Description

Here we go. @SoFi Deep Dive

SoFi is an online finance platform that aims to help high earners not well served (HENWS). Their goal is to “help their member achieve financial independence” and realize the customers’ ambitions.

SoFi is an online finance platform that aims to help high earners not well served (HENWS). Their goal is to “help their member achieve financial independence” and realize the customers’ ambitions.

Here we go. @SoFi Deep Dive

SoFi is an online finance platform that aims to help high earners not well served (HENWS). Their goal is to “help their member achieve financial independence” and realize the customers’ ambitions.

SoFi is an online finance platform that aims to help high earners not well served (HENWS). Their goal is to “help their member achieve financial independence” and realize the customers’ ambitions.

Services 1/2

Services 1/2Offers 4 services for a B2C

1. Borrowing

- student, home, personal loans, and refinancing

2. Investing

- Includes retirement and crypto

3. Banking

- Cash management, SoFi Credit Card

4. Insurance

Services 2/2

Services 2/2B2B Service: SoFi at Work

- A platform for companies to assist their employees to achieve financial goals

- Offers a suite of their services to the company to spread to employees

- Galileo

Galileo

Galileo- API B2B arm of SoFi purchased for $1.2b

- @RobinhoodApp and @Chime were built using Galileo

Offers:

- Account set up & funding

- Direct deposit

- POS authorization

- Bill pay

Edge 1/3

Edge 1/31) Fast

- Borrow Cash

- Invest

- Pay Bills

- Access Cash

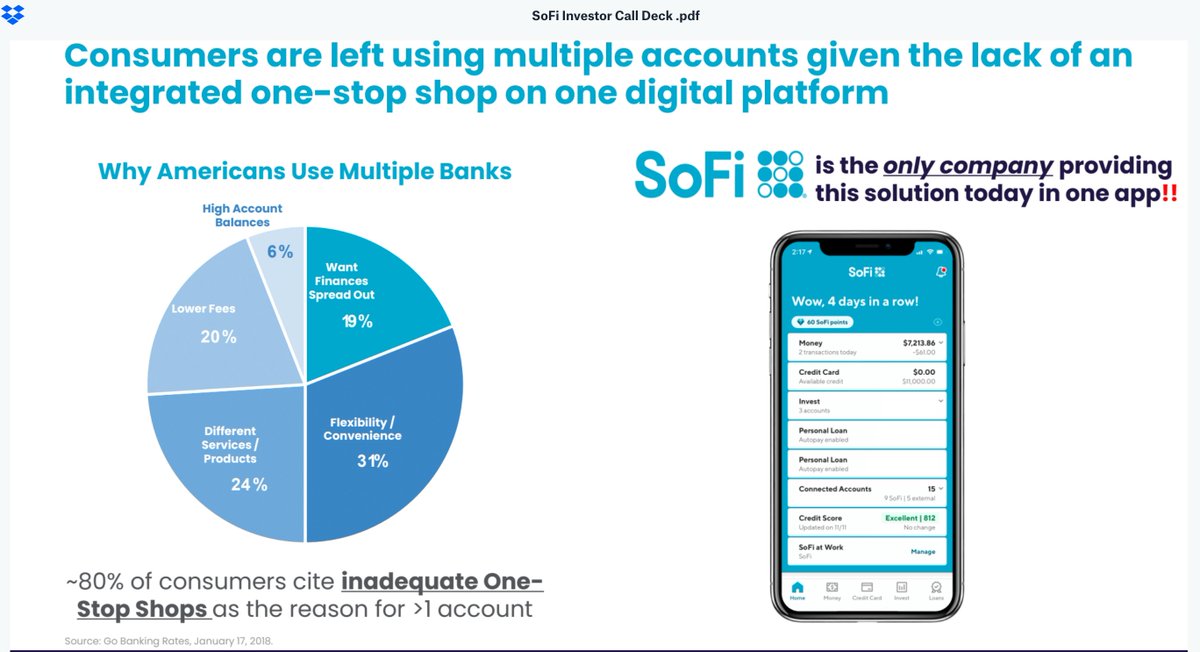

2) One-Stop-Shop for Finance

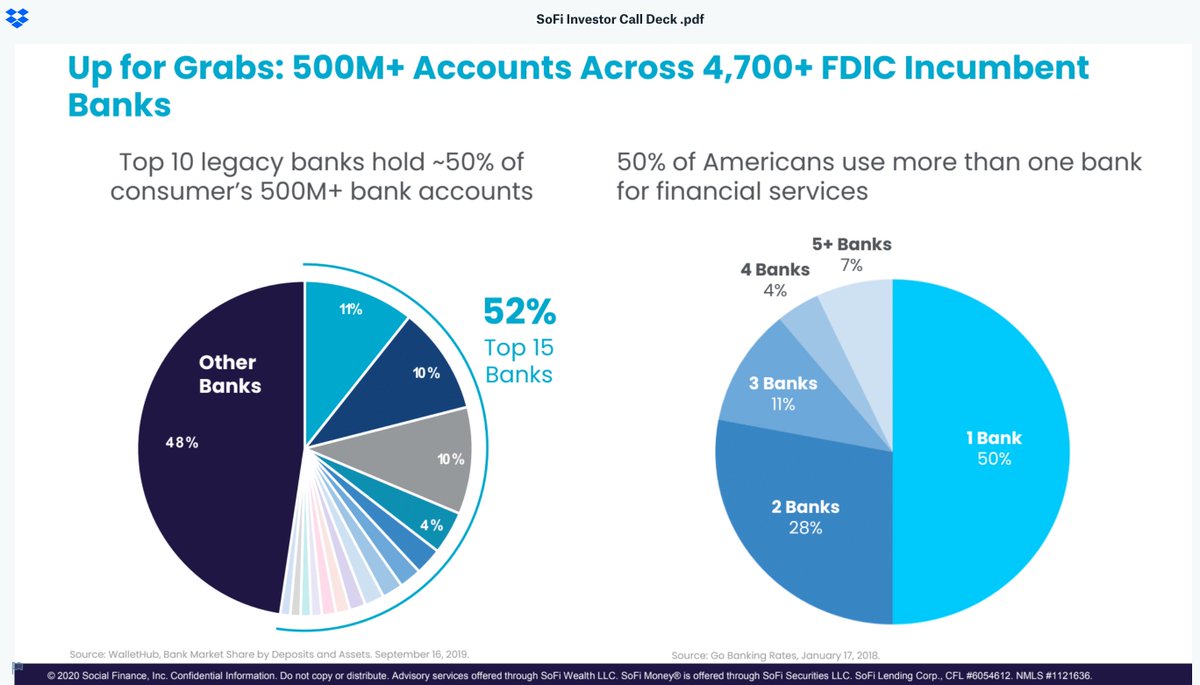

- 50% of Americans use 2+ Banks

- 80% cite inadequate One-Stop-Shop

- Sofi looks to incorporate/solve all the reasons for using 2+ banks

Edge 2/3

Edge 2/3 3) Quality of Content

- Offers tons of education & research

- Investing 101

- Refinance

- Lots of Loan, Mortgage Calculators

4) Quality Selection

- No Cookie Cutter terms

- Personalized member benefits https://www.sofi.com/learn/content/timing-the-stock-market/

Edge 3/3

Edge 3/35) Optionality

- 5 product launches in 1 year

- Products diversified across the financial industry

- Emerging into the Insurance Industry

- Partnered with $LMND and Root https://www.sofi.com/press/sofi-fills-insurance-offerings-together-lemonade-root/

