An overview of the jobs report and some thoughts on why the market doesn't "care" that much about headline "beats" or "misses"

(Thread)

1/

(Thread)

1/

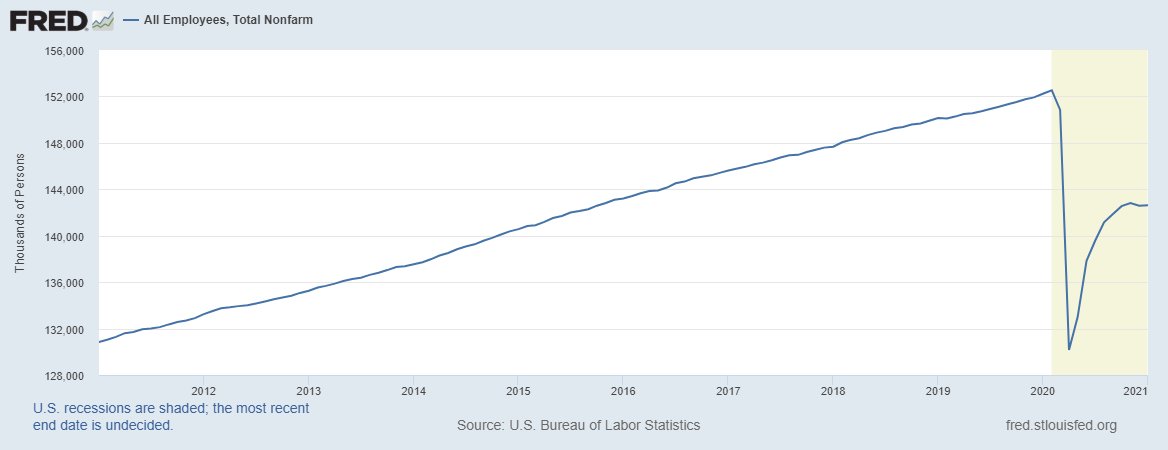

To start, we added just 49k jobs & are still millions of jobs shy of the pre-COVID peak

This is very bad news & something that will exacerbate the long-term structural disinflationary trends in the economy

It is also very bad for society if too many people are not working

2/

This is very bad news & something that will exacerbate the long-term structural disinflationary trends in the economy

It is also very bad for society if too many people are not working

2/

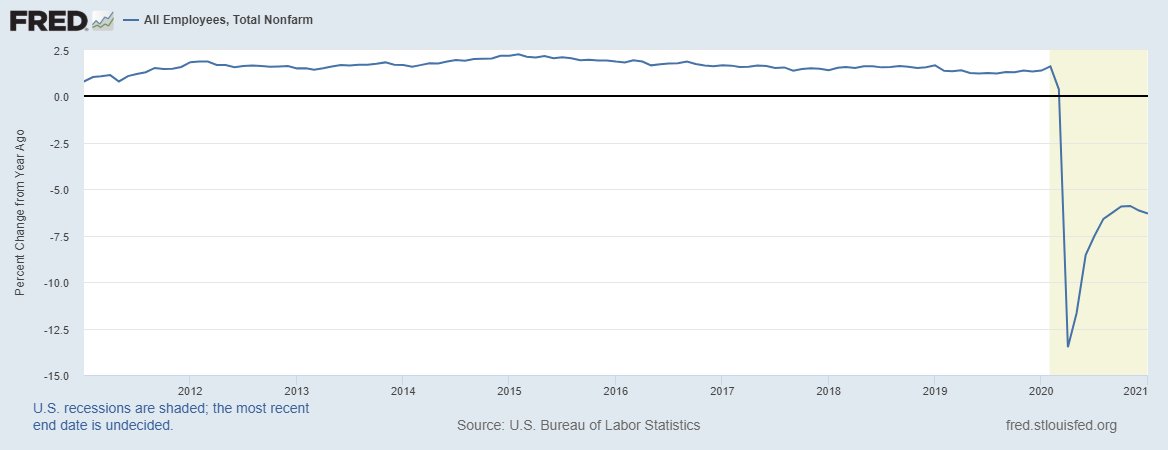

In Y/Y growth rate terms, the vector is rolling over which is also bad news. The vector is higher from April-May, but the deterioration in labor conditions is concerning for the long-term economy.

