I’m sure I’m going to live to regret this. But if I’ve got time, tmrw I’ll take u guys thru a quick masterclass on how I’ve learned to validate signals. I’ll annotate every1 I see & explain whether yay  or nay

or nay  . I validate using price so obvs should work on other systems too.

. I validate using price so obvs should work on other systems too.

or nay

or nay  . I validate using price so obvs should work on other systems too.

. I validate using price so obvs should work on other systems too.

Just so there’s no misunderstanding (I hope not? Had some odd msgs), I’ll be talking about this shit (order flow signals)

In playbook I mentioned that I trade signals “validated by price”. Tomorrow will be a lesson on how I’ve learned to do that. https://twitter.com/fkyesss/status/1357027035906981888

In playbook I mentioned that I trade signals “validated by price”. Tomorrow will be a lesson on how I’ve learned to do that. https://twitter.com/fkyesss/status/1357027035906981888

Yes I’ll be talking signals (which are actually nothing more than a pattern). If you have a pattern of your own that you trade, it might still be helpful to you  Im going to log off, it appears ive got a class to prepare for

Im going to log off, it appears ive got a class to prepare for

Im going to log off, it appears ive got a class to prepare for

Im going to log off, it appears ive got a class to prepare for

I’ll post charts to this thread later today. I’ll look at MNQ from 00:00 - 12:00 EST. I’ll cover EVERY signal I see, regardless of how many there are. Pls be patient, it could take me a while

Same rules as before apply. I got my own money to make first https://twitter.com/fkyesss/status/1352714995822436356

