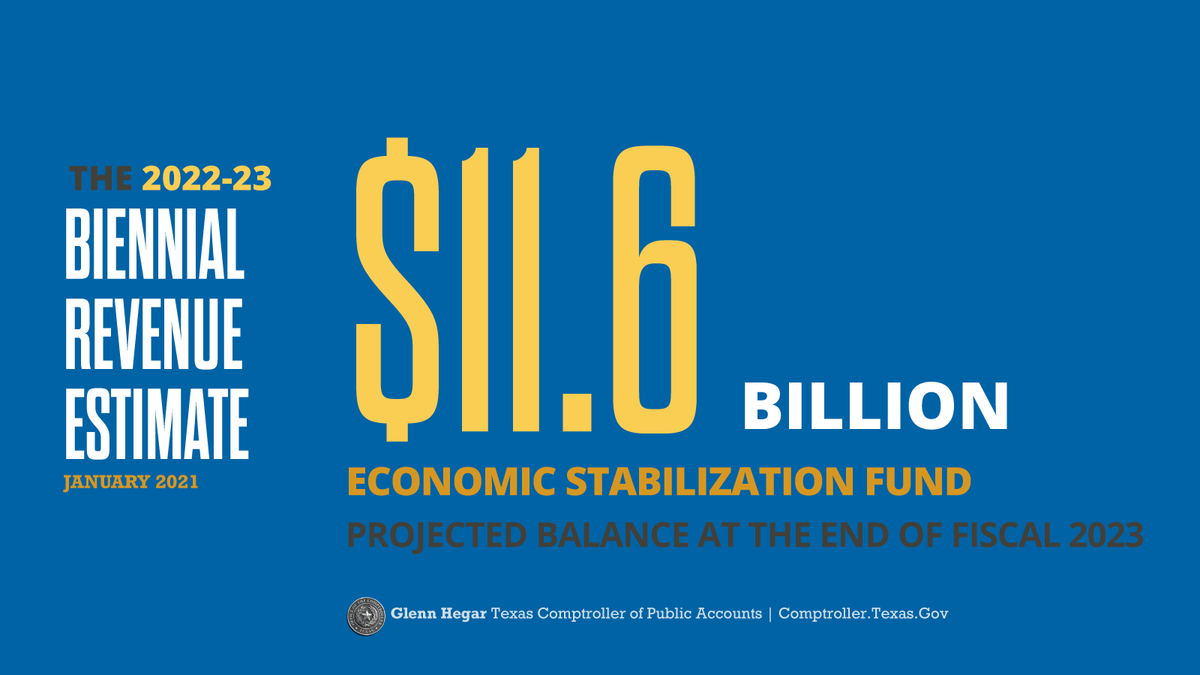

Everyone wants to know, so before we get to the charts, here’s the projection for the Economic Stabilization Fund (aka Rainy Day Fund) #txlege