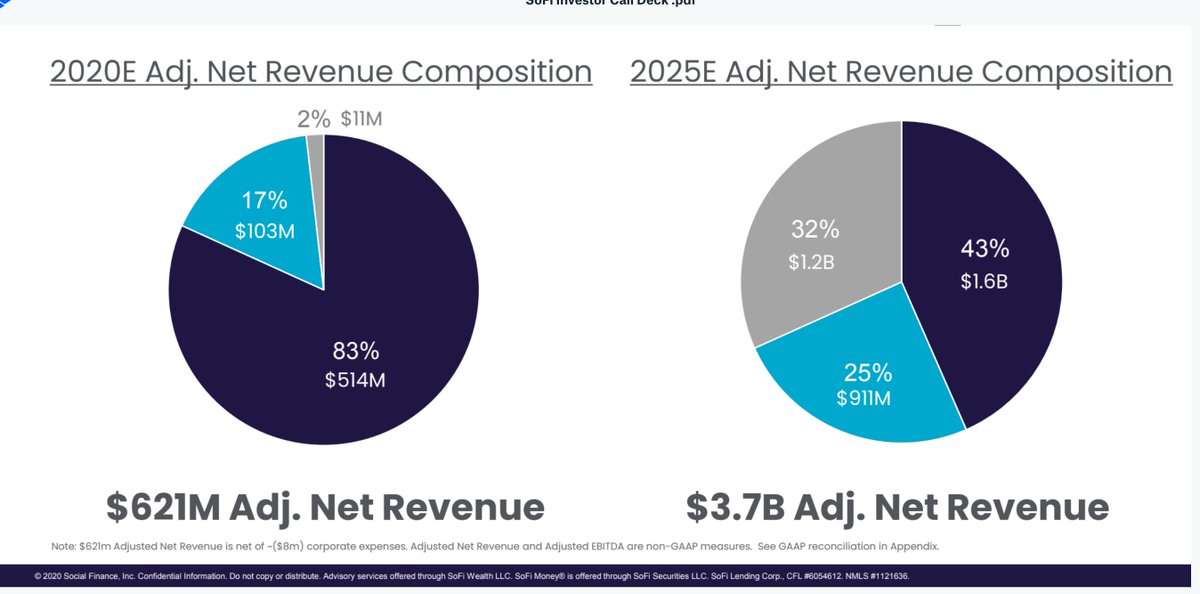

Risks 1/3

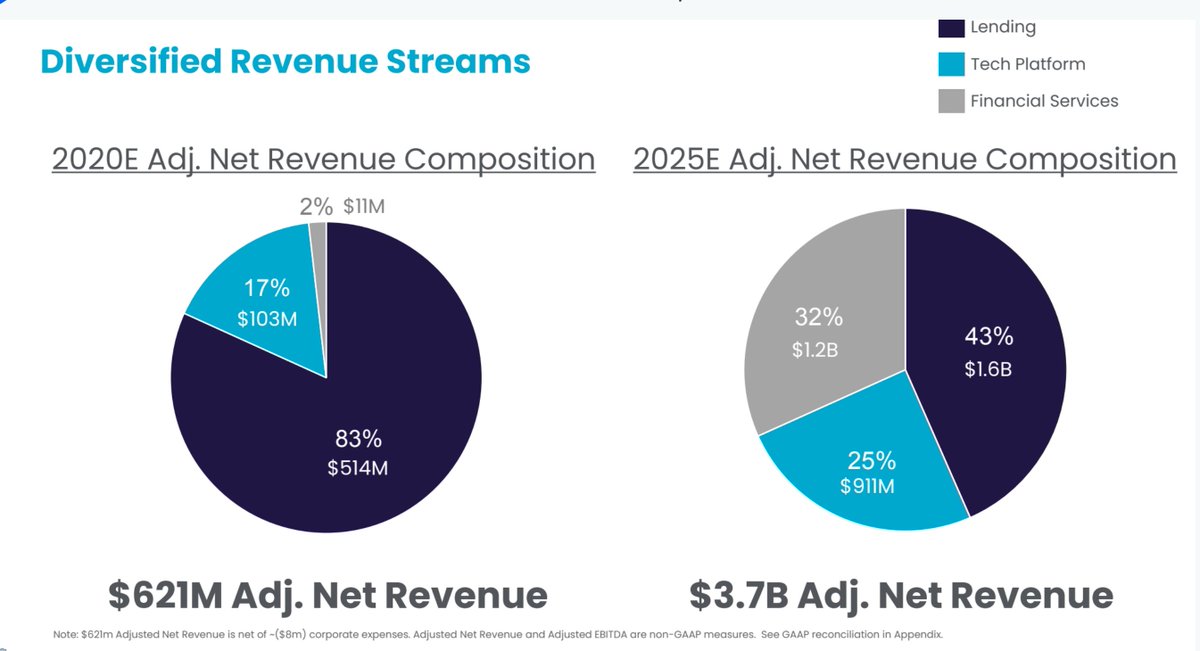

Risks 1/3 Limited diversification

- Diversified in products, but 83% of net rev = loans

- 4.8m in loans, 4m in debt

Crowded space

- Sofi operates in many sectors so they have many competitors

- $SQ biggest competitor

- Bigger user base, could do everything SoFi does

Risks 2/3

Risks 2/3 Growth

- Huge projected growth, they might not pull through

Concentration

- 5 whole loan purchasers account for 53% of principal bal.

