1/ Real talk: How does BRRRRRR translate to higher crypto prices?

All the answers to your questions in plain English --> https://messari.io/article/modern-monetary-theory-and-its-impact-on-crypto

All the answers to your questions in plain English --> https://messari.io/article/modern-monetary-theory-and-its-impact-on-crypto

2/ There are 2 types of investors: those who want to GET rich and those who want to STAY rich.

Modern Monetary Theory (MMT) for those who wanna stay rich requires us to look at history & politics.

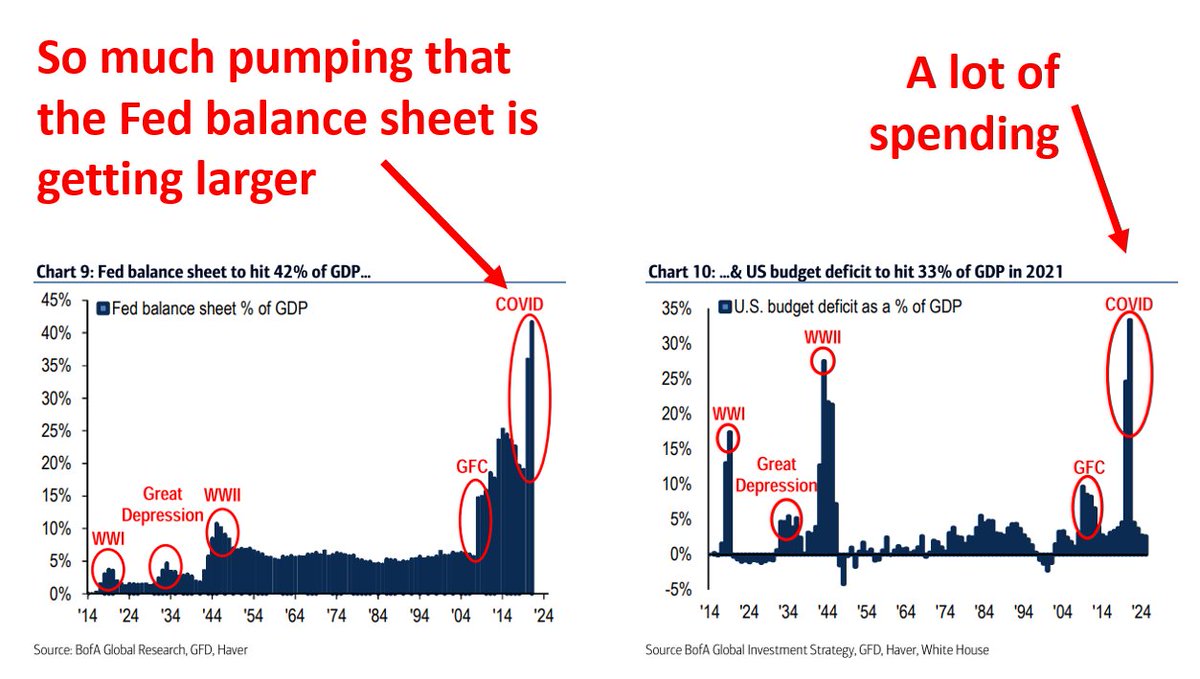

There has never been as much debt or low interest rates as we have today

Modern Monetary Theory (MMT) for those who wanna stay rich requires us to look at history & politics.

