So I learnt today that there is something called The Big Mac index.

The Big Mac index, published by The Economist in 1986, is a novel way of measuring whether the market exchange rates for different countries’ currencies are overvalued or undervalued (Statista).

The Big Mac index, published by The Economist in 1986, is a novel way of measuring whether the market exchange rates for different countries’ currencies are overvalued or undervalued (Statista).

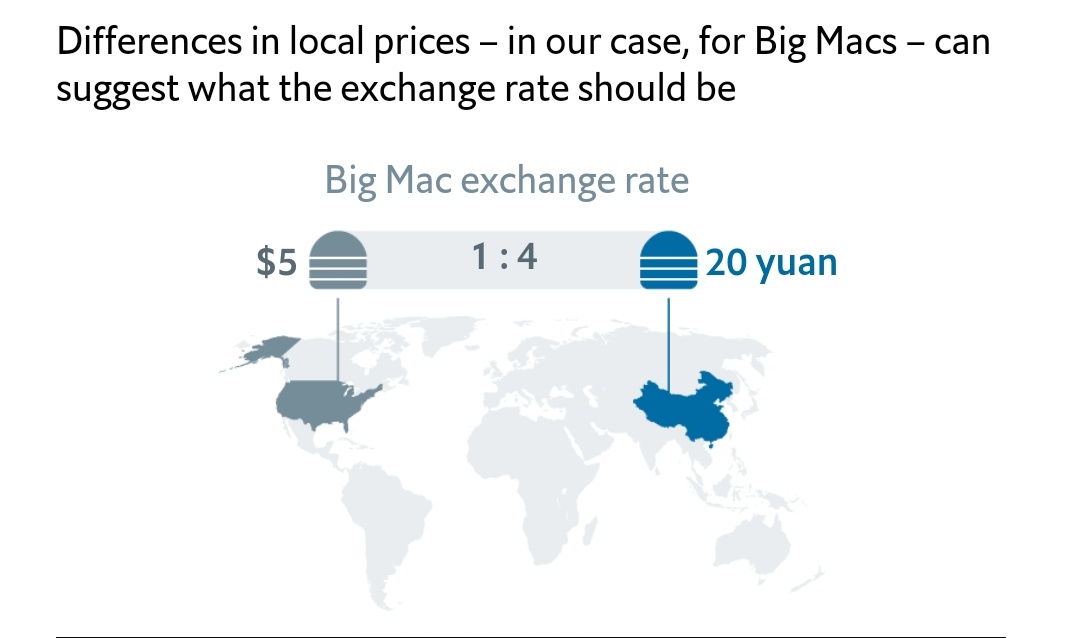

It works by measuring each currency against a common standard – the Big Mac hamburger sold by McDonald’s restaurants all over the world.

Twice a year the Economist converts the average national price of a Big Mac into U.S. dollars using the exchange rate at that point in time.

Twice a year the Economist converts the average national price of a Big Mac into U.S. dollars using the exchange rate at that point in time.

As a Big Mac is a completely standardized product across the world, the argument goes that it should have the same relative cost in every country.

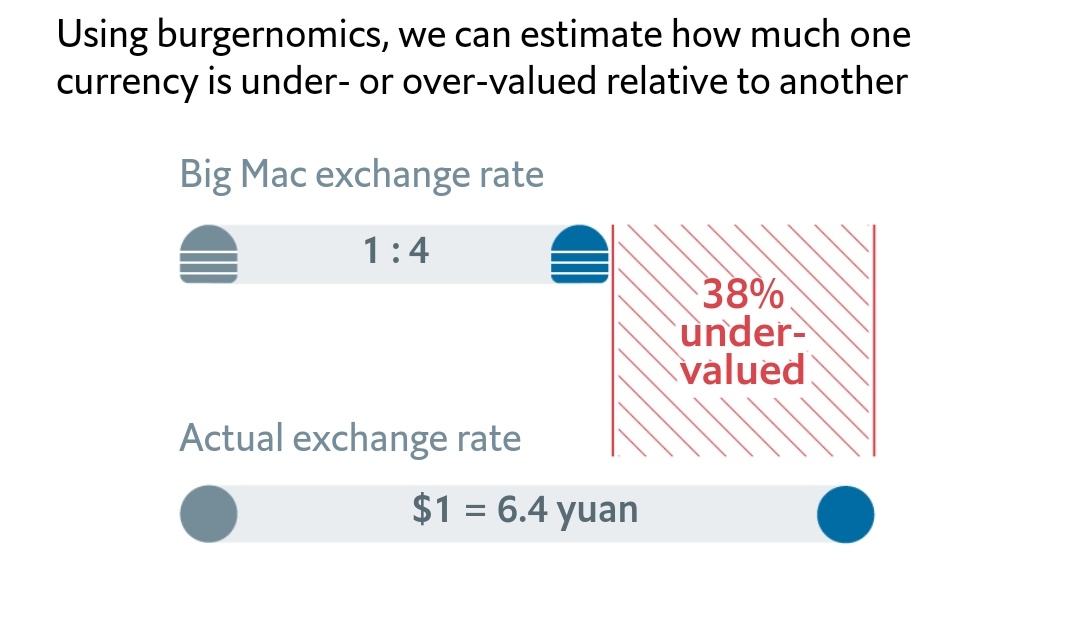

Differences in the cost of a Big Mac expressed as USD therefore reflect differences in the purchasing power of each currency.

Differences in the cost of a Big Mac expressed as USD therefore reflect differences in the purchasing power of each currency.

The Big Mac is most overvalued in Switzerland by ~28.8%.

And most undervalued in Lebanon by ~68.7% for the year 2020.

The Economist states "Burgernomics was never intended as a precise gauge of currency misalignment, merely a tool to make exchange-rate theory more digestible."

And most undervalued in Lebanon by ~68.7% for the year 2020.

The Economist states "Burgernomics was never intended as a precise gauge of currency misalignment, merely a tool to make exchange-rate theory more digestible."

You can play around with the Big Mac index here. https://www.economist.com/big-mac-index

Read on Twitter

Read on Twitter