https://twitter.com/fkyesss/status/1352714995822436356

Same rules as before apply. I got my own money to make first

https://twitter.com/fkyesss/status/1352714995822436356

https://twitter.com/fkyesss/status/1352714995822436356

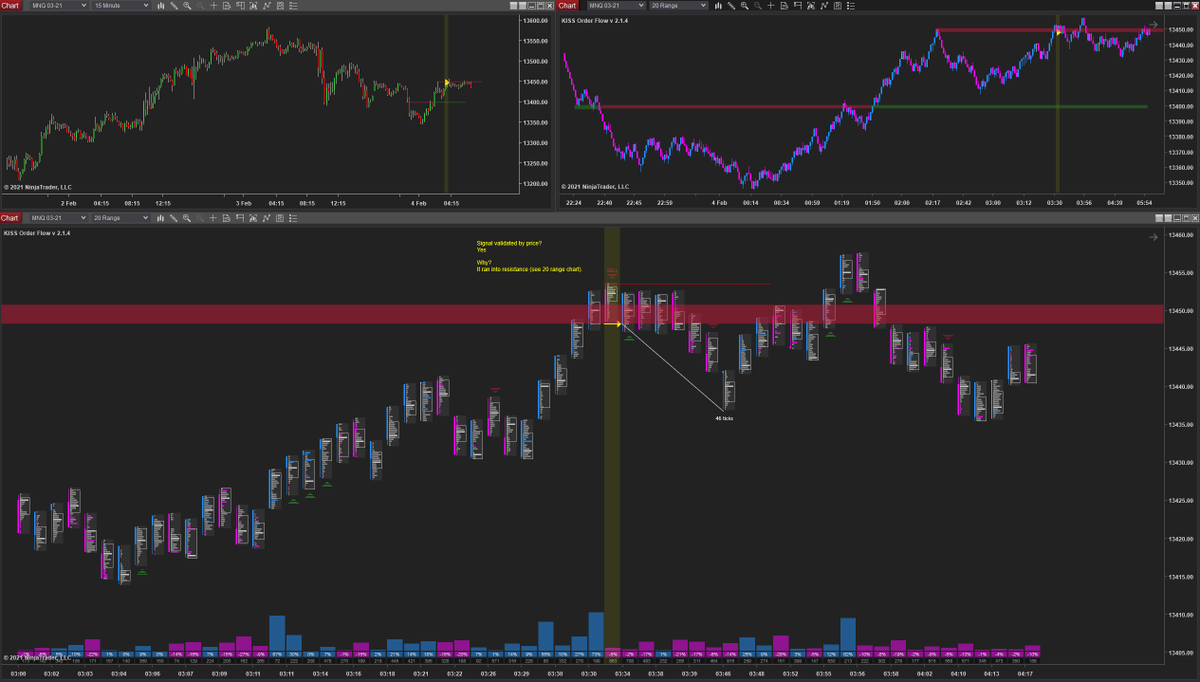

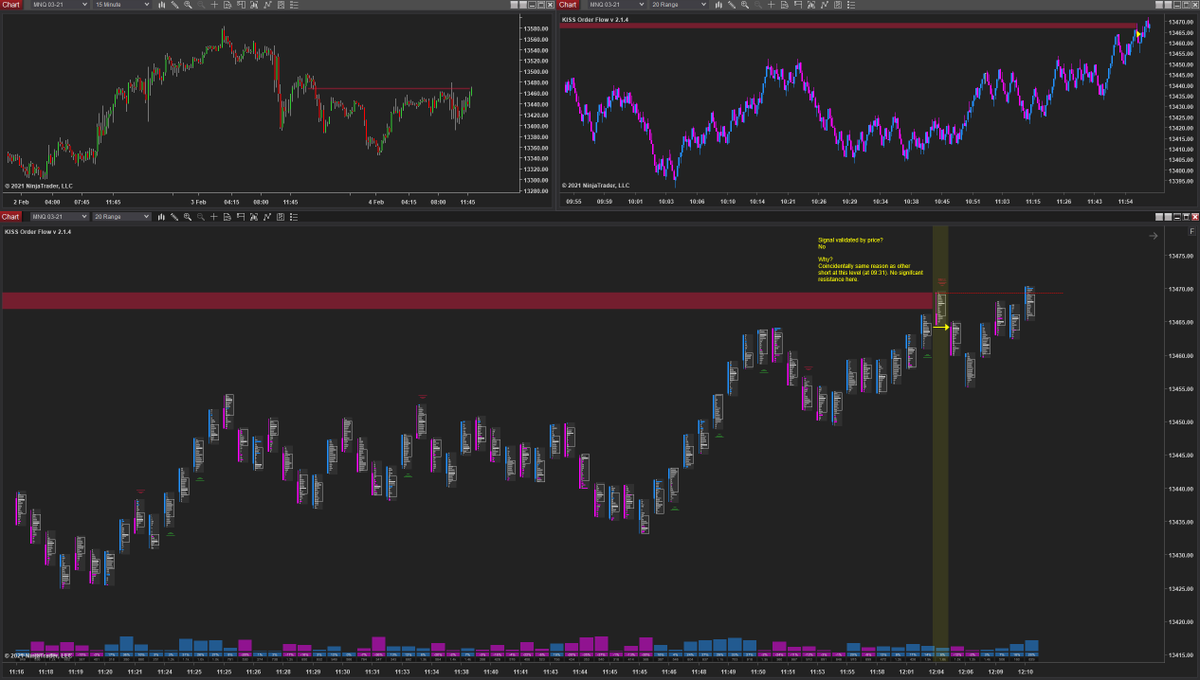

Here you go guys. It's only 12 charts!  Altho I'm actually surprised, I was expecting more. I've re-arranged my charts so the images aren't too big. As I'll only be looking at price (no delta), I've also taken all indys off 15m to make this clearer.

Altho I'm actually surprised, I was expecting more. I've re-arranged my charts so the images aren't too big. As I'll only be looking at price (no delta), I've also taken all indys off 15m to make this clearer.

Altho I'm actually surprised, I was expecting more. I've re-arranged my charts so the images aren't too big. As I'll only be looking at price (no delta), I've also taken all indys off 15m to make this clearer.

Altho I'm actually surprised, I was expecting more. I've re-arranged my charts so the images aren't too big. As I'll only be looking at price (no delta), I've also taken all indys off 15m to make this clearer.

23:38 - 01:04 (all times are EST)

Please make a mental note of the text on this chart. They set the format that I'll be using on all charts.

Please make a mental note of the text on this chart. They set the format that I'll be using on all charts.