There has never been as much debt or low interest rates as we have today

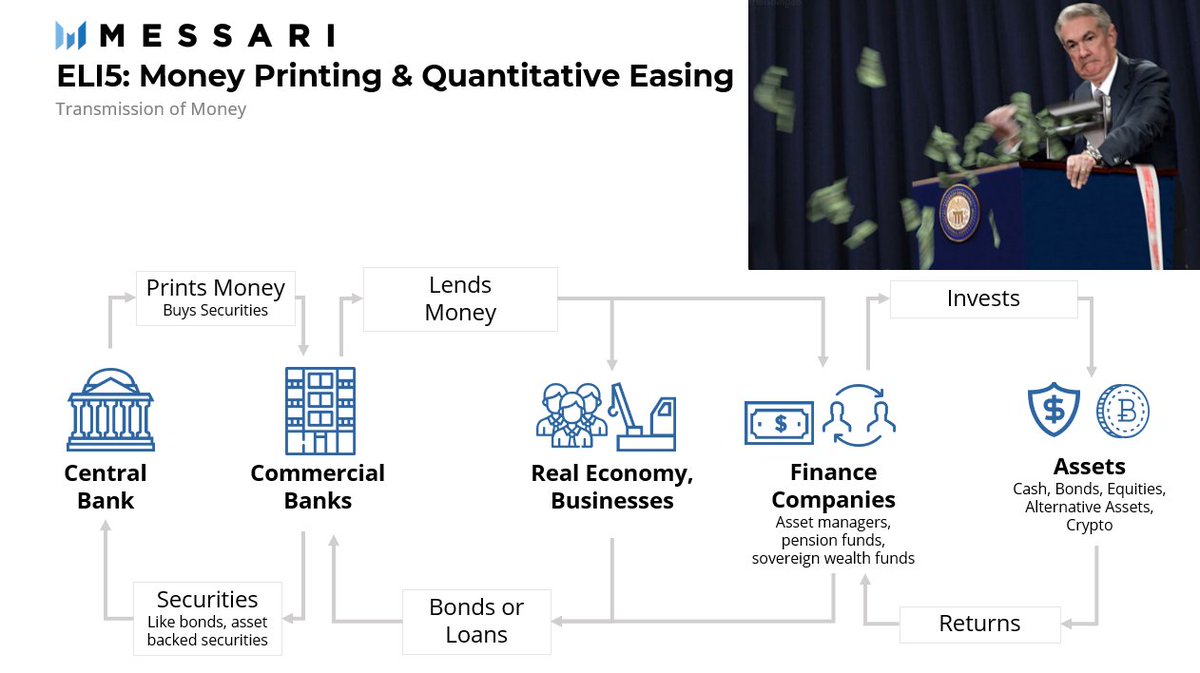

3/ First the basics... What’s Quantitative Easing (QE)?

QE is monetary policy (targeting interest rates and money supply) where a central bank injects money by buying financial assets. That puts money in the hands of people and is meant to pump the econ https://messari.io/article/modern-monetary-theory-and-its-impact-on-crypto

QE is monetary policy (targeting interest rates and money supply) where a central bank injects money by buying financial assets. That puts money in the hands of people and is meant to pump the econ https://messari.io/article/modern-monetary-theory-and-its-impact-on-crypto

4/ Money printing doesn’t mean that the Fed needs to physically print dollar bills.

After they pump the econ with traditional methods, central banks can increase money supply by buying securities. Typically just govt debt; but could buy equities

https://messari.io/article/modern-monetary-theory-and-its-impact-on-crypto

After they pump the econ with traditional methods, central banks can increase money supply by buying securities. Typically just govt debt; but could buy equities

https://messari.io/article/modern-monetary-theory-and-its-impact-on-crypto

5/ When government buys, asset prices go up and interest rates are low, risk premiums get distorted.

Typically Low to High Risk:

Cash < Bonds < Equities < Alternatives (e.g. VC, Crypto, property, Hedge fund)

But 0% rates and money printing makes Cash & Bonds risky to hold.

Typically Low to High Risk:

Cash < Bonds < Equities < Alternatives (e.g. VC, Crypto, property, Hedge fund)

But 0% rates and money printing makes Cash & Bonds risky to hold.

6/ What’s Modern Monetary Theory (MMT)?

MMT is like the magical money tree. It’s like QE on full blast. The govt and central bank join to achieve policy goals.

Taxes and deficits are irrelevant because we can print more. The only limitation is runaway inflation.

MMT is like the magical money tree. It’s like QE on full blast. The govt and central bank join to achieve policy goals.

Taxes and deficits are irrelevant because we can print more. The only limitation is runaway inflation.

7/ What’s the big deal -- isn’t Inflation 2%?

Consumer Price Index (CPI) doesn’t include energy costs, food, housing nor asset prices. But everyone spends on transportation, shelter, and food.

When prices of the stuff (you really buy) inflates, you feel it.

Consumer Price Index (CPI) doesn’t include energy costs, food, housing nor asset prices. But everyone spends on transportation, shelter, and food.

When prices of the stuff (you really buy) inflates, you feel it.