- If those loan purchasers leaves at any point in the next 5 yrs, their growth projections would be slaughtered

Risk 3/3

Risk 3/3- Believe the “winner takes most” opportunity remains

- Claim that its Sofi’s time to take that

Thus, advertise themselves w/ companies who won their WTM opportunity:

$AMZN

$NFLX

$FB

They can be a winner in fintech, but comparing @SoFi to $AMZN is worrying

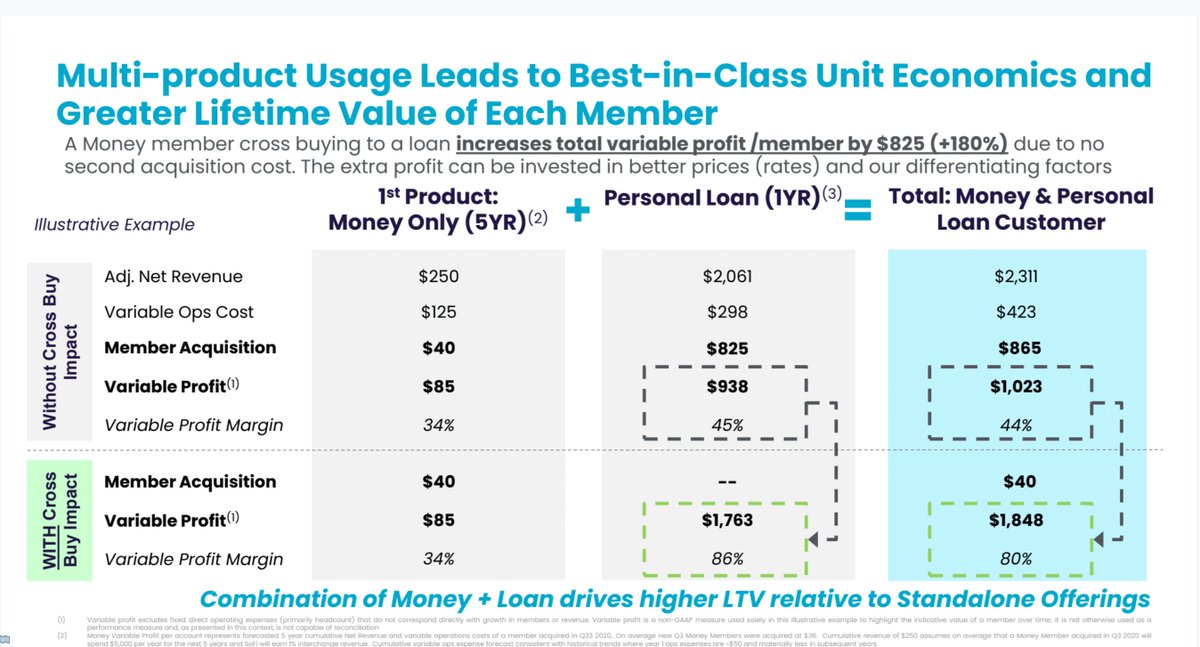

Land and Expand

Land and Expand- Clear Land and Expand strategy @ Sofi

- How?