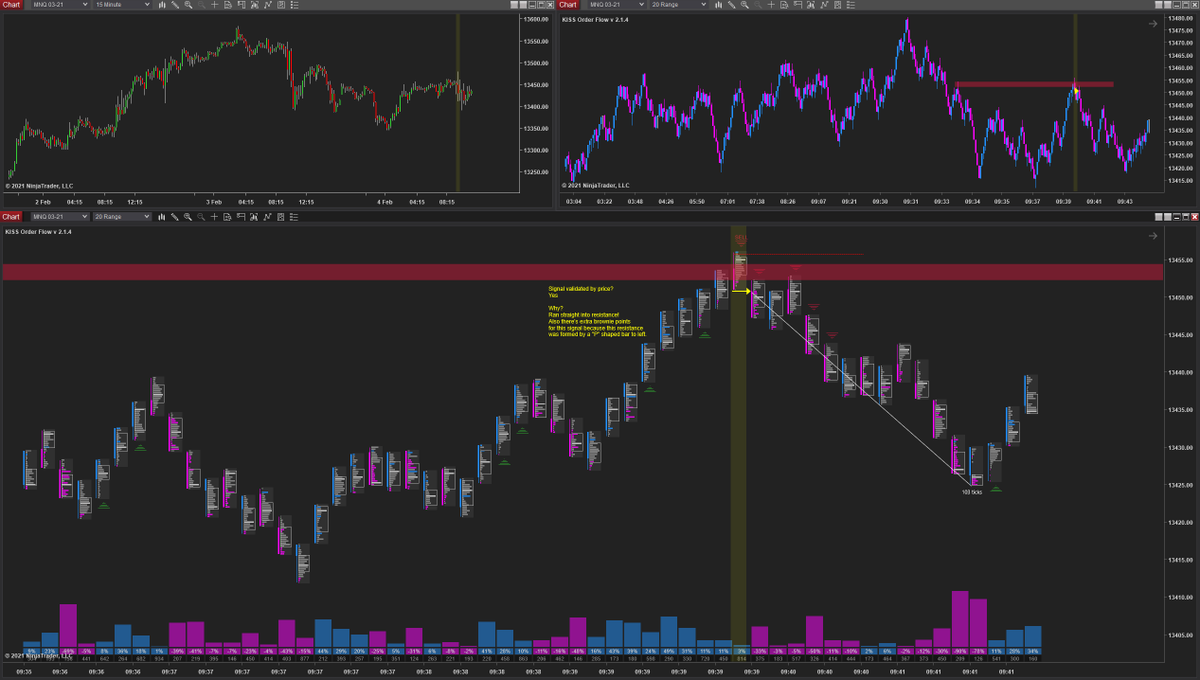

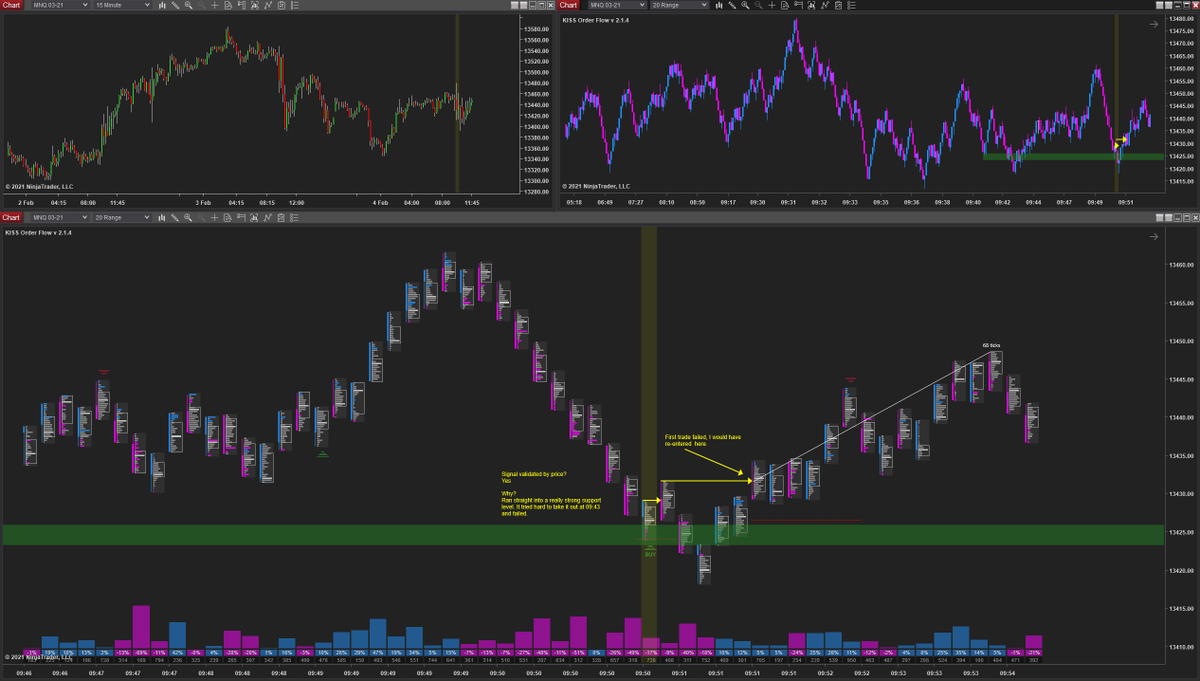

I've drawn each level so you can see what I'm using to validate. When you break it down, it's actually pretty simple. Does the signal occur where we could get a bounce from support or a push away from resistance?

It doesn't really get much more complicated than that. The only other thing that I take into consideration is when we're in a strong trend. I haven't got any examples yet as the last 5 hours have just been a rotational fucked up game of pong!

Hopefully RTH will give me some signals which fail so I can illustrate the dangers of trading a signal blindly.

If price was strongly trending down & I saw a BUY signal, I wouldn't take the trade unless this also fell on a significant support level.

If price was strongly trending down & I saw a BUY signal, I wouldn't take the trade unless this also fell on a significant support level.

A BUY signal in a strong down trend might be ok for a quick scalp (if you exit with a target). But certainly not a runner that I could add-on to. I want to get onto those trades where the mofo runs 100+ ticks and doesn't look back.

Before I start, I do draw some levels. But when I'm trading, I'm always looking left & I visualize the levels as price comes up on them. I don't always draw the level before I take the trade, there usually isn't enough time. You have to be decisive when trading a 20 range chart.