3/

3/

Lak @businesscycle (as always) does a great job of highlighting the labor progression relative to the GFC.

https://twitter.com/businesscycle/status/1357693704933429251?s=20

4/

https://twitter.com/businesscycle/status/1357693704933429251?s=20

4/

Some more bad news before the good and why the market doesn't care much about the short-term stalling of the labor market.

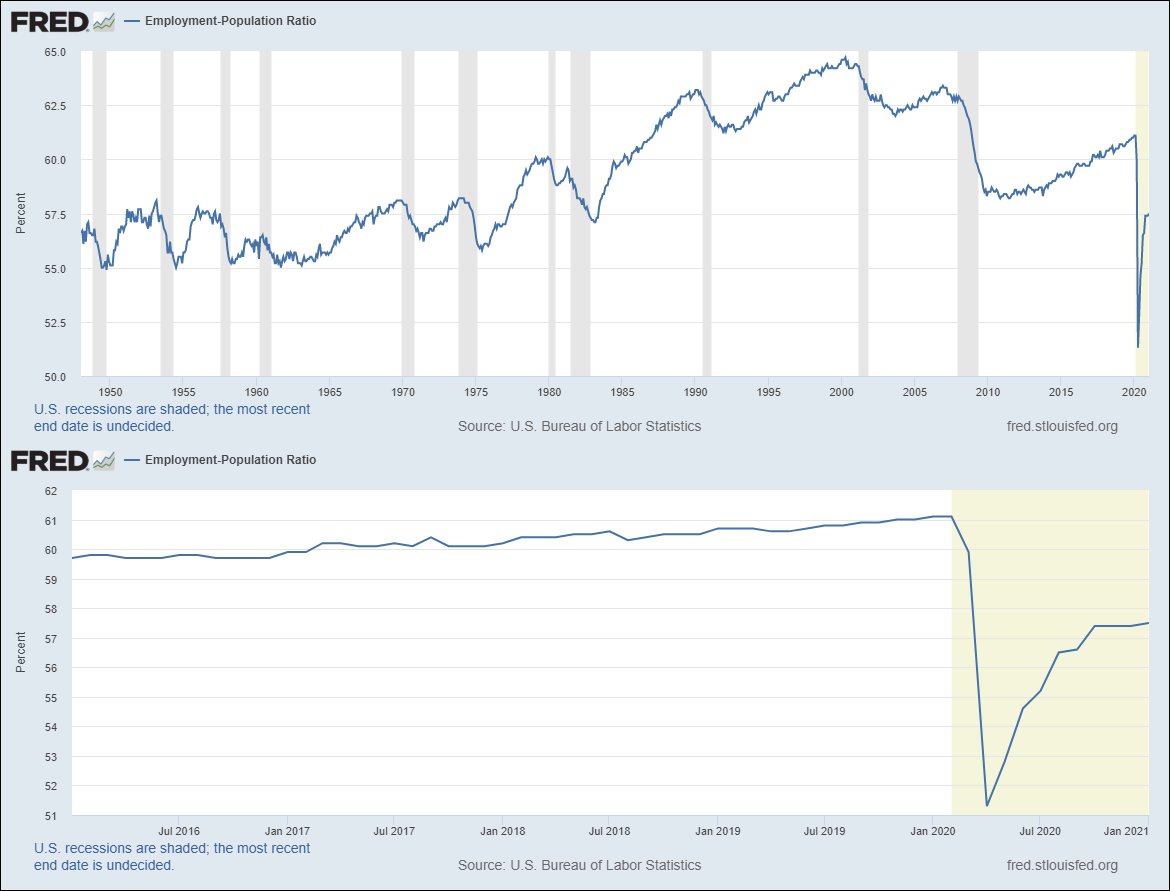

The LFPR fell in January and remains at decades lows.

Horrible news.

5/

The LFPR fell in January and remains at decades lows.

Horrible news.

5/

My preferred measure, the employment-population ratio, is also disastrous on a long-term basis but edged slightly higher in January.

Structural low-wage pressure will be a lasting issue.

6/

Structural low-wage pressure will be a lasting issue.

6/

Manufacturing jobs declined in January but the RoC is still steadily higher.

We are starting to get to the good news part.

7/

We are starting to get to the good news part.