- Building loyalty w/ product 1

- Building products that flow well w/ each other

- It works very well

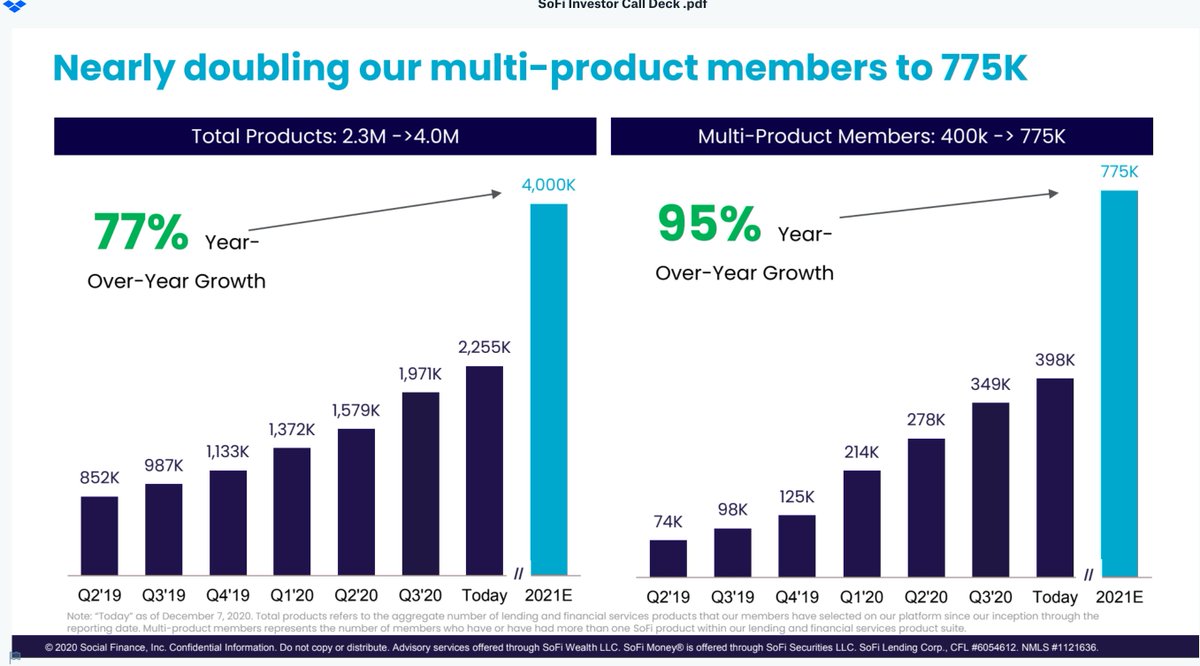

- 95% YoY growth for multi-product members

Network Effects

Network EffectsWith Land and Expand Strategy, Revenue increases @ high rate

Higher revenue growth causes lower CAC and higher profit take

Lower CAC = more net revenue = Sofi is able to lower the costs of products

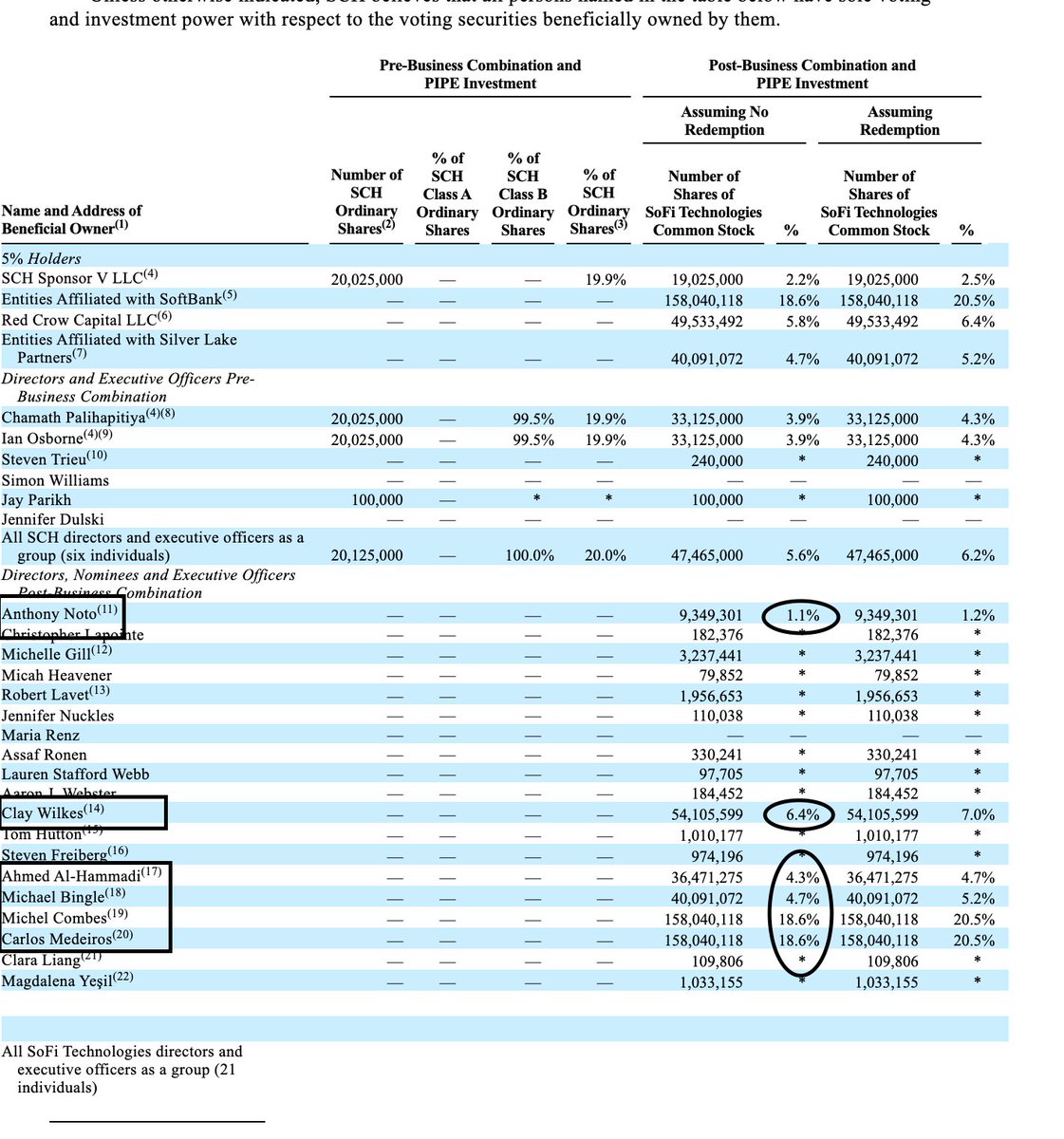

Management

ManagementAnthony Noto- CEO

- Owns 1% of SoFi

- Was COO and CFO at Twitter

Chris Lapointe- CFO

- Global Head of FP&A at Uber

Lauren Stafford Webb- CMO

- Was at Intuit

On Glassdoor

On Glassdoor67% approve of CEO (141 ratings)

3.4 stars

Insider Ownership = 53.7%

Strangely, Board member make up almost all of that

Very odd that management heads don’t own as much

https://www.glassdoor.com/Overview/Working-at-SoFi-EI_IE779979.11,15.htm

Financials

FinancialsYoY Member Growth- 75%

- YoY Multi-Product Member Growth- 95%

- $621m Adj Net Rev

- $8m assets, $5m liabilities

Rev By Product

Lending

- $514m Net Rev

- 58% Margin

Banking

- $11m Net Rev

- On path to profitability

Tech Platform (B2B)

