Over the last couple of days, we have picked up some new data on the Scottish economy. Here’s a thread summarising some of the key messages that are emerging…

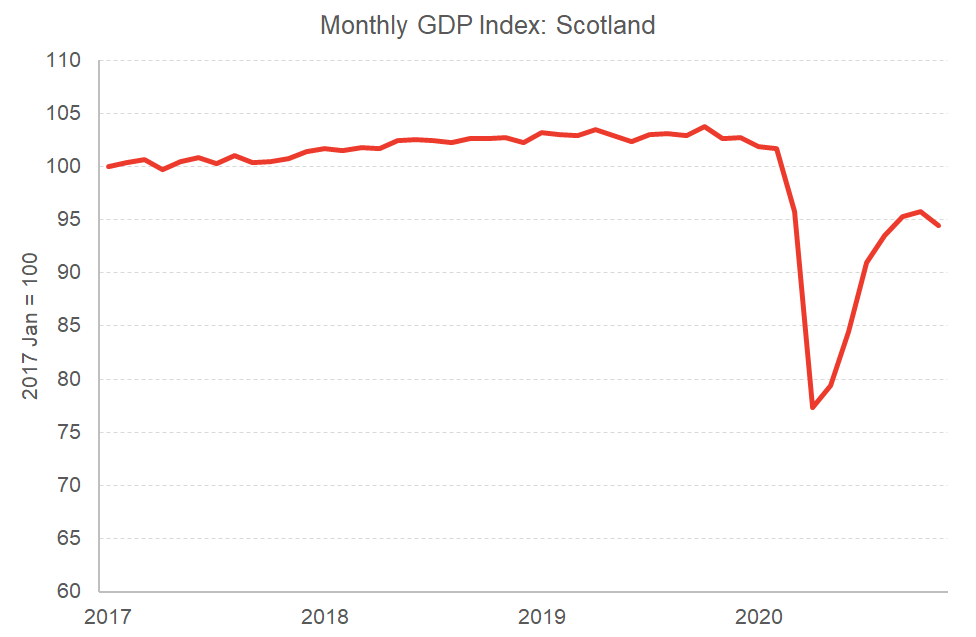

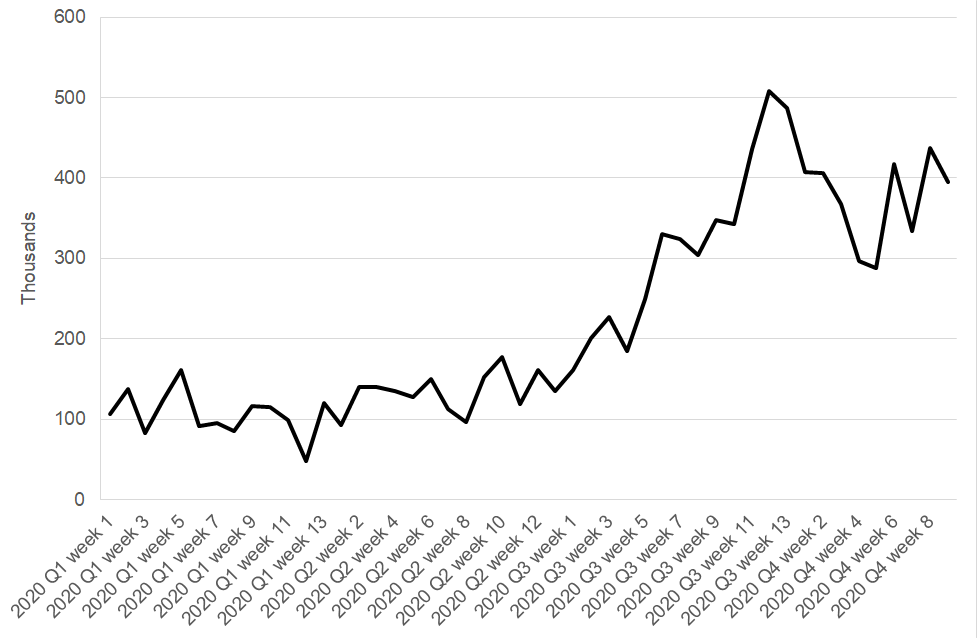

@ScotGov published new data on GDP up to Nov today. You can get the data here: https://www.gov.scot/publications/monthly-gdp-november-2020/. These data show that the economic recovery slipped back for the first time since the height of lockdown in April...