Ninja has an indicator (Price Line) which can help to show what the current price is coming up on. I expect other platforms will also have the same thing. This can help train your mind to look left more and look for these levels

God that was exhausting! Is it Friday yet?

And so that concludes today's lesson in how I validate signals (or other setups like "b" or "P" retests). What I've shown you above can be applied to ANY other signal or setup

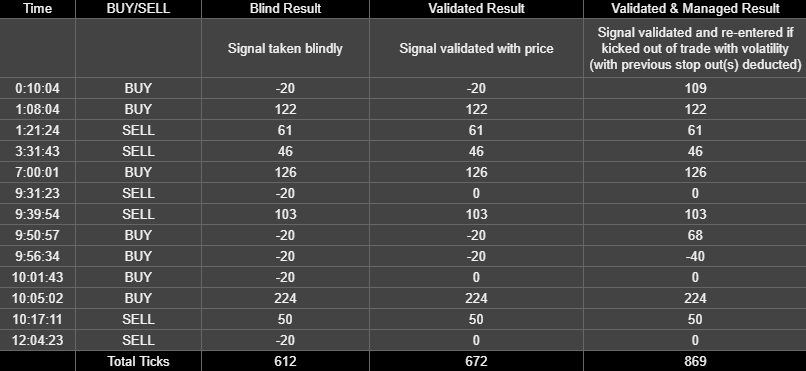

I actually recorded the results and tbh, I'm a bit hesitant to post. Obviously these results aren't accurate because:

- You wouldn't get all the move like I've measured or

- Trade 12 hours straight with no break or

- Get same entry, whether ur slow to execute or with slippage

- You wouldn't get all the move like I've measured or

- Trade 12 hours straight with no break or

- Get same entry, whether ur slow to execute or with slippage

So don't get carried away thinking you could just trade signals and not look at price. Despite how shitty NQ was today, I'm actually quite surprised the blind results are this good to be honest.

Your takeaway from all this should be that validating a signal or setup using PRICE will always lead to more profitable results.

One of my golden rules in trading is price FIRST, indicators SECOND

It's got me this far in my trading career ...

One of my golden rules in trading is price FIRST, indicators SECOND

It's got me this far in my trading career ...

@threader_app unroll

Read on Twitter

Read on Twitter