How do you decide how much you want to invest in stocks or bonds?

The truth is your asset allocation will play a vital part in your average return.

//THREAD//

The truth is your asset allocation will play a vital part in your average return.

//THREAD//

Let’s start with the basics.

What is asset allocation?

It’s an investment strategy whose goal is to balance risk & return by owning different % of asset classes (stocks,bonds,cash).

Each asset class has different levels of risk.

What is asset allocation?

It’s an investment strategy whose goal is to balance risk & return by owning different % of asset classes (stocks,bonds,cash).

Each asset class has different levels of risk.

Why does asset allocation matter?

Because believe it or not (hard to do on Money Twitter), everyone’s goals, risk tolerance and time horizon for their money is different.

What works for me, doesn’t mean it’ll work for you. The key is determining what will work for YOU.

Because believe it or not (hard to do on Money Twitter), everyone’s goals, risk tolerance and time horizon for their money is different.

What works for me, doesn’t mean it’ll work for you. The key is determining what will work for YOU.

The above, at some point, you’ve likely heard.

But have you ever wondered how do different fund allocations stack against each other?

While past performance is not indicative of future performance, let’s take a look at some historical numbers.

But have you ever wondered how do different fund allocations stack against each other?

While past performance is not indicative of future performance, let’s take a look at some historical numbers.