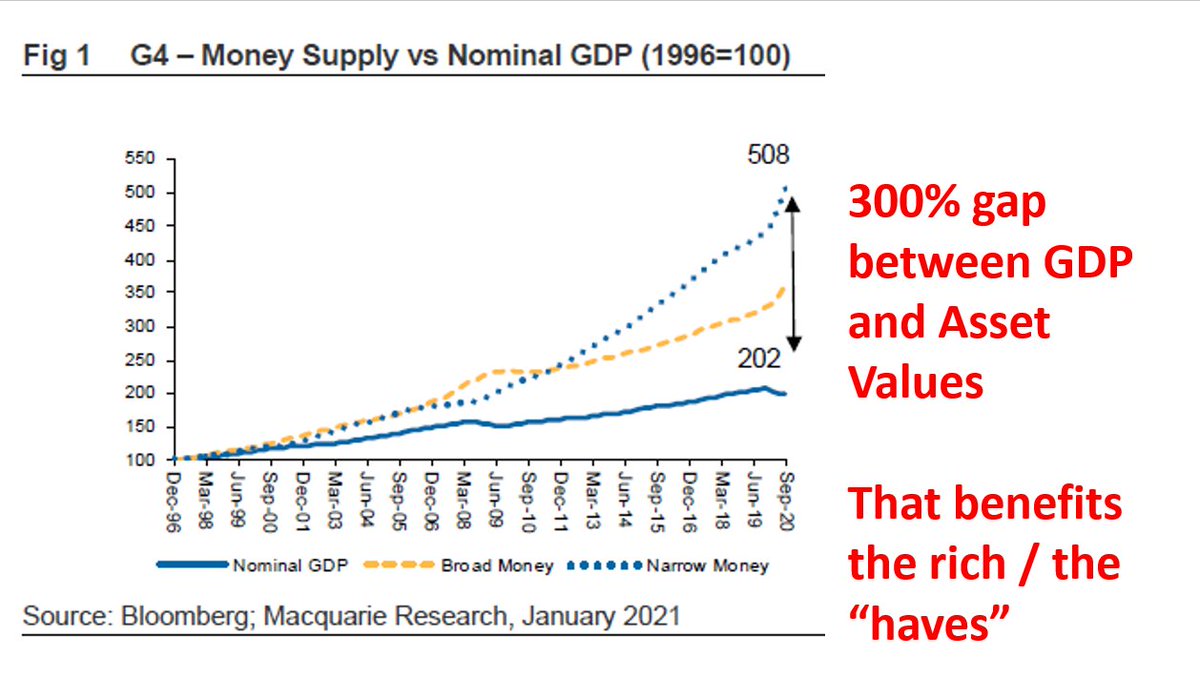

8/ What about the Wealth Gap?

When central banks buys financial assets (puts the money back into the hands of investors) means asset prices go up. The rich benefit.

Opportunity gap also increases, further widened by automation and globalization.

The “have-nots” fall behind.

When central banks buys financial assets (puts the money back into the hands of investors) means asset prices go up. The rich benefit.

Opportunity gap also increases, further widened by automation and globalization.

The “have-nots” fall behind.

9/ How did we get Addicted to Quantitative Easing?

TLDR: Voters wanted to avoid pain. Helicopter money keeps voters happy.

Longer explanation here: https://messari.io/article/modern-monetary-theory-and-its-impact-on-crypto

TLDR: Voters wanted to avoid pain. Helicopter money keeps voters happy.

Longer explanation here: https://messari.io/article/modern-monetary-theory-and-its-impact-on-crypto