7/

Other cyclical areas - residential building - shows job gains that exceed the pre-COVID peak.

Is this a short-term demand-pull-forward? Probably.

But the residential housing market is a high-velocity sector so heavy construction will help in the near term for nGDP growth.

8/

Is this a short-term demand-pull-forward? Probably.

But the residential housing market is a high-velocity sector so heavy construction will help in the near term for nGDP growth.

8/

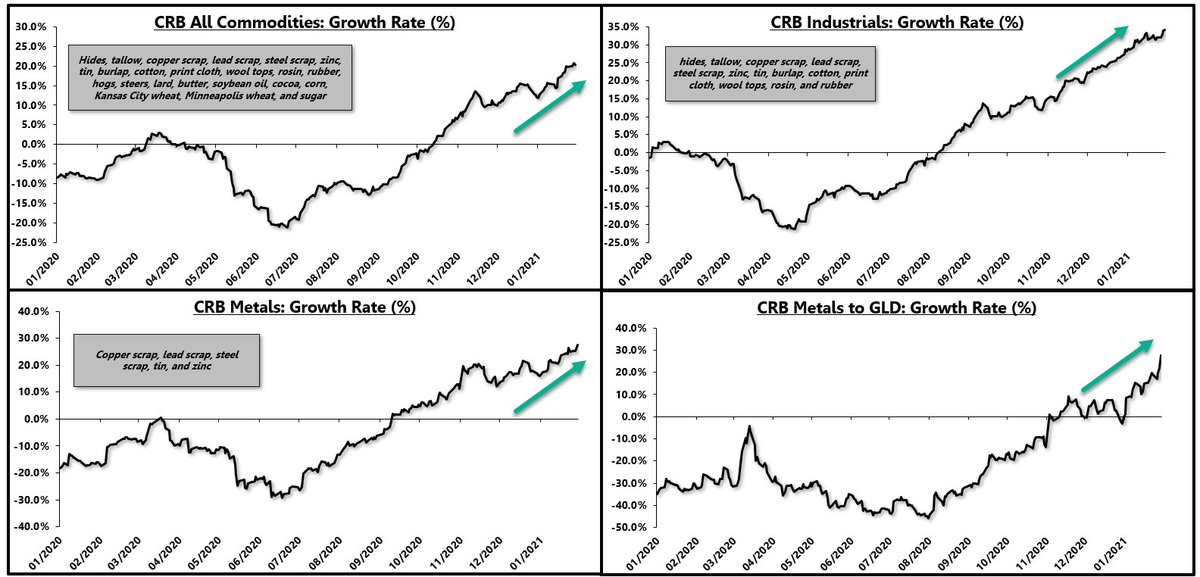

The economy is in a major cyclical upturn, centered around manufactured goods thanks to a demand-shift after COVID and due to the short-term surge in hosing.

We see this in the growth rate of commodities.

Big upturn that isn't over yet.

9/

We see this in the growth rate of commodities.

Big upturn that isn't over yet.

9/

Following - average hours worked in the manufacturing sector, despite the decline in headcount, rose in January and the RoC in growth is straight higher.

10/

10/

As analysts, we have to balance the long-term, secular trends within the multi-quarter or multi-year fluctuations in growth/inflation.

This report highlighted the structural challenges in the economy that will not be solved overnight, nor upon some magical "reopening" date.

12/

This report highlighted the structural challenges in the economy that will not be solved overnight, nor upon some magical "reopening" date.

12/

There is plenty to be bearish about and in the long-term, rates will reflect the reality of decelerating nGDP.

In the short-term, however, we have to see the cyclical rebound for what it is.

Cyclical. And an upturn.

13/

In the short-term, however, we have to see the cyclical rebound for what it is.

Cyclical. And an upturn.

13/

The bond market will regain its footing, only when we see a clear pivot in a majority of leading cyclical indicators.

This report didn't change much on that front, which is why it shouldn't be much of a surprise to see bonds chop around - higher, lower, then higher.

14/

This report didn't change much on that front, which is why it shouldn't be much of a surprise to see bonds chop around - higher, lower, then higher.

14/

Next week, long bonds will go right back to trading on the cyclical trends.

My two cents.

(end)

15/15

My two cents.

(end)

15/15

Read on Twitter

Read on Twitter