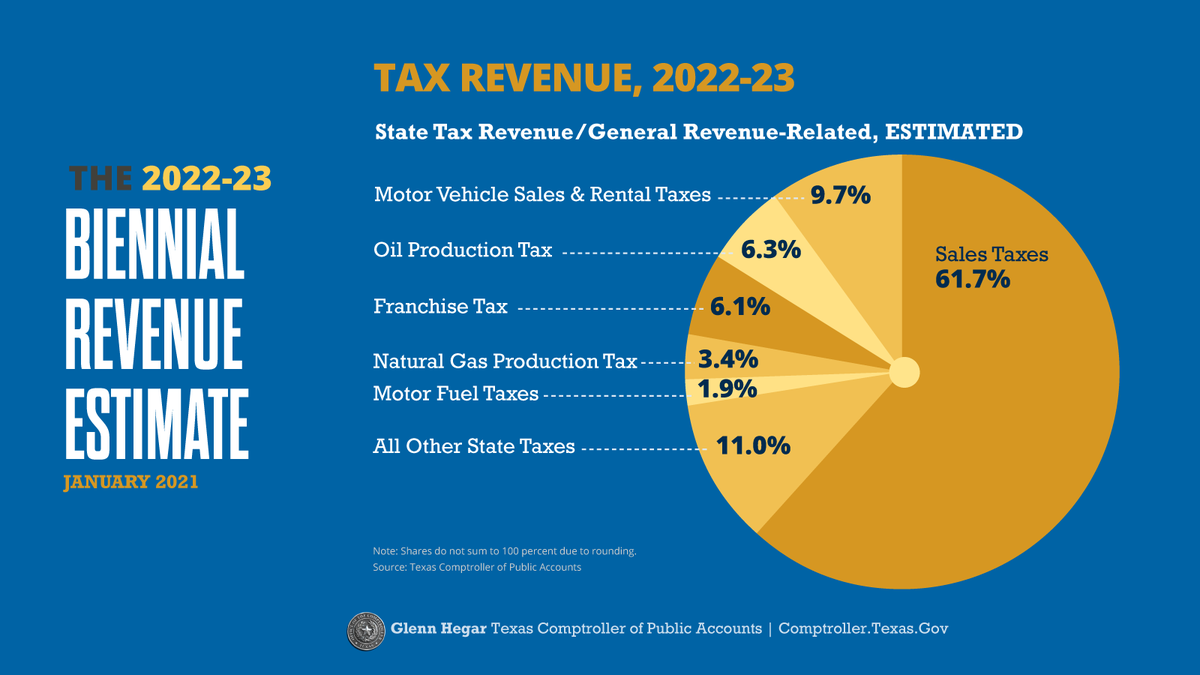

Let’s dig in. Sales taxes are projected to comprise more than 60% of GR-R tax collections. #txbudget

State sales tax collections have performed better than projected during the initial phase of the pandemic, but the last nine months were significantly lower compared to 2019. #txbudget

Texas benefited from the SCOTUS Wayfair case, which required out-of-state online retailers to collect taxes on sales made to Texas consumers. The 86th #txlege’s subsequent HB 1525 required online marketplace providers to collect and remit taxes, too.

In the first 12 months of collections by remote sellers and marketplace providers, state sales tax revenue totaled nearly $1.3 billion. Mostly, this is revenue Texas was not previously collecting. #txbudget

Other sources of revenue have not fared as well, with severance, hotel occupancy and alcoholic beverage taxes getting hit hardest by the pandemic. Though we’ve seen a rebound, some of them are still down by >40% compared to a year ago.

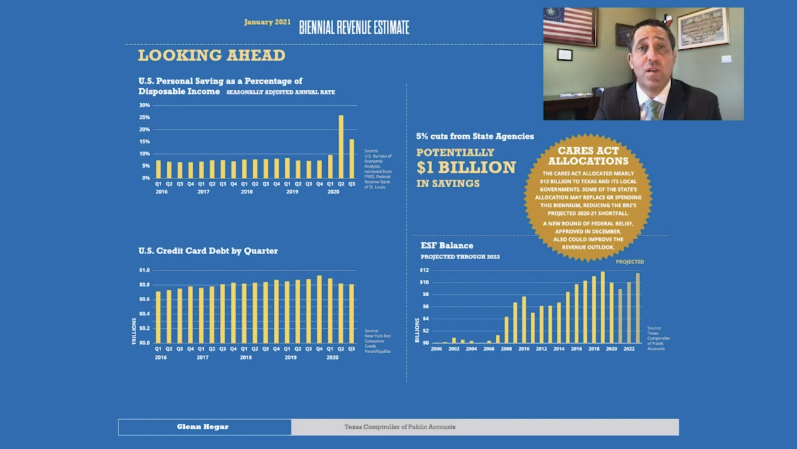

The smart folks in our Revenue Estimating Division are tracking non-traditional indicators to keep a pulse on the health and direction of the economy. They’re following these timely indicators closely during the pandemic. Take a closer look at that data: http://bit.ly/txbre2223

Personal savings rates, enhanced government benefits and consumer debt levels suggest there may be capacity for a surge in consumer spending once pandemic concerns lessen.

The forecast, however, remains clouded with uncertainty. The ultimate path of the pandemic and the behavior of consumers and businesses during a resurgence is difficult to gauge.

There is a wide range of possible outcomes for state revenue through the end of fiscal 2023, and #txlege will face some difficult choices to balance the budget.

You can find analysis about the pandemic’s impact on the state economy in our #BREMonday recommended reading section: http://bit.ly/txbre2223 #FiscalNotes

Read on Twitter

Read on Twitter