1/5 A small thread  with 4 indications that we might have seen or be close to the end of the current #Bitcoin

with 4 indications that we might have seen or be close to the end of the current #Bitcoin  dip

dip

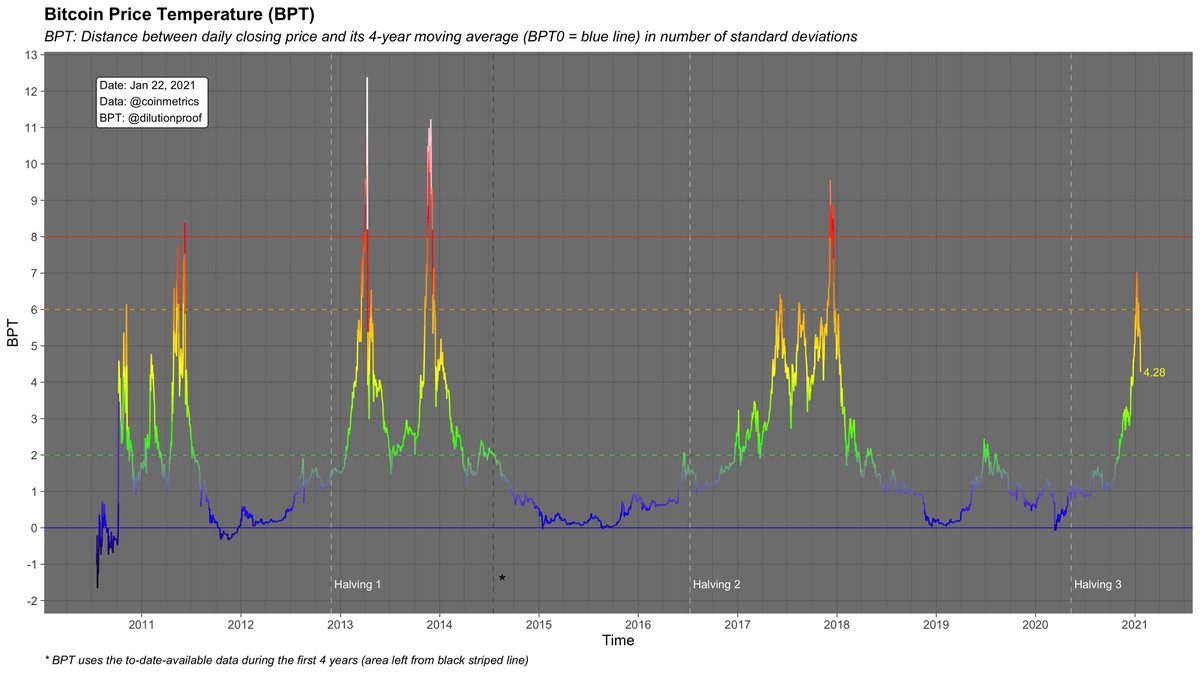

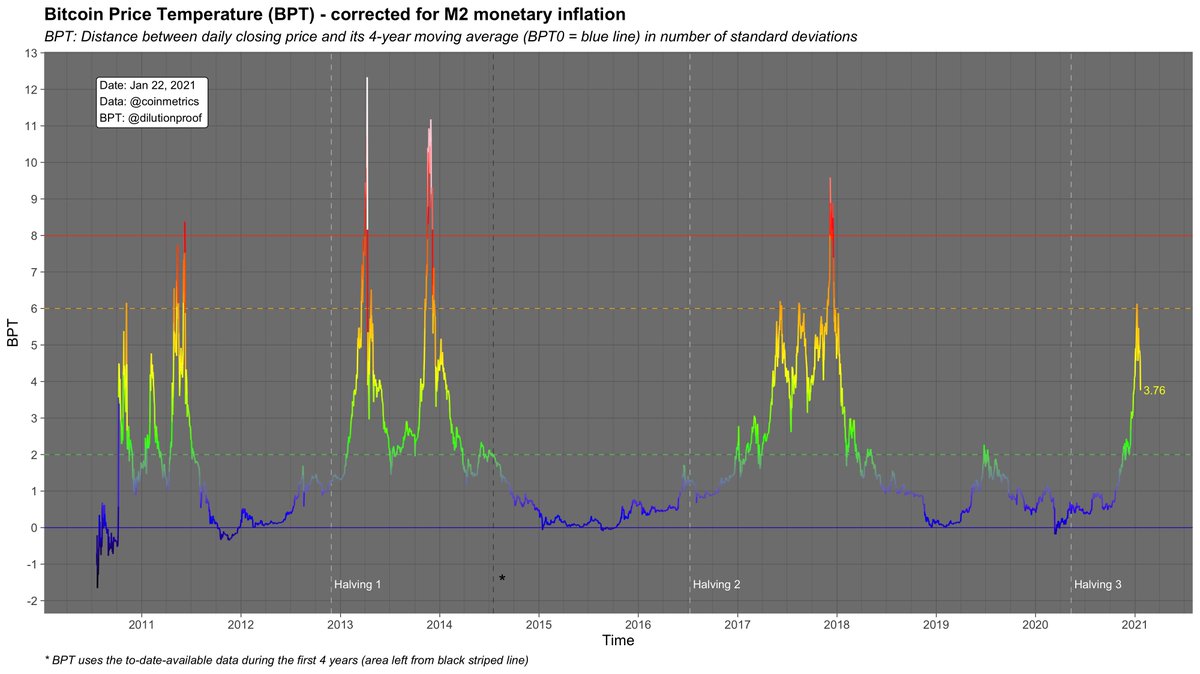

Included charts: SOPR, GBTC premium, BPT + BPT/M2 & comparison with 2017 dips

with 4 indications that we might have seen or be close to the end of the current #Bitcoin

with 4 indications that we might have seen or be close to the end of the current #Bitcoin  dip

dipIncluded charts: SOPR, GBTC premium, BPT + BPT/M2 & comparison with 2017 dips

2/5 The Spent Output Profit Ratio (SOPR) quantifies if the daily sold #Bitcoin  were in a profit (>1) or loss (<1)

were in a profit (>1) or loss (<1)

The SOPR just reset to 1

Under market conditions, this has historically been a key support level, as few market participants are prepared to sell at a loss

market conditions, this has historically been a key support level, as few market participants are prepared to sell at a loss

were in a profit (>1) or loss (<1)

were in a profit (>1) or loss (<1)The SOPR just reset to 1

Under

market conditions, this has historically been a key support level, as few market participants are prepared to sell at a loss

market conditions, this has historically been a key support level, as few market participants are prepared to sell at a loss

3/5 The Grayscale premium has dropped to 1.63%

This is the lowest since October 2015, with only March 2017 (early market phase) coming close

market phase) coming close

This is an opportunity for institutional investors that use $GBTC as a vehicle, who don't hesitate to buy: https://twitter.com/dilutionproof/status/1352169812466741248?s=20

This is the lowest since October 2015, with only March 2017 (early