Of course, monthly GDP is volatile, but the chart below confirms what we already knew - the pace of recovery slowed in autumn, even before the escalation of national lockdown in early 2021...

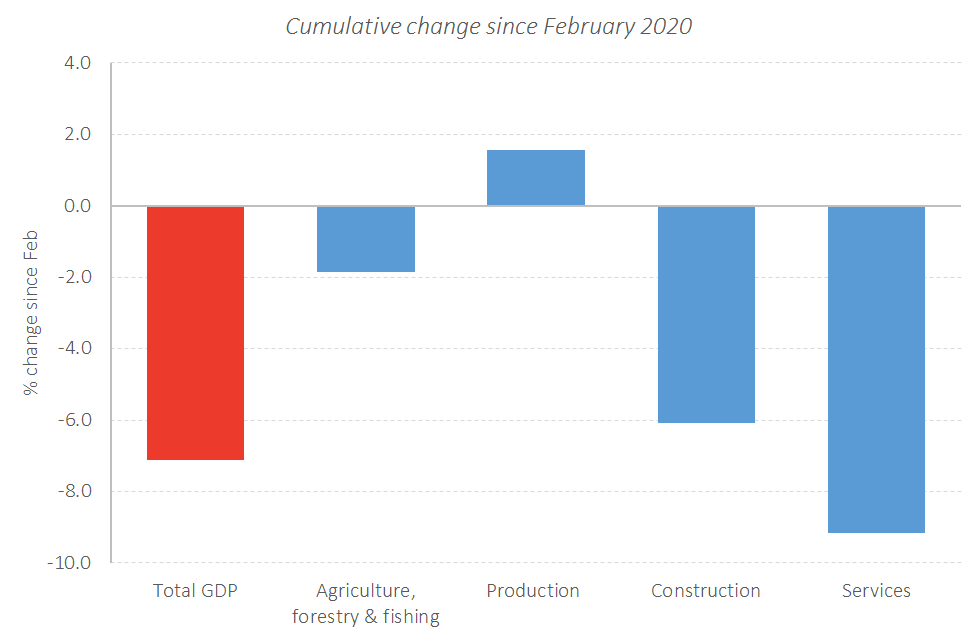

We can see the ‘K’ shaped recession clearly in play – of the 7% hit to overall activity a third of that is coming from Accommodation & food services and Arts, Culture & Recreation which combined represent <5% of the Scottish economy...

