President Biden will sign an executive order today directing Treasury to find ways to deliver stimulus payments to the millions of eligible people who have not yet received this critical relief. https://www.whitehouse.gov/briefing-room/statements-releases/2021/01/22/fact-sheet-president-bidens-new-executive-actions-deliver-economic-relief-for-american-families-and-businesses-amid-the-covid-19-crises/

This group is made up of people who aren’t required to file tax returns (b/c they don’t have enough income) – that is, very low-income families & individuals, & people who have been disconnected from the labor market for long periods.

Reaching non-filers is even more important now b/c the Dec. relief bill expanded eligibility to people in mixed-status households – e.g. a U.S. citizen whose spouse lacks documented status – who were previously left out, & many will need to file a tax return to get payments.

At a time when 90 million adults (more than 1 in 3) reported trouble paying for usual household expenses, it’s crucial to deliver support to low-income people who are eligible but face barriers to claiming their payment. https://www.cbpp.org/research/poverty-and-inequality/tracking-the-covid-19-recessions-effects-on-food-housing-and

In terms of possible practical impact of the EO, Treasury can

1. Assess & build on past outreach

2. Revamp & simplify non-filer portal (e.g. make it mobile-friendly)

3. Expand media campaigns (e.g. through Spanish-language outlets)

4. Form partnerships w/groups serving immigrants

1. Assess & build on past outreach

2. Revamp & simplify non-filer portal (e.g. make it mobile-friendly)

3. Expand media campaigns (e.g. through Spanish-language outlets)

4. Form partnerships w/groups serving immigrants

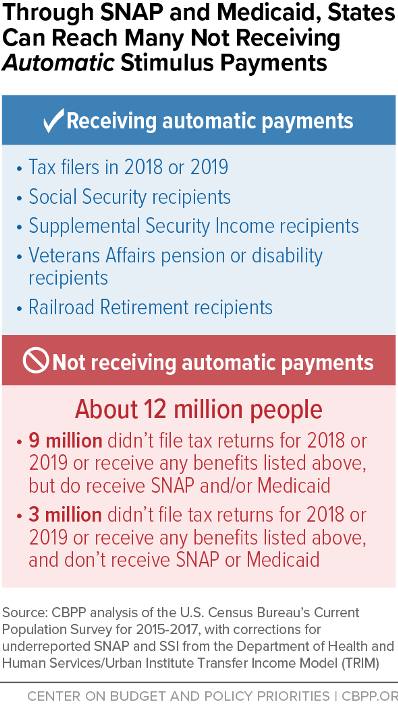

One big way to reach very large numbers of low-income people: Treasury can work with state human services agencies to get payments to millions of people who participate in SNAP or Medicaid but who don’t file tax returns. https://www.cbpp.org/research/federal-tax/aggressive-state-outreach-can-help-reach-the-12-million-non-filers-eligible-for

The IRS already coordinated w/federal agencies (e.g. SSA, VA) to send payments to recipients of federally-administered benefits, like Social Security and SSI. This effort provided a critical lifeline to millions of people who otherwise would've had to file to get a payment.

Treasury can now explore ways to coordinate with state agencies that administer federal benefits, who can use existing channels of communication to reach people enrolled in their programs.

Example: States can conduct targeted outreach & give people info about obtaining stimulus payments. Treasury should also consider ways to share data with these state agencies to make payments automatic – & work with Congress to make it happen.

Read on Twitter

Read on Twitter