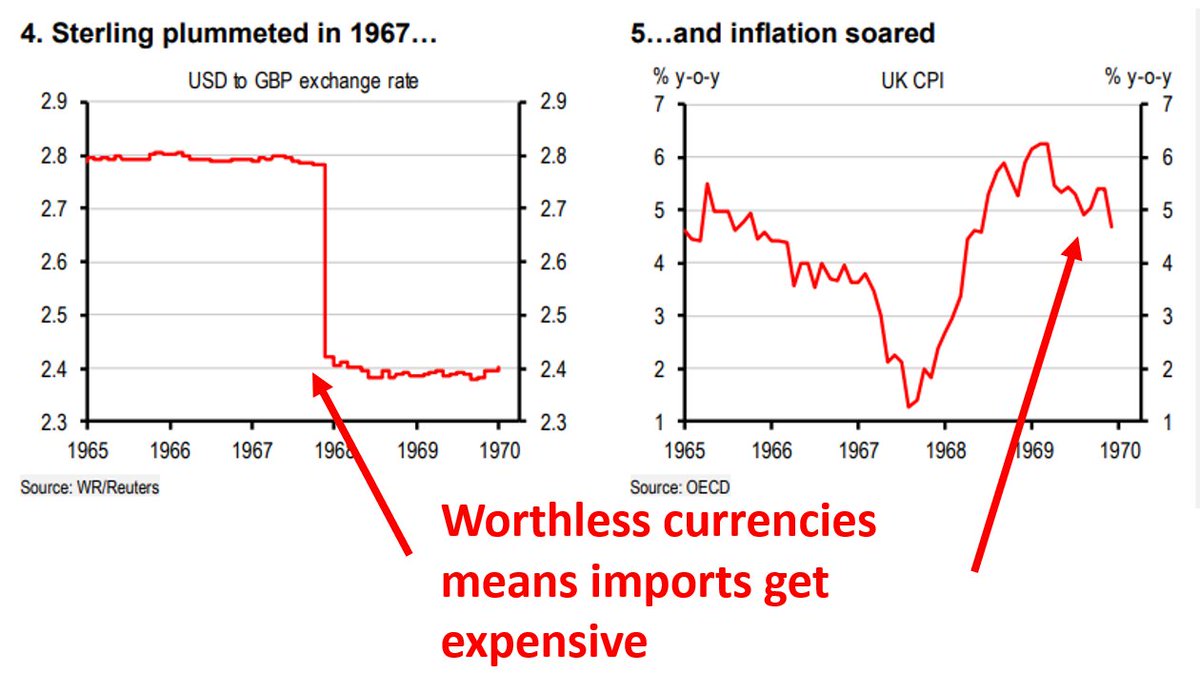

10/ Why is MMT bad for Fiat?

Large deficits means the govt must sell more debt to pay for it

Large deficits means the govt must sell more debt to pay for it

Interest rates should rise to sell extra debt

Interest rates should rise to sell extra debt

The govt can't allow that so they buy the debt themselves. Investors are getting paid back with $$ that is increasingly worthless

The govt can't allow that so they buy the debt themselves. Investors are getting paid back with $$ that is increasingly worthless

Large deficits means the govt must sell more debt to pay for it

Large deficits means the govt must sell more debt to pay for it Interest rates should rise to sell extra debt

Interest rates should rise to sell extra debt The govt can't allow that so they buy the debt themselves. Investors are getting paid back with $$ that is increasingly worthless

The govt can't allow that so they buy the debt themselves. Investors are getting paid back with $$ that is increasingly worthless

11/ Why is MMT bad for Fiat?

This devalues the currency

This devalues the currency

Smart capital (investors) dump the currency to places with high-quality macroeconomics ( #Bitcoin

Smart capital (investors) dump the currency to places with high-quality macroeconomics ( #Bitcoin  ) or with less social conflicts

) or with less social conflicts

This devalues the currency

This devalues the currency Smart capital (investors) dump the currency to places with high-quality macroeconomics ( #Bitcoin

Smart capital (investors) dump the currency to places with high-quality macroeconomics ( #Bitcoin  ) or with less social conflicts

