The SolarWinds security breach last year will be a huge tailwind for cybersecurity stocks. But there’s 1 under the radar stock that should also benefit: $SPLK. Here’s some data that suggests these benefits might appear soon, and why I am bullish on Splunk

For those unaware, the SolarWinds breach was one of the biggest security breaches in years, affecting international governments, and over 18k SolarWinds customers including $MSFT and $CSCO. Enterprises everywhere are scrambling to see if they were affected.

1 immediate need is to detect if they were intruded by analyzing all their logs. $SPLK is arguably the best tool for this job. In fact, Splunk was the most commonly mentioned technology in job openings that required SolarWinds expertise, suggesting a large overlap in customers.

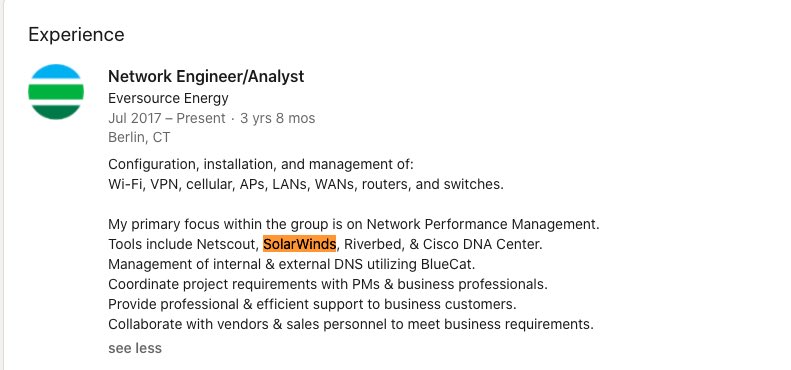

In January, our tracker also found a # of companies moving to Splunk Cloud that were also SolarWinds users. One example of a new $SPLK customer is Eversource Energy which used SolarWinds according to a LinkedIn profile. This hack could have sped up sales cycles for $SPLK.

Deloitte was one of the organizations directly impacted by the breach and claimed they were “taking steps to protect itself from any risks”. They recently put out a job opening looking for a Cyber Security $SPLK engineer in January.

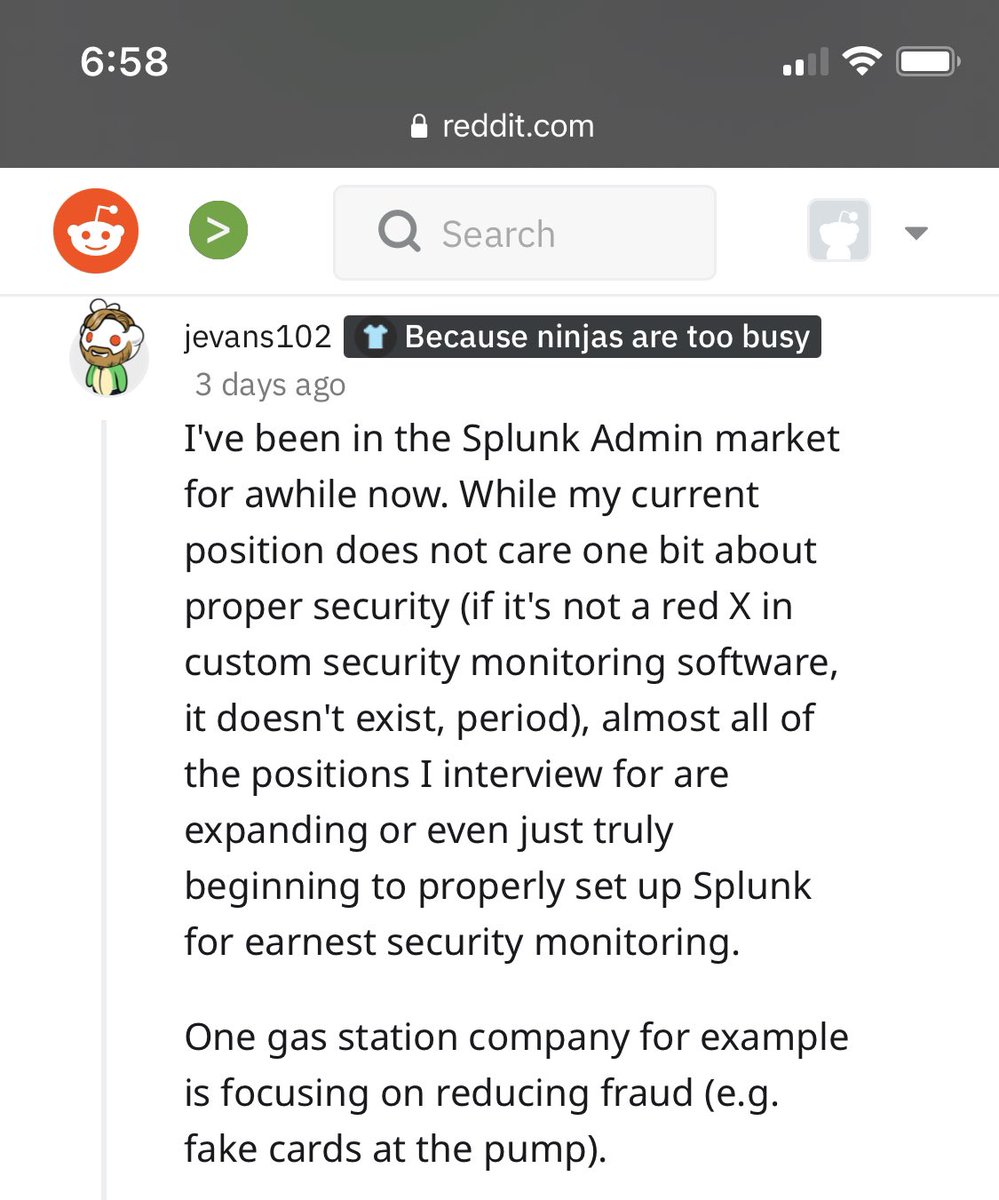

Here’s an anecdote from Reddit in which a Splunk admin says this hack has “released the floodgates” for his company in spending on ingesting logs for SIEM. Reddit is now a reliable source of alpha, don’t you know :)

Even after enterprises are done analyzing their logs, most will take a more comprehensive approach to logging. They will be logging more data (more than they even need) and for longer periods. These are long term tailwinds to $SPLK and lead to more revenue.

On the hiring front, $SPLK has continued hiring at an good pace with total job openings at an all time high and up 15% YoY. Sales-related openings are growing faster than engineering-related ones.

With $SPLK still in the penalty box, lower expectations + conservative guidance, I love the r/r. I was bearish but am doing a 360 now @MuppetTrading @hhhypergrowth @mukund @buysidefolk @DPogrebinsky @breadcrumbsre @akramsrazor @LiviamCapital @jaminball @lfg_cap @shivsharma_5

Read on Twitter

Read on Twitter