market phase) coming close

market phase) coming closeThis is an opportunity for institutional investors that use $GBTC as a vehicle, who don't hesitate to buy: https://twitter.com/dilutionproof/status/1352169812466741248?s=20

4/5 Both the #Bitcoin  Price Temperature & the M2 inflation corrected version recently hit the BPT6 band that offered clear resistance during the early

Price Temperature & the M2 inflation corrected version recently hit the BPT6 band that offered clear resistance during the early  phase of the 2017 cycle

phase of the 2017 cycle

Both have now cooled off considerably since then, also to a similar degree as the pull-backs in 2017

Price Temperature & the M2 inflation corrected version recently hit the BPT6 band that offered clear resistance during the early

Price Temperature & the M2 inflation corrected version recently hit the BPT6 band that offered clear resistance during the early  phase of the 2017 cycle

phase of the 2017 cycleBoth have now cooled off considerably since then, also to a similar degree as the pull-backs in 2017

5/5 During 2017, there were six 29-38% dips on the way up

The current dip is now -31.43% since the $42k ATH

All interpretations in this assume that cycles will be similar, which isn't necessarily the case. If you are convinced they will, this might be a BTFD opportunity

assume that cycles will be similar, which isn't necessarily the case. If you are convinced they will, this might be a BTFD opportunity

The current dip is now -31.43% since the $42k ATH

All interpretations in this

assume that cycles will be similar, which isn't necessarily the case. If you are convinced they will, this might be a BTFD opportunity

assume that cycles will be similar, which isn't necessarily the case. If you are convinced they will, this might be a BTFD opportunity

Read on Twitter

Read on Twitter