- $103m Net Rev

- 62% Margin

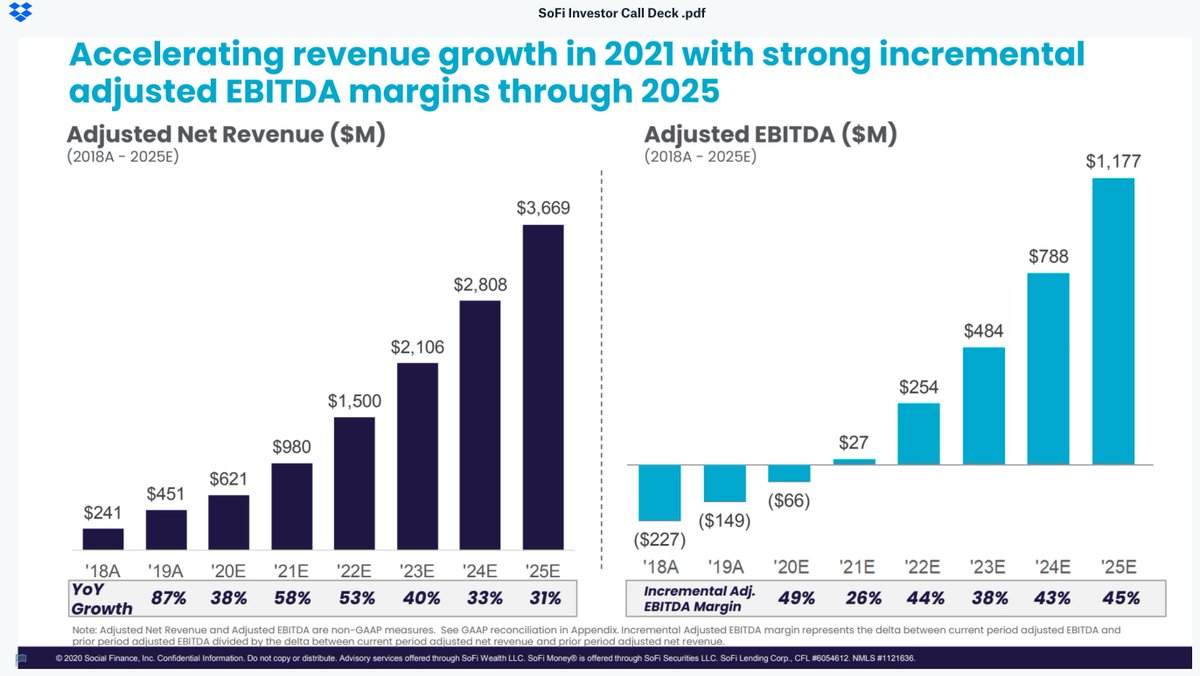

Estimate 1/2

Estimate 1/2 '21 Estimate

- $980m Net Rev

- $27m Adj EBIDTA

- Lending $710m Net Rev

- Tech Platform $226m Net Rev

- Banking $44 Net Rev

'22 Estimate

- $1.5b Net Rev

- $254m Adj EBIDTA

- Lending $956m Net Rev

- Tech Platform $347m Net Rev

- Banking $194m Net Rev

Estimates 2/2

Estimates 2/2 '24 Estimates

- $2.8b Net Rev.

- $788m Adj. EBIDTA

- Lending $1.4b Net Rev

- Tech platform $682 Net Rev

- Banking $765 Net Rev

'25 Estimates

- $3.7b Net Rev.

- $1.2b Adj. EBIDTA

- Lending $1.6b Net Rev

- Tech platform $911 Net Rev

- Banking $1.2 Net Rev

Checklist

ChecklistAs of today, the checklist score is 14 for $IPOE

- This is slightly under investable for me

However, it can get to a score of 19.5

They would need to:

- GM to 80%

- FCF positive + increasing

- Avoid customer concentration

- Beat expectations for 1 year consecutively

Checklist link here https://docs.google.com/spreadsheets/d/1_WA2Mp38AkfewIfohy2Y8jAxzrZul3CUArB-cwKyZz8/edit#gid=0

Checklist link here https://docs.google.com/spreadsheets/d/1_WA2Mp38AkfewIfohy2Y8jAxzrZul3CUArB-cwKyZz8/edit#gid=0

Plan

Plan@SoFi is promising and I love the idea of the biz

However, I own stocks that have the same potential without the risks that SoFi has

I’m really digging SoFi, but until they change some things, I’m staying away

Once they do things mentioned, I would definitely jump in

Read on Twitter

Read on Twitter