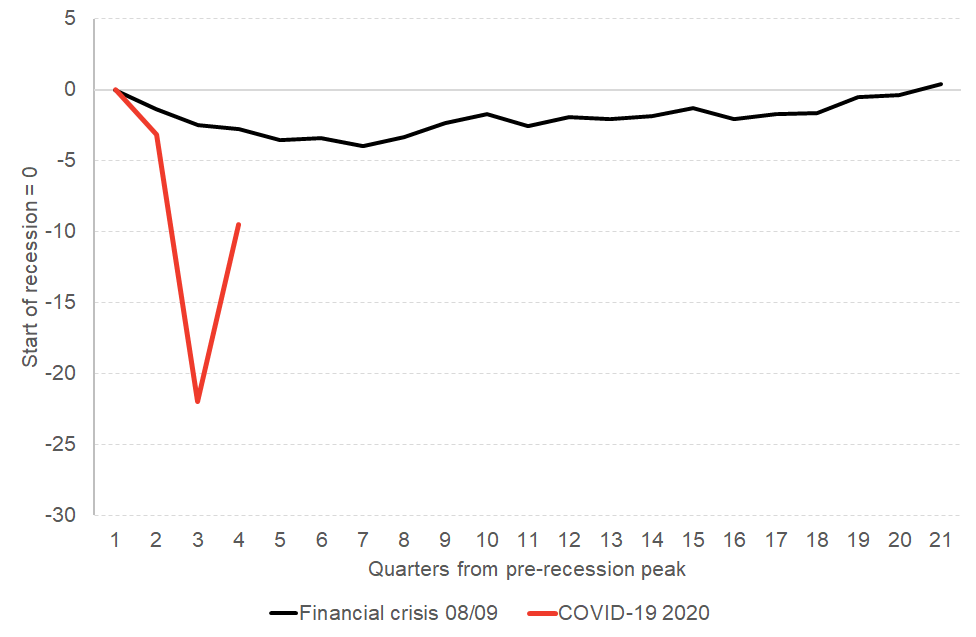

GDP for Q4 isn’t released until March, but given today’s figures and UK numbers last week, it’s unlikely to be pretty. And with lockdown intensifying in Q1 2021, we’re clearly taking a step back on our road to recovery before things get better...

It’s likely to be some time before we cross back over pre-pandemic levels of activity and even then some sectors will take longer to recover than others...

As an aside to all this, Scottish and UK numbers showing a big fall in some public services – including health (which may seem counterintuitive). ONS have a blog on this ( https://blog.ons.gov.uk/2020/12/21/the-virus-the-vaccine-and-gdp-measuring-healthcare-through-the-pandemic/), and @EdConwaySky has highlighted this issue: ( https://twitter.com/EdConwaySky/status/1345050498076958724?s=20)

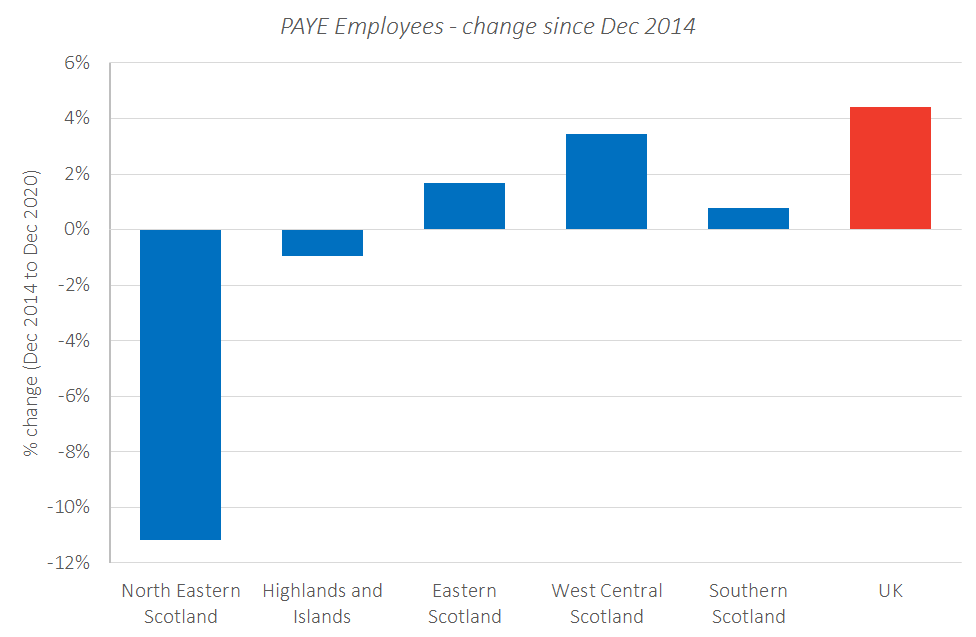

We’ve spoken before about the regional dimension to all this – from remote rural areas to city centres. We’ve also spoken about particular challenges facing North East. This chart is quite sobering – shows the fall in PAYE employees by UK region.

You can get the data here: https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/bulletins/earningsandemploymentfrompayasyouearnrealtimeinformationuk/january2021. Three areas in London have seen the largest falls, followed by NE Scotland with a fall in employees of 5.3% over the year.

Concern too about the long-term trend. Big fall since 2014. Caveats around experimental stats & NE has relatively unique LM given Oil & Gas. But even if only partially reflective of situ on the ground, it shows the scale of the challenge – with big implications for tax take too.