) or with less social conflicts

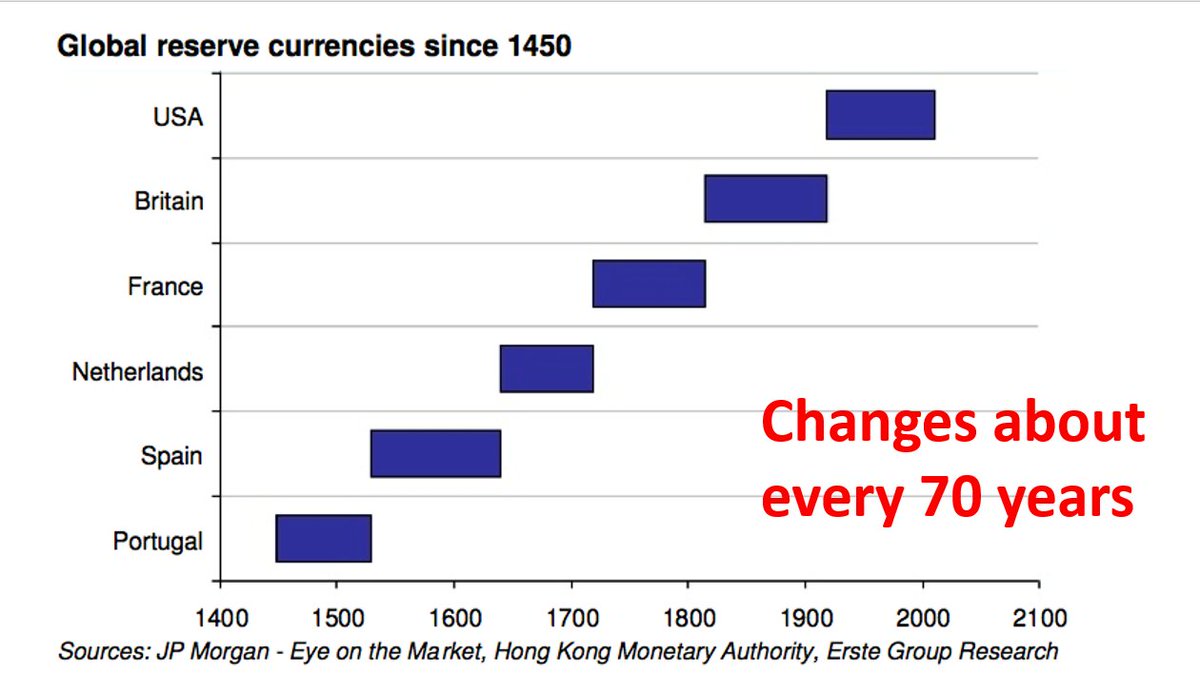

12/ The fall of empires coincides with the fall as the global reserve currency:

Productivity falls, then governments starts the magical money printing tree and the currency finally goes

Productivity falls, then governments starts the magical money printing tree and the currency finally goes

13/ How does it all end?

Accepting bad returns isn’t sustainable. So investors will seek better returns in areas with less conflict.

Governments could respond by blocking taxpayers from leaving with their money (blocking #Bitcoin or capital controls) https://messari.io/article/modern-monetary-theory-and-its-impact-on-crypto

or capital controls) https://messari.io/article/modern-monetary-theory-and-its-impact-on-crypto

Accepting bad returns isn’t sustainable. So investors will seek better returns in areas with less conflict.

Governments could respond by blocking taxpayers from leaving with their money (blocking #Bitcoin

or capital controls) https://messari.io/article/modern-monetary-theory-and-its-impact-on-crypto

or capital controls) https://messari.io/article/modern-monetary-theory-and-its-impact-on-crypto

14/

#Bitcoin

#Bitcoin  non-discretionary monetary policy. Governments can’t tamper with it.

non-discretionary monetary policy. Governments can’t tamper with it.

#Ethereum is an emerging non-sovereign internet money.

#Ethereum is an emerging non-sovereign internet money.

Risk premiums are distorted. Cash & bonds are THAT risky. Crypto and Alternatives aren't THAT safe https://messari.io/article/modern-monetary-theory-and-its-impact-on-crypto

Risk premiums are distorted. Cash & bonds are THAT risky. Crypto and Alternatives aren't THAT safe https://messari.io/article/modern-monetary-theory-and-its-impact-on-crypto

#Bitcoin

#Bitcoin  non-discretionary monetary policy. Governments can’t tamper with it.

non-discretionary monetary policy. Governments can’t tamper with it.  #Ethereum is an emerging non-sovereign internet money.

#Ethereum is an emerging non-sovereign internet money.  Risk premiums are distorted. Cash & bonds are THAT risky. Crypto and Alternatives aren't THAT safe https://messari.io/article/modern-monetary-theory-and-its-impact-on-crypto

Risk premiums are distorted. Cash & bonds are THAT risky. Crypto and Alternatives aren't THAT safe https://messari.io/article/modern-monetary-theory-and-its-impact-on-crypto

Read on Twitter

Read on Twitter