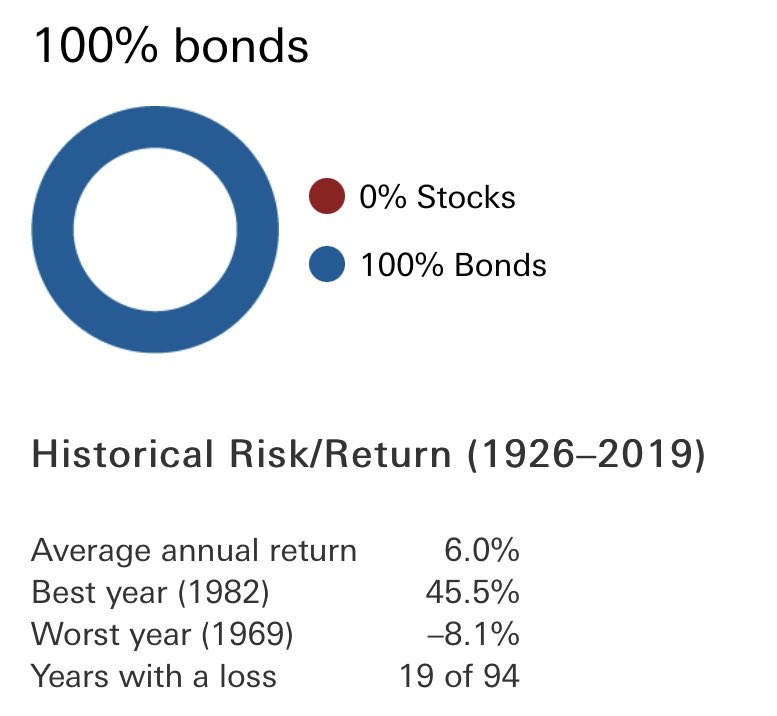

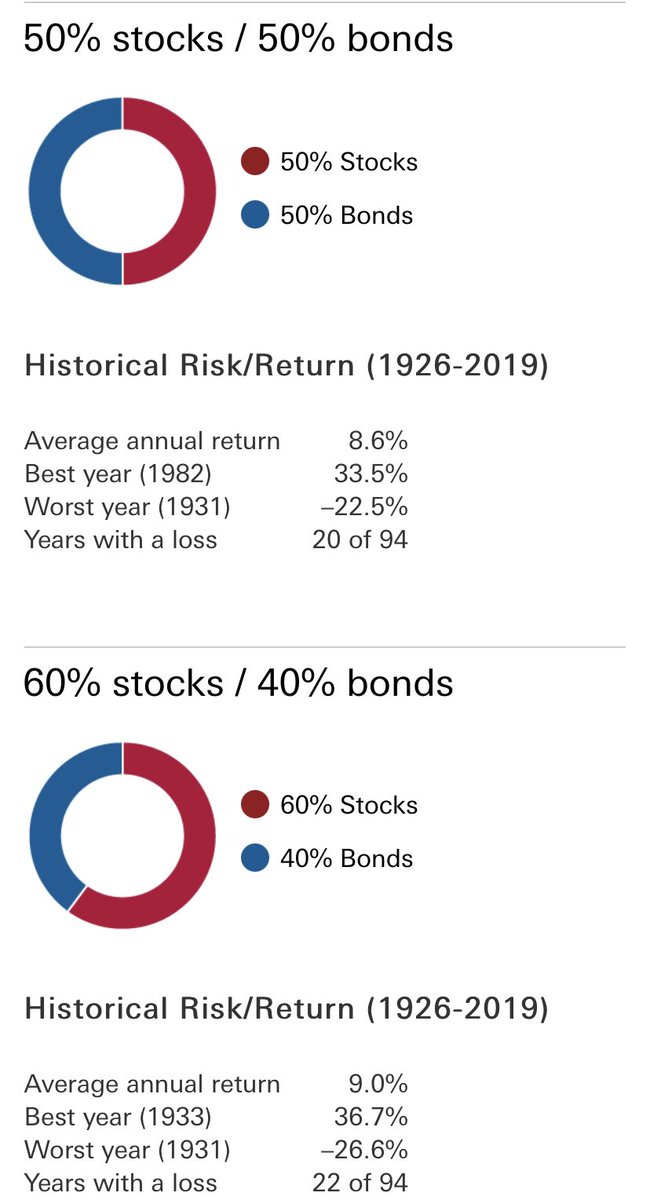

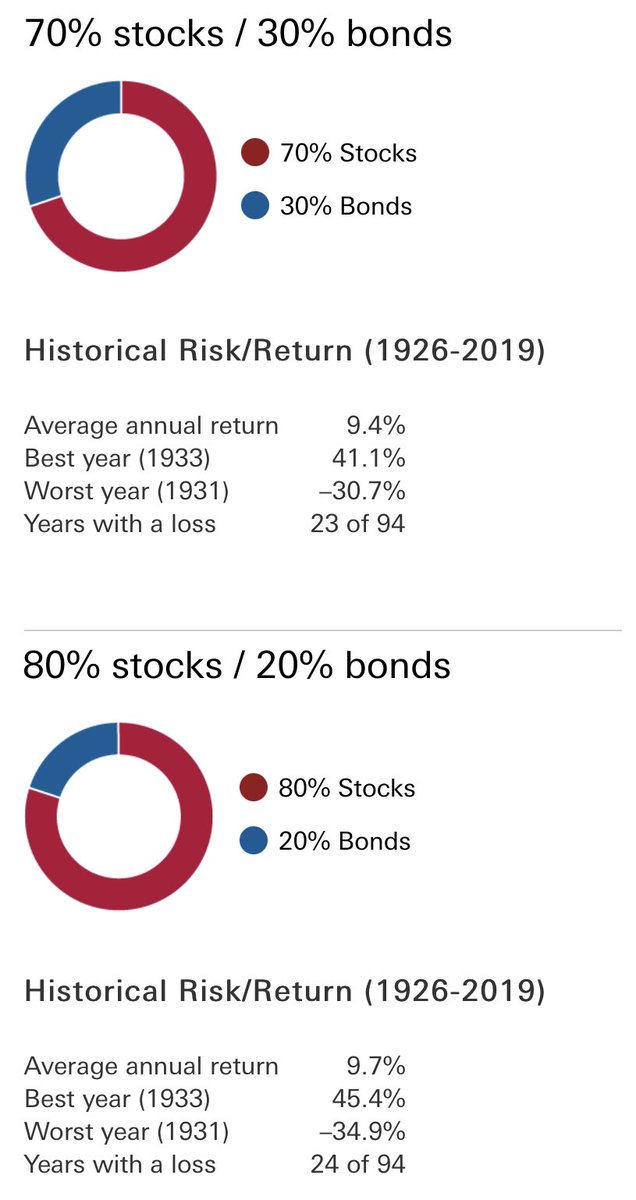

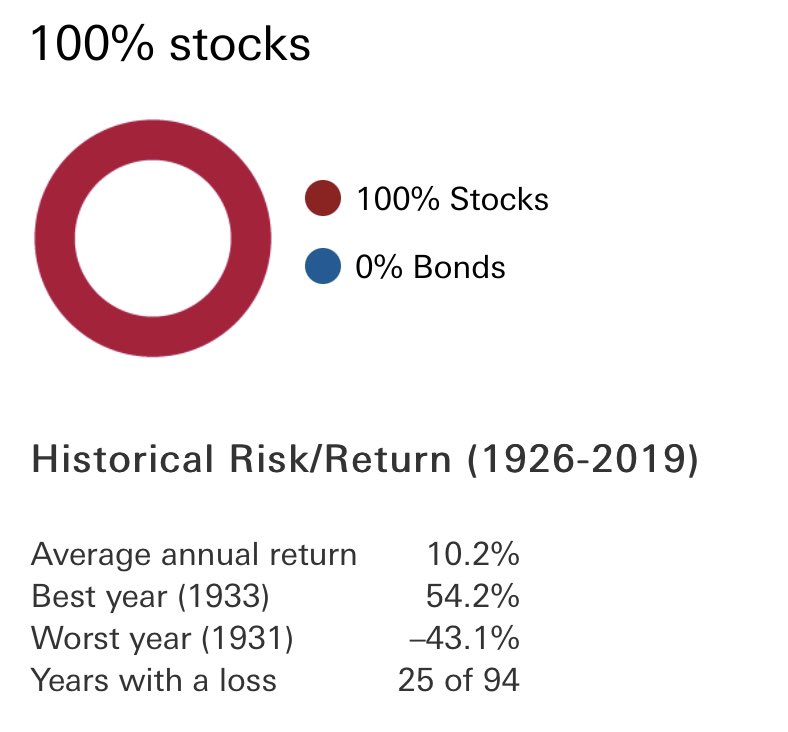

Everything I’m about to show is from Vanguard’s portfolio allocation models

The next few tweets are different stock and bond allocations and how they’ve done from 1926-2019.

“For U.S. stock market returns, we use the Standard & Poor’s 90 Index from 1926 to March 3, 1957, and the Standard & Poor’s 500 Index thereafter.”

“For U.S. bond market returns, we use the Standard & Poor’s High Grade Corporate Index from 1926 to 1968, the Salomon High Grade Index from 1969 to 1972, and the Barclays U.S. Long Credit Aa Index thereafter.”

What caught your eye from all the data?

The one that stood out to me was the 70-30 vs 100-0 allocation.

Because the average annual return difference was 0.8% BUT the worst year difference between the two was 12.4%!

Another was “years with a loss” 23 vs 25

The one that stood out to me was the 70-30 vs 100-0 allocation.

Because the average annual return difference was 0.8% BUT the worst year difference between the two was 12.4%!

Another was “years with a loss” 23 vs 25

This leads us back to what allocation should I use?

That’s something only you can answer.

What it should do is make you think

> how would a worst year scenario make you react?

> are you willing to sacrifice gain for less volatility?

These answers leads to a better decision

That’s something only you can answer.

What it should do is make you think

> how would a worst year scenario make you react?

> are you willing to sacrifice gain for less volatility?

These answers leads to a better decision

Remember,

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

I’m not a financial advisor so make sure to do your own research.

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

I’m not a financial advisor so make sure to do your own research.

What are your thoughts on allocation ?

Has it changed?

If you liked this thread please RT and share.

If you want to see more of the data and different allocations, you can find them at

https://investor.vanguard.com/investing/how-to-invest/model-portfolio-allocation

Has it changed?

If you liked this thread please RT and share.

If you want to see more of the data and different allocations, you can find them at

https://investor.vanguard.com/investing/how-to-invest/model-portfolio-allocation

Read on Twitter

Read on Twitter