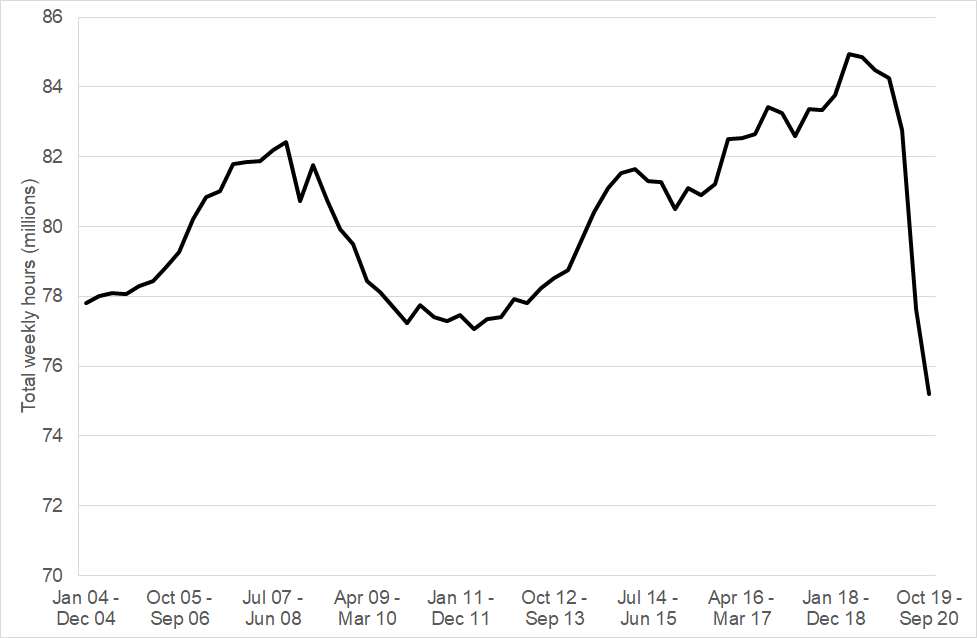

@stuartgmcintyre summarised some of the key labour market data yesterday. Despite headline indicators seeing only modest changes, it's clear that things are exceptionally challenging for people at the moment - and will remain so for some time. https://twitter.com/stuartgmcintyre/status/1354031975879868416?s=20

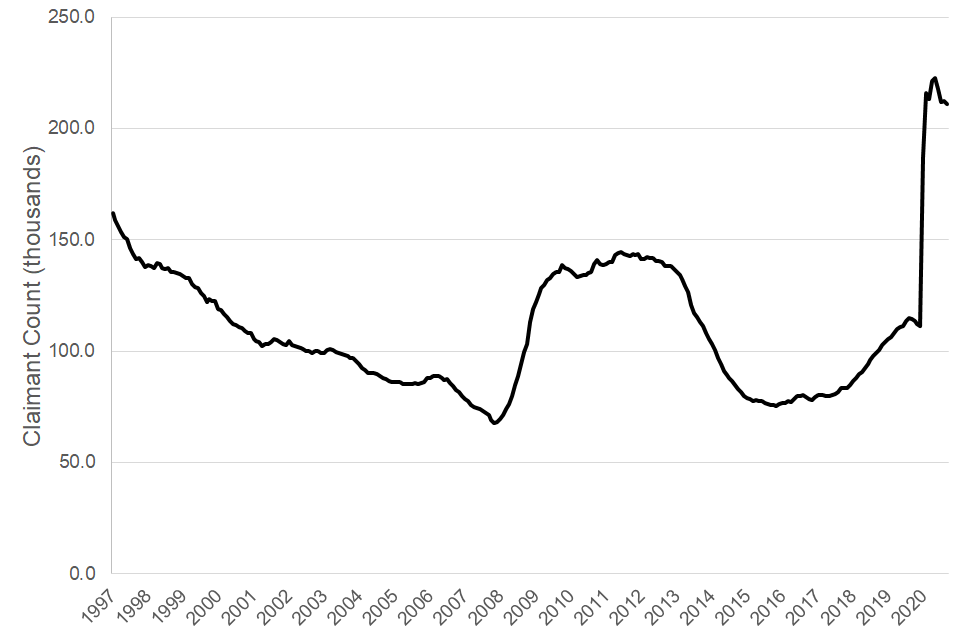

The clearest sign of how challenging things are can be seen in the claimant count data (the count of those claiming unemployment related benefits), which is up by almost 100,000 in Scotland since the start of the pandemic...

Read on Twitter

Read on Twitter